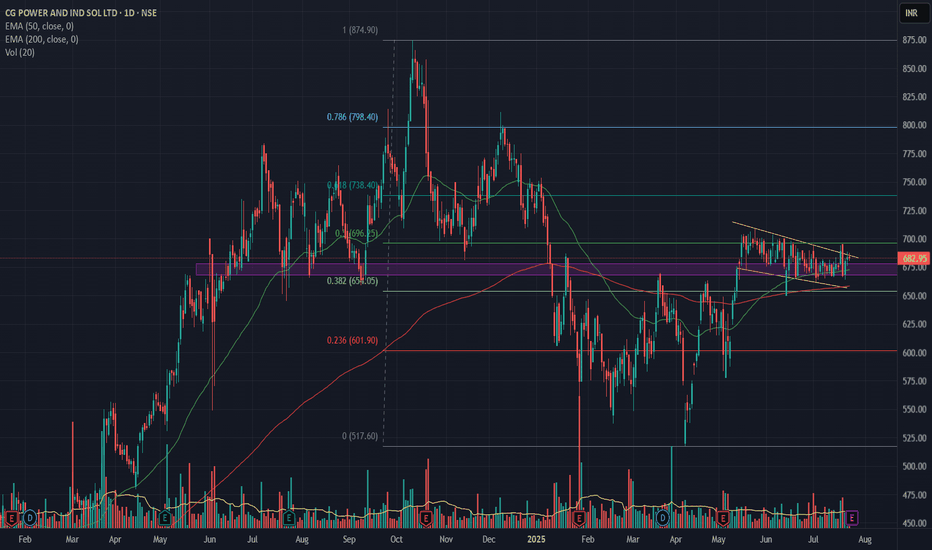

CGPower getting ready for big upside move.Two inside candles after big green candle. Pole & Flag pattern on weekly timeframe and getting ready to give break out with bullish engulfing. Day timeframe is also showing multiple positive reasons like golden crossover, channel breakout and spending time on higher levels. Also near 0.5 fib levels. If it crosses 695 then can see 740 level with 660 as SL.

CGPOWER trade ideas

CG Power and Industrial Solutions with Strong Bullish Flag SetupCG Power and Industrial Solutions just landed its largest-ever single order a 641 crore contract from Power Grid Corporation of India Ltd (PGCIL) for high-voltage transformers and reactors

The company, now under the Murugappa Group, reported consolidated FY25 revenues of 9,909 crore. However, annual profit dipped to 972.98 crore from 1,427.61 crore in FY24, despite a strong Q4 showing with a 17% YoY rise in net profit to 274.26 crore.

- Inverse Head & Shoulders Breakout: The stock recently broke out of an inverse H&S pattern, a classic bullish reversal signal, with strong volume confirmation. Holding above 690 could push it toward 750 TO 800.

Support & Resistance Levels

- Support: 663–679 demand zone

- Resistance: 694, 704 and 712

Trend Summary

- Short-Term: Neutral to bullish

- Medium-Term: Bullish bias if it sustains above 690

- Volatility: Elevated, so expect sharp swings

CG Power Technical Setup📉 CG Power Technical Setup (Daily Chart)

🗓️ Date: 7th June 2025

📊 Current Trend: Consolidation after a strong rally

⸻

🔍 Chart Analysis:

• Support Zone: ₹673 (Red line) – Strong demand area

• Resistance / Entry Trigger: ₹708.90 (Green line) – Previous swing high

• Intermediate Level: ₹681.60 (Blue dotted line) – Possible intraday support/resistance

🔁 Expected Move:

• Price may retest the support zone near ₹673

• A bounce from support could signal strength 📈

• Entry only above ₹708.90 for fresh momentum buying

• Watch for volume confirmation on breakout

🧠 Strategy:

Wait for breakout above ₹709 with good volume.

Avoid premature entry in the consolidation zone.

📌 Disclaimer: Not a buy/sell recommendation. For educational purposes only.

