CNXMETAL trade ideas

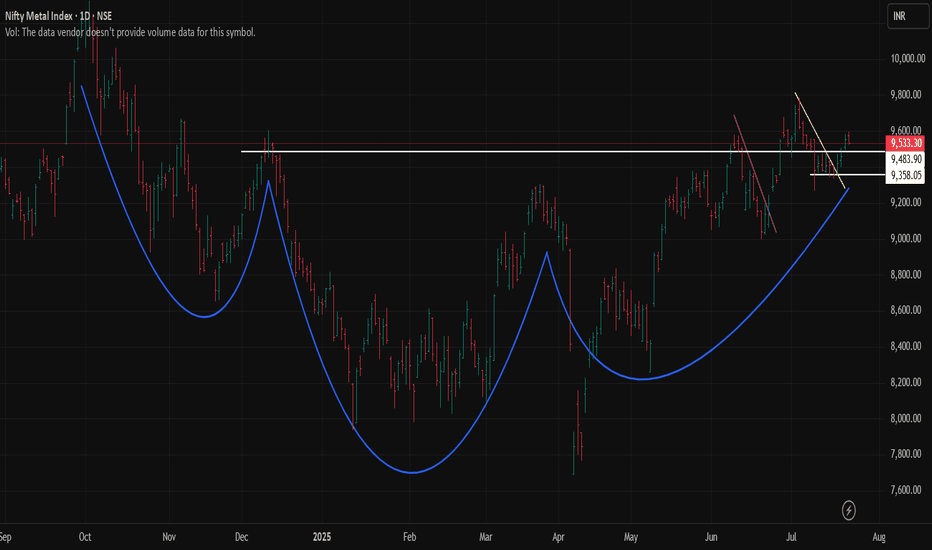

Nifty Metal: Heating Up or Just Polishing the Armor?After a healthy consolidation phase, the Nifty Metal Index is finally starting to flex some muscle. While it’s been behaving like a shy warrior at a dance-off, the structure now looks technically stronger and poised for a potential bullish breakout.

We’ve seen two failed breakout attempts (clearly marked with trendlines)—both classic cases of “all hype, no flight.” But this time, after a tight range consolidation between July 9th and July 18th, it has stepped out of its shell and is teasing a real move.

Next resistance around ₹9,675—and maybe even beyond, if momentum supports the story.

Until then, sitting tight, sharpening the filters, and scouting for individual metal stocks showing relative strength!!!

RIDING THE INDIAN METAL RALLYThe Indian Metal Index (CNXMETALS) is shaping up for an exciting move! 🚀

LINK TO MY FULL REPORT -

drive.google.com

Through technical analysis, I’ve identified a strong inverse correlation between CNXMETALS and the Dollar Index (DXY) 📊.

Historically, when DXY weakens, Indian metal stocks tend to shine.

🔥 Key Observations:

✅ CNXMETALS Technical Setup – Strong indicators suggesting bullish momentum! 🏗️💰

✅ Stock Picks & Targets – I’ve highlighted key stocks that could benefit from this macro and technical setup! 📌💡

✅ Dollar Index at Crucial Support – A breakdown could fuel an upward surge in Indian metal stocks! 📉➡️📈

✅ Global Macro Trends – A quick dive into the global metal sector & its impact on Indian markets 🌍🔎

Metals are heating up, and the charts are telling a compelling story!

Are you tracking this trend?

Let’s discuss in the comments! ⬇️💬

CNXMET : Nifty Metal index shows the sign of recoveryWhile most sectors in Indian market are still in down trend, Nifty Metal index(CNXMET) shows signs of trend reversal. This is a positive sign in at least one of the Indian sectors.

Note: It is always a risk to go against the larger market trend, Nifty and Sensex are still in down trend. This analysis is for eduacational purposes only, do not trade based on this study.

Index to watch out for next week is Metal Index. The index that did very well this week and which has potential to carry forward the momentum into the next week seems to be the Metal index if it can cross 2 major hurdles at 8941 and 9227. Currently the closing of CNX Metal Index is at 8926.90. In the coming weeks if we get a closing above 8941 and eventually above 9227 the index has a potential to go north wards towards 9453, 9828 or even 10K plus levels if the rally in Nifty and the one we are seeing in the Metal index sustain. Metal index this week gave a closing above Mother line of 50 weeks EMA which is at 8750. RSI of the Metal index has also entered a bullish looking territory. The significance of Mother and Father lines, Parallel Channels, RSI can be learned by reading my past articles or by reading my Book The Happy Candles Way To Wealth Creation which is available on Amazon or can be availed by contacting me. The book is one of the highest rated books on Amazon in it's category. Now if this breakout actually happens in the Metal Index the stocks that composit the metal index will be the beneficiary in general. Some might benefit more some might benefit less and some might not benefit but for index to move upward the stocks composing it have to perform well. To know which stocks will do better than others we will have to look at their individual charts. The stocks which make the metal index are Welspun Corp, Hindalco, Nalco, Hindustan Zinc, Tata Steel, Vedanta, Sail, NMDC, hindustan Copper, Jindal Steel, JSW Steel, Jindal Stainless, Apl Apollo Tubes, Ratnamani Metals, Adani Enterprise. Thus it is obvious some of these stocks have potential to benefit if index does well. Choose wisely after consulting your investment advisor, studying fundamentals and Technicals of each company.

