Tesla Stock Gains After Musk Gets $30 Billion Award — What Now?Tesla board is hoping that the pile of shares would be enough to pin down the CEO and lock down his focus. But challenges are there. Here’s one — $30 billion might not be enough to keep Musk around.

💰 $30 Billion Retention Bonus

Tesla stock NASDAQ:TSLA is up about 4% since the start of the week after the board of directors handed Elon Musk a gift-wrapped, legally-contingent $30 billion stock package .

What’s inside? A cool 96 million shares — nearly enough to buy a small country or, at the very least, keep Musk’s wandering focus in the Tesla lane.

In a letter to shareholders, the board didn’t mince words: “We are confident that this award will incentivize Elon to remain at Tesla. Retaining Elon is more important than ever.” Translation: “Please don’t leave, here’s money.”

This isn’t just about stock awards or executive compensation. It’s about bringing back lost focus and whether the most famous CEO on the planet can be convinced to stop juggling a handful of companies and pay full attention (ok, more attention) to the one that’s public, highly volatile, and still kinda trying to figure out self-driving and robotaxis .

🎢 If the Stock Could Talk

The market’s response? Pretty bullish. Traders seem to like the idea of Musk staying inside the Tesla factory gates — or at least not moonlighting in so many side quests.

After all, Elon’s presence — erratic tweets, spontaneous product reveals, and all — is a core part of Tesla’s brand value. The stock has often behaved more like a crypto coin than a traditional automaker.

Musk already owns over 400 million shares, around 13% of Tesla, worth roughly $125 billion. But he’s gunning for more: his long-stated ambition is 25% voting control (equal to $250 billion in shares based on the current $1 trillion market valuation. This new package edges him closer to that goal. If he can’t own a country, a quarter of Tesla might do.

⚖️ A Legal Complication Worth $56 Billion

There’s one tiny footnote here: if Elon wins back his 2018 $56 billion pay package — the one struck down by a Delaware court — he might have to forfeit this new batch.

So yes, Tesla may have just given the richest man in the world a “Plan B” golden parachute. Or a “Plan A” depending on how Delaware judges are feeling when they decide on it.

🤖 AI, Robots, and Attention Deficits

Let’s not forget what lit the fire under this latest move. Back in January, Elon posted on X that he was “uncomfortable growing Tesla to be a leader in AI & robotics” without more control. It was a public shakedown — and apparently it worked.

Tesla’s ambitious AI goals — full self-driving software, Optimus the humanoid robot, and a suite of other sci-fi-sounding visions and promises — are largely tied to Musk’s personal involvement. Investors know that without him, these projects could end up shelved… or sold to xAI, his other pet project and owner of X (former Twitter).

🧮 The Math of Mega-Pay

Tesla says the accounting value of the package — after subtracting what Musk would have to pay to exercise the options and adjusting for restrictions — sits at about $23.7 billion. That's about the GDP of Malta and only slightly smaller than the SEC’s collective headache every time Musk tweets.

In return, Musk has to stick around for five years — or at least not officially leave. The board hopes that’s enough to keep him engaged. But the question is: How much is enough to counteract everything else going on?

The man’s worth $350 billion to $400 billion (depending on volatility) and if he wants to build Martian houses or dig tunnels under Paris, a few billion dollars aren’t going to make a difference.

🔀 A Shifting CEO, A Shaky Business?

It’s not just about Elon’s attention span. Tesla’s business hasn’t exactly been smooth sailing. The EV market is more crowded than ever. Sales are dropping in Europe. Tariff threats are buzzing in the background.

On top of that, it’s the earnings season and the Earnings calendar is hot to the touch. In recent quarters, Elon’s perceived absence from the factories have coincided with slumping revenue and nervous investors.

Add in the fact that Elon just exited the Trump administration after a brief stint and dramatic fallout — yes, that happened — and Tesla investors are understandably hoping for a little more focus in the months ahead. Not to mention his new Washington gig — his “America party” political party .

🚗 Is Tesla Still a Growth Story?

Tesla is still the largest EV maker in the US, but the shine has worn off a bit. The Cybertruck’s still not mainstream, Model 3s are getting old, and margins are being squeezed by global competition and pricing wars.