CG Power Technical Setup📉 CG Power Technical Setup (Daily Chart)

🗓️ Date: 7th June 2025

📊 Current Trend: Consolidation after a strong rally

⸻

🔍 Chart Analysis:

• Support Zone: ₹673 (Red line) – Strong demand area

• Resistance / Entry Trigger: ₹708.90 (Green line) – Previous swing high

• Intermediate Level: ₹681.60 (Blue dotted line) – Possible intraday support/resistance

🔁 Expected Move:

• Price may retest the support zone near ₹673

• A bounce from support could signal strength 📈

• Entry only above ₹708.90 for fresh momentum buying

• Watch for volume confirmation on breakout

🧠 Strategy:

Wait for breakout above ₹709 with good volume.

Avoid premature entry in the consolidation zone.

📌 Disclaimer: Not a buy/sell recommendation. For educational purposes only.

Bullish on CG POWERCG POWER had been correcting since Oct-2024. After a massive decline, the stock has now found good support.

The stock formed a low on 28th Jan 2025 and tried to reverse.

Further on, it again corrected sharply when the Trump tarriff came into force.

However, it could not breach its earlier low and now it has started to move upwards.

I have built long position on the stock for a target to 750 price.

P.S. Not a recommendation. Pls do your own due diligence.

Bullish on CGPOWERCGPOWER has some interesting price action.

The stock has declined more than 40% from its highs in Oct-24.

Now, the stock is showing excellent Bullish tendency.

Notice that it forms a low in Jan-25 and then continously forms Higher lows in Feb & March 2025.

In April due to the Trump tarriff panic, the stock gaps down put again shoots back up. This signals that buyers are lapping up the good prices.

As per my analysis, a target of 750 is likely in the near term.

Today, let's dive into an analysis of CGPower stock-CGPower is a large-cap stock with a market capitalization of ₹98,023 crore. The stock currently trades at a Price-to-Earnings (P/E) ratio of 104, which is significantly higher than the industry average of 64. Based on these fundamentals, CGPower seems to have entered an overbought zone, suggesting that the stock may be trading at a premium compared to its earnings potential.

Now, let's turn to the technical side of things.

The all-time high for CGPower was around ₹875, after which the stock underwent some profit booking. Since then, it has experienced a correction of approximately 40%. In the short term, there could be some upside, but a more cautious view is warranted over the long term.

The stock currently has strong support levels in the range of ₹530-₹500. Given its overvaluation, there’s a higher likelihood of the stock continuing to face downward pressure in the near future, rather than sustaining upward momentum.

In conclusion, while there may be short-term movements, the long-term outlook suggests that CGPower might struggle to maintain its current valuation, with more risk of a decline than a sustained recovery

Review and plan for 9th December 2024 Nifty future and banknifty future analysis and intraday plan.

Stock for short term.

This video is for information/education purpose only. you are 100% responsible for any actions you take by reading/viewing this post.

please consult your financial advisor before taking any action.

----Vinaykumar hiremath, CMT

POV: CGPOWER - Channel + Cup and Handle Breakout**POV: CGPOWER - Channel + Cup and Handle Breakout**

**Chart Reading:**

1. Today, it started with a 0.6% gap-up, tested, and traded below the previous day's close, then rose and closed above the channel's upper range.

2. There have been five previous breakout attempts. One attempt almost succeeded, but a market downturn pulled it back into the channel.

3. The Cup and Handle pattern formed within the channel. The cup took exactly 25 sessions to form, aligning with my minimum criterion of 20 sessions.

4. The 200 SMA shows a steadily growing path. In my observation, it’s rare to see such a clean rising angle.

5. The channel has been in existence for more than 100 sessions.

6. The average candle range is relatively narrow.

7. Trend and momentum are in sync.

*For educational purposes only. This is not financial advice. Please consult a professional before making financial decisions.*

**#NiVYAMi**

CG power looks Powerful. CG Power & Industrial Solutions Ltd. engages in the design and manufacture of power conversion equipment products. It operates through the Power Systems and Industrial Systems segments. The Power Systems segment includes transformer, switchgear, and turnkey projects. The Industrial Systems segment offers electric motors, alternators, drives, and traction electronics.

CG Power & Industrial Solutions Ltd. CMP is 730.05. The positive aspects of the company are Company with No Debt, Company with Zero Promoter Pledge, FII / FPI or Institutions increasing their shareholding. The Negative aspects of the company are High Valuation (P.E. = 77.3), MFs decreased their shareholding last quarter, Inefficient use of shareholder funds.

