Review and plan for 18th July 2025Nifty future and banknifty future analysis and intraday plan.

Analysis of quarterly results.

This video is for information/education purpose only. you are 100% responsible for any actions you take by reading/viewing this post.

please consult your financial advisor before taking any action.

----Vinaykumar hiremath, CMT

AXISBANK trade ideas

Axis Bank Hi,

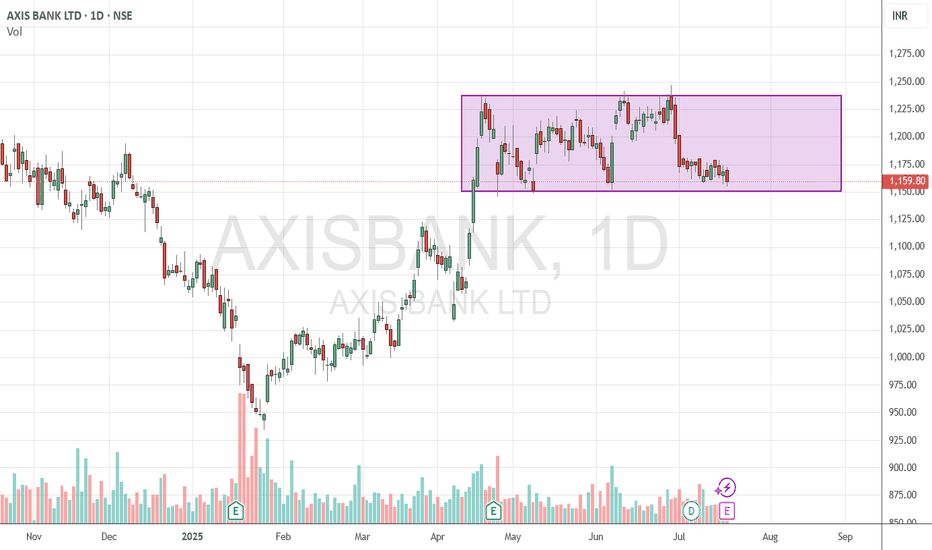

price Trade in zone . And currently it is available at support area.

So it's possible that price will move above The support area

This idea is for Educational purpose and paper trading only. Please consult your financial advisor before investing or making any position. Facts or Data given above may be slightly incorrect. We are not SEBI registered

AXIS BANK at Best Support !!Here are two charts of Axis Bank — one in the 4-hour timeframe and the other in the 1-hour timeframe.

4-Hour Timeframe Chart:

In this chart, Axis Bank is moving within a parallel channel, with the support zone lying in the 1150–1160 range.

1-Hour Timeframe Chart:

Axis Bank is forming a descending broadening wedge pattern, with support near the 1150–1155 zone.

If this level is sustain ,then we may see higher prices in Axis Bank.

Thank You !!

AXIS BANK - FOR SWING TRADEOn a weekly time frame price has given a curve line breakout and currently price is in a range .

Previous week a Pin bar candle has formed in it's Fib 50% level which is also a good support area.

Current price is 1219

This week price can give us a good upside move, if not then price will be in the same range.

Axis Bank Ltd view for Intraday 22nd May #AXISBANK Axis Bank Ltd view for Intraday 22nd May #AXISBANK

Resistance 1220 Watching above 1223 for upside momentum.

Support area 1180 Below 1180 ignoring upside momentum for intraday

Watching below 1179 for downside movement...

Above 1200 ignoring downside move for intraday

Charts for Educational purposes only.

Please follow strict stop loss and risk reward if you follow the level.

Thanks,

V Trade Point

Axis Bank Ltd view for Intraday 20th May #AXISBANK Axis Bank Ltd view for Intraday 20th May #AXISBANK

Resistance 1220 Watching above 1223 for upside momentum.

Support area 1180 Below 1200 ignoring upside momentum for intraday

Watching below 1179 for downside movement...

Above 1200 ignoring downside move for intraday

Charts for Educational purposes only.

Please follow strict stop loss and risk reward if you follow the level.

