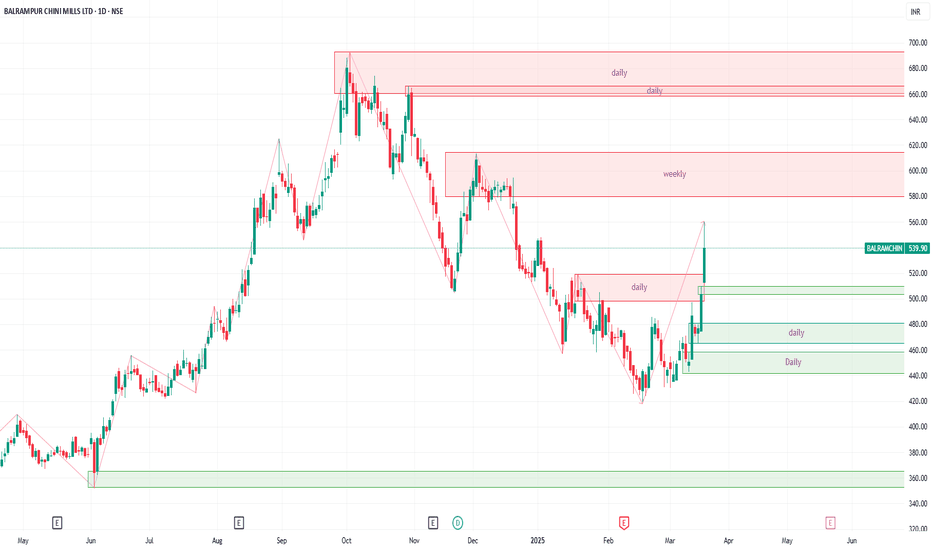

Balrampur Chini: Eyeing All-Time High! 🚀 Balrampur Chini: Eyeing All-Time High! 🚀

📉 CMP: ₹619

🔒 Stop Loss: ₹575

🎯 Target: ₹700

🔍 Why Balrampur Chini Looks Promising?

✅ Technical Strength: Trading above 61.8% Fibonacci level post-correction, indicating strong support

✅ Consolidation Base: Tight range between ₹615–₹580 signals accumulati

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

21.65 INR

4.37 B INR

54.15 B INR

171.26 M

About BALRAMPUR CHINI MILLS LTD

Sector

Industry

CEO

Vivek Saraogi

Website

Headquarters

Kolkata

Founded

1975

ISIN

INE119A01028

FIGI

BBG000C20CP7

Balrampur Chini Mills Ltd. engages in the manufacture and sale of sugar. It operates through the following segments: Sugar, Distillery, Polylactic Acid, and Others. The Sugar segment is involved in the distribution of sugar and its by-products such as molasses, bagasse, and pressmud. The Distillery segment markets industrial alcohol. The Polylactic Acid segment refers to a new line of business manufacturing polylactic acid, a biodegradable polymer. The Others segment consists of agricultural fertilizers such as soil conditioner and granulated potash. The company was founded in 1975 and is headquartered in Kolkata, India.

Related stocks

Balramchin It gave a break out last july moved a bit with good momentum came down, retested and took support on the trendline.

weekly and monthly (with higher highs) looks good for a positional trade/ swing trade, with this swing low as stop loss. ( or can keep the stop loss with respect to the time frame and

BALRAMCHIN Price MovementExpect the price to rise to 580 where the weekly supply zone (red rectangle) lies. The supply zone will push the price downwards. The price should start moving upwards again from one of the 3 demand zones (green rectangle). Break past the supply zone @ 614 and reach for the second supply zone @ 658

# BalaramChin , 1W and 1DIt is Looking Very good in Weekly time frame with Triangle Pattern .

it has given a Very Good Breakout Previously and Now it has Come to same point to Retest the Breakout Trendline

And Now it is forming Another Pattern at retest trendline and very high chances for Breakout of the Pattern , Becau

"Symmatricle Tringle" **||Balrampur Chini Mills Ltd||*** 16 years Consolidation touched on Support multiple times, and breakout on april-21, and on symmetrical Tringle pattern Jun-21 To July-24 3 Years consolidation pattern breakout 1M TF

* 14 Year Consolidation touched on resistance multiple times trend line Year Nov-11 TO July-24.