Entry can be taken after closing above 733 Targets in the stock will be 754, 786 and 816. The long-term target in the stock will be 854 and 875. Stop loss in the stock should be maintained at Closing below 651.

Disclaimer: The above information is provided for educational purpose, analysis and paper trading only. Please don't treat this as a buy or sell recommendation for the stock. We do not guarantee any success in highly volatile market or otherwise. Stock market investment is subject to market risks which include global and regional risks. We will not be responsible for any Profit or loss that may occur due to any financial decision taken based on any data provided in this message.

CG POWER S/R Support and Resistance Levels:

Support Levels: These are price points (green line/shade) where a downward trend may be halted due to a concentration of buying interest. Imagine them as a safety net where buyers step in, preventing further decline.

Resistance Levels: Conversely, resistance levels (red line/shade) are where upward trends might stall due to increased selling interest. They act like a ceiling where sellers come in to push prices down.

Breakouts:

Bullish Breakout: When the price moves above resistance, it often indicates strong buying interest and the potential for a continued uptrend. Traders may view this as a signal to buy or hold.

Bearish Breakout: When the price falls below support, it can signal strong selling interest and the potential for a continued downtrend. Traders might see this as a cue to sell or avoid buying.

20 EMA (Exponential Moving Average):

Above 20 EMA(50 EMA): If the stock price is above the 20 EMA, it suggests a potential uptrend or bullish momentum.

Below 20 EMA: If the stock price is below the 20 EMA, it indicates a potential downtrend or bearish momentum.

Trendline: A trendline is a straight line drawn on a chart to represent the general direction of a data point set.

Uptrend Line: Drawn by connecting the lows in an upward trend. Indicates that the price is moving higher over time. Acts as a support level, where prices tend to bounce upward.

Downtrend Line: Drawn by connecting the highs in a downward trend. Indicates that the price is moving lower over time. It acts as a resistance level, where prices tend to drop.

RSI: RSI readings greater than the 70 level are overbought territory, and RSI readings lower than the 30 level are considered oversold territory.

Combining RSI with Support and Resistance:

Support Level: This is a price level where a stock tends to find buying interest, preventing it from falling further. If RSI is showing an oversold condition (below 30) and the price is near or at a strong support level, it could be a good buy signal.

Resistance Level: This is a price level where a stock tends to find selling interest, preventing it from rising further. If RSI is showing an overbought condition (above 70) and the price is near or at a strong resistance level, it could be a signal to sell or short the asset.

Disclaimer:

I am not a SEBI registered. The information provided here is for learning purposes only and should not be interpreted as financial advice. Consider the broader market context and consult with a qualified financial advisor before making investment decisions.

CG POWERStock is in strong bullish trend since 06-May-2024. reached its life time high of 735 on 24-Jun-2024.

Massive move from 530 to 735 (205 points in 48 days)

since the stock is in all time high level.. we can wait for correction and enter at accumulation zone between 660-680. Major support seen at 648

Strict stop-loss to be maintained at 621 (For short term)

for short term trades the targets are 787 & 873

Long term investors need not worry about stop-loss but below 555 accumulation is not recommended .

CGPower : Strong Bullish Momentum: Key Support & Resistance Zone NSE:CGPOWER in Strong Bullish Momentum: Key Support & Resistance Zones

NSE:CGPOWER continues to demonstrate solid upward momentum across multiple timeframes, with positive trends seen on the daily, weekly, and even shorter 75-minute charts. Here's an advanced look at key levels and insights:

Key Indicators to Watch:

Weekly 50 EMA: ₹605 – A strong long-term support level. The price remains well above this, indicating a sustained bullish trend.

Daily 50 EMA: ₹736 – Medium-term support. A key level to watch for any pullbacks or corrections.

Weekly 10 EMA: ₹745 – Immediate weekly support, offering a clear level for trend continuation.

Daily 10 EMA: ₹792 – The near-term support on the daily chart; holding this level is crucial for continued upward momentum.

