BNS trade ideas

BNS IS A MUST PORTOFOLIO STOCK!FUBDAMENTALS Summary

1.Bank of Nova Scotia has announced 6 acquisitions in the past few quarters.

2.The company now expects about C$200 to C$250 million of integration costs in the next two years.

3.The bank should be able to achieve significant synergies and improve its operational efficiency through back-end systems improvement.

4.Bank of Nova Scotia should be able to benefit from strong economic growth in Latin America.

TECHNICAL OBSERVATIONS

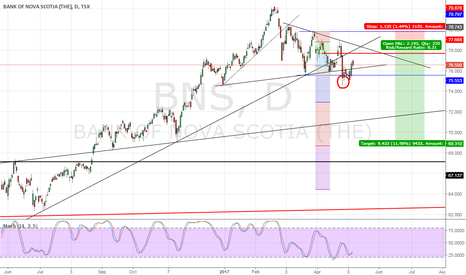

1.We have a descending trendline that will give us the sign for a change of trend if of course we have a break above and a re-test.

2.We can see that price moved above the 200 EMA but the EMA has still negative slope and every time price did that failed to validate it moving again below it.That's why a double confirmation should give us a high probability sign for a buy.

3.We can also see that the EMA strategy we are in consolidation phase on daily chart,but looking under more longterm scope on a monthly chart is a nice buy after a pullback to the mean.

4.Ichimoku clouds are not giving a reliable sign as we are in consolidation phase and they are nor respected.

POSSIBLE TRADE

ENTRY AT RE-TEST OF BROKEN TRENDLINE ABOVE 200EMA

STOP LOSS AT 73$ MONTHLY LOW AND BREAK OF ASCENDING TRENDLINE

FIRST TARGET AT 85,50$ PREVIOUS HIGHS

SECOND TARGET WILL BE UPDATED IN NEXT ARTICLE!

THANKS FOR SUPPORT!

KEEP FOLLOWING FOR MORE PROFITS!

PLEASE LEAVE A COMMENT,YOUR OPINION OR EVEN A QUESTION YOU MIGHT HAVE!

BNS IS MUST PORTOFOLIO STOCK!FUBDAMENTALS Summary

1.Bank of Nova Scotia has announced 6 acquisitions in the past few quarters.

2.The company now expects about C$200 to C$250 million of integration costs in the next two years.

3.The bank should be able to achieve significant synergies and improve its operational efficiency through back-end systems improvement.

4.Bank of Nova Scotia should be able to benefit from strong economic growth in Latin America.

TECHNICAL OBSERVATIONS

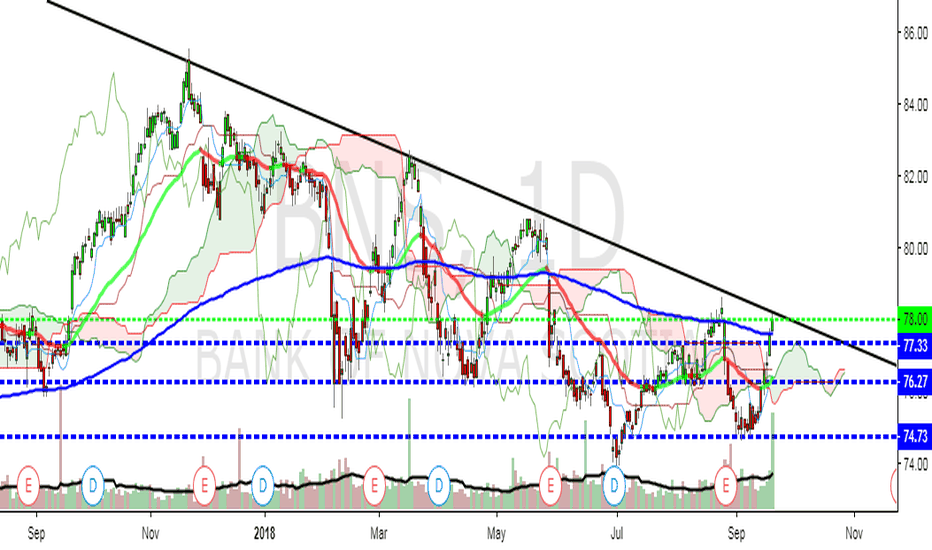

1.We have a descending trendline that will give us the sign for a change of trend if of course we have a break above and a re-test.