Disclaimer: The above information is provided for educational purpose, analysis and paper trading only. Please don't treat this as a buy or sell recommendation for the stock or index. The Techno-Funda analysis is based on data that is more than 3 months old. Supports and Resistances are determined by historic past peaks and Valley in the chart. Many other indicators and patterns like EMA, RSI, MACD, Volumes, Fibonacci, parallel channel etc. use historic data which is 3 months or older cyclical points. There is no guarantee they will work in future as markets are highly volatile and swings in prices are also due to macro and micro factors based on actions taken by the company as well as region and global events. Equity investment is subject to risks. I or my clients or family members might have positions in the stocks that we mention in our educational posts. We will not be responsible for any Profit or loss that may occur due to any financial decision taken based on any data provided in this message. Do consult your investment advisor before taking any financial decisions. Stop losses should be an important part of any investment in equity.

Nifty Metal | A Sector to watch out for in this falling market.Nifty 50 and it's major indices are falling and the correction is expected to continue over the next few weeks.

However, there is one sector which looks resilient and that is the Metal Space.

While the sentiment may not be super Bullish, as per my analysis, we can expect this space to consolidate over the next couple of months and then give a Bullish move.

As you can see from the chart, the sector is consolidating and not in a vertical decline like the other sectors. So watch out for this space.

In fact, Heavyweights like Hindalco and TATA Steel are already showing Bullish momentum.

NIFTY Metal LongNIFTY METAL

MTF Analysis

Nifty Metal 50 Yearly Demand Breakout 8016

Nifty Metal 50 6 Month Breakout 8016

Nifty Metal 50 Qtrly Demand 8436

Nifty Metal 50 Monthly Demand 8436

Nifty Metal 50 Weekly Demand 9171

Nifty Metal 50 Daily Demand dmip 9173

ENTRY -1 9171

SL 8727

RISK 444

Potential Target 11856

First recovery Target Points 1661

Last Swing Low 8534

Last Swing High 10195

RR 3.74

RR 29%

METALS --BUYmetals index have bottom out at 8700 level .382 % retracement of previous wave and c of 4th ended now again made 9500 approx in 1st wave and in 2nd wave corrected to 9009 level in 2nd of 5th wave now 3rd of 5th in progress and once crosses high of 1st wave approx 9505 you will see high volume and our trg of minimum 11000 inverse head and shoulder breakout also .

Nifty Metal: An overviewThis is a quick one. The chart should tell you everything there is to know. We will keep updating the comments below as the price action unfolds.

Have Requests, Questions, or Suggestions? Let us know in the comments below.👇

⚠️Disclaimer: We are not registered advisors. The views expressed here are merely personal opinions. Irrespective of the language used, Nothing mentioned here should be considered as advice or recommendation. Please consult with your financial advisors before making any investment decisions. Like everybody else, we too can be wrong at times ✌🏻

Nifty Metal !!! are we going to experience the BIGGG Fall ??Hello All,

The recommendations are purely for educational purpose only, consult you financial advisor before trading.

Targets are mentioned in charts (either red lines or balck lines), keep Stop Loss as per your risk..

If you like my Idea, Don't forget to Boost and comment on my Analysis..

Have a profitable year ahead

Gautam Khanna

Technical Analyst by Passion :-)

CNXMETAL - Just a View📈Keep an eye on Nifty Metals Index .

📈On 13th Feb Index has formed hammer candle which indicates trend reversal.

📈Metal index has taken support on trendline as shown into chart and started moving upwards. 📈Index has made triple top and triple bottom pattern on daily chat. We may see bullishness till 8348 level.

📈Stocks to watch into Metal Sector are as follow: -

📊 Script: SAIL

⏱️ C.M.P 📑💰- 125

🟢 Target 🎯🏆 - 142-150

📊 Script: TATASTEEL

⏱️ C.M.P 📑💰- 141

🟢 Target 🎯🏆 - 147

📊 Script: JSL

⏱️ C.M.P 📑💰- 599

🟢 Target 🎯🏆 - 615

2024 belongs to metalsNifty Metal broke out of the expanding triangle in the year 2022 with an amazing rally of 350%

After this rally, it consolidated for a while in the form of another contracting triangle till November last year and it recently retested the upper channel of the contracting triangle

I will look to buy at current market price

Stoploss @ 6,350

Target @ 20,000

Time frame 2-3 years