ASKAUTOLTD trade ideas

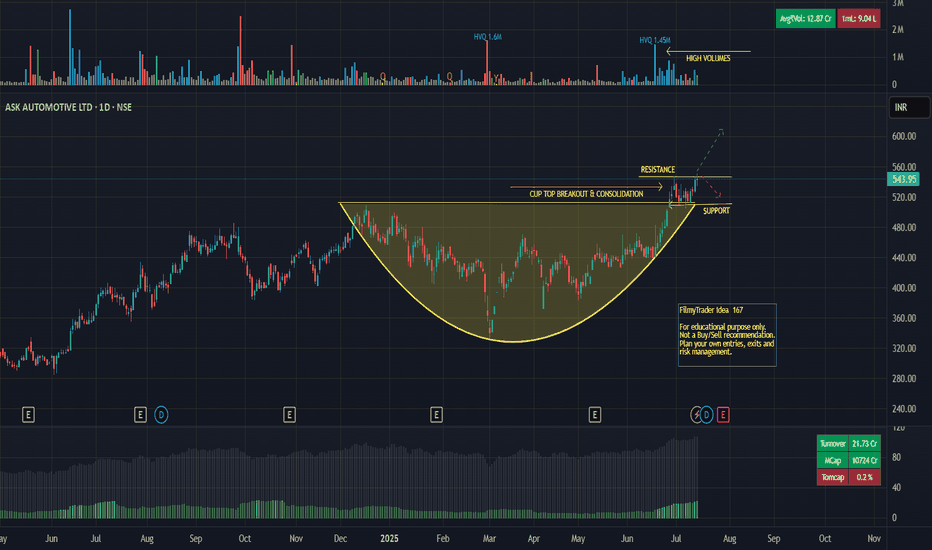

ASKAUTOLTD - Strong Technicals + Strong Fundamentals Should be a long term play, looks strong from the medium term. Beautiful Chart. MCap less than 10K Cr, poised for growth, strong fundamentals, strong technicals.

How to build Positions - Gradual scale in is your answer. Do not put in money blindly at open, good thinks take time to build and so should your portfolio.

SL - 480 (roughly 11% away, slow accumulation should help get your average price less than 7% away from this SL)

Amazing breakout on WEEKLY Timeframe - ASKAUTOLTDCheckout an amazing breakout happened in the stock in Weekly timeframe, macroscopically seen in Daily timeframe. Having a great favor that the stock might be bullish expecting a staggering returns of minimum 25% TGT. IMPORTANT BREAKOUT LEVELS ARE ALWAYS RESPECTED!

NOTE for learners: Place the breakout levels as per the chart shared and track it yourself to get amazed!!

#No complicated chart patterns

#No big big indicators

#No Excel sheet or number magics

TRADE IDEA: WAIT FOR THE STOCK TO BREAKOUT IN WEEKLY TIMEFRAME ABOVE THIS LEVEL.

Checkout an amazing breakout happened in the stock in Weekly timeframe.

Breakouts happening in longer timeframe is way more powerful than the breakouts seen in Daily timeframe. You can blindly invest once the weekly candle closes above the breakout line and stay invested forever. Also these stocks breakouts are lifelong predictions, it means technically these breakouts happen giving more returns in the longer runs. Hence, even when the scrip makes a loss of 10% / 20% / 30% / 50%, the stock will regain and turn around. Once they again enter the same breakout level, they will flyyyyyyyyyyyy like a ROCKET if held in the portfolio in the longer run.

Time makes money, GREEDY & EGO will not make money.

Also, magically these breakouts tend to prove that the companies turn around and fundamentally becoming strong. Also the magic happens when more diversification is done in various sectors under various scripts with equal money invested in each N500 scripts.

The real deal is when to purchase and where to purchase the stock. That is where Breakout study comes into play.

Check this stock which has made an all time low and high chances that it makes a "V" shaped recovery.

> Taking support at last years support or breakout level

> High chances that it reverses from this point.

> Volume dried up badly in last few months / days.

> Very high suspicion based analysis and not based on chart patterns / candle patterns deeply.

> VALUABLE STOCK AVAILABLE AT A DISCOUNTED PRICE

> OPPURTUNITY TO ACCUMULATE ADEQUATE QUANTITY

> MARKET AFTER A CORRECTION / PANIC FALL TO MAKE GOOD INVESTMENT

DISCLAIMER : This is just for educational purpose. This type of analysis is equivalent to catching a falling knife. If you are a warrior, you throw all the knives back else you will be sorrow if it hits SL. Make sure to do your analysis well. This type of analysis only suits high risks investor and whose is willing to throw all the knives above irrespective of any sectoral rotation. BE VERY CAUTIOUS AS IT IS EXTREME BOTTOM FISHING.

HOWEVER, THIS IS HOW MULTIBAGGERS ARE CAUGHT !

STOCK IS AT RIGHT PE / RIGHT EVALUATION / MORE ROAD TO GROW / CORRECTED IV / EXCELLENT BOOKS / USING MARKET CRASH AS AN OPPURTUNITY / EPS AT SKY.

LET'S PUMP IN SOME MONEY AND REVOLUTIONIZE THE NATION'S ECONOMY!

ASK AUTOMOTIVE LTD S/R Support and Resistance Levels:

Support Levels: These are price points (green line/shade) where a downward trend may be halted due to a concentration of buying interest. Imagine them as a safety net where buyers step in, preventing further decline.

Resistance Levels: Conversely, resistance levels (red line/shade) are where upward trends might stall due to increased selling interest. They act like a ceiling where sellers come in to push prices down.

Breakouts:

Bullish Breakout: When the price moves above resistance, it often indicates strong buying interest and the potential for a continued uptrend. Traders may view this as a signal to buy or hold.

