$NEO, Crossing above ~92k resistance level & EMA 50 on the daily$NEO

Crossing above ~92k resistance level & EMA 50 on the daily chart

MACD & RSI bullish divergence on lower TFs

Volume slowly increasing

UCTS Indicator turning green across the board

Waiting for a retest of this level prior continuation could be a safer approach..

#NEO

NEOBTC trade ideas

NEOBTCNEOBTC update

Entonnoir : W/D/H4 (swing)

Biais weekly haussier avec le prix qui vient du bas de la compression (blanc). Le daily vient de sortir de sa compression (jaune) de façon fulgurante. Nous en sommes certes à la première impulsion ce qui la rend tradable, mais vu la taille de celle-ci je préconise de ne pas rentrer avant la prochaine sortie de compression H4.

—————

Funnel : W/D/H4 (swing)

Bias is bullish on weekly as the price is coming from the bottom of its compression (white). The daily has broke out of its compression (yellow) but seeing the size of this candle I would not go long before the next compression breakout on H4.

Neo, High Risk Reward Ratio Trade as China embraces BlockchainChina market makers and syndicates are very well known for their scheme and operations.

I am not surprised that these whales have their intentions well solidified and they are just waiting for the good enough catalyst for their massive operations.

Rule 1: Fundamental doesn't matter (in the sense that it doesn't matter if Neo will never beat Ethereum in adoption, they have strong backings and that is what matters)

Rule 2: Whales are very greedy and wants to maximize their profit.

Rule 3: China is full of whales and syndicates and they are very elaborate in their operations, for proofs, Malaysian stocks market are mostly operated by Chinese and you can study Malaysians stock market penny stocks pump and dump history.

Rule 4: In order to maximize profit, whales and smart money must inflict the most pain to the retail users. Having a shill youtuber rage quit crypto just few days before Bitcoin spike was a prime example of how whales manipulate and play with people psychology. Anyways, good riddance of that guy. 2017 was a lucky year for everyone, 2018 and 2019 was a testing year.

How far can Neo goes? I don't know, I don't have the secrets. However, my algorithm can "smell" something is cooking here.

Is this the best risk reward trade? Maybe. If it can do 10-20x, then, even a small risk taken can still result in massive profits.

Can Neo break All time high? Depends on the overall market.

Market is very dynamics and so one strategy needs to adapt and follow the market. There is never a trade that works.

Whales can simply drop a coin 90% in order to tell people that they means serious business. Looks at all those chinese coins in Huobi.

Dropping 90% deosn't mean it is dead, it just means that Whales want to accumulate more and they can only do that by lowering the price enough that retails will simply sell and rage quit.

This game is not for the fainted hearts. And that's why most traders will lose money. Because they stick to their old school traditional technical analysis thinking that they can beat the whales and smart money by doing that.

If you can't play this game, go find high paying jobs, this game is not for everyone.

I don't have time to respond to anyone or anybody either. This account remain a troll account.

Regards.

NEO looking mighty bullish$NEO broke through previous resistance and is entering a new channel. On top of that, it has rose above its 50 day moving average, and the MACD is showing some bullish signals as well. The Bollinger Bands have been squeezing around the price since accumulating back in August, so it's likely to pop.

BTC made the drop to 7,500 today, but most alt/btc pairs remain relatively unscathed, and some are even pumping.

NEO could potentially make it to above 1000 SATS before December or higher if it maintains this general direction.

I'm not a professional. Take my opinion with a grain of salt, as you should with all investments.

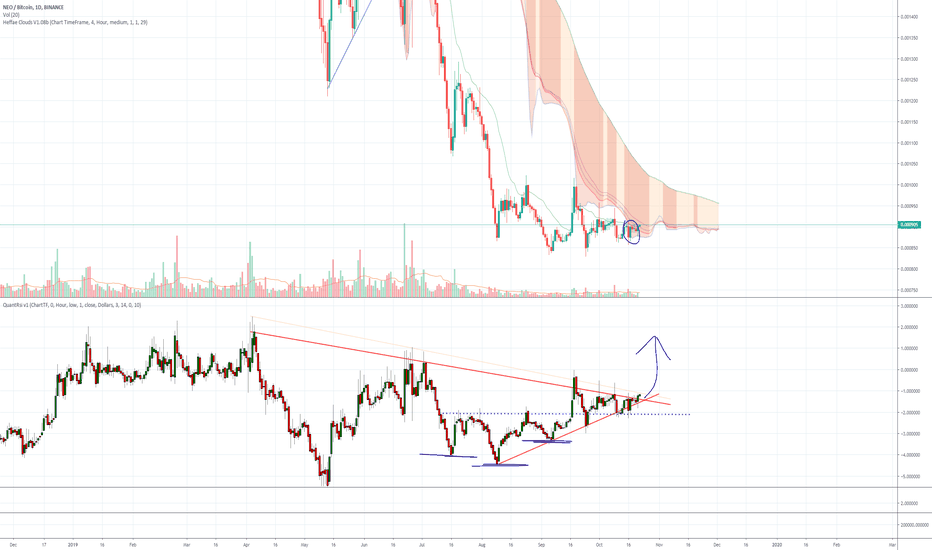

NEO/BTC worth a look - Bullish reversal situation QuantRsi 1DAt first glance this NEO chart looks like consolidation with dwindling volume, however the QuantRsi and Heffae Cloud indicators paint a potential bullish scenario.

