The 5 different types of Professional TradersLearn what each professional trader group trades, how they trade, when they trade and why they trade.

There are:

Sell Side Institution Floor Traders

Buy Side Institution Floor Traders

Proprietary Desk Traders (prop)

Specialist Professional Traders

Independent Professional traders.

Each type of profe

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

0.84 USD

393.08 M USD

2.44 B USD

443.11 M

About The Trade Desk, Inc.

Sector

Industry

CEO

Jeffrey Terry Green

Website

Headquarters

Ventura

Founded

2009

FIGI

BBG00629NGT2

The Trade Desk, Inc. engages in the provision of a self-service and cloud-based ad-buying platform. It operates through the United States and International geographical segments. The firm offers omnichannel advertising, audience targeting, solutions for identity, application programming interface (API), custom, and programmatic, measurement and optimization. The company was founded by Jeffrey Terry Green and David Pickles in November 2009 and is headquartered in Ventura, CA.

Related stocks

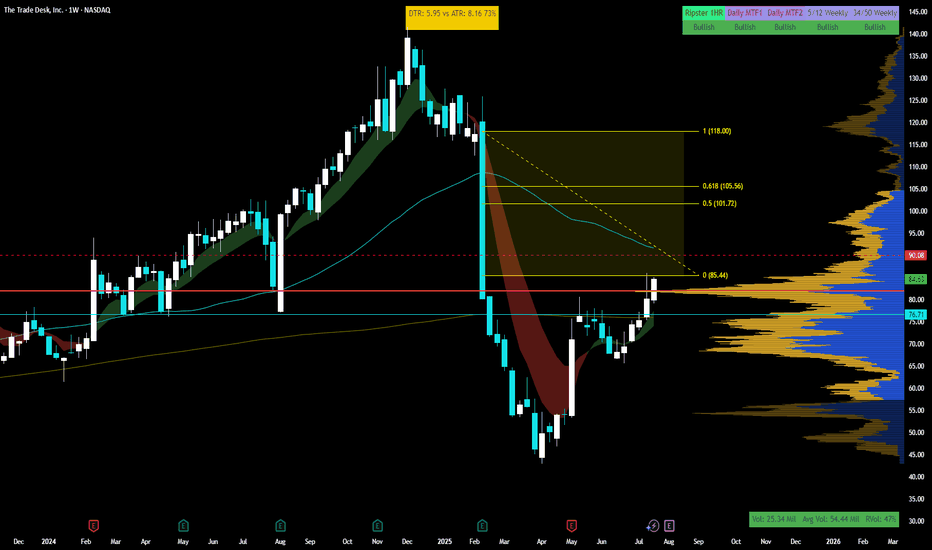

$TTD is ready to move into triple digits - Lock n load Pretty straight forward in the face setup.

Here are pros-

+Got added to s&p500

+massive volume shelf from multi year above 80 which we are above

+beautiful gap from q1 2025 to ride from $85 to $120

++Relative strength strong vs spy for 55 period(thats what I use)

+++ $100 Psych level is a MAGNET -

The Trade Desk: Why the Sudden Surge?The Trade Desk (TTD) recently experienced a significant stock surge. This rise stems from both immediate market catalysts and robust underlying business fundamentals. A primary driver was its inclusion in the prestigious S&P 500 index, replacing Ansys Inc. This move, effective July 18, immediately t

TTD is giving a second chance A few days ago, we mentioned that NASDAQ:TTD could have reached a great buying level around the $44 area. After a recent rally, we’re now seeing a typical bullish continuation pattern. If the flag breaks to the upside, you’ll have a new opportunity to join the upward move.

Once again, a tight sto

$TTD | Smart Money Accumulation or Just a Dead Cat Bounce?WaverVanir International LLC Analysis

🧠 Weekly Chart | Smart Money Concepts (SMC) | June 25, 2025

After a dramatic markdown, The Trade Desk (TTD) has bounced sharply off a major strong low / demand zone (~$40–$45). We’re currently trading near $69.80, building bullish momentum toward the equilibriu

TTD Swing Trade Plan – 2025-06-06🐻 TTD Swing Trade Plan – 2025-06-06

Bias: Moderately Bearish

Timeframe: 5–7 trading days

Catalysts: Weak daily trend, below EMAs, oversold conditions may delay move

Trade Type: Naked put option

🧠 Model Summary Table

Model Bias Strategy Strike Premium Target(s) Stop-Loss Confidence

Grok Moderately B

Long on $TTD ; It should test 75-80 range- Many good news have come for NASDAQ:TTD in the last 2 weeks and one of that is Judge ruling against Google Ad business which might lead to relaxed rules by Google which will help other advertisers expand their TAM

- Netflix ads should allow DSPs like NASDAQ:TTD to get more investment dollars

$TTD Breakout After Earnings | Gapped Up w/ Volume Surge📊 Summary for TradingView Post:

NASDAQ:TTD exploded +11% post-earnings, gapping above key resistance and closing strong with massive volume.

Price cleared multiple supply zones with conviction, now sitting above $79 with eyes on $82.74 and $86.43.