* Expected To r

50 SMA Rising- Positional TradeDisclaimer: I am not a Sebi registered adviser.

This Idea is publish purely for educational purpose only before investing in any stocks please take advise from your financial adviser.

Its 50 SMA Rising Strategy. Suitable for Positional Trading Initial Stop loss lowest of last 2 candles and keep tra

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

Frequently Asked Questions

The current price of BALRAMCHIN is 590.15 INR — it has decreased by −0.53% in the past 24 hours. Watch BALRAMPUR CHINI MILLS LTD stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on NSE exchange BALRAMPUR CHINI MILLS LTD stocks are traded under the ticker BALRAMCHIN.

BALRAMCHIN stock has fallen by −5.05% compared to the previous week, the month change is a −0.67% fall, over the last year BALRAMPUR CHINI MILLS LTD has showed a 26.89% increase.

We've gathered analysts' opinions on BALRAMPUR CHINI MILLS LTD future price: according to them, BALRAMCHIN price has a max estimate of 720.00 INR and a min estimate of 602.00 INR. Watch BALRAMCHIN chart and read a more detailed BALRAMPUR CHINI MILLS LTD stock forecast: see what analysts think of BALRAMPUR CHINI MILLS LTD and suggest that you do with its stocks.

BALRAMCHIN reached its all-time high on Oct 3, 2024 with the price of 691.80 INR, and its all-time low was 6.50 INR and was reached on Nov 23, 2001. View more price dynamics on BALRAMCHIN chart.

See other stocks reaching their highest and lowest prices.

See other stocks reaching their highest and lowest prices.

BALRAMCHIN stock is 2.68% volatile and has beta coefficient of 1.36. Track BALRAMPUR CHINI MILLS LTD stock price on the chart and check out the list of the most volatile stocks — is BALRAMPUR CHINI MILLS LTD there?

Today BALRAMPUR CHINI MILLS LTD has the market capitalization of 118.29 B, it has increased by 1.08% over the last week.

Yes, you can track BALRAMPUR CHINI MILLS LTD financials in yearly and quarterly reports right on TradingView.

BALRAMPUR CHINI MILLS LTD is going to release the next earnings report on Aug 6, 2025. Keep track of upcoming events with our Earnings Calendar.

BALRAMCHIN earnings for the last quarter are 10.90 INR per share, whereas the estimation was 10.40 INR resulting in a 4.81% surprise. The estimated earnings for the next quarter are 3.20 INR per share. See more details about BALRAMPUR CHINI MILLS LTD earnings.

BALRAMPUR CHINI MILLS LTD revenue for the last quarter amounts to 15.04 B INR, despite the estimated figure of 14.37 B INR. In the next quarter, revenue is expected to reach 15.50 B INR.

BALRAMCHIN net income for the last quarter is 2.29 B INR, while the quarter before that showed 704.71 M INR of net income which accounts for 225.13% change. Track more BALRAMPUR CHINI MILLS LTD financial stats to get the full picture.

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. BALRAMPUR CHINI MILLS LTD EBITDA is 7.04 B INR, and current EBITDA margin is 13.00%. See more stats in BALRAMPUR CHINI MILLS LTD financial statements.

Like other stocks, BALRAMCHIN shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade BALRAMPUR CHINI MILLS LTD stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So BALRAMPUR CHINI MILLS LTD technincal analysis shows the neutral today, and its 1 week rating is buy. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating BALRAMPUR CHINI MILLS LTD stock shows the buy signal. See more of BALRAMPUR CHINI MILLS LTD technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.