Voyager Therapeutics' ($VYGR) Breakthrough

In a groundbreaking move within the biotechnology sector, Voyager Therapeutics recently announced a strategic licensing deal with Novartis, catapulting its shares up by an impressive 35% in premarket trading. The collaboration involves Novartis making an upfront payment of $100 million to gain exclusive access to Voyager's cutting-edge RNA-based screening platform and to advance a promising gene therapy candidate targeting Huntington's disease (HD). This alliance not only signifies a significant financial boost for Voyager but also opens up a pathway to revolutionize the treatment landscape for Huntington's disease.

Key Deal Highlights:

The $100 million upfront payment from Novartis is a testament to the immense potential perceived in Voyager's technology and the promising gene therapy candidate currently in the pre-clinical stage for Huntington's disease. As part of the agreement, Voyager stands to receive substantial milestone payments, amounting to up to $1.2 billion, reflecting Novartis' confidence in the successful development and commercialization of the therapy. Furthermore, Voyager is entitled to tiered royalties on global net sales of products utilizing its RNA-based screening platform, providing a long-term revenue stream.

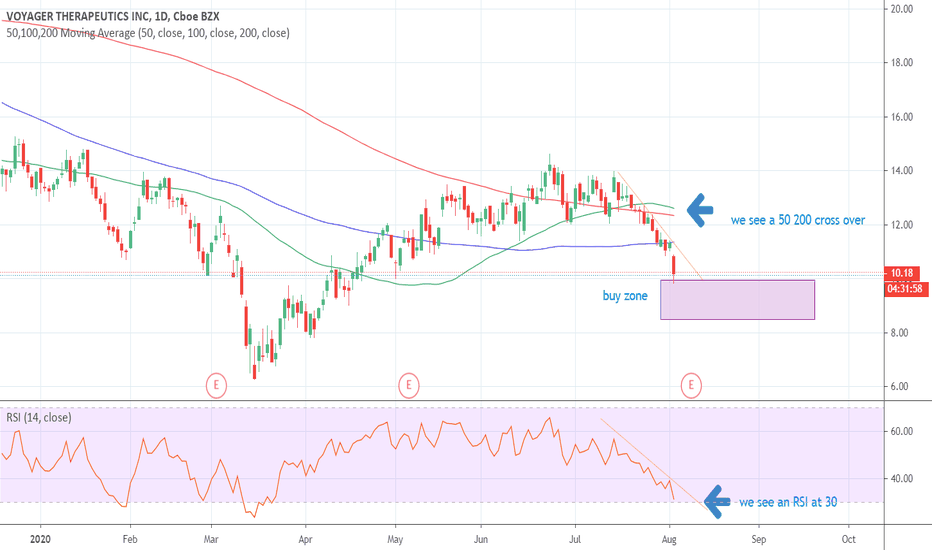

Technical Analysis Signals Positive Momentum:

From a technical analysis perspective, Voyager Therapeutics has broken through the ceiling of a falling trend channel in the medium to long term. This breakout suggests a potential shift in the stock's trajectory, signaling either a slower descent initially or the initiation of a more horizontal development. The stock currently finds support at $8.00 and faces resistance at $10.80. Positive volume balance indicates a strong presence of aggressive buyers, while sellers appear to be more passive, further strengthening the stock's position.

Why Buy Voyager Therapeutics Stock Now:

1. Strategic Partnership: The collaboration with Novartis positions Voyager as a key player in the gene therapy space, validating the potential of its RNA-based screening platform.

2. Financial Boost: The $100 million upfront payment and the possibility of up to $1.2 billion in milestone payments underscore the financial viability and growth potential of Voyager Therapeutics.

3. Huntington's Disease Focus: With a gene therapy candidate specifically targeting Huntington's disease, Voyager is addressing an unmet medical need and contributing to advancements in treating genetic disorders.

4.Technical Breakout: The technical analysis signals a positive momentum shift, suggesting a potential upward trend. The stock's support at $8.00 and resistance at $10.80 provides a clear framework for potential gains.

Voyager Therapeutics' recent licensing deal with Novartis has injected new life into the biotech firm, sparking optimism among investors. The financial infusion, strategic partnership, and positive technical signals make Voyager an attractive prospect for buyers seeking exposure to the rapidly evolving field of gene therapy. As the company advances its pre-clinical gene therapy candidate for Huntington's disease, investors stand to benefit from the potential growth and transformative impact of this collaboration on the future of genetic disorder treatments.

VYGR trade ideas

Target $ 6.12Voyager Therapeutics (VYGR) has signed an agreement through which Pfizer Inc. (PFE) may exercise options to license novel capsids generated from Voyager's TRACER screening technology to treat certain neurologic and cardiovascular diseases.

Under terms of the deal, Pfizer will have the right to evaluate novel capsids selected for central nervous system and cardiac tropisms from Voyager's TRACER platform and to exercise options to license capsids for exclusive use in Pfizer's development of adeno-associated virus gene therapies incorporating two undisclosed transgenes. The transgenes will be distinct from those planned for Voyager's internal pipeline. Voyager will retain global rights to all licensed capsids for use with other transgenes and to all other applications of its TRACER technology, the company said.

