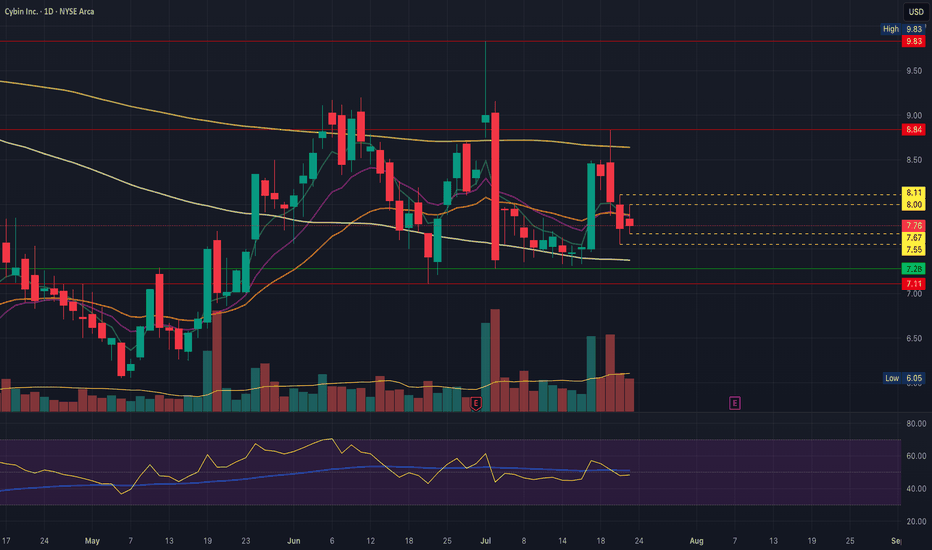

CYBN earnings reaction will break this 6 week rangeCYBN still sideways, nothing has changed, still trying to shake off the earnings hangover. Earnings call will break this either up or down.

Key support 7.11

Key resistance 8.18, 8.84

I publish regular technical analysis of the shrooms sector, be sure to like and follow so you don't miss future updates!

CYBN trade ideas

CYBN clearly the sector laggardCYBN is trading very differently from the rest of the sector which as significant bullish momentum which CYBN is the same price it was 7 weeks ago

I post regular analysis of the psychedelics sector, please like and follow to make sure you don't miss my next update!

Support: 7.74, 7.67, 7.55

Resistance: 7.99, 8.07, 8.18

CYBN remains in daily equilibriumCYBN remains within a wide daily equilibrium, we have an inside bar today for early clues to get an early gauge on direction. Nothing changes for me as long as price remains between 7.11 and 8.84, and we can remain tightening within this range for another couple of weeks..

Support: 7.67, 7.55, 7.28, 7.11 key

Resistance: 8.00, 8.11, 8.847 key

CYBN finally breaks out of its base of supportCYBN finally breaks out of 2-weeks of basing support on a very high volume bull move, close at the high of the day. I would normally anticipate a lower high below 9.83 but if this massive volume (4.5x yesterday volume!) keeps up, bulls may be able to take that level out. We will learn more in the coming days!

Resistance: Daily 200 SMA, 9.16, 9.83

Supports: 7.28, 7.11 (big red flags if lost)

Nothing changes while price is below 8.01CYBN continues to reject form 4hr EMA12, bulls need to break above this in the next few trading sessions or it will continue to decline and knock the price below support, which would be a big step backwards and would be a clear signal that CYBN is not enjoying the same series of bullish signals that ATAI and MNMD are giving

CYBN in sideways channel, bulls need to break above 8.01Nothing changes for me between 7.11 and 8.01. Break below and I will stop out of my swing and be very patient while I reassess, break above 8.01 and we look for a lower high below 9.83. Currently, 4hr EMA12 continues to be resistance on each little bounce attempt.

If you are bullish here, you have decent entry opportunity to play off of 7.11 support with a stop loss below that - you'll certainly be in a much better position with your position than I am with mine on this stock!

