CHAMBAL FERTILISERS LTD – Potential Bottoming Out‽CHAMBAL at Demand Zone | Volumes story

After a steep fall from 730 to 516, Chambal is now consolidating in a critical demand zone backed by visible volume activity. This range has previously triggered price reversals, and now history might repeat.

The stock is respecting the support between 527–516, forming a potential base. On the upside, a clean breakout above ₹555.55 can unlock a near-term target of 633+, a move of over 14%.

The risk-to-reward ratio remains attractive with a tight invalidation below ₹527, while the volume profile suggests accumulation in this range.

Technical View :

• Major support: ₹516–527

• Breakout trigger: ₹555.55

• Upside target: ₹633–636

• Risk below: ₹527

• Volume profile: Dense node suggests buyer interest

Valuation :

• PE: ~10.3 (undervalued vs peers)

• Dividend Yield: ~6.5% (steady income potential)

• Promoter Holding: 60.62% (strong & stable)

• No recent equity dilution

• DII/FII: Activity neutral, could turn if technical align

A good mix of fundamentals, attractive valuation, and technical structure makes this a stock to keep an eye on. If it crosses ₹560 with volume, it may kick off a short-term trend reversal.

This chart is for educational use only and not a buy/sell recommendation.

CHAMBLFERT trade ideas

CHAMBLFERT 1H Chart Analysis📉 CHAMBLFERT 1H Chart Analysis – Potential Breakdown Ahead

📅 Date: 7th June 2025

📊 Current Trend: Bearish continuation forming

⸻

🔍 Key Observations:

• 📌 Price: ₹539.90

• 🔻 Recent Drop: -2.27% today

• 🟩 1H FVG (Fair Value Gap): Indicates minor supply; price struggling to reclaim

• 🟥 30M FVG Above: Larger supply zone near ₹569.55, likely to act as strong resistance

📉 Bias:

Market structure shows weakness. If the price fails to reclaim the 1H FVG, further downside is likely.

🔽 Next potential targets: ₹525 → ₹510

📈 Upside Possibility?

Only if price reclaims ₹550+ and sustains above the 30M FVG zone, else sellers likely remain in control.

🧠 Strategy:

Consider short on retest of 1H FVG with SL above ₹550

Targeting downside levels as per risk-reward plan

📌 Disclaimer: This is a personal analysis, not financial advice. Do your own research before trading.

CHAMBLFERT - Chambal Fertilizers Ltd. (Daily chart, NSE) - LongCHAMBLFERT - Chambal Fertilizers Ltd. (Daily chart, NSE) - Long Position; short-term swing research idea.

Risk assessment: High {volume & support structure integrity risk}

Risk/Reward ratio ~ 3.41

Current Market Price (CMP) ~ 594

Entry limit ~ 592 on May 27, 2025

1. Target limit ~ 610 (+3.04%; +18 points)

2. Target limit ~ 625 (+5.57%; +33 points)

3. Target limit ~ 650 (+9.80%; +58 points)

Stop order limit ~ 575 (-2.87%; -17 points)

Disclaimer: Investments in securities markets are subject to market risks. All information presented in this group is strictly for reference and personal study purposes only and is not a recommendation and/or a solicitation to act upon under any interpretation of the letter.

LEGEND:

{curly brackets} = observation notes

= important updates

(parentheses) = information details

~ tilde/approximation = variable value

-hyphen = fixed value

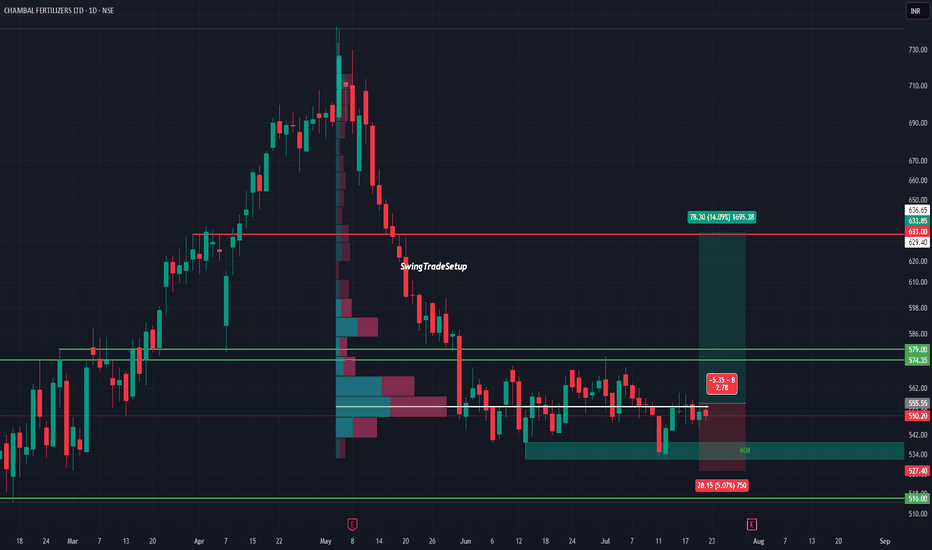

Key Support / Resistance Breakout - Swing TradeDisclaimer: I am not a Sebi registered adviser.