If Musk is serious about staying and building, this could be Tesla’s opportunity to pivot — from hype-driven volatility to sustained, AI-powered growth. But if not, well... there’s SpaceX. Or xAI. Or Neuralink. Or The Boring Company. Or the next startup he tweets into existence.

Off to you : Do you feel like Tesla is paying Elon to stay interested — or rewarding him for prior (and future?) performance. And is that the way to buy loyalty and dedication? Share your thoughts in the comments!

TSLA trade ideas

Tesla Roadmap: From $300 Zone to $575Hello traders, here’s my latest analysis on Tesla (TSLA) based on the weekly and daily timeframes. On the weekly chart, I have drawn a downtrend line starting from December 2024, and the recent price action shows a breakout above this line on a weekly close. This breakout is a promising sign that an uptrend may be developing in the medium term.

On the daily chart, we can see a cup & handle pattern forming, which is a bullish continuation structure. However, the daily downtrend drawn from the December 2024 highs remains unbroken, so I will need to see a weekly close above the $332 resistance level to confirm a swing long setup.

My preferred positioning zone for longs is between $300 and $350, using a multi-entry approach to average into the trade. My upside targets are $366, $445, $500, and finally $575. These levels align with inverse Fibonacci projections, with “safety 1” at $360 and “0” at $227, pointing toward the 161, 200, and 261 extensions as key objectives.

For stop-loss placement, patient traders who are willing to hold through volatility may consider a weekly close below $265 as their invalidation point. For faster or more short-term oriented traders, a weekly close below $300 could be used as a tighter stop level. Although I believe it is unlikely for price to drop this far, even if it does, I expect strong buying interest and a potential rebound from the $265 support zone.

Risk management remains crucial for this setup. I recommend not risking more than 10% of your capital, scaling in over multiple entries, and always confirming with your own strategy before committing to the trade. Position sizing and discipline will be key to managing volatility and protecting capital.

NASDAQ:TSLA

TSLA to $450-$500 this year Technicals:

Big Picture: Huge wedge breakout, followed by retest and bounce, and now we are flagging.

2Month Chart: Every time TSLA has had a hammer candle on the 2M chart, we have rallied hard within 2-7 months.

100 SMA on the daily: Everytime TSLA’s daily 100 SMA has gone from an extended downslope to upsloping (with the addition of some wedge breakout or Inverted H&S), it’s been the beginning of a rally.

Fundamentals: While this analysis is primarily technical, Tesla’s long-term prospects, its strong base of loyal investors, and the high level of short interest believing its already over priced- suggests to me that the technicals are signaling a huge run this year to $450-$500+.

TESLA What Next? SELL!

My dear friends,

My technical analysis for TESLA is below:

The market is trading on 329.70 pivot level.

Bias - Bearish

Technical Indicators: Both Super Trend & Pivot HL indicate a highly probable Bearish continuation.

Target - 319.77

Recommended Stop Loss - 335.01

About Used Indicators:

A pivot point is a technical analysis indicator, or calculations, used to determine the overall trend of the market over different time frames.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

TESLA Sellers In Panic! BUY!

My dear friends,

TESLA looks like it will make a good move, and here are the details:

The market is trading on 302.63 pivot level.

Bias - Bullish

Technical Indicators: Supper Trend generates a clear long signal while Pivot Point HL is currently determining the overall Bullish trend of the market.

Goal - 310.73

Recommended Stop Loss - 298.19

About Used Indicators:

Pivot points are a great way to identify areas of support and resistance, but they work best when combined with other kinds of technical analysis

