Bajaj Healthcare - Potential UpsideFundamentals Perspective

Revenue Growth: Bajaj Healthcare has shown a significant increase in revenue, with a 13.1% rise in Q3FY25 compared to the same period in FY24, reaching Rs 1,227.9 million. This growth indicates a strong operational performance.

Profitability Improvement: The company reported a substantial increase in PAT (Profit After Tax) for Q3FY25, with a 153.4% change compared to the previous year, reaching Rs 117.2 million. This improvement suggests effective cost management and operational efficiency.

Segmental Growth: The formulations segment experienced a remarkable 58% YoY growth, highlighting the company's manufacturing capabilities and market demand. Additionally, the opium processing segment saw a 32% YoY growth, indicating optimism in the alkaloid processing segment.

Operational Excellence: The company's focus on operational excellence and cost efficiencies has contributed to its profitability surge, as noted by the Managing Director.

However, Bajaj Healthcare is trading at a premium of 489% based on intrinsic value estimates, which might raise concerns about overvaluation.

Technicals Perspective

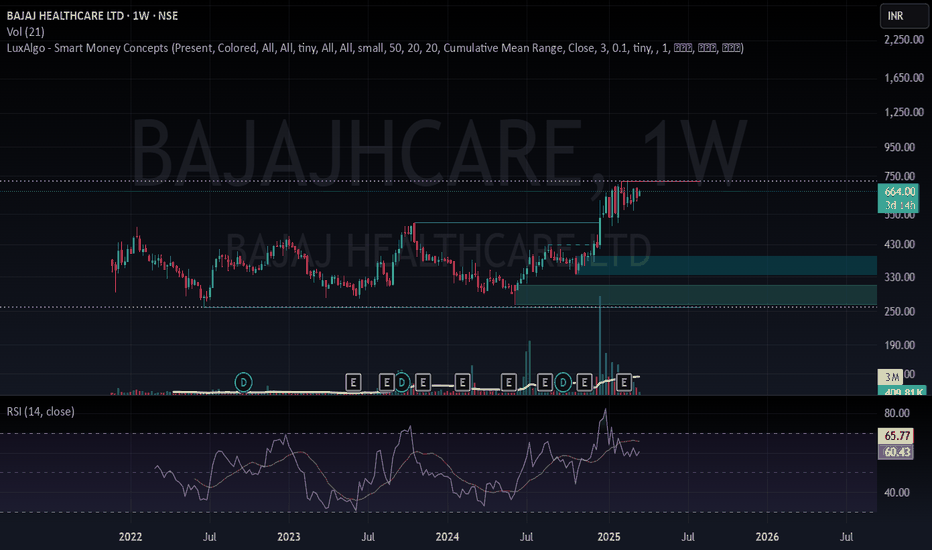

Current Market Trend: The stock has been in a mixed trend recently, with fluctuations in share price. As of March 18, 2025, the stock closed at ₹664, showing a decent consolidation since Jan 2025.

Short-Term Outlook: Given the sideways trend, short-term projections should focus on support and resistance levels. However, if the stock breaks out of this consolidation phase, it could potentially move upwards.

Long-Term Projections: Based on machine learning and technical analysis, the stock has the potential to reach ₹950. The time frame for reaching this target can vary depending on market conditions and the company's performance. Historically, stocks in similar growth phases have seen significant price movements within 12 to 24 months. However, this is speculative and depends on various factors such as economic conditions, sector performance, and company-specific developments.

Technical Indicators: While specific technical indicators like RSI, MACD, and ADX are not detailed in the available data, a comprehensive technical analysis would typically involve evaluating these metrics to assess overbought or oversold conditions and trend directions.

In summary, from a fundamentals perspective, Bajaj Healthcare's revenue growth and profitability improvements are attractive. However, the stock's valuation and a potential lack of analyst coverage could be concerns. Technically, the stock's short-term trend is sideways, but long-term projections suggest potential growth if market conditions favor the healthcare sector.

Recommendation

Investment Strategy: Consider a long-term perspective if you believe in the company's operational strengths and potential for future growth.

Risk Management: Be cautious of the current valuation premium and monitor market trends closely.

Technical Analysis: Use detailed technical indicators to time your entry and exit strategies effectively.