First there is the Daily cloud entry, which is a sign of bullish reversal. The inter-cloud paths still pose a threat of heavy resistance, but historically, high timeframe cloud entries like the one here can lead to bullish reversals more often than not.

Second, the QuantRsi has an inverted HnS chart pattern with a clear step above neckline. These QuantRsi chart patterns often lead price reversal.

Third, the QuantRsi trendline that forms a triangle of sorts has crossed, but without confirmation. The prior candles that did cross failed the re-test, as well as Sept 17th rejecting off the daily cloud.

I plan on buying a retest of the QuantRsi trend, with a stop below the daily cloud bottom.

This is a perfect storm for bullish reversal. First takeprofit / re-evaluation level is at the top of the daily cloud around .00103

Apologies for the botched title screenshot, the way TradingView handles chart preview for published ideas is abysmal

NEO bottomedNEO doesn't make huge moves, at least recently. But now looks like found the bottom, so in case of hodling might bring some good profits.

Buy zone 1/3 size +/- 905-910

Buy zone 2/3 size +/- 888 (sell <900 or hold for targets)

Main target 955 (~5%)

Bonus targets 990 - 1050 - 1100 loss below 870 (~2.5% from average cost)

Wake up NEO, +190% potential ROE till March 2020looks like NEO has finally formed its bottom and way for next huge rally is open for NEOBTC, looking for potentially +190% profits in terms of Bitcoin, in USD it could be even more but better we focus on Bitcoin pair.

NEOBTC chart shows extreme downtrend in price movement but when you notice NEOUSDT chart its clear that right now prices strongly holding fib786 support level and there's high probability prices will start to take off from here with the upcoming alt season.

meanwhile my custom indicator is strongly suggesting for a potential blast off in prices in coming days with strong bullish divergence.

am expecting this rally last long upto mid march 2020 where we could achieve all targets and can easily make huge profits, as one of the top cryptocurrencies NEO is one of the safe crypto asset to invest in coming months.

Buy #NEOBTC from 90k - 91k

Position Size 5-8%

T1 101k

T2 120k

T3 168k

T4 270k

SL 79.5k

------------

if this idea helps you making some really nice profits, than do support me by hitting like and following me on tradingview, telegram or twitter...

this is husainzabir signing out...

thankyou.

NEO/BTC Buying Opportunity..!!NEO/BTC (Update)

Chinese Ethereum in Accumulation Zone So Grab Some & Hold it For Midterm..

Keep in Mind, Buying in Accumulation zone is Better than Buying in FOMO..(Patience Will Pay You)

NEOUSDT (Update)

Forming a Falling Wedge Pattern (Bullish Pattern) in Daily Timeframe with Bullish Indicators,,

Please, give us your opinion in the comments!

If you like the idea, please, hit the Like button and subscribe to the profile in order not to miss our updates.

Join Telegram Channel for more analysis - t.me

The information given is never financial advice. Always do your own research

NEO BTC the Chinese Bitcoin still fighting for its gloryNEO still fighting to get some top position in the Altcoin market, but in general NEO is going south, and it will be for quite some time, it probably will visit an old candle that it printed in NOV 2017 down towards the 0.00008600 area

So the new range will be: 0.00008600 btc - 0.00030000 btc

Only for entertainment purposes

Remember to like and leave a comment

What do you think?

Oportunidad en Largo en NEOBTCDale me gusta y Síguenos en Tradingview , comparte esta información con tus amigos y escribe cualquier comentario, tu opinión es importante para mi!.

Las entradas en su mayorÍa serán en Alcoins y Tokens de Binance, vamos a seguir la regla de acumulación de riqueza de ROPOFB , en la cual liquidaremos el 80% de las posiciones en la primera salida y el 20% en un segundo profit, buscando el movimiento más extendido del mercado.

NEO-BTC Trade IdeaDue to BTC dump NEO dropped back to its last support (red line ). It is recovering back nicely with volume

RSI is rising and volume is increasing

SBS indicator signaled BUY

BUY at the breakout or at the retest,

Targets are same as previous idea and its on the chart

SL is at last swing low or at last support.

lets see if it hits previous targets again