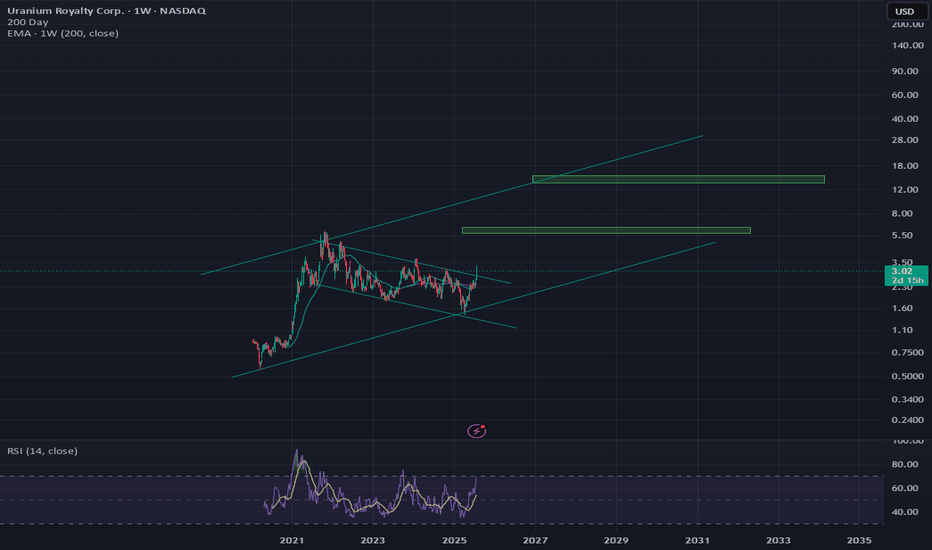

News mentions of Nuclear this & Uranium that, whats the Macro?This is a look into the macro developments happening currently in UROY.

This is strictly a TA look into the big picture. We zoom out to Timeframes bigger than 1W.

At times zooming in to check (3 Day, 5 Day, maybe 1D) for potential swing trades.

I tend to look into things like price action, indicators, volume and other data to sway probabilities of where an asset may go and determine best opportunities of supply and demand zones based on my interpretations.

So jumping right in this is a look into price action on the 1 Month timeframe.

Looks to me like a massive macro falling wedge.

But theres massive volume. So thats a little contradicting.

In anycase always look for confirmation of breakouts.

On another negative note: this is only 5 years of data. Would have loved more price data.

Also note potential bullish cross of STOCH RSI, a momentum indicator. Still need confirmation though. If blue and orange line above 20 level on STOCH at monthly candle close.

COuld be a positive.

But key is to watch for confluence of many signs and or indicators.

I will be keeping my eyes on this.

Look for more posts as things develop on UROY.

DISCLAIMER: This is not financial advice, i am not a financial advisor. The thoughts expressed in the posts are my opinion and for educational purposes. Do not use my ideas for the basis of your trading strategy, make sure to work out your own strategy and when trading always spend majority of your time on risk management strategy.

UROY trade ideas

UROY Bull flag (weekly candles)Very bullish

Reasons

-over 200sma day and weekly

-bullish market

-already shown a push in 2021

-higher time frames have a stronger move in direction and with the bull flag being so clear, you can't deny the next leg.

Slower move rather than a straight shot to the levels.

UROY an energy penny stock LONGUROY basically sells rights to mine uranium for a percentage of the production. It is a penny

stock in the nuclear subsector of energy which is undergoing a renaissance in this era of

fossil fuel addiction detoxification in the context of climate change remediation agendas.

The 240 minute chart shows a parabolic move in mid January followed by consolidation

and capitulation into a double top all at about the first anchored VWAP line above the mean

followed by a trend down into the present level near to the first lower VWAP line.

I will take a long trade here targeting the mean VWAP confluent with a standard Fibonacci

retractment which is the green line on the chart. $.05 is taken as a safe stop loss at the lows.

The target is 0.40 upside yielding a R:r of 8. I have positions in URA and UEC at this time.

The entire uranium subsector is cycling from warm to hot again.