2.We can see that price moved above the 200 EMA but the EMA has still negative slope and every time price did that failed to validate it moving again below it.That's why a double confirmation should give us a high probability sign for a buy.

3.We can also see that the EMA strategy we are in consolidation phase on daily chart,but looking under more longterm scope on a monthly chart is a nice buy after a pullback to the mean.

4.Ichimoku clouds are not giving a reliable sign as we are in consolidation phase and they are nor respected.

POSSIBLE TRADE

ENTRY AT RE-TEST OF BROKEN TRENDLINE ABOVE 200EMA

STOP LOSS AT 73$ MONTHLY LOW AND BREAK OF ASCENDING TRENDLINE

FIRST TARGET AT 85,50$ PREVIOUS HIGHS

SECOND TARGET WILL BE UPDATED IN NEXT ARTICLE!

THANKS FOR SUPPORT!

KEEP FOLLOWING FOR MORE PROFITS!

PLEASE LEAVE A COMMENT,YOUR OPINION OR EVEN A QUESTION YOU MIGHT HAVE!

Long BNS based USDCAD correlationBNS has been tightly correlated with CAD since July 2014. Specifically, the relationship appears to be:

(daily % change in BNS) = 2x(daily % change in CADUSD)

CAD itself is correlated with oil.

I originally planned to buy CAD for an upcoming oil rally. But I ended up buying BNS instead. It pays a 5% dividend.

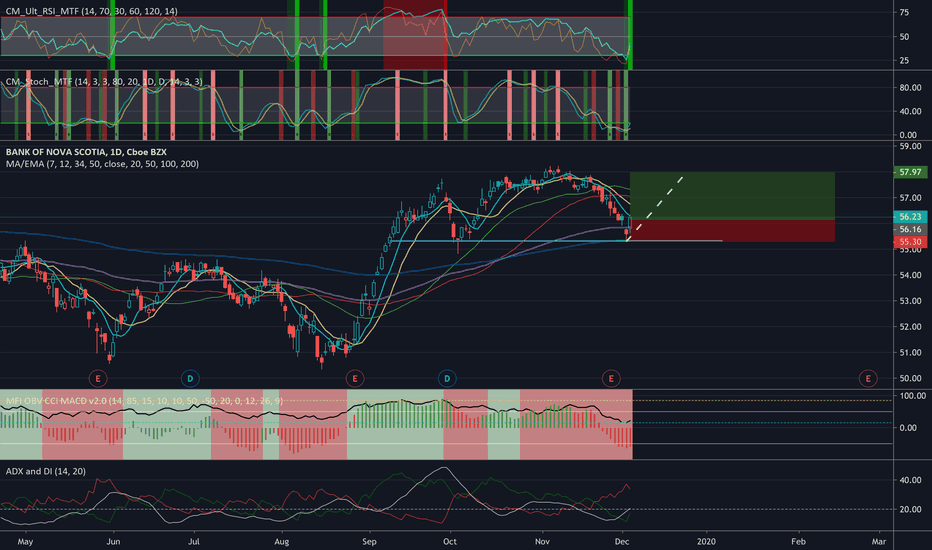

BNS 10% over 200D EMA, Time to take profitsAs someone with BNS holdings I am going to be cutting back my position and taking profits. Why?

The main reason is illsutrated in the chart above, the stock has had a tremendous rally in recent months and is now trading at a 10% premium to its 200D EMA. Since 2013 there have been two other instances where BNS was trading 10% over the 200D EMA and over the following months the stock fell. I am very comfortable taking profits here and will.

Look for a retracement to the 200D EMA over the next couple months.