WULF / 3hNASDAQ:WULF traded sideways today, as expected, with no significant change to the broader outlook. The ongoing consolidation continues to support the current wave structure—specifically, a developing triangle in wave iv (circled), which may be forming ahead of the anticipated final advance in wave v (circled).

The Fibonacci extension target >> 6.93 remains valid.

Trend Analysis >> Upon completion of Minor degree wave C, the countertrend advance of Intermediate degree wave (B), which has been unfolding since April 9, is likely to give way to a decline in wave (C) of the same degree. This downtrend might begin in the coming days and potentially extend through the end of the year!!

NASDAQ:WULF CRYPTOCAP:BTC BITSTAMP:BTCUSD MARKETSCOM:BITCOIN

#CryptoStocks #WULF #BTCMining #Bitcoin #BTC

WULF trade ideas

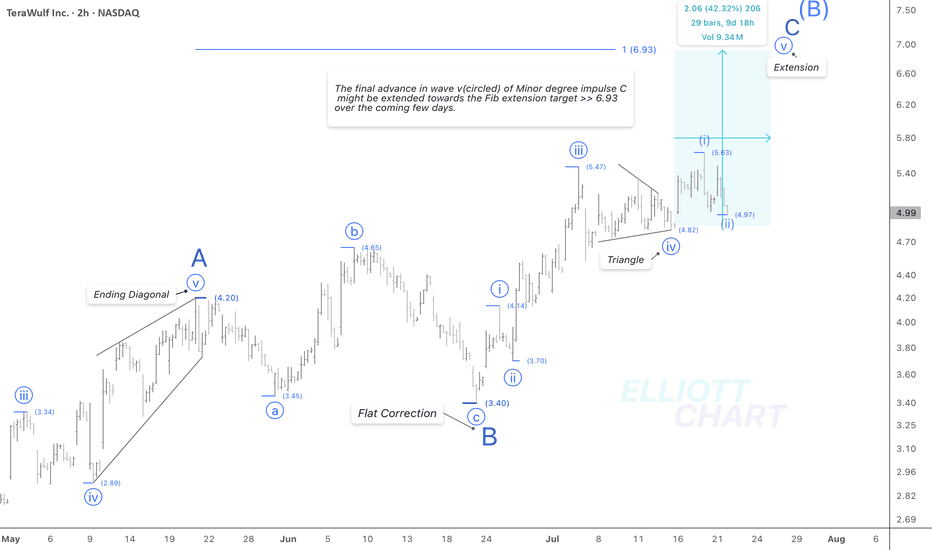

WULF / 3hThe unexpected 4% decline today suggests a potential shift in the wave iv (circled) corrective structure—from the previously identified triangle pattern to a more complex (w)-(x)-(y) combination. While differing corrective variations remain possible, this alternate structure now appears to be nearing completion. It is likely to precede the anticipated advance of approximately 45% in wave v (circled) of the ongoing Minor degree wave C.

The Fibonacci extension target at 6.93 remains unchanged.

Trend Analysis >> Upon completion of Minor wave C, the countertrend advance of Intermediate wave (B)—in progress since April 9—is expected to give way to a decline in wave (C) of the same degree. This next downtrend may begin in the coming days and has the potential to extend through the end of the year.

