Balrampur Chini: Eyeing All-Time High! 🚀 Balrampur Chini: Eyeing All-Time High! 🚀

📉 CMP: ₹619

🔒 Stop Loss: ₹575

🎯 Target: ₹700

🔍 Why Balrampur Chini Looks Promising?

✅ Technical Strength: Trading above 61.8% Fibonacci level post-correction, indicating strong support

✅ Consolidation Base: Tight range between ₹615–₹580 signals accumulation before a potential breakout

✅ Upside Potential: Breakout from current range could take the stock to all-time high levels

💡 Strategy & Risk Management:

📈 Staggered Entry: Accumulate in phases as the market remains sideways; avoid expecting sharp moves

🔒 Strict SL: Maintain stop loss at ₹575 to manage risk effectively

📍 Outlook: Strong base formation with Fibonacci support makes Balrampur Chini an attractive swing opportunity towards ₹700.

📉 Disclaimer: Not SEBI-registered. Please do your own research or consult a financial advisor before investing.

#BalrampurChini #SugarStocks #TechnicalAnalysis #BreakoutTrade #SwingTrading #StockMarketIndia #InvestmentOpportunities

BALRAMCHIN trade ideas

Balramchin It gave a break out last july moved a bit with good momentum came down, retested and took support on the trendline.

weekly and monthly (with higher highs) looks good for a positional trade/ swing trade, with this swing low as stop loss. ( or can keep the stop loss with respect to the time frame and nature of the trade)

#balramchin

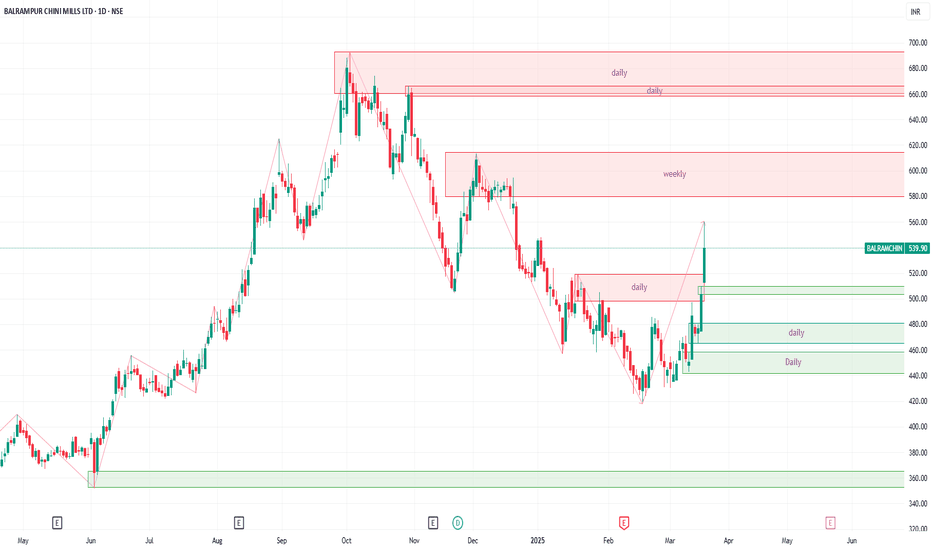

BALRAMCHIN Price MovementExpect the price to rise to 580 where the weekly supply zone (red rectangle) lies. The supply zone will push the price downwards. The price should start moving upwards again from one of the 3 demand zones (green rectangle). Break past the supply zone @ 614 and reach for the second supply zone @ 658 break past this supply zone @ 666, chasing a target of 690.

***Disclaimer:

I am not SEBI registered. The information provided here is for learning purposes only and should not be interpreted as financial advice. Consider the broader market context and consult with a qualified financial advisor before making investment decisions.

# BalaramChin , 1W and 1DIt is Looking Very good in Weekly time frame with Triangle Pattern .

it has given a Very Good Breakout Previously and Now it has Come to same point to Retest the Breakout Trendline

And Now it is forming Another Pattern at retest trendline and very high chances for Breakout of the Pattern , Because From October Month There is No Bullishness in Nifty , Now we Can expect a Bullish Move from Today .