CYBN still holding daily supports - barelyCYBN remains in a choppy pattern after a big volume bull break and then an even bigger volumr 18% sell-off. There's a big range on this that I anticipate will tighten up for a while unless bears show up first thing next week and break 7.30ish and 7.11 supports. In the entire psych sector, this daily chart is the closest one to breaking down and has the most amount of overhead supply.

Entry: 8.35 (approx)

Stop loss: 6.99

The Convoluted Wellness Movement Say what you will about RFK Jr, but his ideas, if implemented even in some small ways, would have a drastic impact on the psychopharmaceutical industry. I'm a therapist myself, and I can't tell you how many teenagers are placed on SSRIs and ADHD medication without careful consideration for long term effects. Not that these medications are poisonous - they can be very helpful for many. I do think they are overprescribed, however, and can lead to lifelong dependency if not used carefully or with intent. While I don't think psychedelics would be great for teenagers and their developing brains (says the guy who took mushrooms for the first time at 17), I do think they are a powerful alternative, and do not require as much consistent dosing. The pharmaceutical industry will try to push microdosing, so as to make greater profits.

Do I think psychedelics will be implemented as mental health treatment successfully on the first go-around? Not necessarily. Do I think that certain people with a family history of psychosis and mood disorders should avoid psychedelics? Probably.

The companies at the forefront of this research could be in a decent position to spike in value. They may be eventually bought out by other entities, of course, or simply lose their speculative value. Maybe this is already happening. I'm wondering if CYBIN in particular, is forming a bottom here. It does look trapped in an endless wedge, with every pump getting aggressively sold. However, volume is steadily increasing week by week, which could indicate some hidden accumulation.

MindMedicine may be positioned a little better, from a technical perspective. I've bought back into both MindMedicine and Cybin equally over the last day or two. Not a big position, but perhaps worth the gamble. Each could easily decline by 50% or more from here. MNDMD at least seems to have a healthier chart.

The bigger concern is whether these companies' finances can withstand more time before regulatory clarity, as well as governmental stability as a whole. Things are looking very strange in the U.S. Either way, there is a movement (public or not) towards homeopathic medicine.

I guess we'll see. This investment is entirely speculative, and seems just as likely to trend towards zero as it is to explode 10x in value.

This is my personal opinion, and is meant for personal use only - not as financial advice. These stocks have relatively low volume and are prone to wild price swings.

a possible cycle upWe have two bullish candles on the bottom of an upward parallel structure, and one of those candles has appeared to have broken out of the minor downward trend, in addition we just had a bullish MACD(Chris Moody) cross over. These confluences allude to *possible* positive price action. Please double check and stay safe.

'We're Pretty Cheap At The Moment' CYBIN $100+Poised to disrupt mental health treatment Cybin is on the verge of a revolution unlike any treatment the world has ever seen in depression. Phase 3 trails/data will bring many catalysts for the future, into the unknown where no one has gone legally before..

CYBN youtubers pump over... Possible C or wave 3 is starting??The youtubers pump and dump is over IMO. They hype has worn off. I picked up some today and have a lower buy set in place. This is a hero or ZERO play for me. If it melts faces I'll take some profit before summer's end. Expecting a pump above .50 soonish and a retracement to under .40 and a flatline before the face melting happens. Merry Jane stocks had their pumps and GWAV paid me twice in the last two weeks time for the rotation IMO. Watch our on crypto I think we could see some alts crash 40%+ before summer and BTC to 25-38k.

NOT FINANCIAL ADVICE!!!!

CYBIN - The Mushroom Long Term Play Amidst my re-evaluation of markets, divestment from crypto, and future planning, I'm slowly building a long term position in CYBIN. As a therapist who also happens to be a fan of psychedelics, this one fits me well. I think it can continue to flounder around, and perhaps test some even lower levels. Just looking for optimal entry points now, and managed to scoop some up the other day at $0.50. Over the next 10 years, I think the psychedelic mushroom industry will be an interesting place for growth. Screw tech. Mushrooms all the way! And not just the magic ones. I'll be on the lookout for other companies as well, and should probably devote some more time to research.

I placed some theoretical targets for this, since the company is currently valued just under $100M. I think $3 Billion is fairly conservative, hence the $15 target.

