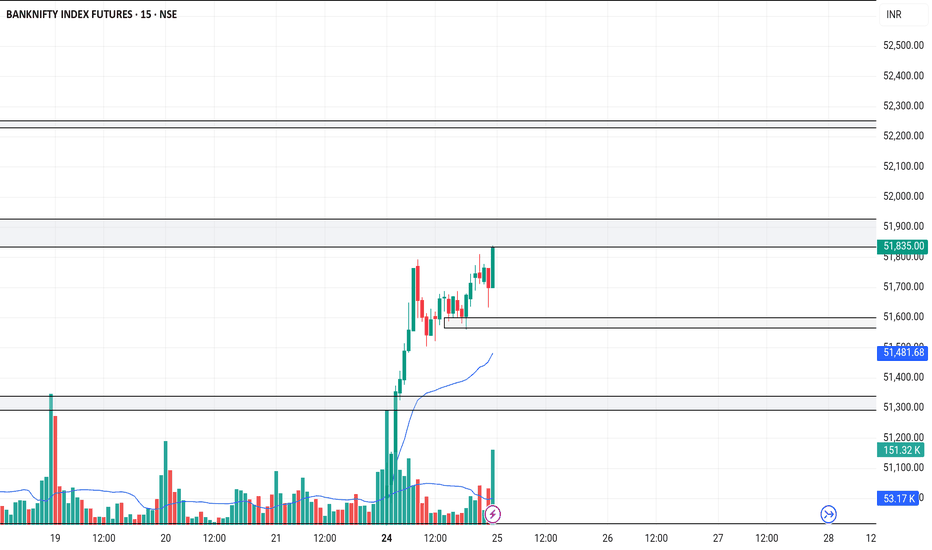

BANKNIFTY1! trade ideas

Bank Nifty FutureBank Nifty Future

MTF Analysis

Bank NiftyYearly Demand 41,820

Bank Nifty 6 Month Demand 44,893

Bank NiftyQtrly Demand BUFL 48,870

Bank NiftyMonthly Demand 44,820

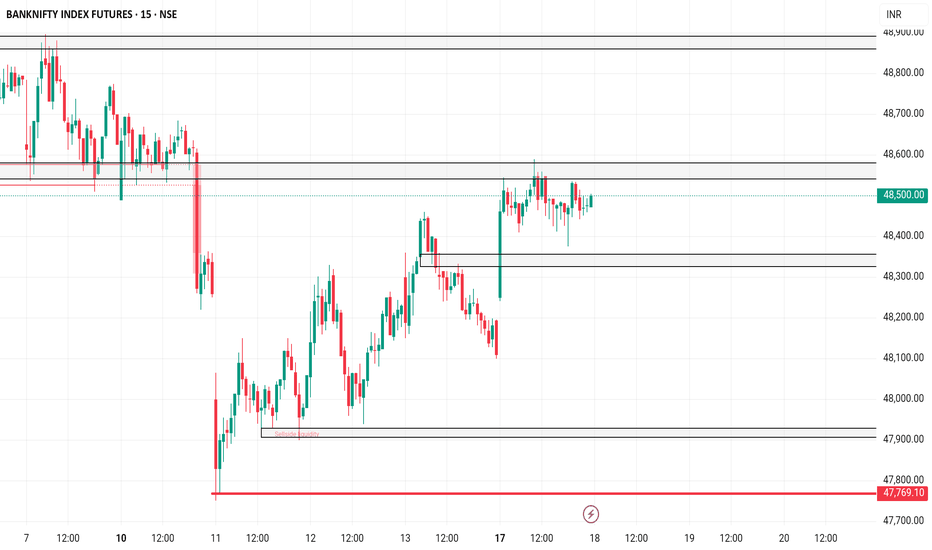

Bank NiftyWeekly Demand 47,763

Bank NiftyWeekly Demand 48,698

Bank NiftyDaily Demand DMIP 50,187

ENTRY -1 Long 50,168

SL 50,000

RISK 168

Target as per Entry 56,449

RR 37

Last High 52,100

Last Low 47,751

Review and plan for 28th March 2025Nifty future and banknifty future analysis and intraday plan in kannada.

This video is for information/education purpose only. you are 100% responsible for any actions you take by reading/viewing this post.

please consult your financial advisor before taking any action.

----Vinaykumar hiremath, CMT

Plan for 19th March 2025 Nifty future and banknifty future analysis and intraday plan.

This video is for information/education purpose only. you are 100% responsible for any actions you take by reading/viewing this post.

please consult your financial advisor before taking any action.

----Vinaykumar hiremath, CMT