NASDAQ:WULF CRYPTOCAP:BTC BITSTAMP:BTCUSD MARKETSCOM:BITCOIN

#CryptoStocks #WULF #BTCMining #Bitcoin #BTC

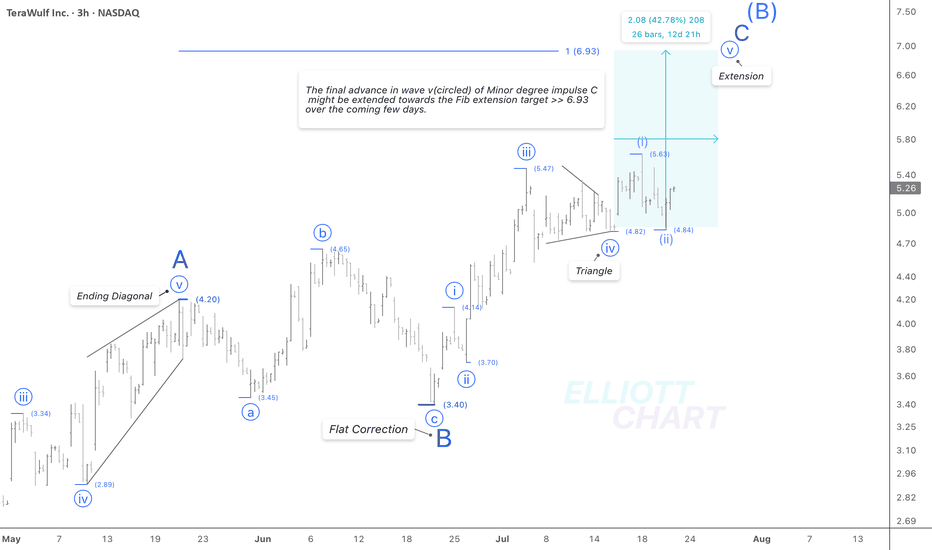

WULF / 3hNASDAQ:WULF continued to consolidate sideways today, in line with expectations, with no material change to the broader outlook. The narrowing price action supports the current wave structure—specifically, a completed triangle in wave iv (circled), likely preceding the anticipated final advance of approximately 33% in wave v (circled) of the ongoing Minor degree wave C.

The Fibonacci extension target at 6.93 remains valid.

Trend Analysis >> Upon completion of Minor degree wave C, the countertrend advance of Intermediate degree wave (B), which has been unfolding since April 9, is likely to give way to a decline in wave (C) of the same degree. This downtrend might begin in the coming days and potentially extend through the end of the year!!

NASDAQ:WULF CRYPTOCAP:BTC BITSTAMP:BTCUSD MARKETSCOM:BITCOIN

#CryptoStocks #WULF #BTCMining #Bitcoin #BTC

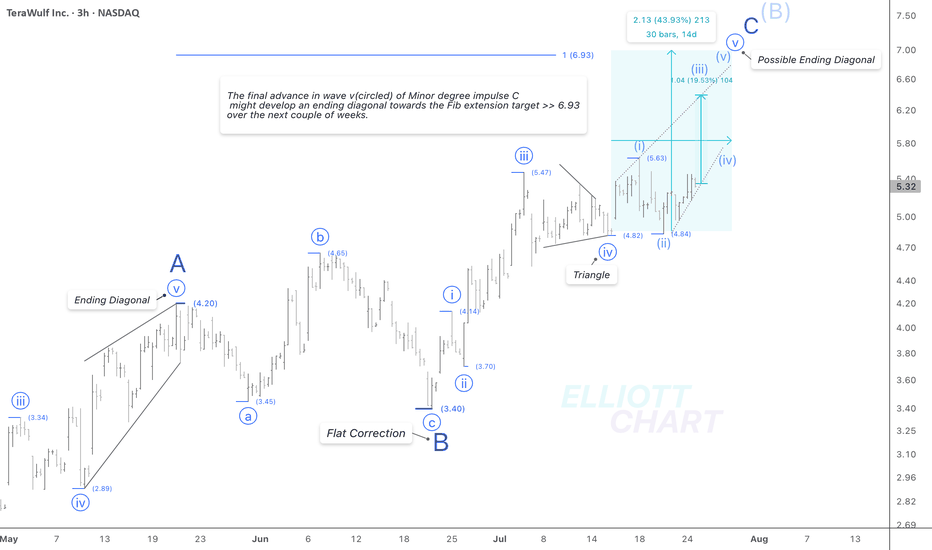

WULF / 3hWave Analysis >> While the current outlook on WULF remains consistent with previous analysis, the internal structure of wave v (circled) suggests the potential development of an ending diagonal in the final leg of Minor degree wave C.

Trend Analysis >> Upon completion of Minor degree wave C, the countertrend advance of Intermediate degree wave (B), which has been unfolding since April 9, is likely to give way to a decline in wave (C) of the same degree. This downtrend might begin in the coming days and potentially extend through the end of the year.

NASDAQ:WULF CRYPTOCAP:BTC BITSTAMP:BTCUSD MARKETSCOM:BITCOIN

#CryptoStocks #WULF #BTCMining #Bitcoin #BTC

WULF / 3hWave Analysis >> While the overall outlook on NASDAQ:WULF remains consistent with the previous analysis, the ongoing sideways volatility suggests a need to reassess the wave count on the final stages of Minor degree impulsive advance in wave C.

The Fib extension target remains intact >> 6.93

Trend Analysis >> Upon completion of Minor degree wave C, the countertrend advance of Intermediate degree wave (B), which has been unfolding since April 9, is likely to give way to a decline in wave (C) of the same degree. This downtrend might begin in the coming days and potentially extend through the end of the year!!

