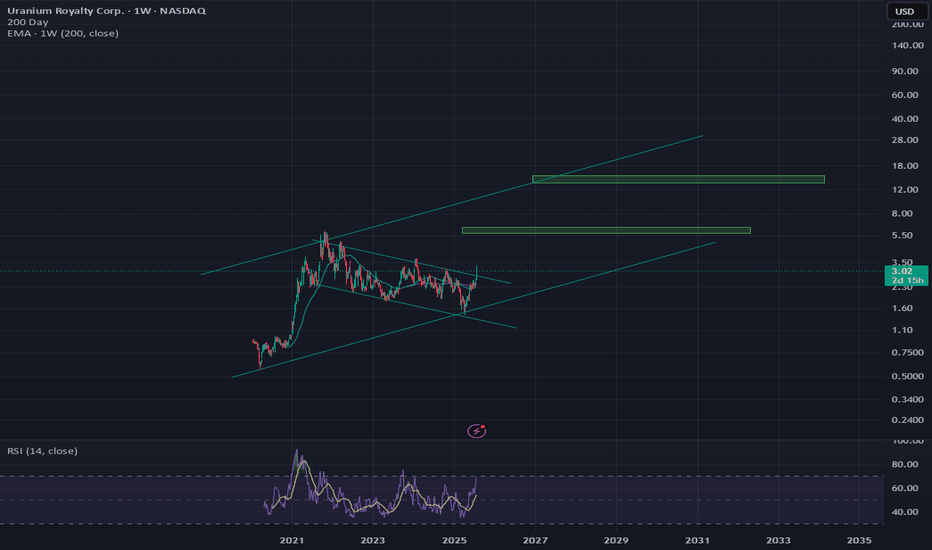

UROY Bull flag (weekly candles)Very bullish

Reasons

-over 200sma day and weekly

-bullish market

-already shown a push in 2021

-higher time frames have a stronger move in direction and with the bull flag being so clear, you can't deny the next leg.

Slower move rather than a straight shot to the levels.

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

−0.03 USD

−4.10 M USD

11.30 M USD

112.58 M

About URANIUM ROYALTY CORP

Sector

Industry

CEO

Scott Melbye

Website

Headquarters

Vancouver

Founded

2017

FIGI

BBG00RC86FX3

Uranium Royalty Corp. operates as an exploration company, which engages in acquiring and assembling a portfolio of royalties, and investing in companies with exposure to uranium and physical uranium. The company was founded by Amir Adnani on April 21, 2017 and is headquartered in Vancouver, Canada.

Related stocks

News mentions of Nuclear this & Uranium that, whats the Macro?This is a look into the macro developments happening currently in UROY.

This is strictly a TA look into the big picture. We zoom out to Timeframes bigger than 1W.

At times zooming in to check (3 Day, 5 Day, maybe 1D) for potential swing trades.

I tend to look into things like price action, indicato

UROY an energy penny stock LONGUROY basically sells rights to mine uranium for a percentage of the production. It is a penny

stock in the nuclear subsector of energy which is undergoing a renaissance in this era of

fossil fuel addiction detoxification in the context of climate change remediation agendas.

The 240 minute char

UROY Uranium finance lease mining play LONGUROY does royalties foe uranium mining ore to refined et cetera. On the 60 minute chart,

it has been on fire this week picking up 30% in market cap showing explosive volumes

at 5X and sustained. The past two days have been rest and recuperation in consolidation.

The zero-lag MACD suggests the

UROY Short Sell Trade from High Tight Flag Breakdown SHORTUROY topped out as shown by my other ideas. Profits are redeployed into it in a short trade

to play the volatility. Expect 10% in 1-3 days. Text box comments are on the chart. The

volatility is increased;the uranium sector is hot ( no pun here) given the climate warming and t

the ongoing de

UROY Swing Trade Recap Volume Profile Analysis LONGUROY on a 15-minute chart with the volume profile and the EMA cloud as the indicators

demonstrates a one-week-long swing trade. Both stock shares and inexpensive call contracts

were traded. The stock trade profit was 30% over five trading days ( MLK Holiday ignored).

Options dramatically more pro

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

Frequently Asked Questions

The current price of UROY is 3.10 USD — it has increased by 1.64% in the past 24 hours. Watch Uranium Royalty Corp. stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on NASDAQ exchange Uranium Royalty Corp. stocks are traded under the ticker UROY.

UROY stock has risen by 18.77% compared to the previous week, the month change is a 31.91% rise, over the last year Uranium Royalty Corp. has showed a 34.78% increase.

We've gathered analysts' opinions on Uranium Royalty Corp. future price: according to them, UROY price has a max estimate of 4.52 USD and a min estimate of 2.91 USD. Watch UROY chart and read a more detailed Uranium Royalty Corp. stock forecast: see what analysts think of Uranium Royalty Corp. and suggest that you do with its stocks.

UROY reached its all-time high on Oct 25, 2021 with the price of 5.95 USD, and its all-time low was 0.56 USD and was reached on Mar 18, 2020. View more price dynamics on UROY chart.

See other stocks reaching their highest and lowest prices.

See other stocks reaching their highest and lowest prices.

UROY stock is 6.14% volatile and has beta coefficient of 2.36. Track Uranium Royalty Corp. stock price on the chart and check out the list of the most volatile stocks — is Uranium Royalty Corp. there?

Today Uranium Royalty Corp. has the market capitalization of 416.00 M, it has increased by 8.43% over the last week.

Yes, you can track Uranium Royalty Corp. financials in yearly and quarterly reports right on TradingView.

Uranium Royalty Corp. is going to release the next earnings report on Sep 10, 2025. Keep track of upcoming events with our Earnings Calendar.

UROY net income for the last quarter is −838.41 K USD, while the quarter before that showed −1.31 M USD of net income which accounts for 36.24% change. Track more Uranium Royalty Corp. financial stats to get the full picture.

No, UROY doesn't pay any dividends to its shareholders. But don't worry, we've prepared a list of high-dividend stocks for you.

As of Jul 27, 2025, the company has 14 employees. See our rating of the largest employees — is Uranium Royalty Corp. on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. Uranium Royalty Corp. EBITDA is −3.40 M USD, and current EBITDA margin is −30.05%. See more stats in Uranium Royalty Corp. financial statements.

Like other stocks, UROY shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade Uranium Royalty Corp. stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So Uranium Royalty Corp. technincal analysis shows the buy rating today, and its 1 week rating is strong buy. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating Uranium Royalty Corp. stock shows the strong buy signal. See more of Uranium Royalty Corp. technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.