In exchange, Voyager will receive $30 million upfront and is entitled to receive up to $20 million in exercise fees for two options, exercisable by Pfizer within 12 months of signing. Voyager will also be eligible to earn up to $580 million in total development, regulatory, and commercial milestones associated with licensed products incorporating the two transgenes together with a Voyager licensed capsid. Voyager is also eligible to receive mid- to high-single-digit tiered royalties on net sales of Pfizer's products incorporating the licensed capsids.

Shares of Voyager Therapeutics are up nearly 37% in recent Wednesday premarket activity.

Big News, potential breakoutVoyager Therapeutics, Inc. is a clinical-stage gene therapy company, which engages in the development of treatments for severe neurological diseases. Its pipeline of gene therapy programs includes VY-AADC, VY-SOD101, VY-HTT01, VY-FXN01, Tau Program, and VY-NAV01. The company was founded by Guang Ping Gao, Mark A. Kay, Krystof Bankiewicz, and Phillip Zamore in June 2013 and is headquartered in Cambridge, MA.

"the gene therapy company announced a license option agreement with Pfizer Inc. PFE, -0.24% that could valued at more than $600 million. Trading volume spiked up to 3.9 million shares ahead of the open, which compares with the full-day average of about 173,000 shares. The agreement allows Pfizer to exercise options to license novel capsids generated from Voyager's RNA-driven screener technology, which would be used by Pfizer to develop, make and commercialize gene therapies. As part of the agreement, Voyager will receive an upfront payment of $30 million, and is entitled to receive up to $20 million in exercise fees. Voyager will also be eligible to receive up to $580 million in milestone payments, and will be eligible to receive "mid- to high-single-digit tiered royalties" based on sales of Pfizer products using the licensed capsids."

VYGR Breakout Stock Alert UpdateBREAKOUT STOCK ALERT UPDATE

$VYGR - Voyager Therapeutics, Inc. - Common Stock

Initial Alert Price: $8.38

Price High: $7.19

% Gains/Losses: -14.2%

(-29.63% Less Than Expected)

Potential Stop Loss: $6.8305

VYGR is currently trading below our 10% Sell Threshold but we have are watching to determine if the stock breaks below the current support levels around the $7.00 Price Levels. We have an alert set to initiate the Sell Alert to all members moving forward which could potential call us to look in somewhere near -15% on the trade. From a fundamental outlook, the company is doing impressively well with 126.71% EPS Growth YoY, 2674.66% Net Profit Margin Growth YoY, and 25.80% Gross Profit Margins YoY respectfully. So we still have confidence in the company and the stock, so we're holding here to determine what we will do moving forward. #Breakout #Stocks #Trading #Investing #Alerts #StockMarket #Daily #News #Today

VYGR Technical Analysis 🧙Voyager Therapeutics Inc is functional in the United States biotechnology industry. Its focus lies in the research and development of gene therapies for the cure of severe diseases of the central nervous system such as the Parkinson's, Huntington's and Alzheimer's disease. The company has developed products such as VY-AADC01 for Advanced Parkinson's Disease, VY-HTT01 for Huntington's Disease. Voyager's sole source of revenue is generated through its collaboration with a company called Genzyme. Genzyme funds the collaboration for the multiple gene therapy programs, including programs for Parkinson's disease, Friedreich's ataxia, and Huntington's disease, as well as other CNS disorders.

If you understand the idea,🎯 press a thumb up! 👍 Have a question? Don't be shy to ask! 🤓 Interested to study how to analyze charts, follow me!

voyager therapeutics could jump up on another surprise earningsVoyager therapeutics could jump up on another surprise earnings

The 50 day Moving average is below the 100 and 200 day moving - volume is up

and earnings have amazing earnings up 60% and 1300% these last few quarters so.... it might turn around - I am not buying at this price though.

How long can you out perform with your stock falling ?

I don't know.

ABC BullishPossible stop below 9.8

Not a recommendation

Voyager Therapeutics, Inc., a clinical-stage gene therapy company, focuses on the development of treatments for patients suffering from severe neurological diseases. The company's lead clinical candidate is the VY-AADC, which is in open-label Phase 1b clinical trial for the treatment of Parkinson's disease. Its preclinical programs comprise VY-SOD102 for the treatment of amyotrophic lateral sclerosis; VY-HTT01 for Huntington's disease; VY-FXN01 for Friedreich's ataxia; Tau program for the treatment of tauopathies, including Alzheimer's disease, progressive supranuclear palsy, and frontotemporal dementia; and alpha-synuclein program for synucleinopathies, Parkinson's disease, Lewy Body Dementia, and multiple system atrophy. The company has strategic collaboration agreements with the University of Massachusetts; and ClearPoint Neuro, Inc., as well as collaborations with Brammer Bio and Fujifilm Diosynth Biotechnologies to support the development of its gene therapy programs. It also has a collaboration and license agreement with Neurocrine Biosciences, Inc. for the research, development, and commercialization of adeno-associated virus-based gene therapy products. Voyager Therapeutics, Inc. was founded in 2013 and is headquartered in Cambridge, Massachusetts.

Voyager will liftoff soonVYGR has reached a strong support area while the RSI has had higher lows indicating accumulation. The MACD is also increasing and is almost positive.

Expecting the price to increase steadily soon.

Look out for the bull cross of EMA9 of EMA21. This will accelerate the price rise.

The next earnings are on Feb 26.