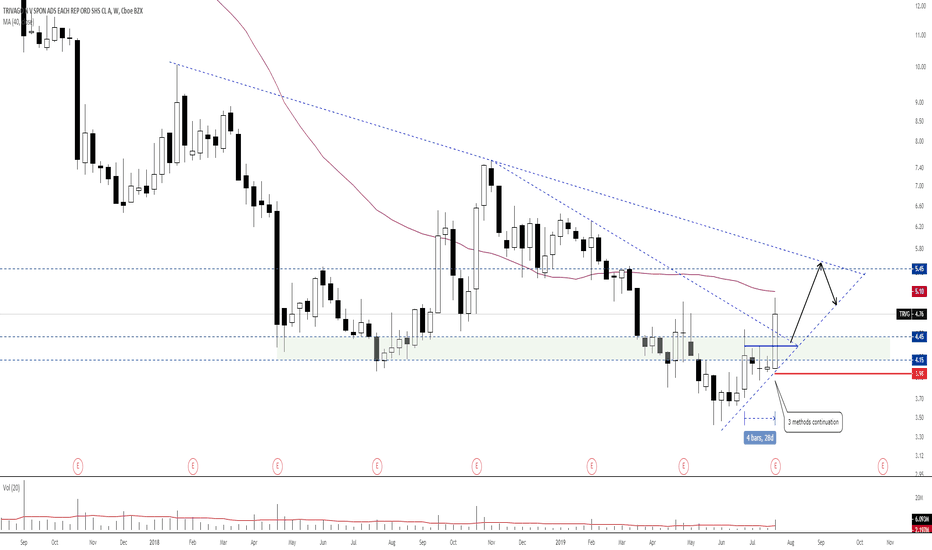

TRVG - Basic Analysis can lead to great trade ideas!This is as simple as it gets. See a taper, be a taper!

Good trade opportunity incoming if we prove a breakout of red strong selling and we can make our way toward a HTF purple tapered selling and ultimately prove a HTF buying continuation in orange.

Happy Trading :)

TRVG trade ideas

TRIVAGO - more falls aheadThe breach of the 3.20 line down put an end to any hopes of an end to correction.

This is the moment when what was shown as perhaps a simple correction turns out to be a trend. Downtrend!

There is no hope in variable income, just facts

See in the graph how an inappropriate purchase can result in disproportionate losses

Despite the classic breakup, we observed that the fibo-clouds lined up and compacted, a fact that confirms the sales configuration

Trivago hasn't done the bottom yet. Far from it.

TRVG: Bullish Flag. awaiting confirmationBullish Flag, awaiting confirmation

Pros:

Descending volume during formation

Volume at break out

Golden cross in blue

PPS above 50MA and 200MA

RS above 0, and ascending

ATR Ascending

R/R ratio above 3

250RSI above 50

200MA ascending

Target:

PT = 5.27$

1000 Followers! Thank you all!

Thank you to those who donate Coins!

Stay Humble, have fun, make money!

TRVG BUY Swing Trading-Weekly descending bevel broken by the top

-There is a divergence in weekly between the price and the RSI

-The strong neutrality zone if RSI has been broken too, and you can see the pullback

-The resistance of 3.00 dollar has been broken

-And we have a ascending triangle broken by the top in H4

The strategy is to wait a pullback to 3 dollar and to buy here in the green zone

Look at this :

Expedia CEO: We’re seeing plenty of signs of demandWe’re seeing plenty of signs of demand:’ Expedia CEO on travel demand amid pandemic.

As we said yesterday on our earnings, we are seeing some signs of improvement in the first month of the year. It started around the holidays. And we've been slowly modestly improving from there. January was better than December.

It's kind of a story of waiting. And there are some countries like the US that are stronger, where people are moving around more. There are areas in Asia as well. And then there are places like Europe, where things are still fairly locked down.

So it's really where people are feeling more confident about travel, where people are allowed to travel. We're certainly seeing plenty of signs of demand. It's just a question of consumer confidence and risk tolerance and what governments are allowing people to do.

finance.yahoo.com

TRVG - Trade idea, low risk call options, little capital neededThis is a very interesting daily chart for me. RSI (7 day) dipped below 50 and is back over today. If it closes over 50 then tomorrow a trade over today's high gives a trigger long.

Yesterday's candle closed at 20sma, and stochastic below 20 should support a move higher in price as it turns up. The TTM is quite negative and while it does not give a buy signal, I will look for the bars to get shorter in support of a price move higher.

I like this trade because 2/19 expiry 2.50 strike calls are less than 50 cents. Anytime I hold options in a swing position I must be prepared to lose it all (anything can happen). In this example, if I buy 1 call contract I spend less than $50 so that is the max I can lose. The reward to risk is fantastic. Only spend an amount of capital that you are willing to completely lose, and identify your loss exits (% loss on option, trade below recent low, below daily support zone).

TRVG - Starting To Trend On The 1DTrivago NV is a Germany-based company that operates an online hotel search platform. The platform allows users to search for, compare and book hotels. It gathers information from various third parties' platforms and provides information about the hotel, pictures, ratings, reviews and filters, such as price, location and extra options. The Company offers access to approximately 2.5 million hotels and other types of accommodation, including over 1.0 million units of alternative accommodation, such as vacation rentals and private apartments in over 190 countries. It provides access to its platform through more than 50 localized websites and applications in over 30 languages. The Company also offers marketing tools and services to hotels and hotel chains, as well as to online travel agencies and advertisers, among others. Its principal executive offices are located in Germany.

P/E Ratio (with extraordinary items)

157.34

SHORT INTEREST

5.39M 06/28/19

Analysts Recommendations: HOLD

Target Price $5