BAJAJ HOUSING FINANCE LTD GOOD TIME TO PICK IT Bajaj Housing Finance Ltd. (BHFL) is a prominent non-banking financial company (NBFC) in India, specializing in housing-related finance. It's a subsidiary of Bajaj Finance Ltd., and has been classified as an Upper-Layer NBFC by the RBI under its Scale-Based Regulations.

📊 Latest Financial Highlights (Q1 FY26 Preview)

- Assets Under Management (AUM): 1.2 lakh crore, up 24% YoY and 5% QoQ

- Loan Assets: 1.05 lakh crore, up 24.2% YoY

- Disbursements: 14,640 crore, up 22% YoY

- Net Profit (PAT): Expected to rise 19–21% YoY to 574–584 crore

- Net Interest Income (NII): Estimated to grow 24–28% YoY to 827–851 crore

- Net Interest Margin (NIM): Projected at ~3.2%, slightly compressed due to rate cuts

The company is well-positioned to benefit from the rising demand for housing loans, as more people seek to buy homes. With a focus on technology and customer service, BHFL is likely to enhance its operational efficiency, attracting more clients and growing its market share. As a result, the stock price of BHFL could rise, with steady growth by its expanding loan portfolio and strong brand recognition. In 2026, its share price target would be 253, as per our analysis.

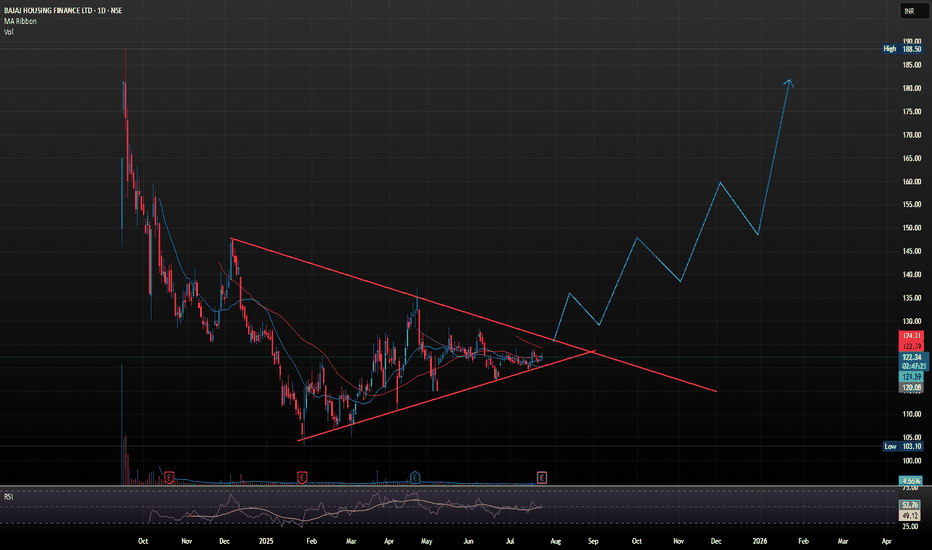

SHORT TERM VIEW

entry - 119.50-123

stop loss - 117.60

target - 135-140

BAJAJHFL trade ideas

Review and plan for 24th April 2025 Nifty future and banknifty future analysis and intraday plan in kannada.

Quarterly results.

This video is for information/education purpose only. you are 100% responsible for any actions you take by reading/viewing this post.

please consult your financial advisor before taking any action.

----Vinaykumar hiremath, CMT

BAJAJHFL Short term IdeaBAJAJHFL is at breakout level. It has tested the TL 2 times and now the swing broke.

People who are looking for low risk and High reward can look this.

This is not a call, please analyze and consult your financial advisor before investing.

Entry can be at Spot(115.29) or safe players can enter above 120, your Risk will be 110(Stoploss) and Targets T1 - 145, T2 - 180.

Estimated Holding time - 3 to 6 months, maximum - 1 year

Turning After Healthy CorrectionDisclaimer

I'm not SEBI Registered

This is just an Elliott Wave Practice and just for educational purposes

Bajaj Housing Finance looks like completed Tripple Correction now heading towards new Wave Development it may test 38.2% and if sustained above this it may test 61.8% Level.

If you do trade or invest, please discuses with financial experts.

Go long in Bajaj Housing Finance only above 128.50Bajaj Housing finance is near it's all time low support area. From here, we can plan a reversal trade only if it closes above 128.50 on daily frame. Then, from 128.50 the targets on the upside would be 132.80,138.30, 142.10 & 146.

Stoploss against this investment can be placed near it's all time now 124. Exit your positions if it closes below 124 on daily frame.