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

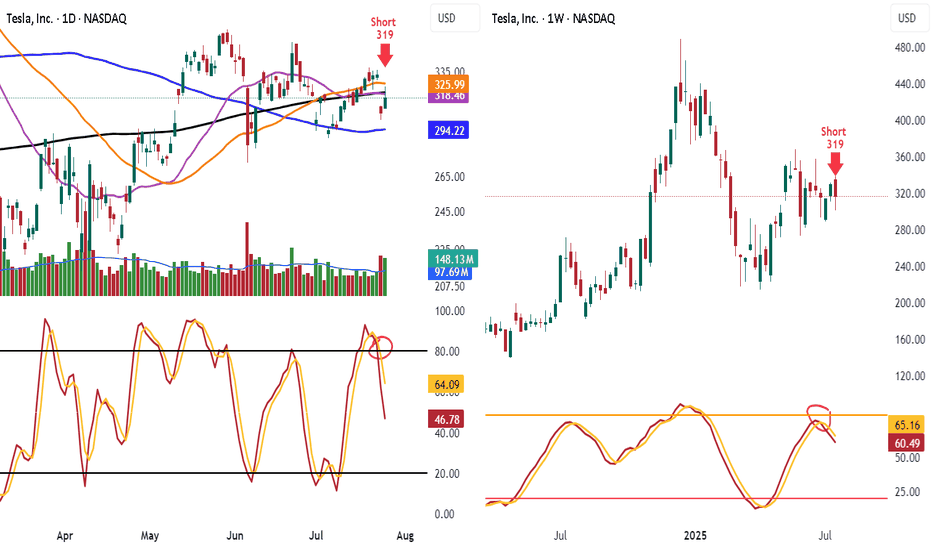

Shorted TSLA 319 Look at TSLA hit 50 day and 200 day MA and failed and know under them

Look at the lower highs and see the stoch heading down

Know lets look weekly stoch heading down and lower highs

Target is 100 day ma 294.22 take some off. When it breaks will add back on

Have trailing stop in place

TESLA ABC Trap ZoneTesla’s price action has been exhibiting a period of consolidation characterized by lateral movement, forming a pattern commonly identified as a triangular structure. Triangular formations, by their nature, have the potential to break out in either direction—upward or downward—depending on market dynamics. However, my focus is particularly on recognizing this pattern within the context of an Elliot Wave ABC corrective structure.

Specifically, the second wave in this sequence appears to manifest as a triangle, suggesting a phase of market indecision and consolidation. This phase is typically followed by a final impulsive move downward, which would serve to complete the overall corrective pattern. Understanding this sequence is critical, as it provides insight into the potential continuation or reversal of Tesla’s price trend after the correction concludes.

Next Volatility Period: Around August 21

Hello, traders.

Please "Follow" to get the latest information quickly.

Have a nice day today.

-------------------------------------

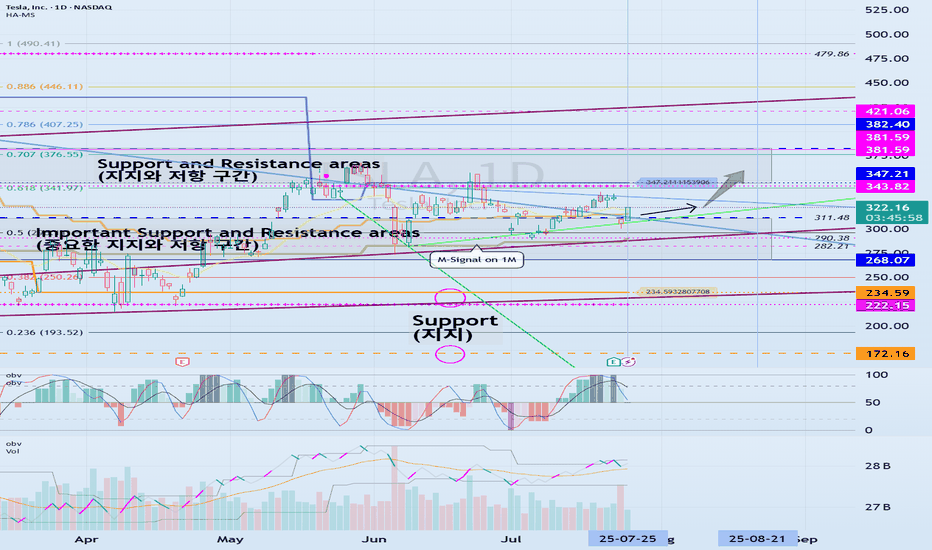

#TSLA

We need to see if it is rising along the rising channel.

The key is whether it can rise with support near 311.48 to break out of the downtrend line.

The key is whether it can rise along the short-term uptrend line and break through the short-term downtrend line after passing through this volatility period around July 25.

Therefore, we need to see whether it can rise above the 347.21-382.40 range with support near 311.48.

The next volatility period is expected to be around August 21.

-

The important thing is to maintain the price above the M-Signal indicator on the 1M chart.

If not, there is a possibility of a long-term downtrend.