Thanks,

V Trade Point

Axis Bank Ltd view for Intraday 5th May #AXISBANK Axis Bank Ltd view for Intraday 5th May #AXISBANK

Resistance 1200-1202 Watching above 1203 for upside movement...

Support area 1170 Below 1180 ignoring upside momentum for intraday

Watching below 1168 for downside movement...

Above 1180 ignoring downside move for intraday

Charts for Educational purposes only.

Please follow strict stop loss and risk reward if you follow the level.

Thanks,

V Trade Point

Axis Bank Ltd view for Intraday 2nd May #AXISBANK Axis Bank Ltd view for Intraday 2nd May #AXISBANK

Resistance 1200 Watching above 1203 for upside movement...

Support area 1170 Below 1190 ignoring upside momentum for intraday

Watching below 1168 for downside movement...

Above 1190 ignoring downside move for intraday

Charts for Educational purposes only.

Please follow strict stop loss and risk reward if you follow the level.

Thanks,

V Trade Point

Axis Bank Ltd view for Intraday 28th April #AXISBANK Axis Bank Ltd view for Intraday 28th April #AXISBANK

Resistance 1175 Watching above 1177 for upside movement...

Support area 1160 Below 1160 ignoring upside momentum for intraday

Watching below 1157 for downside movement...

Above 1170 ignoring downside move for intraday

Charts for Educational purposes only.

Please follow strict stop loss and risk reward if you follow the level.

Thanks,

V Trade Point

AXISBANK – Classic Cup & Handle Breakout | Targeting 1280 & 1320🧠 Technical Analysis:

AXISBANK has formed a textbook Cup and Handle pattern over the past few months. The breakout above the resistance zone around ₹1199 marks a potential start of a new bullish rally.

🔹 Cup Formation: Rounded bottom between Dec 2024 - Apr 2025

🔹 Handle Formation: Consolidation range in Oct - Dec 2024

🔹 Breakout Candle: Strong bullish candle with increasing volume

🔹 200 EMA: Price is now well above the 200 EMA, adding to the bullish bias

🎯 Targets:

Target 1: ₹1280

Target 2: ₹1320

These levels are based on the measured move technique and previous swing highs.

🛡️ Support:

Immediate support lies around the breakout zone near ₹1199

Next strong support is near ₹1090 (200 EMA)

📊 Volume:

Breakout accompanied by a surge in volume confirms buyer interest and validates the pattern.

📌 Conclusion:

AXISBANK is showing strong bullish momentum with a confirmed breakout from a well-defined Cup and Handle formation. As long as it sustains above ₹1199, the stock could potentially rally toward ₹1280 and ₹1320 in the coming sessions.

📅 Keep it on your radar for bullish continuation setups!

Disclaimer:

This analysis is shared purely for educational and informational purposes and should not be considered as financial advice or a recommendation to buy or sell any security. Always do your own research and consult with a qualified financial advisor before making any investment decisions. Trading and investing involve risk.

AXISBANK(13 March 2023)→Type of trade:BREAKOUT TRADE(TC09)AXIS BANK (13 March 2023) → Type of trade: BREAKOUT TRADE (TC09) (IN FOLDER)

→ Result of Breakout in hindsight : It was a GENUINE BREAKOUT

RED STICKER - SHORT TRADE - HORIZONTAL LINE BREAKDOWN

---------------------------------------------------------------------------------------------------------------

TRADE OVERVIEW

---------------------------------------------------------------------------------------------------------------

WHEN WE IDENTIFIED THIS SETUP? OFF-MARKET HOURS (DURING H.W) OR LIVE MARKET?

Axis Bank Short Position Axis bank has formed a Death Crossover on chart i.e 50 and 200 Ema Forming a Crossover leading to Downtrend of the prices . The price after making a lower high taking resistance from 50 EMA and now it is moving towards prev. low swing again and seems like it has weakness and could break trendline . Also there is a news Catalyst which is of Indusind Bank which will also help price to move towards low areas .