BAJAJHFL 147 is very nice up side Weekly chart displays breakout

The neckline of inverse XABCD pattern confluence

with the upper side of the symmetrical triangle.

price is based at strong support neckline

this chart clearly shows that a massive potential targets ahead

it will be the level Study and buy

only for

Education purpose

Bajaj Housing Finance AnalysisNSE:BAJAJHFL

Technical Analysis : You can get an Idea about the potential move from the given chart if the price follows the price action and market sentiment remain bullish.

Fundamental Analysis :

Key Financial Data:

1. **Share Price**: ₹129.56.

2. **Market Capitalization**: ₹1,07,899 crore.

3. **Earnings Per Share (EPS)**: ₹2.65.

4. **Revenue (FY2023-24)**: ₹7,617 crore (34% growth YoY).

5. **Profit After Tax (FY2023-24)**: ₹1,731 crore (38% growth YoY).

6. **Total Assets**: ₹81,827 crore.

7. **ROE (Return on Equity)**: 3.78%.

### Analytical Valuation Models:

Using a combination of financial models to estimate the fair value:

1. **Discounted Cash Flow (DCF) Analysis**:

Assuming moderate growth in free cash flows and using an estimated discount rate (WACC), the DCF valuation suggests a fair value of **₹140 per share**.

2. **Comparable Company Analysis (CCA)**:

Analyzing peers like LIC Housing Finance and Housing Development Corporation, Bajaj Housing Finance appears fairly priced in the **₹125–₹135 range** based on its P/E and P/B ratios.

3. **Precedent Transactions Analysis**:

Benchmarking against recent acquisitions in the housing finance sector, a fair value of **₹135 per share** is plausible.

4. **Dividend Discount Model (DDM)**:

Given the company’s limited dividends, this model is less applicable as it skews conservative with a valuation below **₹100**.

5. **Gordon Growth Model (GGM)**:

Factoring the modest dividend growth, the GGM valuation estimates **₹120 per share**.

6. **Financial Ratios**:

- **P/E Ratio**: Trading at 7.11x earnings.

- **Fair Value**: ₹130 per share based on earnings growth.

7. **Price/Earnings to Growth (PEG) Ratio**:

Considering robust profit growth (38% YoY), the PEG method supports a valuation of **₹140 per share**.

8. **Residual Income Model**:

Using the ROE and cost of equity, the fair value aligns near **₹135 per share**.

9. **Economic Value Added (EVA)**:

Assessing the company’s ability to generate returns over its cost of capital, EVA-based valuation gives **₹138 per share**.

Summary Table:

| **Model** | **Fair Value (₹)** |

|----------------------------------------------|---------------------|

| Discounted Cash Flow (DCF) | 140 |

| Comparable Company Analysis (CCA) | 125–135 |

| Precedent Transactions | 135 |

| Dividend Discount Model (DDM) | 100 |

| Gordon Growth Model (GGM) | 120 |

| Financial Ratios | 130 |

| PEG Ratio | 140 |

| Residual Income Model | 135 |

| Economic Value Added (EVA) | 138 |

**Average Fair Value**: ₹133 per share

**Current Price**: ₹129.56

**Upside Potential**: ~2.66%

Conclusion:

Bajaj Housing Finance Ltd. is currently trading close to its estimated fair value. While not significantly undervalued, it offers stability and modest growth potential, suitable for long-term holding in portfolios focused on housing finance or related sectors.

Disclaimer: This analysis is for informational purposes only. Please consult a financial advisor before making investment decisions.

Why Bajaj Housing Finance is a Compelling Investment OpportunityIntroduction

In the dynamic world of Indian finance, a new star has emerged: Bajaj Housing Finance Ltd. Since its blockbuster debut on the NSE and BSE in mid-September 2024, the stock has been making headlines with its impressive performance. Here’s why you should be paying close attention to this housing finance giant.

Stellar Listing and Current Trends

Bajaj Housing Finance made a historic entry into the stock market, listing at a staggering 136% above its IPO price on its debut day. Despite a recent correction, the stock has still rallied 93.79% from its IPO price of Rs 70, indicating strong investor confidence.

x.com

Financial Performance

The quarterly and annual financials paint a robust picture:

Revenue Growth: The company has shown consistent revenue growth, with revenues increasing from Rs 5,665 crore in March 2023 to Rs 7,617 crore in March 2024. The quarterly revenues have also been on the rise, from Rs 1,585 crore in March 2023 to Rs 2,209 crore in June 2024.

Profitability: Net profits have surged from Rs 1,258 crore in March 2023 to Rs 1,731 crore in March 2024. The EPS has also seen a significant increase, from Rs 1.87 to Rs 2.58 during the same period.