Therefore, if it shows support in the 268.07-311.48 range, it is a time to buy.

-

Thank you for reading to the end.

I hope you have a successful trade.

--------------------------------------------------

TSLA Momentum Unstoppable To $370— Don’t Miss Out! 🚀 TSLA Weekly Options Analysis — Bullish Momentum Confirmed! (2025-08-11) 🚀

### 🔥 Key Highlights:

* **RSI Signals Bullish:** Daily RSI at **59.5**, Weekly RSI at **54.9** — momentum is building strong!

* **Massive Weekly Gain:** +13.62% this week, breaking past key moving averages & resistance levels.

* **Options Flow:** Call/Put ratio at **1.77** — traders and institutions betting big on upside!

* **Volatility:** VIX low at **15.8** — ideal environment for bullish directional trades.

* **⚠️ Volume Caution:** Weekly volume at **0.8x** last week — watch closely for institutional commitment shifts.

---

### 📈 Consensus:

Most models say: **BULLISH** ✅

* Momentum + Options Flow + Low Volatility = Perfect setup

* Volume dip is a caution flag but not a dealbreaker (yet).

---

### 🎯 Trade Setup: Buy Calls on TSLA

| Parameter | Details |

| ----------------- | ------------------------------------ |

| **Strike** | \$370 |

| **Expiry** | Aug 15, 2025 |

| **Entry Price** | \$0.53 (market open) |

| **Stop Loss** | \$0.26 (50% loss) |

| **Profit Target** | \$1.06 (100% gain) |

| **Position Size** | Risk 2-4% of account (1-2 contracts) |

---

### ⚠️ Risk Management & Notes

* Moderate gamma risk — manage actively as expiry nears

* Watch volume trends for sudden shifts

* Confidence level: **75%** — strong bullish signals but stay nimble!

---

### 📊 JSON Trade Snapshot for Algo Fans

```json

{

"instrument": "TSLA",

"direction": "call",

"strike": 370.00,

"expiry": "2025-08-15",

"confidence": 0.75,

"profit_target": 1.06,

"stop_loss": 0.26,

"size": 2,

"entry_price": 0.53,

"entry_timing": "open",

"signal_publish_time": "2025-08-11 14:59:39 UTC-04:00"

}

```

---

💡 **TL;DR:** TSLA’s weekly surge + bullish options flow make \$370 calls a compelling play this week. Manage risk, watch volume, and aim for that 2x profit target!

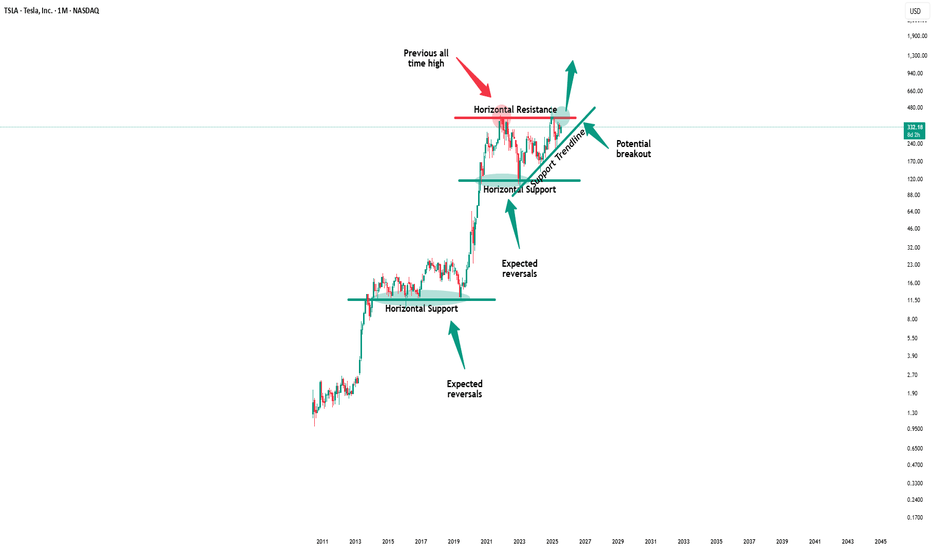

Tesla - The all time high breakout!🚗Tesla ( NASDAQ:TSLA ) will break out soon:

🔎Analysis summary:

For the past five years Tesla has overall been consolidating between support and resistance. But following the recent bullish break and retest, bulls are slowly taking over control. It is actually quite likely that Tesla will soon break above the previous all time highs.