Because of this i am posting Some Good Charts , so You can Use this bullish move properly

"Symmatricle Tringle" **||Balrampur Chini Mills Ltd||*** 16 years Consolidation touched on Support multiple times, and breakout on april-21, and on symmetrical Tringle pattern Jun-21 To July-24 3 Years consolidation pattern breakout 1M TF

* 14 Year Consolidation touched on resistance multiple times trend line Year Nov-11 TO July-24.

* Expected To reach at the next level. Price level - 2364

50 SMA Rising- Positional TradeDisclaimer: I am not a Sebi registered adviser.

This Idea is publish purely for educational purpose only before investing in any stocks please take advise from your financial adviser.

Its 50 SMA Rising Strategy. Suitable for Positional Trading Initial Stop loss lowest of last 2 candles and keep trailing with 50 days SMA if price close below 50 SMA then Exit or be in the trade some time trade can go for several months.

Be Discipline because discipline is the Key to Success in the STOCK Market.

Trade What you see not what you Think

Balrampur Chini Mills Ltd intraday level for 21st Aug #BALRAMCHIBalrampur Chini Mills Ltd intraday level for 21st Aug #BALRAMCHIN

Buying may witness above 573

Support area 566-566. Below ignoring buying momentum for intraday

Charts for Educational purposes only.

Please follow strict stop loss and risk reward if you follow the level.

Thanks,

V Trade Point

sell at zone - intraday- expecting small fall from the zone .

- good for intraday trade

ENTRY

- entry is strictly inside the zone

- look for confirmation in smaller time frame ( 15 mins preferred )

TARGET

- use fibonacci retracement on C to latest swing high

- mark 0.236 fib value as target

STOPLOSS

- if daily tf candle close is above the zone .

IGNORE

- if u didn't get confirmation inside zone , ignore this pick

- if daily timeframe candle close is above this zone , this pattern become invalid and ignore this pick

Blarampur Chini - Nearing to Multiyear Breakout/Ethanol News Blarampur Chini - Nearing to Multiyear Breakout with Ethanol News doing the fresh round again, it will be a good sector for short tem mometum play...

Disclaimer:

This analysis is for informational purposes only and does not constitute investment advice. Trading involves significant risk and may result in the loss of capital. Always conduct your own research or consult a financial advisor before making investment decisions. I am not responsible for any actions taken based on this analysis.

BALRAMPUR CHINI MI S/RSupport and Resistance Levels: In technical analysis, support and resistance levels are significant price levels where buying or selling interest tends to be strong. They are identified based on previous price levels where the price has shown a tendency to reverse or find support.

Support levels are represented by the green line and green shade, indicating areas where buying interest may emerge to prevent further price decline.

Resistance levels are represented by the red line and red shade, indicating areas where selling pressure may arise to prevent further price increases. Traders often consider these levels as potential buying or selling opportunities.

Breakouts: Breakouts occur when the price convincingly moves above a resistance level (red shade) or below a support level (green shade). A bullish breakout above resistance suggests the potential for further price increases, while a bearish breakout below support suggests the potential for further price declines. Traders pay attention to these breakout signals as they may indicate the start of a new trend or significant price movement.

20 EMA: The yellow line denotes 20 EMA, to interpret the 20 EMA, you need to compare it with the prevailing stock price. If the stock price is below the 20 EMA, it signals a possible downtrend. But if the stock price is above the 20 EMA, it signals a possible uptrend.

Disclosure: I am not SEBI registered. The information provided here is for learning purposes only and should not be interpreted as financial advice. It is important to consult with a qualified financial advisor before making any investment decisions. Tweets neither advice nor endorsement.

BALRAMCHIN : Longgg Consolidation.🎯The chart is self-explanatory as always.

🎯 The price has been consolidating in a range for a long time

🎯 A rebound is possible as the price has been respecting the support zone

🎯The sugar companies are in focus given the govt policies in this domain

⚠️Disclaimer: We are not registered advisors. The views expressed here are merely personal opinions. Irrespective of the language used, Nothing mentioned here should be considered as advice or recommendation. Please consult with your financial advisors before making any investment decisions. Like everybody else, we too can be wrong at times ✌🏻