This is meant for speculation only, and not as financial advice.

-Victor Cobra

CYBIN Cybin is a clinical-stage biopharmaceutical company on a mission to create safe and effective psychedelic-based therapeutics to address the large unmet need for new and innovative treatment options for people who suffer from mental health conditions.

Cybin’s goal of revolutionizing mental healthcare is supported by a network of world-class partners and internationally recognized scientists aimed at progressing proprietary drug discovery platforms, innovative drug delivery systems, and novel formulation approaches and treatment regimens.

Billionaire Steve Cohen Buys 19M Shares Of Cybin Stock For Psychedelics R&D, Blake Mycoskie $100M Pledge.

The considerably large acquisition puts Cybin in the limelight with credibility status in ongoing and future work - see Cybin’s recent acquisition announcement of DMT therapeutics developer Small Pharma DMTTF.

Blake Mycoskie On His $100M Pledge To Psychedelics Research

Following a sound pledge of $100 million for psychedelics research, billionaire Blake Mycoskie has updated on how his funding agenda -representing around 25% of his wealth- will unfold.

Mycoskie says he is planning to “give $5 million a year for the rest of the time, until the $100 million runs out,” a yearly sum that “feels right, because the industry still feels nascent.”

That could change in the presence of “a huge opportunity” or in the need of “a huge campaign push.” Although he understands other donors are waiting for further regulatory and scientific success, his personal standpoint is that those aren’t needed in view of solid works authored by Johns Hopkins and New York University, among others.

$CYBN Lincoln Park’s Long Haul Pact Amidst a dwindling cash balance, and an erosive burn rate Cybin Inc. (NYSE: CYBN) found itself presented with a solution in the form of a common share purchase agreement with Lincoln Park Capital Fund, LLC (LPC). This deal will help CYBN overcome its current financial hurdles by providing cash that will help it fund its ongoing trials which may allow it to reach profitability in the long term. With 2 clinical trial results expected in Q3, CYBN stock could be a bargain as it is trading near its all-time low.

CYBN Fundamentals

Rock bottom sometimes comes in the form of a shrinking cash balance that constantly collides with incoming expenses, CYBN found itself in that very situation before the deal came along. The inevitability of bankruptcy drastically waned as a result of a $30 million funding deal that the company entered with LPC. According to the share purchase agreement, CYBN has a 36-month time frame in which it can sell shares at its own discretion. Additionally, LPC agreed not to short CYBN or participate in other hedging activities which will not see CYBN stock witnessing strong selling pressure as in the case with other similar deals.

CYB004

News of the agreement came a few days after CYBN started the first in-human dosing of dDMT (CYB004) in phase 1 clinical trials for generalized anxiety disorder. This treatment is the first of its kind as no other company has utilized dDMT in treating generalized anxiety disorder. Since most DMT treatments are focused on depression, CYBN has a major advantage over its competition in that field. One of the most prominent competitors in the DMT space is Small Pharma which does not have an anxiety treatment in its pipeline at the moment.

The global anxiety treatments market is expected to grow by 5% CAGR from $11 Billion in 2021 to $16 Billion in 2026 and CYBN could be well-positioned to gain a large share of this market since CYB004 is protected under a patent until 2041. In that way, no other company can utilize dDMT for an anxiety treatment while the patent is active. With this in mind, CYBN shared that it expects to release its phase 1 trial in Q3 which might be a major catalyst for the stock since it is the only DMT treatment for anxiety.

CYB003

In addition to CYB004, CYBN is developing its leading clinical program CYB003 psilocybin treatment for Major depression disorder (MDD) which is in phase 1/2a of clinical trials. CYBN recently shared positive interim data from that very trial where some patients experienced a short-acting psychedelic response which is a positive sign in psychedelic treatment. The trial also demonstrated that the desired effect occurred even in low doses and there was no fluctuation in plasma levels which is a great sign. CYBN expects to release the topline trial results of this trial in Q3 which could also be a major catalyst for the stock. However, CYBN is competing with several companies in depression treatments – chief among them COMPASS Pathways plc (NASDAQ: CMPS).