📝Levels to watch:

$400

🙏🏻#LONGTERMVISION

SwingTraderPhil

$TSLA: Branching Effect🏛️ Research Notes

Reaching branching effect through cross-cycle interconnection. Alongside I'll test some elements mentioned below.

Local Progressions

Rhyme and levels derived from apparent cycle compression.

Added channels with darkening gradient that cover bullrun from mid 2019, driven by angle of tops.

In the local scope, as price deepens into denser zone the probability of disproportional reaction gets higher. t would probably complete its intermediate and even longer-term cycles before escaping the boundary.

TSLA Facing Key Resistance – Short Setup Targeting 301 SupportTesla is currently testing a key resistance area formed by the intersection of a descending trendline and a previously tested supply zone around 321.

Price action in this region may lead to a potential rejection.

**Forecast:**

If the rejection is confirmed, I expect a move toward the 301–300 support zone.

This area aligns with prior demand and a technical timing window from my harmonic model.

Trade idea based on trend structure, liquidity zones, and time-based forecast methodology.

📅 Watch price behavior around 321 for confirmation.

📉 Target: 301 support area

TESLA: Expecting Bearish Movement! Here is Why:

Balance of buyers and sellers on the TESLA pair, that is best felt when all the timeframes are analyzed properly is shifting in favor of the sellers, therefore is it only natural that we go short on the pair.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

TeslaIn regard to Tesla, not a lot happened last week. Price started to raise back up towards the orange target box the week prior but failed to make new local highs. After that slight raise, it spent the last week grinding lower and breached the prior local low. If it can manage to breach the orange c wave low @ $288.77 (marked by red dashed line), we're headed to the grey target box.

That red dashed line is very significant. The reason being is it invalidates the potential triangle if it gets breached. Should that happen, the only pattern I see is pointing to the grey box. If we do head to the lower target box, the $220's looks like the sweet spot for minor A to complete. I say this due to the green 1.618, yellow 1.618, & white 0.618 fibs being in that area. As you know, all levels of .618 are some of the strongest fibs if not THE strongest.

Should orange prevail, and we have in fact carved out a triangle, the likely target would be the 0.786 @ $429.81 IMO. We have to wait to find out though as price is still refusing to lift its skirt and show the goods so to speak.

To repeat and summarize, below $288.77 and we're likely headed to the gray box. Above the orange (D) high @ $338.88 (orange dotted line), and we're most likely headed to the orange target box. If we can manage to get into the grey box, I will begin looking for an entry very likely in the $220's or $230's.

Tesla Builds Momentum - Can It Reach $490?Tesla Builds Momentum - Can It Reach $490?

From a technical perspective, Tesla is showing signs of volume accumulation and appears to be forming a contracted triangle pattern.

The price seems to have found solid support around 287, suggesting this corrective phase might be nearing its end.

If the price breaks out of the triangle, especially above 330, the dominant bullish trend is likely to resume.

On top of that, Tesla’s quarterly results beat expectations, which further strengthens the bullish outlook.

My eyes are on price targets around 400, 450, and 490.

News:

📊 Tesla approves share award worth $29 billion to CEO Elon Musk

Tesla has granted CEO Elon Musk 96 million shares worth about $29 billion, a move aimed at keeping the billionaire entrepreneur at the helm as he fights a court ruling that voided his original pay deal for being unfair to shareholders.

📊Tesla signed on Wednesday a $4.3 billion battery deal with LGES, source says, reducing China reliance. South Korea's LG Energy Solution has signed a $4.3 billion deal to supply Tesla with energy storage system batteries, said a person familiar with the matter, as the U.S. company looks to reduce reliance on Chinese imports due to tariffs.

You may find more details in the chart!

Thank you and Good Luck!

PS: Please support with a like or comment if you find this analysis useful for your trading day

Tight Squeeze in TeslaTesla rallied sharply in late 2024, followed by a drop in the first quarter. Now, after a long period of consolidation, some traders may think the EV maker is getting ready to move again.

The first pattern on today’s chart is the series of higher lows and lower highs since May. That converging triangle may give TSLA breakout potential.