This Idea is publish purely for educational purpose only before investing in any stocks please take advise from your financial adviser.

Key Support & Resistance Breakout. Stock has give Breakout of Resistance level. Keep in watch list. Buy above the high. Suitable for Swing Trade. Stop loss & Target Shown on Chart.

Be Discipline because discipline is the Key to Success in the STOCK Market.

Trade What you see not what you Think.

BULLISH"LONG-TERM INVESTMENT IN CHAMBAL FERTILIZERS (6-9 MONTHS)📊 Long-Term Opportunity: NSE:CHAMBLFERT (6-9 Months)

🔍 Overview:

Chambal Fertilizers presents a 📈 bullish opportunity for long-term investors, supported by strong technical patterns and sectoral growth potential. With a favorable risk-reward ratio and government focus on 🌾 agriculture, this stock could deliver significant returns in the next 6-9 months.

🚀 Key Opportunity Highlights:

1️⃣ 📌 Entry Point:

A breakout above ₹510 (expected before 22/01/2025) signals the start of a major uptrend.

2️⃣ 🛑 Stop-Loss:

Maintain a stop-loss at ₹485 to protect your capital.

3️⃣ 🎯 Targets:

🟡TP1 (Short-Term): ₹551 – A critical resistance level with high likelihood of being reached.

🟡TP2 (Mid-Term): ₹610 – A strong intermediate target for potential gains.

🟡TP3 (Long-Term): ₹710 – Final target achievable within the 6-9 month timeframe

4️⃣ 📊 Technical Setup:

Head & Shoulders Pattern indicates strong bullish potential.

Support from trendlines and moving averages aligns with an upward trajectory.

5️⃣ 📅 Fundamental Catalyst:

Budget 2025 and government focus on agriculture create a 🌟 favorable backdrop for growth in this sector.

🌟 Why This Opportunity Stands Out

📐 Strong Technical Setup: Clear patterns support bullish momentum.

📅 Budget-Driven Growth: Agriculture-focused policies could act as a major growth driver.

⚖️ Balanced Strategy: Defined entry, stop-loss, and targets create a well-structured opportunity.

⚠️ Note: This is a high-potential opportunity but should be pursued with proper risk management. Always consult your financial advisor before making investment decisions.

🔴 Disclaimer

I am not SEBI-registered, and this analysis is shared for educational and informational purposes only. Stocks and securities are subject to market risks, and past performance is not indicative of future results.

Please read all levels, key highlights, and the associated risks carefully before making any investment decisions.ensure alignment with your investment goals and risk appetite.

If you really like this idea...leave a coment below...

Like,share,subscribe @Alpha_strike_trader

SWING IDEA - CHAMBAL FERTILIZERSChambal Fertilizers , a leading manufacturer of fertilizers and agri-products in India, is presenting a compelling swing trade setup with strong technical indicators.

Reasons are listed below :

Break of Cup and Handle Pattern : A classic bullish continuation pattern indicating potential for a significant upside.

Bullish Marubozu Candle : A strong bullish marubozu candle on the weekly timeframe highlights sustained buying pressure.

500 Zone Breakout : The price is attempting to break above the 500 resistance zone after consolidating near its all-time high, signaling strength.

Prolonged Consolidation Breakout : The stock is breaking out of a consolidation phase spanning over 3 years, suggesting a fresh trend initiation.

Target - 675

Stoploss - weekly close below 440

DISCLAIMER -

Decisions to buy, sell, hold or trade in securities, commodities and other investments involve risk and are best made based on the advice of qualified financial professionals. Any trading in securities or other investments involves a risk of substantial losses. The practice of "Day Trading" involves particularly high risks and can cause you to lose substantial sums of money. Before undertaking any trading program, you should consult a qualified financial professional. Please consider carefully whether such trading is suitable for you in light of your financial condition and ability to bear financial risks. Under no circumstances shall we be liable for any loss or damage you or anyone else incurs as a result of any trading or investment activity that you or anyone else engages in based on any information or material you receive through TradingView or our services.

@visionary.growth.insights

CHAMBAL FERTILISERS:C&S PATTERN NECKLINE BREAKOUTChambal : Has clearly given Cup&Saucer Neckline break out in daily chart.As per the pattern the Target would be 580+,Moreover 20DEMA Golden cross over above 50/100/200DEMAs further establishes the Price action and momentum of the stock.(For educational purpose only+

Chambal FertliiserChambal Fertliser

MTF Analysis

Chambal FertliserYearly Demand Breakout 451

Chambal Fertliser 6 Month Demand 385

Chambal FertliserQtrly Demand BUFL 403

Chambal FertliserMonthly Demand 403

Chambal FertliserWeekly Demand 437

Chambal FertliserDaily Demand BUFL 488

ENTRY -1 488

SL 475

RISK 13

Potential Target 673

First Target Points 574

First recovery Target Points 99

Last Swing Low 475

Last Swing High 574

RR 8

RR 38%