CAMPUS trade ideas

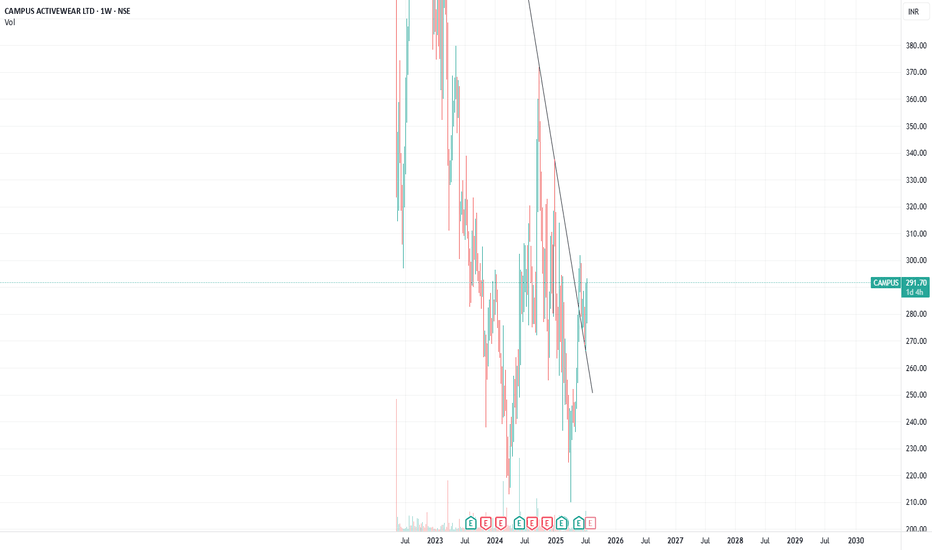

CAMPUS ACTIVE WEAR LTD SWING TRADE📊 Price Action & Trend Analysis

Analyzing market trends using price action, key support/resistance levels, and candlestick patterns to identify high-probability trade setups.

Always follow the trend and manage risk wisely!

Price Action Analysis Interprets Market Movements Using Patterns And Trends On Price Charts.

👉👉👉Follow us for Live Market Views/Trades/Analysis/News Updates.

Campus Activewear Short Setup: Breaking Critical Support LevelsCampus Activewear is showing bearish momentum with a breakdown below key support levels. The stock faces selling pressure and weak volume recovery. Potential shorting opportunities arise with targets at ₹249 and ₹213, keeping an eye on ₹275 as resistance. Stay cautious and manage risk!

CAMPUS: Low Public Shareholding 📉🤦

The shareholding pattern of a company refers to the distribution of its ownership among different categories of investors, including promoters, Foreign Institutional Investors (FII), Domestic Institutional Investors (DII), and the general public.

The ideal shareholding pattern can vary depending on the nature of the company, industry dynamics, and regulatory guidelines. However, A low public shareholding tells a lot about the future of both the company and its shareholders. Below are some good to know pointers:

1. Low Liquidity:

Low public holding can lead to lower trading volumes a.k.a. Low liquidity. It means there are fewer buyers and sellers in the market.

2. Wider Bid-Ask Spreads:

The reduced liquidity could result in wider bid-ask spreads. The bid-ask spread is the difference between the highest price a buyer is willing to pay (bid) and the lowest price a seller is willing to accept (ask). In illiquid markets, bid-ask spreads tend to be wider, making it more expensive to buy or sell shares, and potentially making it difficult to execute trades at desired prices.

3. Lack of Price Discovery:

The market sets the price for every security after discounting it for everything that matters. In illiquid markets, the true market price may be difficult to determine due to a lack of trading activity. This lack of price discovery can make it harder for investors to assess the fair value of the share.

4. Market Manipulation and Market volatility:

Low liquidity markets may be more susceptible to market manipulation, as a small number of investors can have a significant impact on prices. Imagine a particular DII or FII exiting its entire position in an illiquid market. The prices would crash like crazy.

5. Risk of Delisting:

This is a rare case scenario but is still a possibility. PE and VC funds keep an eye on such companies as it is comparatively easier to make such companies private.

When to invest in such companies:

Taking a closer look at CAMPUS's shareholding, we can see that promoters own about 75% of the company, while Foreign Institutional Investors (FIIs) have 7.5%, Domestic Institutional Investors (DIIs) hold 6.5%, and the general public has around 8%. This does show that the promoters, DIIs and FIIs are pretty confident about their investment.

Promoters, FIIs, and DIIs are different from regular individual investors. They invest for the long haul, focusing on the company's overall health rather than just buying and selling shares. Unlike many individual investors, FIIs and DIIs carefully choose to invest in a business for specific reasons. They're patient and willing to wait for their investments to grow over time because they believe in the company's potential.

A retail investor may invest in such a company if:

- He has confidence in the industry the company operates in,

- He trusts that the company's business is solid,

- He has faith in the management's ability to make good decisions, And

- He is willing to be patient for the Company to reach its prime

Else, investing in such a company can be a real Nightmare. Campus stands at an All-Time low. Imagine an investor who invested during its IPO and is still red.

Can you tell us what other companies have low public shareholding?

What should we analyze next?

Have Requests, Questions, or Suggestions? DM us or comment below.👇

⚠️Disclaimer: We are not registered advisors. The views expressed here are merely personal opinions. Irrespective of the language used, Nothing mentioned here should be considered as advice or recommendation. Please consult with your financial advisors before making any investment decisions. Like everybody else, we too can be wrong at times ✌🏻

Campus Activewear LtdCampus Activewear Limited (“Campus”) was incorporated on September 24, 2008, and is one of India’s largest sports and athleisure footwear brands in terms of value and volume. The company manufactures and distributes a variety of footwear like Running Shoes, Walking Shoes, Casual Shoes, Floaters, Slippers, Flip Flops, and Sandals, available in multiple colors, styles, and at affordable prices.

#campus making inv H&S pattern, close above 261 fatega kya?#Campus activewear on daily time frame is making a pattern on popular shampoo pattern, Head & shoulder. A daily close above 261 can take this stock towards 294/308. This is a company where around 12.5% stake is held by FII&DII put together and these big sharks never enter for small gains. Campus is going to publish their results on 28th May, so volatility will be at its peak. Below 240 will be exit sign for me. Lets see if we get desired movement or not.

campus activewear surging with volumescampus activewear after slipping to a low of 215 has reversed the trend and likely to hit 300 in the short term..the moving averages are realigning and getting compressed nicely.it has moved into the positive territory in the daily charts on the ichimoku cloud and is seeing massive volumes today.a very safe bet with a stoploss of 240..there could be a minor resistance around 295,after which it may reclaim its previous high