NASDAQ:WULF CRYPTOCAP:BTC BITSTAMP:BTCUSD MARKETSCOM:BITCOIN

#CryptoStocks #WULF #BTCMining #Bitcoin #BTC

WULF / 2hThere is no change in the NASDAQ:WULF 's analysis; it might extend its final advance in an impulsive extension of wave v(circled) of the ongoing Minor degree wave C, in which the first and second subdivisions were done. An impulsive 3rd wave is anticipated.

Trend Analysis >> After completion of the Minor degree wave C, the countertrend advance of Intermediate degree wave (B), which has developed since April 9, will probably change to decline in the same degree wave (C) in the coming few days! And it'll likely last until the end of the year!!

$Crypto $Stocks CRYPTOCAP:BTC MARKETSCOM:BITCOIN BITSTAMP:BTCUSD

#CryptoStocks #WULF #BTCMining #Bitcoin #BTC

WULF / 3hThere is no specific change in the NASDAQ:WULF 's analysis; it might extend its final advance in an extension of wave v(circled) of the ongoing Minor degree wave C.

Trend Analysis >> After completion of the Minor degree wave C, the countertrend advance of Intermediate degree wave (B), which has developed since April 9, will probably turn to an ultimate decline in the same degree wave (C) in the coming few days! And it'll likely last until the end of the year!!

NASDAQ:WULF CRYPTOCAP:BTC BITSTAMP:BTCUSD MARKETSCOM:BITCOIN

#CryptoStocks #WULF #BTCMining #Bitcoin #BTC

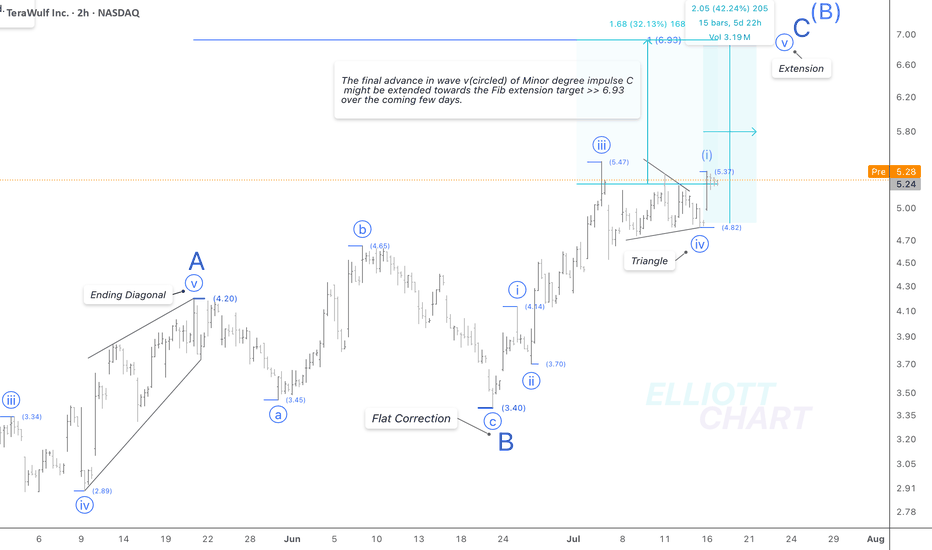

WULF / 2hAs depicted in the 2h-frame above, NASDAQ:WULF might extend its final advance in an impulsive extension of wave v(circled) of the ongoing Minor degree wave C. Hence, the target would adjust to the Fib extension target at 6.93.

Wave Analysis >> The triangle correction in wave iv(circled) worked well, followed by an initial swift advance of the same degree wave v(circled), which would likely extend towards the Fib extension target >> 6.93. So, an advance of 32% lies ahead to conclude the Minor degree wave C of the entire correction in an A-B-C zigzag as a countertrend advance in Intermediate degree wave (B).

Trend Analysis >> After completion of the Minor degree wave C, the countertrend advance of Intermediate degree wave (B), which has developed since April 9, will probably change to decline in the same degree wave (C) in the coming few days!

And it'll likely last until the end of the year!!

NASDAQ:WULF CRYPTOCAP:BTC MARKETSCOM:BITCOIN

#CryptoStocks #WULF #BTCMining #Bitcoin #BTC

WULF / 3hAccording to the prior analysis, NASDAQ:WULF rose by 10.5% intraday in a swift advance as expected.

Wave Analysis >> The triangle correction in wave iv(circled) worked, followed by a swift advance in the same degree wave v(circled), which its 6% is left to conclude the Minor degree wave C of the entire correction in an A-B-C zigzag as a countertrend advance in Intermediate degree wave (B) >> Not shown in this frame.