75-min Chart:

50 EMA: ₹786 – This EMA offers intraday support, crucial for short-term traders.

21 EMA: ₹816 – Further intraday support, maintaining strength at this level keeps the bullish sentiment intact.

10 EMA: ₹840 – Immediate short-term support in intraday action.

Key Resistance Levels:

52-Week High : ₹874.70 – A breakout above this significant level could lead to a fresh rally with further upside potential.

₹846 – Short-term resistance that aligns with 75-min 10 EMA, a key test for continued bullish momentum.

₹875-₹900 – If the stock breaks its 52-week high, we may see this range as the next target zone.

Support Levels to Watch:

₹756 – Short-term support level; a strong dip-buying opportunity if prices pull back to this region.

₹786 – A key support level on the 75-minute 50 EMA; holding this strengthens the upward move.

₹816 – The 75-minute 21 EMA provides a solid intraday support level.

₹846 – A critical near-term support zone that should hold for the continuation of bullish movement.

Outlook:

NSE:CGPOWER is showing a healthy bullish momentum, with consistent support levels across the daily and weekly charts. Holding above ₹756 and breaking past ₹874.70 could fuel further bullish activity. Watch for pullbacks near support levels for potential buying opportunities. As long as the price holds above its key EMAs, especially the daily and 75-min EMAs, the trend remains strongly positive.

Conclusion:

With CGPower's upward momentum intact and strong support from its EMAs, it remains in a bullish trajectory. Monitoring price action near ₹756, ₹786, ₹816, and ₹874 is essential for confirming continued strength.

Disclaimer: I am not a SEBI Registered Research Analyst (RA). This analysis is for educational purposes only and should not be considered as investment advice. Please conduct your own research or consult a financial advisor before making any trading decisions.

CG Power & Industrial Solutions Ltd – Bullish Momentum with FlagCG Power is showing strong bullish momentum, having previously surged by 85.31% within a defined bullish flag pattern. Following a healthy consolidation, the stock has successfully tested and held the triple bottom support line, signaling potential for further upside movement.

Key technical indicators suggest a likely breakout from the flag pattern in the coming sessions, with a potential 13.24% move towards the next target of ₹838.70. The stock is currently trading above its key moving averages, indicating sustained upward momentum, while the MACD presents a bullish crossover, reinforcing a positive outlook.

Key Observations:

Bullish Flag Pattern: Indicates continuation of the prior uptrend.

Triple Bottom Support Line: Strong support zone holding around ₹680.

Volume Profile: Shows healthy accumulation, with strong buying interest near current levels.

Potential Upside Target: ₹838.70 (based on flag pattern breakout).

A breakout above ₹738 would confirm the next leg of the uptrend, and traders should monitor this level closely. Overall, CG Power continues to display robust technical strength, positioning itself for a potential rally.

50 SMA RISINGI am not a Sebi registered adviser.

This Idea is publish purely for educational purpose only before investing in any stocks please take advise from your financial adviser.

It 50 SMA Rising. Suitable for Suitable for Swing Trading. Initial Stop loss lowest of last 2 candles and keep trailing with 50 days SMA if price close below 50 SMA then Exit or be in the trade 2 to 4 weeks.

CG POWER S/R Support and Resistance Levels:

Support Levels: These are price points (green line/share) where a downward trend may be halted due to a concentration of buying interest. Imagine them as a safety net where buyers step in, preventing further decline.

Resistance Levels: Conversely, resistance levels (red line/shade) are where upward trends might stall due to increased selling interest. They act like a ceiling where sellers come in to push prices down.

Breakouts:

Bullish Breakout: When the price moves above resistance, it often indicates strong buying interest and the potential for a continued uptrend. Traders may view this as a signal to buy or hold.

Bearish Breakout: When the price falls below support, it can signal strong selling interest and the potential for a continued downtrend. Traders might see this as a cue to sell or avoid buying.

20 EMA (Exponential Moving Average):

Above 20 EMA: If the stock price is above the 20 EMA, it suggests a potential uptrend or bullish momentum.

Below 20 EMA: If the stock price is below the 20 EMA, it indicates a potential downtrend or bearish momentum.

Disclaimer:

I am not a SEBI registered. The information provided here is for learning purposes only and should not be interpreted as financial advice. It's important to remember that while these indicators can be useful, they are not foolproof. Always consider the broader market context and consult with a qualified financial advisor before making any investment decisions.