Second, Bollinger Bandwidth has squeezed to a 13-month low. Will that price compression give way to expansion?

Third, the rising 200-day simple moving average may suggest a longer-term uptrend remains in effect.

Next, prices are trying to push above the 21-day exponential moving average. That may be consistent with increasing bullishness in the short term.

Finally, TSLA is a highly active underlier in the options market. (Its average daily volume of 2.3 million contracts ranks behind only Nvidia in the S&P 500, according to TradeStation data.) That may help traders take positions with calls and puts.

TradeStation has, for decades, advanced the trading industry, providing access to stocks, options and futures. If you're born to trade, we could be for you. See our Overview for more.

Past performance, whether actual or indicated by historical tests of strategies, is no guarantee of future performance or success. There is a possibility that you may sustain a loss equal to or greater than your entire investment regardless of which asset class you trade (equities, options or futures); therefore, you should not invest or risk money that you cannot afford to lose. Online trading is not suitable for all investors. View the document titled Characteristics and Risks of Standardized Options at www.TradeStation.com . Before trading any asset class, customers must read the relevant risk disclosure statements on www.TradeStation.com . System access and trade placement and execution may be delayed or fail due to market volatility and volume, quote delays, system and software errors, Internet traffic, outages and other factors.

Securities and futures trading is offered to self-directed customers by TradeStation Securities, Inc., a broker-dealer registered with the Securities and Exchange Commission and a futures commission merchant licensed with the Commodity Futures Trading Commission). TradeStation Securities is a member of the Financial Industry Regulatory Authority, the National Futures Association, and a number of exchanges.

Options trading is not suitable for all investors. Your TradeStation Securities’ account application to trade options will be considered and approved or disapproved based on all relevant factors, including your trading experience. See www.TradeStation.com . Visit www.TradeStation.com for full details on the costs and fees associated with options.

Margin trading involves risks, and it is important that you fully understand those risks before trading on margin. The Margin Disclosure Statement outlines many of those risks, including that you can lose more funds than you deposit in your margin account; your brokerage firm can force the sale of securities in your account; your brokerage firm can sell your securities without contacting you; and you are not entitled to an extension of time on a margin call. Review the Margin Disclosure Statement at www.TradeStation.com .

TradeStation Securities, Inc. and TradeStation Technologies, Inc. are each wholly owned subsidiaries of TradeStation Group, Inc., both operating, and providing products and services, under the TradeStation brand and trademark. When applying for, or purchasing, accounts, subscriptions, products and services, it is important that you know which company you will be dealing with. Visit www.TradeStation.com for further important information explaining what this means.

Tesla (TSLA) Shares Break Above July HighTesla (TSLA) Shares Break Above July High

As the chart indicates, Tesla (TSLA) stock is demonstrating a pronounced upward trend. Specifically, its price:

→ has risen for four consecutive days;

→ has moved above its July high;

→ has gained over 10% since the start of August.

Why Is TSLA Rising?

Among other factors, TSLA’s share price is being driven by:

→ News that Tesla has extended the estimated delivery time for the Model Y from one–three weeks to four–six weeks (according to Barron’s). This may signal an increase in orders, boosting market optimism after the first two quarters showed a notable decline in electric vehicle sales.

→ Statements from Elon Musk regarding the development of the robotaxi project. According to him, Tesla’s robotaxi service will be publicly available next month. Musk also noted that Tesla has achieved several additional breakthroughs in artificial intelligence that will make car control remarkably similar to that of a human driver.

Can TSLA continue to rise?

Technical Analysis of TSLA Stock

When analysing the TSLA chart on 24 July, we identified a broadening triangle pattern with its axis around $317. Since then:

→ the price tested the lower boundary of the triangle and reversed upwards (as indicated by the arrow);

→ importantly, it broke through the upper boundary. This was made possible by the improvement in the fundamental backdrop (as reflected in the news), leading to a shift in market sentiment in favour of buyers.

Yesterday, the NASDAQ recorded the highest trading volume in August, with the daily candle closing below its midpoint – a sign of increased seller activity, further confirmed by the most recent long bearish candle on the hourly chart.