Target >> The Fib expansion target at 5.55 remains intact >> Where Minor degree wave C would equal the same degree wave A.

Trend Analysis >> The countertrend advance as Intermediate degree wave (B) will probably change to decline in the same degree wave (C) very soon!! And it'll likely last until the end of the year!

#CryptoStocks #WULF #BTCMining #Bitcoin #BTC

NASDAQ:WULF CRYPTOCAP:BTC MARKETSCOM:BITCOIN

WULF / 3hAs a second alternative, NASDAQ:WULF may have developed a five-wave impulsive sequence as the Minor degree wave C, in which its 4th wave correction in a triangle appears to be over at 4.82.

So, the final advance by 15% in the same degree wave v(circled) lies ahead to conclude the Minor degree wave C of the entire correction in an A-B-C zigzag as a countertrend advance in Intermediate degree wave (B).

Trend Analysis >> The countertrend advance as Intermediate degree wave (B) will probably change to decline in the same degree wave (C) very soon!! And it'll likely last until the end of the year.

#CryptoStocks #WULF #BTCMining #Bitcoin #BTC

NASDAQ:WULF CRYPTOCAP:BTC MARKETSCOM:BITCOIN

WULF / 3hNASDAQ:WULF

According to the bearish alternative in my weekly frame (not the chart below and not posted recently), the entire countertrend rally, which has developed in an ABC zigzag sequence as anticipated in the analysis which I posted on May 12, may have reached a very late stage where an adjusted expanding diagonal as the thorough Minor degree wave C remains at the start point of a final advance as its 5th subdivision. It will conclude the entire correction upward since April 9.

NASDAQ:WULF 's Bearish Alternative :

Wave Analysis >> As depicted on this 3h-frame above, the structure of the entire countertrend advance, which has developed since April 9, may be considered in a thorough ABC zigzag correction, in which Minor degree wave C should have diagonally reached its very late stage now. It would likely achieve its expansion target >> 5.55.

And it would be a 170% gain of a countertrend rally at the end!!

Now, 8.6% of the advance remains to complete a possible ending expanding diagonal upward as the Minor degree wave C.

Trend Analysis >> The countertrend upward as Intermediate degree wave (B) will probably change to decline in the same degree wave (C) very soon!! And it'll likely last until the end of the year.

#CryptoStocks #WULF #BTCMining #Bitcoin #BTC

NASDAQ:WULF CRYPTOCAP:BTC MARKETSCOM:BITCOIN

WULF / 2hNASDAQ:WULF

According to the bearish alternative in my weekly frame (not the chart above and not posted recently), the entire countertrend rally, which has developed in an ABC zigzag sequence as anticipated in the analysis which I posted on May 12, may have reached a very late stage where an expanding diagonal remains at the start point of a final advance as its 5th subdivision. It would be an ending rise of the entire correction upward since April 9.

NASDAQ:WULF 's Bearish Alternative :

Wave Analysis >> As depicted on this 2h-frame above, the structure of the entire countertrend advance, which has developed since April 9, may be considered in a thorough ABC zigzag correction, in which Minor degree wave C should have reached its very late stage now. It would likely achieve its expansion target at 5.55.

And it was a 170% gain of a countertrend rally!!

>> Now, 13% advance is left to complete a possible ending expanding diagonal as the wave v(circled) of C.

Trend Analysis >> The uptrend would likely change to down in an Intermediate degree wave (C) very soon!! It will likely last until the end of the year.

#CryptoStocks #WULF #BTCMining #Bitcoin #BTC

$WULF Critical Resistance!NASDAQ:WULF has had a great come back but has just hit a triple sword resistance: weekly 200EMA, weekly pivot and High Volume Node where I expect it to struggle for a while!

Are CRYPTOCAP:BTC miners the new altcoins?

Bullish continuation through these resistances will flip them to support and demonstrate fundamental resilience on an improving macro economic background overcoming technical analysis.

Long term tailwind potential can be as high a10x from here but more realistic targets are the R3 weekly pivot $17 and R5 weekly pivot at $25.

Analysis is invalidated below the high degree wave (4) of a leading (or ending) diagonal Elliot Wave pattern.

Safe trading

WULF / 2hAccording to the prior analysis, NASDAQ:WULF has risen by 13.5% today.

Wave Analysis >> The ongoing impulsive wave c(circled) seems to be extending in its fifth wave.

Trend Analysis >> The Minor degree trend is up now in an impulsive wave c(circled).

#CryptoStocks #WULF #BTCMining #Bitcoin #BTC

WULF / 2hNASDAQ:WULF has revealed an impulsive sequence that's gone beyond the June high >> 4.65.

