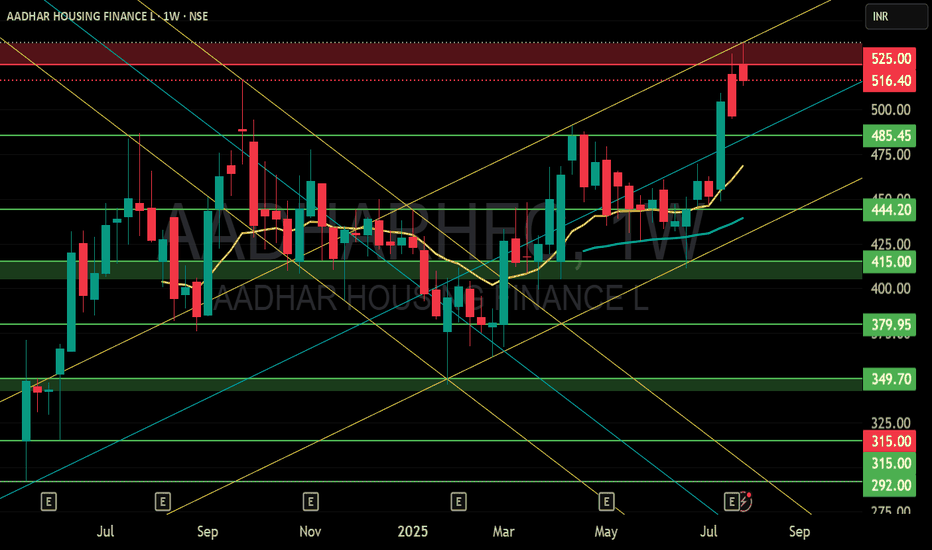

AADHAR HOUSING FINANCE LTD Support and Resistance Levels:

Support Levels: These are price points (green line/shade) where a downward trend may be halted due to a concentration of buying interest. Imagine them as a safety net where buyers step in, preventing further decline.

Resistance Levels: Conversely, resistance levels (red line/shade) are where upward trends might stall due to increased selling interest. They act like a ceiling where sellers come in to push prices down.

Breakouts:

Bullish Breakout: When the price moves above resistance, it often indicates strong buying interest and the potential for a continued uptrend. Traders may view this as a signal to buy or hold.

Bearish Breakout: When the price falls below support, it can signal strong selling interest and the potential for a continued downtrend. Traders might see this as a cue to sell or avoid buying.

MA Ribbon (EMA 20, EMA 50, EMA 100, EMA 200) :

Above EMA: If the stock price is above the EMA, it suggests a potential uptrend or bullish momentum.

Below EMA: If the stock price is below the EMA, it indicates a potential downtrend or bearish momentum.

Trendline: A trendline is a straight line drawn on a chart to represent the general direction of a data point set.

Uptrend Line: Drawn by connecting the lows in an upward trend. Indicates that the price is moving higher over time. Acts as a support level, where prices tend to bounce upward.

Downtrend Line: Drawn by connecting the highs in a downward trend. Indicates that the price is moving lower over time. It acts as a resistance level, where prices tend to drop.

Disclaimer:

I am not SEBI registered. The information provided here is for learning purposes only and should not be interpreted as financial advice. Consider the broader market context and consult with a qualified financial advisor before making investment decisions.

AADHARHFC trade ideas

Aadhar Housing looks enticing. Aadhar Housing Finance Ltd. engages in the provision of home loans. It also offers loans to customers including individuals, Companies, Corporations, Societies or Association of Persons for purchase; construction; repair and renovation of residential property.

Aadhar Housing Finance Ltd. CMP is 434.25. The positive aspects of the company are Stocks Outperforming their Industry Price Change in the Quarter, Decrease in Provision in recent results, Company with Zero Promoter Pledge and Annual Net Profits improving for last 2 years. The Negative aspects of the company are Moderately High Valuation (P.E. = 22.4), Poor cash generated from core business - Declining Cash Flow from Operations for last 2 years and Companies with high market cap, lower public shareholding.

Entry can be taken after closing above 439 Targets in the stock will be 453, 468 and 480. The long-term target in the stock will be 495 and 518. Stop loss in the stock should be maintained at Closing below 399 or 375 depending upon your risk taking ability.

Disclaimer: The above information is provided for educational purpose, analysis and paper trading only. Please don't treat this as a buy or sell recommendation for the stock. We do not guarantee any success in highly volatile market or otherwise. Stock market investment is subject to market risks which include global and regional risks. We will not be responsible for any Profit or loss that may occur due to any financial decision taken based on any data provided in this message.

AADHAR Housing Finance Recent BreakoutAadhar Housing Finance's shares have seen a recent surge, with a 6.3% jump in intraday trading following Kotak Institutional Equities' initiation of coverage with a 'buy' rating. The brokerage set a target price of ₹550, implying a 41% upside potential. The stock just broke out and ready for the upswing..

Aadhar Housing Finance Ltd - Pre and Post IPO Statistics

IPO Price: 315

Issue Size: 3000 Crore

Lot Size: 47

Listed: 315 ( Flat listing)

Closing on Listing Date: Closed in Positive@ 329( minor gain of 4.4%)

Listing Day Candle: Spinning Candle

Listing Day Volume: 7.1 Crore

IPO price and Listing day low PRICE would act as a support in immediate future.

Support Range: 292-315 ( 7.3%)