Bearish Breakout: When the price falls below support, it can signal strong selling interest and the potential for a continued downtrend. Traders might see this as a cue to sell or avoid buying.

20 EMA (Exponential Moving Average):

Above 20 EMA(50 EMA): If the stock price is above the 20 EMA, it suggests a potential uptrend or bullish momentum.

Below 20 EMA: If the stock price is below the 20 EMA, it indicates a potential downtrend or bearish momentum.

Trendline: A trendline is a straight line drawn on a chart to represent the general direction of a data point set.

Uptrend Line: Drawn by connecting the lows in an upward trend. Indicates that the price is moving higher over time. Acts as a support level, where prices tend to bounce upward.

Downtrend Line: Drawn by connecting the highs in a downward trend. Indicates that the price is moving lower over time. It acts as a resistance level, where prices tend to drop.

RSI: RSI readings greater than the 70 level are overbought territory, and RSI readings lower than the 30 level are considered oversold territory.

Combining RSI with Support and Resistance:

Support Level: This is a price level where a stock tends to find buying interest, preventing it from falling further. If RSI is showing an oversold condition (below 30) and the price is near or at a strong support level, it could be a good buy signal.

Resistance Level: This is a price level where a stock tends to find selling interest, preventing it from rising further. If RSI is showing an overbought condition (above 70) and the price is near or at a strong resistance level, it could be a signal to sell or short the asset.

Disclaimer:

I am not a SEBI registered. The information provided here is for learning purposes only and should not be interpreted as financial advice. Consider the broader market context and consult with a qualified financial advisor before making investment decisions.

ASKAUTO strengthening Financias as well as Price Action NSE:ASKAUTOLTD

........................

KEY Performance

........................

Robust growth in both top line & bottom line

Highest ever Revenue & PAT in any quarter in past

Revenue growth outperformed Industry growth

Revenue up +31%, EBITDA up + 59%, PAT up +63%

EBITDA Margins at 11.9%, up 210 bps YoY

EBITDA margin improvement resulting from:

Higher Volume driven economies of scale

Benefit from ramp up of Karoli facility

Focus on cost optimization initiatives

EPS at Rs. 2.88, up +63% YoY

CRISIL revised outlook to Positive from Stable

CRISIL reaffirmed Credit Rating to AA- for

Long Term and A1+ for Short Term

Construction work of new Bengaluru Plant

progressing well as per plan

......................

Powertrain Agnostic product offerings in both EV and Non-EV.

4 World Class Technical Collaborations and 2 World Class Joint Ventures.

Robust financial performance with 17% Revenue growth, 26% EBITDA growth, 41% PAT growth and RoACE of 23.64% in FY24.

High entry barriers due to proprietary material formulations, in-house Engg, Designing & Tool room.

Long standing relationship with customers & established Aftermarket focused on Quality, Cost & Delivery.

ASKAUTOLTD to the moonIf you're considering investing in ASKAUTOLTD (a hypothetical automotive company), here are some potential reasons why it might be a good investment:

### 1. **Strong Financial Performance**

- **Revenue Growth**: Consistent revenue growth over the past few years indicates the company is expanding its market share and improving sales.

- **Profit Margins**: Healthy profit margins suggest efficient operations and strong pricing power.

- **Cash Flow**: Robust cash flow can provide stability and the ability to reinvest in growth opportunities or return value to shareholders through dividends and buybacks.

### 2. **Market Position**

- **Brand Recognition**: Strong brand recognition and customer loyalty can lead to sustained demand for products.

- **Innovation**: Investment in research and development (R&D) can lead to cutting-edge technology and new product lines, keeping the company competitive.

### 3. **Industry Trends**

- **Electric Vehicles (EV)**: If ASKAUTOLTD is a leader in electric vehicle technology, it stands to benefit from the global shift towards more sustainable transportation.

- **Autonomous Driving**: Investments in autonomous driving technology could position the company as a leader in the future of mobility.

### 4. **Management Team**

- **Experienced Leadership**: A strong, experienced management team with a proven track record can effectively steer the company towards its goals.

- **Strategic Vision**: Clear strategic vision and execution plans can drive long-term growth and shareholder value.

### 5. **Global Expansion**

- **Emerging Markets**: Expansion into emerging markets can provide new revenue streams and growth opportunities.

- **Diversification**: Geographic diversification can mitigate risks associated with economic downturns in specific regions.

### 6. **Sustainability Initiatives**

- **Environmental, Social, and Governance (ESG)**: Commitment to sustainability and strong ESG practices can attract socially conscious investors and improve the company's reputation.

### 7. **Competitive Advantages**

- **Technological Edge**: Proprietary technology or patents can give ASKAUTOLTD a competitive edge.

- **Supply Chain Efficiency**: Efficient supply chain management can reduce costs and improve profitability.

### 8. **Dividend and Share Buybacks**

- **Dividends**: Regular dividend payments can provide a steady income stream for investors.

- **Share Buybacks**: Buyback programs can increase shareholder value by reducing the number of outstanding shares.

### 9. **Partnerships and Collaborations**

- **Strategic Alliances**: Collaborations with other companies, tech firms, or startups can enhance product offerings and market reach.

- **Joint Ventures**: Joint ventures in new markets can reduce risk and provide growth opportunities.

### 10. **Valuation**

- **Attractive Valuation**: If the stock is undervalued compared to its peers or historical averages, it might present a good buying opportunity.

### Conclusion

Investing in ASKAUTOLTD could be advantageous due to its strong financial health, strategic market positioning, innovation in the automotive sector, and commitment to sustainability. However, it's essential to conduct thorough due diligence, considering both the company's fundamentals and broader market conditions before making an investment decision.