Buyers showed up heavy. This is no random push—str

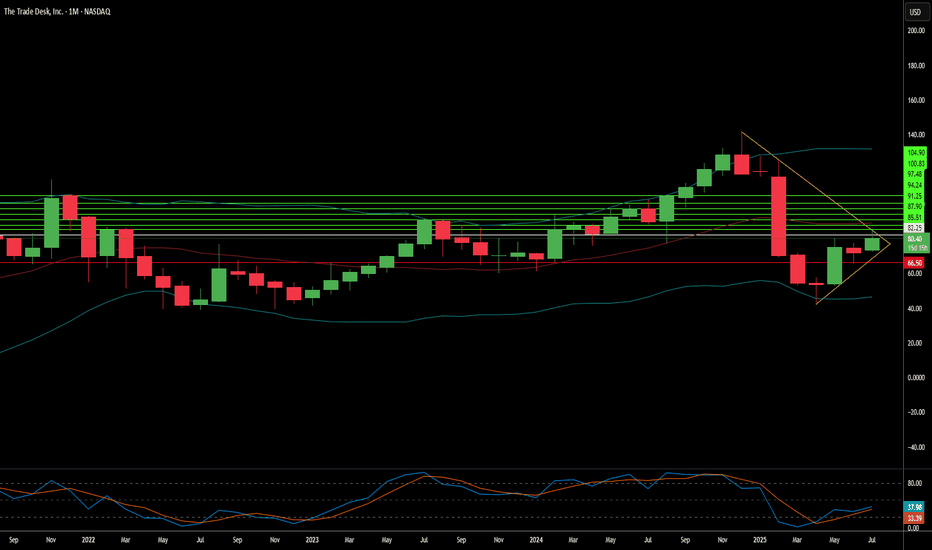

$TTD stock has been in a steady uptrend!📊 The Trade Desk ( NASDAQ:TTD ) – Stock Analysis

🔍 Fundamental Analysis

1. Company Overview:

Name: The Trade Desk Inc.

Ticker: TTD

Sector: Technology / Advertising

Business Model: The Trade Desk is a leading demand-side platform (DSP) for digital ad buyers, enabling programmatic advertising acro

TTD eyes on $54.xx: Major Resistance to be flipped to SupportTTD dumped even before tariffs but trying to recover.

Now testing a major resistance zone at $54.21-54.34

If rejected then watch next support zone $51.26-51.43

Previous Analysis that called the top:

================================================

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

Curated watchlists where TTD is featured.

Software stocks: US companies at our finger tips

49 No. of Symbols

See all sparks

Frequently Asked Questions

The current price of TTD is 86.08 USD — it has decreased by −1.01% in the past 24 hours. Watch The Trade Desk, Inc. stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on NASDAQ exchange The Trade Desk, Inc. stocks are traded under the ticker TTD.

TTD stock has risen by 0.91% compared to the previous week, the month change is a 17.97% rise, over the last year The Trade Desk, Inc. has showed a −4.90% decrease.

We've gathered analysts' opinions on The Trade Desk, Inc. future price: according to them, TTD price has a max estimate of 135.00 USD and a min estimate of 47.00 USD. Watch TTD chart and read a more detailed The Trade Desk, Inc. stock forecast: see what analysts think of The Trade Desk, Inc. and suggest that you do with its stocks.

TTD stock is 6.22% volatile and has beta coefficient of 1.44. Track The Trade Desk, Inc. stock price on the chart and check out the list of the most volatile stocks — is The Trade Desk, Inc. there?

Today The Trade Desk, Inc. has the market capitalization of 42.09 B, it has increased by 5.24% over the last week.

Yes, you can track The Trade Desk, Inc. financials in yearly and quarterly reports right on TradingView.

The Trade Desk, Inc. is going to release the next earnings report on Aug 7, 2025. Keep track of upcoming events with our Earnings Calendar.

TTD earnings for the last quarter are 0.10 USD per share, whereas the estimation was 0.14 USD resulting in a −27.42% surprise. The estimated earnings for the next quarter are 0.18 USD per share. See more details about The Trade Desk, Inc. earnings.

The Trade Desk, Inc. revenue for the last quarter amounts to 616.02 M USD, despite the estimated figure of 575.31 M USD. In the next quarter, revenue is expected to reach 685.47 M USD.

TTD net income for the last quarter is 50.68 M USD, while the quarter before that showed 182.23 M USD of net income which accounts for −72.19% change. Track more The Trade Desk, Inc. financial stats to get the full picture.

No, TTD doesn't pay any dividends to its shareholders. But don't worry, we've prepared a list of high-dividend stocks for you.

As of Aug 2, 2025, the company has 3.52 K employees. See our rating of the largest employees — is The Trade Desk, Inc. on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. The Trade Desk, Inc. EBITDA is 542.70 M USD, and current EBITDA margin is 21.05%. See more stats in The Trade Desk, Inc. financial statements.

Like other stocks, TTD shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade The Trade Desk, Inc. stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So The Trade Desk, Inc. technincal analysis shows the buy rating today, and its 1 week rating is buy. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating The Trade Desk, Inc. stock shows the buy signal. See more of The Trade Desk, Inc. technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.