Given the above (as well as the RSI indicator approaching overbought levels), we could assume that TSLA’s share price could see a short-term correction following its rally in early August. Should the market follow this scenario, the price could pull back to the area highlighted in purple, which represents a significant support level, as it lies close to:

→ the upper boundary of the triangle (former resistance);

→ the lower boundary of the ascending channel (shown in blue);

→ the 50% retracement level of the A→B impulse;

→ price zones of strong upward movement (a bullish imbalance zone, as described by the Fair Value Gap pattern of the Smart Money Concept methodology).

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

$TSLA Bullish WedgeWeekly Chart Consolidation Pattern: TSLA has formed a clear triangle consolidation pattern after the significant pullback from its 2025 highs around $440. Price is currently testing the upper boundary of this triangle at $329.65, suggesting potential for a breakout.

Key Support Levels Holding: The stock has established strong support at $273.38, which has been tested multiple times and held firmly. This creates a solid foundation for a bullish move.

Momentum Shift: TSLA recently breaking above its descending trendline resistance, indicating a shift in short-term momentum from bearish to bullish.

Higher Lows: On both daily and weekly charts, TSLA has been forming higher lows since April 2025, suggesting accumulation and strengthening bullish sentiment.

Fundamental Catalysts

Several fundamental factors support a bullish outlook:

Robotaxi Progress: Recent news confirms TSLA received a Texas Robotaxi permit (August 9th), allowing it to launch a ride-hailing service with safety drivers, competing directly with Uber and Lyft in the autonomous vehicle space.

Q2 Earnings Beat: The July 23rd earnings report showed TSLA beating expectations with EPS of $0.40 (14.29% above estimates) and revenue of $22.5B (slightly above estimates), demonstrating the company's resilience despite challenging market conditions.

Production Plans on Track: During the earnings call, Tesla confirmed "plans for new vehicles that will launch in 2025 remain on track, including initial production of a more affordable model in 1H25." This addresses a key market concern about Tesla's product roadmap.

Strong Analyst Support: Despite mixed ratings, several prominent analysts remain highly bullish, with Wedbush maintaining a $500 price target (approximately 52% upside from current levels). RBC Capital also raised their price target from $319 to $325 recently.

AI and Technology Leadership

TSLA's AI initiatives offer significant upside potential:

FSD Progress: Elon Musk stated during the earnings call that "unsupervised FSD likely to be available for personal use by end of year," which could be a major competitive advantage.

Samsung Partnership: The company secured a $16.5 billion chip deal with Samsung for next-gen AI chips, positioning Tesla for continued leadership in autonomous driving technology.

Supply Chain Resilience: Tesla is "localizing supply chains to mitigate geopolitical risk," making it the only automaker sourcing batteries at scale through non-Chinese routes, according to Piper Sandler.

Price Action and Potential Targets

The recent price action suggests TSLA is preparing for a potential upward move:

Immediate Resistance: The $340.24 level shown on your chart represents the first significant resistance. A decisive break above this level could trigger a run toward the $400 psychological level.

Intermediate Target: If momentum continues, the next target would be a retest of the 2025 high near $440.

Current Price Action: The stock has recently crossed above the descending trendline that had been in place since January 2025, which is typically a bullish signal.

Risks to Monitor

While maintaining a bullish bias, it's important to acknowledge potential risks:

AI Team Changes: Recent news indicates Tesla scrapped its Dojo Supercomputer AI team, which could impact some AI development initiatives.

Competition: Chinese EV makers and traditional automakers are intensifying efforts in both EV and autonomous driving spaces.

Technical Support: The $275-280 zone remains critical - a break below could invalidate the bullish thesis.

In conclusion, TSLA's technical setup across multiple timeframes, combined with positive fundamental developments in robotaxi, AI initiatives, and upcoming product launches, creates a compelling bullish case for the stock in the near to medium term. The stock appears positioned for a potential upside move as it tests key technical resistance levels with strong support established below current prices.

Telsa! Fake out or Buy now?We have been showing we are consolidating for a while now and we are very close to a break out and although we all want to buy into this stock, is it the right time?

Well looking at this chart there is a chance we get a Bearish Breakout towards the lower Support and facing lower Demand zones showing were there is a higher demand of Buyers.

Saying that there is every possibility that we could buy this Breakout now and get the positive response we are all hoping for. Tonight market open shall give us a strong sentiment of what the close future of Tesla is holding for us all

Good luck to any traders that follow this chart pattern