BAJAJHCARE trade ideas

Bajaj Healthcare LtdBajaj Healthcare Ltd

BHL is focused on development, supply, manufacturing of Amino Acids, Nutritional Supplements and Active Pharma Ingredients for Pharmaceutical, Nutraceuticals and Food industries. It manufactures active pharmaceutical ingredients and formulations in the form of tablets, capsules, powder, etc. for ~550+ clients, exporting bulk drugs to ~62+ countries in Europe, USA, Africa, Australia, etc.

something happening!!!

Bajaj Healthcare Long term targetsBajaj Healthcare is moving out of long consolidation zone with weekly and monthly breakout with significant rise in volume. Technically Bajaj healthcare looks strong on chart, whereas fundamentally its still improving with strong commentary from management in last quarter.

Short term technical trade weekly TFSince 29-01-2024 candle, price tried many times to positively close above key level 336.45 but failed many times . Now since last 5 weeks price is in upside momentum and closed above key level 336.45.... Sl below 325 closing basis Target 410....Not any recommendation....only for educational purpose ...

Bajaj Healthcare can remain bullish on buy back offerBajaj Healthcare Ltd. is a pharmaceutical company, which engages in the development, manufacturing, and supply of amino acids, nutritional supplements, and active pharmaceutical ingredients, serving various Pharmaceuticals, Nutraceuticals and Food industries globally.

Bajaj Healthcare Ltd CMP is 355. The positive aspects of the company are Company with Zero Promoter Pledge, Mutual Funds Increased Shareholding in Past Month and Increasing Revenue every quarter for the past 2 quarters. The Negative aspects of the company are declining Net Cash Flow : Companies not able to generate net cash.

Entry can be taken after closing above 359. Targets in the stock will be 377. The long-term target in the stock will be 403, 429 and 447. Stop loss in the stock should be maintained at Closing below 312.

The above information is provided for educational purpose, analysis and paper trading only. Please don't treat this as a buy or sell recommendation for the stock. We do not guarantee any success in highly volatile market or otherwise. Stock market investment is subject to market risks which include global and regional risks. We will not be responsible for any Profit or loss that may occur due to any financial decision taken based on any data provided in this message.

Can $NSE:BAJAJHCARE Will Take Support ?Dear Followers,

I hope this message finds you well. I wanted to share my swing trade view on NSE:BAJAJHCARE with you. I've analyzed the chart and identified some potential opportunities that I believe align with our swing trading strategy.

Stock: NSE:BAJAJHCARE

Holding Time Frame: 90 Days

Entry Point: 360-363

Stop Loss Point : 335

Target Point: 410,440,470

I've created a chart on TradingView that illustrates my analysis. You can view it by clicking on the following link:

Please keep in mind that markets are inherently unpredictable, and there are no guarantees in trading. This view is based on my analysis as of Date 10-Dec-2023 , and conditions may change. It's important to do your own research and consider your risk tolerance before making any trading decisions.

Feel free to reach out if you have any questions or if you'd like to discuss this swing trade view further. Your feedback and insights are always appreciated.

Best regards,

Prachi M

BAJAJHCARE Symmetrical Triangle breakoutNSE:BAJAJHCARE BSE:BAJAJHCARE

Time Frame – Weekly

Observations : -

* Symmetrical Triangle breakout done with good volume

* High Volume activity seen since last 4 weeks

* Price taken support at weekly 200 SMA and gave good bounce.

Resistance – 512 / 637 / 778 / 875

Support – 375-420 zone

DISCLAIMER : NCFM Certified Technical Analyst. I am not SEBI registered analyst. All posts are for educational purposes only. I am not responsible for your any loss or profit. Consult your adviser before taking any trade. I help people to learn technical analysis & charts reading.

BAJAJ HEALTH CARE yearly chart Bajaj healthcre the chart say the starting to the this year the share in continusly give good retrun to the investor and give divident in time to time yearly chare data is limited. I am bullish this share but i am not surprice that the share give net negative return at eh year end

Bajaj Healthcare looking good. Bajaj Healthcare Ltd. is a pharmaceutical company which is into the operations of manufacturing of amino acids, nutritional supplements and other pharmaceutical ingredients. Its CMP is 400.1.

Negatives of Bajaj Healthcare are that they have declining net cash flow and FII are decreasing their stake in the company.

The positives are that they have Zero promoter pledge and increase in operating profit margins.

X/2 Entry in Bajaj Healthcare can be taken above 408 and X/2 above 431. Targets will be 462 and 496.

Stop Loss can be kept at a closing below 360.

Educational purpose / Paper Trading only.