Currently, CMPS is in phase 3 clinical trials for a psilocybin treatment for treatment-resistant depression (TRD) which is a more extreme form of MDD. CMPS is likely to win the pipeline race since its treatment is more advanced than CYBN’s, however, CYB003 has an edge since CYBN is in preclinical studies for using CYB003 for treating alcoholism.

There are more than 15 million people in the US who struggle with alcohol use disorder – more commonly known as alcoholism. If approved, CYBN could accrue substantial revenues by providing alcohol use disorder treatments.

CYBN Financials

According to its Q3 report, CYBN reported $60.6 million in assets – representing a decline from $84 million at the beginning of the year – which could be attributed to the decline in cash on hand from $53.6 million to $22.5 million. Meanwhile, CYBN successfully reduced its liabilities compared to the beginning of the year to $4.3 million from $7.9 million.

In terms of revenues, CYBN did not report any revenues since its treatments are still under development. As for operating costs, CYBN reported $12 million – a YoY decline from $16.4 million. In this way, CYBN’s net loss improved YoY from $17.2 million to $10.7 million.

Considering CYBN’s cash burn rate, the company’s recent $30 million deal with LPC is a major help since the company’s cash balance would have been sufficient for 2 more quarters based on the current cash burn rate.

Technical Analysis

CYBN stock is in a neutral trend with the stock trading in a sideways channel between the support at $.27 and the resistance at $.29. Looking at the indicators, CYBN is trading below the 200, 50, and 21 MAs, however, it is currently testing both the 50 and 21 MAs as resistance. Meanwhile, the RSI is neutral at 49 and the MACD is approaching a bearish crossover.

As for the fundamentals, CYBN has 2 major upcoming catalysts in the expected trial results for CYB003 and CYB004 in Q3. Since these results are critical in the advancement of both trials, CYBN stock could soar on positive results as it might be closer to FDA approval.

CYBN Forecast

Thanks to LPC’s $30 million agreement CYBN may see the fruits of its labor since the deal comes at a time when CYBN’s financial situation spelled disaster for the company. With 2 clinical trial results expected in Q3, CYBN stock could be one to watch closely ahead of these catalysts with the stock trading near its all-time low.

Waiting for a healthy marketCompared to some of my other small caps, this isn't doing as terrible in this market turmoil. It's been mostly sideways bouncing off oversold on the daily for over a month now, still in the descending wedge but it's not showing any strength yet and lost a short term support at $1.10 I was watching. Next support seems to be $1. RSI on the weekly is not oversold yet. I have a neutral to bearish short term outlook overall on the economy and market, but long term, a few years out I am still bullish on this and it's potential. Just look at all the additional people suffering from mental issues and addiction with this pandemic this could help. This latest Covid surge has to be peaking soon so maybe once that dies off, the market and this will start looking healthier.

CYBN - Mushrooms; Nixon Delayed the InevitableOne of PSYK's holdings, young industry with a growing addressable market.

Big pharma has not only failed to help humans who suffer depression, PTSD, drug abuse, etc. but in some ways made the situation worse.

Psychedelics are widely misunderstood and I believe they can offer solutions under proper conditions and in a therapeutic manner.

Barriers to entry is approval to perform R&D from the U.S. Drug Enforcement Agency and states to legalize it.

Currently Legal in Oregon, California was put on hold until Jan 2022, working group to study medical use in Texas and 13 states in active legislation. The momentum seems positive and I do no see Biden going against the grain as big pharma has clearly failed and would take anything right now.

Some bullish news fresh today could cause the breakout in the positive direction for shareholders.

TORONTO — Cybin Inc., a biopharmaceutical company focused on progressing “Psychedelics to Therapeutics TM ”, today announced that the Company has been granted a Schedule I manufacturing license from the U.S. Drug Enforcement Agency (“DEA”). The DEA license is a federal requirement for any investigators who intend to study, produce, analyze or otherwise work with Schedule I controlled substances.

financialpost.com

Heat map of Psychedelics Legalization

psilocybinalpha.com