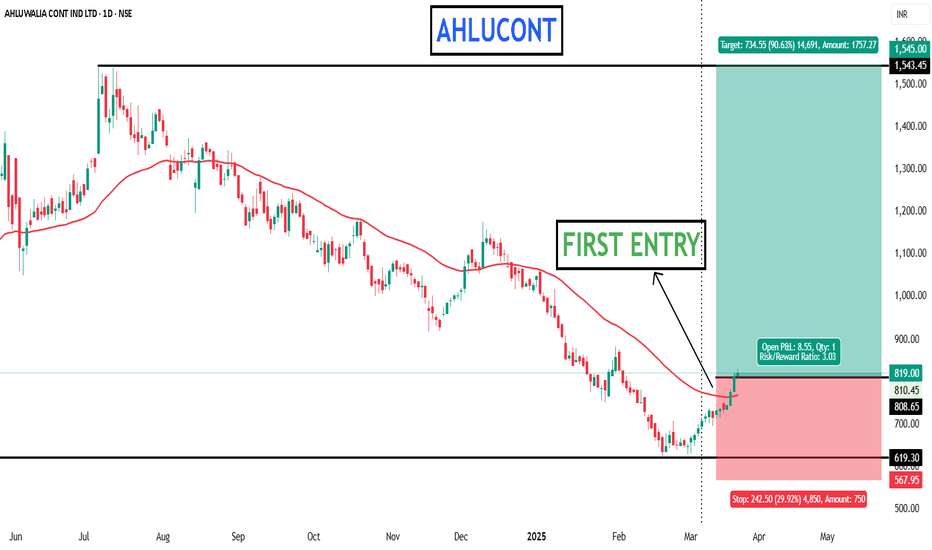

AHLUCONT trade ideas

AHLUCONT - BET ON INFRASTRUCTURE SECTOR Everything is pretty much explained in the picture itself.

I am Abhishek Srivastava | SEBI-Certified Research and Equity Derivative Analyst from Delhi with 4+ years of experience.

I focus on simplifying equity markets through technical analysis. On Trading View, I share easy-to-understand insights to help traders and investors make better decisions.

Kindly check my older shared stock results on my profile to make a firm decision to invest in this.

For any query kindly dm.

Thank you and invest wisely.

$NSE:AHLUCONT 60% up?Regression pattern breakout: ongoing

Long term/ monthly view (60%) :

Entry @1074-80 Exit @ 1747/2000

Accumulates on dips @ 1250/1333/1540

Short term/ weekly view(15-20%) :

Entry @1074, exit @1242

further fall accumulate same lot as before @ 1012 then exit @1172

further fall accumulate @ 957 then exit @ 1072

SL - 890

AHLUWALIA CONT IND LTD S/R Support and Resistance Levels:

Support Levels: These are price points (green line/shade) where a downward trend may be halted due to a concentration of buying interest. Imagine them as a safety net where buyers step in, preventing further decline.

Resistance Levels: Conversely, resistance levels (red line/shade) are where upward trends might stall due to increased selling interest. They act like a ceiling where sellers come in to push prices down.

Breakouts:

Bullish Breakout: When the price moves above resistance, it often indicates strong buying interest and the potential for a continued uptrend. Traders may view this as a signal to buy or hold.

Bearish Breakout: When the price falls below support, it can signal strong selling interest and the potential for a continued downtrend. Traders might see this as a cue to sell or avoid buying.

20 EMA (Exponential Moving Average):

Above 20 EMA: If the stock price is above the 20 EMA, it suggests a potential uptrend or bullish momentum.

Below 20 EMA: If the stock price is below the 20 EMA, it indicates a potential downtrend or bearish momentum.

Trendline: A trendline is a straight line drawn on a chart to represent the general direction of a data point set.

Uptrend Line: Drawn by connecting the lows in an upward trend. Indicates that the price is moving higher over time. Acts as a support level, where prices tend to bounce upward.

Downtrend Line: Drawn by connecting the highs in a downward trend. Indicates that the price is moving lower over time. It acts as a resistance level, where prices tend to drop.

RSI: RSI readings greater than the 70 level are overbought territory, and RSI readings lower than the 30 level are considered oversold territory.

Combining RSI with Support and Resistance:

Support Level: This is a price level where a stock tends to find buying interest, preventing it from falling further. If RSI is showing an oversold condition (below 30) and the price is near or at a strong support level, it could be a good buy signal.

Resistance Level: This is a price level where a stock tends to find selling interest, preventing it from rising further. If RSI is showing an overbought condition (above 70) and the price is near or at a strong resistance level, it could be a signal to sell or short the asset.

Disclaimer:

I am not a SEBI registered. The information provided here is for learning purposes only and should not be interpreted as financial advice. Consider the broader market context and consult with a qualified financial advisor before making investment decisions.

Ahluwalia Contracts - On verge of a BreakoutAhluwalia Contracts - Weekly TF - Confluence of two patterns, Ascending triangle and VCP. The breakout is above Rs 335.

CMP - Rs 321.20

SL - Rs 300

R:R - 1.71

Disclaimer - I'm not SEBI registered. Do your own analysis before investing. The above idea is for educational purpose only,

AHLUCONT Short term Positional Call Www.techno-funda.com

Ahluwalia Contracts (india) Limited CMP 390, Closing based SL 369, Targets 405, 415

* Volume Breakout

* Morning Star pattern

* Swing high Breakout

* Pre Breakout Trading (so involves little risk)

Disclaimer: All levels are for learning purpose only.