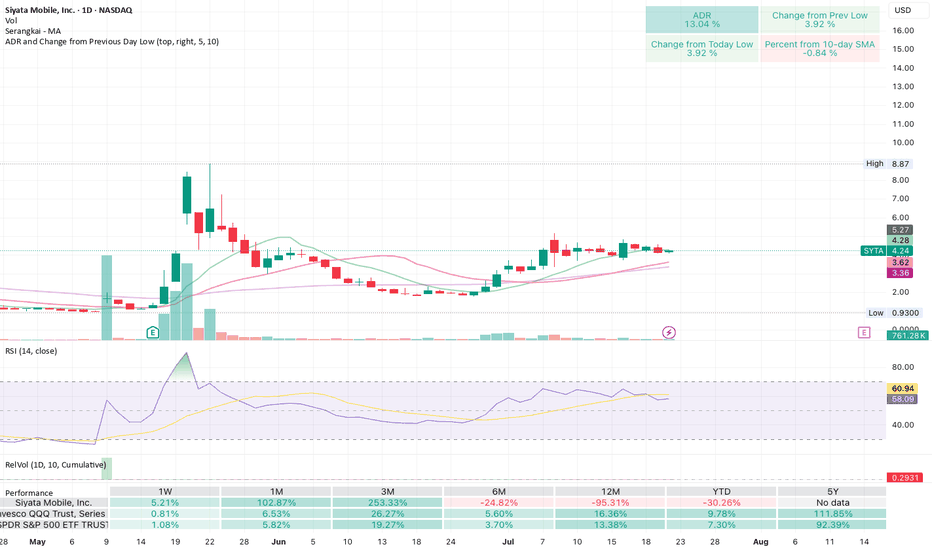

Getting ready to blow! Cup and handle after positive surprisesSiyata makes 2-way telecoms for things like first responders, miltary, construction crews.

Had big earnings and revenue surprises a few weeks ago, and now looks to be forming a cup and handle. Low volume yesterday shows a squeeze pattern like it's getting ready to go.

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

−1,204.19 USD

−25.27 M USD

11.63 M USD

8.89 M

About Siyata Mobile, Inc.

Sector

Industry

CEO

Marc Seelenfreund

Website

Headquarters

Montréal

Founded

1986

FIGI

BBG000BXPF58

Siyata Mobile, Inc. engages in the provision of cellular communications systems for enterprise customers. It specializes in connected vehicle products for professional fleets, marketed under the Uniden Cellular and Siyata brands. The firm operates through the following geographical segments: Europe, the Middle East and Africa; Unites States; Canada; and Australia and New Zealand. The company was founded by Marc Seelenfreund on October 15, 1986 and is headquartered in Montreal, Canada.

Related stocks

$3's to $7's catching easiest vertical part of the chart $SYTAGot to let the stock evolve properly, once enough of shortsellers are trapped inside they can only try to manipulate with crash attempts and when even those don't work out they're forced to cover (buy to exit their short position) into vertical push, and those amounts cannot be just clicked out in a

Syta trend predictionSyta a Canadian cellular telecom company has had a lot of success in Saudi Arabia with their push to talk over cellular. Emergency Services Teams (Ambulance, Fire, Police, Security, etc) Love this!

Syta reverse split 1-100, from 4 cents to 4 dolla last week and has been in accumulation phase since t

SYTA BullishPrice has made higher lows since May and yesterday it closed above the channel it has been trading in since March. It also closed above the descending trend line on the weekly. The ADX is showing a strong trend and the force index appears to be curling up.

Watching it to hold 1.26 (.50 fib) and al

I see that RSI curling upward, time for a BIG BOUNCE!Siyata Mobile Inc. develops and provides cellular communications solutions for enterprise customers. It offers vehicle mounted cellular based communications platforms over advanced 4G mobile networks and cellular booster systems. The company also provides 4G LTE devices, such as Uniden UV350 and Uni

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

Frequently Asked Questions

The current price of SYTA is 3.26 USD — it has decreased by −2.91% in the past 24 hours. Watch Siyata Mobile, Inc. stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on NASDAQ exchange Siyata Mobile, Inc. stocks are traded under the ticker SYTA.

SYTA stock has fallen by −9.24% compared to the previous week, the month change is a −21.60% fall, over the last year Siyata Mobile, Inc. has showed a −89.74% decrease.

SYTA reached its all-time high on Feb 16, 2021 with the price of 1,983,904.65 USD, and its all-time low was 0.93 USD and was reached on May 7, 2025. View more price dynamics on SYTA chart.

See other stocks reaching their highest and lowest prices.

See other stocks reaching their highest and lowest prices.

SYTA stock is 5.39% volatile and has beta coefficient of −3.15. Track Siyata Mobile, Inc. stock price on the chart and check out the list of the most volatile stocks — is Siyata Mobile, Inc. there?

Today Siyata Mobile, Inc. has the market capitalization of 29.70 M, it has decreased by −6.17% over the last week.

Yes, you can track Siyata Mobile, Inc. financials in yearly and quarterly reports right on TradingView.

Siyata Mobile, Inc. is going to release the next earnings report on Aug 14, 2025. Keep track of upcoming events with our Earnings Calendar.

SYTA earnings for the last quarter are −2.35 USD per share, whereas the estimation was −2.48 USD resulting in a 5.24% surprise. The estimated earnings for the next quarter are −1.61 USD per share. See more details about Siyata Mobile, Inc. earnings.

Siyata Mobile, Inc. revenue for the last quarter amounts to 2.47 M USD, despite the estimated figure of 2.00 M USD. In the next quarter, revenue is expected to reach 3.00 M USD.

SYTA net income for the last quarter is −3.79 M USD, while the quarter before that showed −8.92 M USD of net income which accounts for 57.54% change. Track more Siyata Mobile, Inc. financial stats to get the full picture.

No, SYTA doesn't pay any dividends to its shareholders. But don't worry, we've prepared a list of high-dividend stocks for you.

As of Aug 12, 2025, the company has 25 employees. See our rating of the largest employees — is Siyata Mobile, Inc. on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. Siyata Mobile, Inc. EBITDA is −15.20 M USD, and current EBITDA margin is −122.65%. See more stats in Siyata Mobile, Inc. financial statements.

Like other stocks, SYTA shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade Siyata Mobile, Inc. stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So Siyata Mobile, Inc. technincal analysis shows the sell today, and its 1 week rating is sell. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating Siyata Mobile, Inc. stock shows the sell signal. See more of Siyata Mobile, Inc. technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.