UROY Uranium finance lease mining play LONGUROY does royalties foe uranium mining ore to refined et cetera. On the 60 minute chart,

it has been on fire this week picking up 30% in market cap showing explosive volumes

at 5X and sustained. The past two days have been rest and recuperation in consolidation.

The zero-lag MACD suggests there is more upside in the near term with a line cross under a

histogram rising from zero. The advanced RSI indicator shows a relative strength pullback from

80ish to about 65 and surprisingly the linear regression lines suggest an oversold state at

present. I will take a long position here which may be risky at nearly 2 standard deviations

above a rising mean VWAP and extended from the POC line of the volume profile but the

supertrend indicator is showing a stepped rise and that is good enough for me. I have a

new position in UEC a penny energy stock in the uranium subsector.

UROY Short Sell Trade from High Tight Flag Breakdown SHORTUROY topped out as shown by my other ideas. Profits are redeployed into it in a short trade

to play the volatility. Expect 10% in 1-3 days. Text box comments are on the chart. The

volatility is increased;the uranium sector is hot ( no pun here) given the climate warming and t

the ongoing debates on fossil fuels and government initiatives supporting green energy and

trying to wean the oil addiction. ( ZOOM out and to the left for text comments )

UROY Swing Trade Recap Volume Profile Analysis LONGUROY on a 15-minute chart with the volume profile and the EMA cloud as the indicators

demonstrates a one-week-long swing trade. Both stock shares and inexpensive call contracts

were traded. The stock trade profit was 30% over five trading days ( MLK Holiday ignored).

Options dramatically more profit for the expiration of 1/19th. The analysis, setup and

trade management occupied about 5 minutes per day as assisted by typical alerts and

notifications on the indicators as per TV.

The options contracts were closed as they were expiring later that Friday afternoon. The stock

position could have continued over a closed market weekend but I opted to close the

the entire position of stock simultaneously with the options.

This idea demonstrates the utility of the volume profile in this case applied to a penny stock

the hot uranium subsector within the energy sector at large. See also my other ideas on UROY

and also UEC.

The profits here will be used to take another long call option for UROY striking $ 5.00

for January 2025 sith some change left over for the next re-entry.

URANIUM ROYALTY - Can we double in price???We had a small gap that just filled so now is time to look at this as a viable trade. A lot of geopolitical reasons to think Uranium will be in demand, like it or not.

seekingalpha.com

Uranium Royalty Corp is focused on gaining exposure to uranium prices by making strategic investments in uranium interests, including royalties, streams, debt and equity in uranium companies, as well as through physical uranium transactions. The Company's strategy recognizes the inherent cyclicality of valuations based on uranium prices, including the availability of capital in different pricing environments.

UROY - Alt.Looks like the triangle, in the X position of a WXY, may have just completed, and a continuation down may be expected. I have not corroborated this view with any other uranium chart, nor have I reviewed other factors that may give a hint as to the direction. I published a bullish view on this instrument in a previous post, here:

Best of luck!

UROY Uranium Royalty Corp Options Ahead Of EarningsLooking at the UROY Uranium Royalty Corp options chain ahead of earnings , i would buy the $2.5 strike price Calls with

2023-1-20 expiration date for about

$0.22 premium.

If the options turn out to be profitable Before the earnings release, i would sell at least 50%.

Looking forward to read your opinion about it.

UROYAt support so not too keen to short. Long would be the way to go but I'm concerned with the inefficiency below.

Will wait for one of the two arrows to give me a trigger to take the trade. Personally would like the inefficiency filled below and then long.

We don't, however, receive what we want, so will wait for the market to come to me.

UROY LONG SETUPNASDAQ:UROY

On the daily chart UROY which is a uranium royalty play

is at a three month long. Outlook is good when energy

costs are rising and uraniums is widely considered

more green than Oil, natural gas and other CO2 producing

fuels.

The RSI Oscillator is in mid-range. Within the past

few days, a high spike of buying volume is noted.

A Doji candle a few days ago signaled the reversal.

It is there that I will set the stop loss.

I am targetting a 40-60 % retracement of the downtrend

mindful of the Fibonacci levels and so about a 20-25%

upside.

URC poppingThis is another example of a trading pattern that I trade regularly, you just have to look for it.