Financing Margin: The financing margin has remained strong, hovering around 25-30%, indicating efficient cost management and healthy profitability.

Key Financial Ratios

Return on Equity (ROE): The ROE has consistently improved, reaching 15% in March 2024, a testament to the company's ability to generate profits from shareholders' equity.

Gross and Net NPA: The Gross NPA and Net NPA percentages are at 0.28% and 0.11%, respectively, as of June 2024, reflecting a well-managed asset quality.

PE and PB Ratios: Although the PE ratio is high at 132.42 and the PB ratio is at 10.25, these metrics are justified given the company's strong growth prospects and market position.

Technical Analysis

Support and Resistance: The stock has broken down from a key support level of Rs 150 but is expected to find strong support at Rs 134. A decisive close above Rs 145 could trigger a further upside towards Rs 155.

Breakout Potential: Analysts suggest waiting for a confirmed breakout above Rs 150 before considering a long position, as this level could act as a strong base for future upward movements.

Market and Economic Factors

Market Capitalization: With a market capitalization of over Rs 1,25,000 crore, Bajaj Housing Finance is one of the most valuable mortgage lenders in India.

Promoter Holding: The promoters hold a significant 88.75% stake, indicating their long-term commitment to the company.

Investment Advice

Given the current market conditions and the stock's recent correction, here are some key takeaways for investors:

Long-term View: Investors with a long-term perspective can hold onto the stock, as the company's fundamentals remain strong. Fresh buying is not advised at current levels; instead, wait for earnings reports to reassess.

Entry Points: Look for opportunities to buy on dips, especially if the stock reclaims and sustains above the Rs 150 level. This could be a strong entry point for those looking to capitalize on the stock's potential upside.

Conclusion

Bajaj Housing Finance Ltd. is not just another housing finance company; it is a powerhouse with robust financials, strong market positioning, and a promising future outlook. While the stock has experienced some volatility, the underlying fundamentals and technical indicators suggest that this could be an excellent addition to your investment portfolio.

Key Takeaways:

Strong Financials: Consistent revenue and profit growth.

Healthy Ratios: Impressive ROE, low NPA, and strong financing margins.

Technical Support: Wait for a breakout above Rs 150 for a potential long position.

Long-term Potential: Ideal for investors with a long-term view.

As the Indian housing finance sector continues to grow, Bajaj Housing Finance is well-positioned to capitalize on this trend. Keep a close eye on this stock, and you might just find yourself riding the wave of one of India's most promising financial stories. Share this post on TradingView and other social platforms to spread the word about this compelling investment opportunity

BAJAJ HOUSING FINANCE S/R Support and Resistance Levels:

Support Levels: These are price points (green line/shade) where a downward trend may be halted due to a concentration of buying interest. Imagine them as a safety net where buyers step in, preventing further decline.

Resistance Levels: Conversely, resistance levels (red line/shade) are where upward trends might stall due to increased selling interest. They act like a ceiling where sellers come in to push prices down.

Breakouts:

Bullish Breakout: When the price moves above resistance, it often indicates strong buying interest and the potential for a continued uptrend. Traders may view this as a signal to buy or hold.

Bearish Breakout: When the price falls below support, it can signal strong selling interest and the potential for a continued downtrend. Traders might see this as a cue to sell or avoid buying.

20 EMA (Exponential Moving Average):

Above 20 EMA(50 EMA): If the stock price is above the 20 EMA, it suggests a potential uptrend or bullish momentum.

Below 20 EMA: If the stock price is below the 20 EMA, it indicates a potential downtrend or bearish momentum.

Trendline: A trendline is a straight line drawn on a chart to represent the general direction of a data point set.

Uptrend Line: Drawn by connecting the lows in an upward trend. Indicates that the price is moving higher over time. Acts as a support level, where prices tend to bounce upward.

Downtrend Line: Drawn by connecting the highs in a downward trend. Indicates that the price is moving lower over time. It acts as a resistance level, where prices tend to drop.

RSI: RSI readings greater than the 70 level are overbought territory, and RSI readings lower than the 30 level are considered oversold territory.

Combining RSI with Support and Resistance:

Support Level: This is a price level where a stock tends to find buying interest, preventing it from falling further. If RSI is showing an oversold condition (below 30) and the price is near or at a strong support level, it could be a good buy signal.

Resistance Level: This is a price level where a stock tends to find selling interest, preventing it from rising further. If RSI is showing an overbought condition (above 70) and the price is near or at a strong resistance level, it could be a signal to sell or short the asset.

Disclaimer:

I am not a SEBI registered. The information provided here is for learning purposes only and should not be interpreted as financial advice. Consider the broader market context and consult with a qualified financial advisor before making investment decisions.