And it would suggest a bullish alternative in which the correction of wave b(circled) could be thoroughly over at 3.40.

So, an impulsive advance in anticipated wave c(circled) should be underway.

Trend Analysis >> Trend has turned upward in impulse c(circled).

#CryptoStocks #WULF #BTCMining #Bitcoin #BTC

WULF / 2hNASDAQ:WULF

Wave Analysis >> The counter-trend rally of wave (b) has unfolded an formation as a zigzag, and now a final advance of 7% is left to thoroughly over.

As illustrated on the 2h-frame above, the correction in wave b(circled) may expand an (a)-(b)-(c) flat formation in a three-wave sequence. After the completion of the counter-trend rally in wave (b), a final decline as the last subdivision in wave (c) of b(circled) is expected to follow.

#CryptoStocks #WULF #BTCMining #Bitcoin #BTC

WULF / 2hAs anticipated in the prior analysis, NASDAQ:WULF started to retrace downward today after a 33% counter-trend rally of the week as the correction in wave (b) of Minute degree b(circled).

Wave Analysis >> As illustrated on the 2h-frame above, the correction in wave b(circled) may have remained in progress. After an impulsive counter-trend rally of 15.5% yesterday, the second subdivision in wave (b) unfolded into a three-wave sequence. A final decline as the last subdivision in wave (c) has started since the last-day high at 4.53 to complete the entire correction of wave b(circled) in a zigzag formation.

The retracement targets >> 3.36 >> 3.28 >> 3.05

#CryptoStocks #WULF #BTCMining #Bitcoin #BTC

WULF / 2hNASDAQ:WULF rose by 15.5% today! An unexpected counter-trend rally, which may be considered the last high in June.

Wave Analysis >> According to my bearish alternative >> as depicted on the 2h-frame above, the correction in wave b(circled) may have remained at the extreme of its second subdivision in wave (b), a final decline as the last subdivision in wave (c) would likely follow to complete the entire correction of wave b(circled) in a three-wave sequence like a zigzag or flat formation.

The expected targets >> 3.36 >> 3.28 >> 3.05

#CryptoStocks #WULF #BTCMining #Bitcoin #BTC

WULF / 2hAs anticipated, an expected spike high pointed well to the extreme of the diagonal's 4th wave at 4.14 today.

Wave Analysis >> The expanded diagonal in an ending formation will soon conclude the entire correction in ongoing wave b(circled). Now, a further decline of 15% lies ahead on the last subdivision of the ending diagonal wave (c).

The retracement target remains intact >> 3.20

Trend Analysis >> The trend will turn upward very soon to a Minute degree impulsive wave c(circled) after completion of correcting down in the same degree wave b(circled).

#CryptoStocks #WULF #BTCMining #Bitcoin #BTC

WULF / 2hAs illustrated on the NASDAQ:WULF 2h-frame above, considering the internal structure of the ongoing wave (c) would suggest now respecting an expanded diagonal as the ending formation of the entire correction in wave b(circled) as an alternative.

So after the completion of retracing up in the 4th subdivision, A final decline of 20% is expected to follow to conclude the entire correction in wave b(circled) in an expanded flat formation.

The next retracement target >> 3.20

Trend Analysis >> The trend will turn upward very soon! to a Minute degree impulsive wave c(circled) after completion of correcting down in the same degree wave b(circled).

#CryptoStocks #WULF #BTCMining #Bitcoin #BTC

WULF / 2hAccording to the prior analysis, NASDAQ:WULF reached the first target >> 3.45, extending its correction by a 9% intraday decline in the 5th subdivision of wave (c), as anticipated. A final decline of just 10.6% will conclude the entire correction in wave b(circled) in an expanded flat formation very soon!

The next retracement target >> 3.20

Trend Analysis >> The trend will turn upward soon! to a Minute degree impulsive wave c(circled) after completion of correcting down in the same degree wave b(circled).

#CryptoStocks #WULF #BTCMining #Bitcoin #BTC

WULF / 2hAccording to the prior NASDAQ:WULF analysis, wave (c) started to extend in its 5th subdivision. It's now anticipated to further decline by 14.44% to complete the expanding flat formation as the entire correction in wave b(circled) over the next week.

The Retracement Targets >> 3.45 >> 3.20

Trend Analysis >> The trend will turn upward soon to a Minute degree impulsive wave c(circled) after completion of correcting down in the same degree wave b(circled).

#CryptoStocks #WULF #BTCMining #Bitcoin #BTC