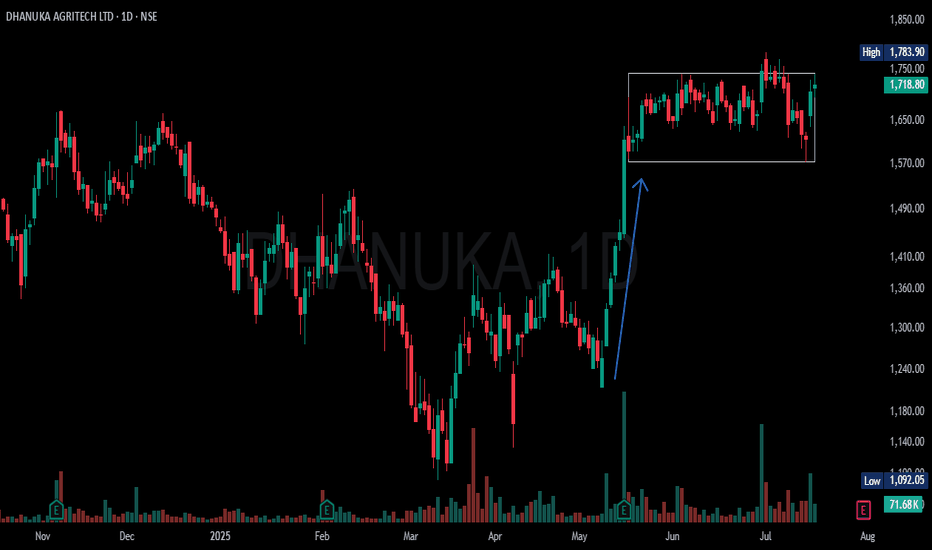

DHANUKA trade ideas

Dhanuka ,1DPattern Is looking very good for Breakout , Nifty is also Supporting also all the stocks for Bullish Breakouts , This Is best time to enter in breakout stocks .

Consider Only those stocks that seems Technically strong with Good Volume Breakouts and Strong close .

Risk According to your capacity and aim for 40% and Risk upto 4-5% for this trade , Mainly you have to give the Room to Fluctuate the Stock , according to this flucations you have to decide your Stop loss .

Take Only A+ Setups , so that your Accuracy Should Be High and Returns also High

Follow for more Swing Ideas Like this

Descending Channel on DHANUKADHANUKA formed a descending channel pattern on daily chart. Price broke out resistance with strong bullish candle. Also note the volume on breakout that is above average. Multiple support and resistance were tested before the breakout. There was a strong runup prior to formation of this pattern showing buyers interest. Formation of hammer candlestick pattern prior to breakout signifies there is strong buying pressure with less sellers. Entry can be held just above breakout candles high with stop loss on breakout candle low.

Hope you liked this idea. If so, please boost this idea or leave a comment down on what your think. I'll be glad to hear from you. Otherwise happy trading :-)

DHANUKA: A good upmove LIKELY!DHANUKA is an Agro-Chemical Manufacturing Company.

The chart is a Weekly Timeframe analysis of Dhanuka.

We can see some good technical analysis points.

1. We can see a good support of 200 Moving average in Weekly Timeframe.

2. We can notice a Fakeout move in Dhanuka.

3. Dhanuka has broken its resistance trendline too and is consolidating above it.

There is some other reason of selecting this stock too.

Fundamentals of Dhanuka are good.

1. Profits rising every year

2. A debt free company

3. Presence of FIIs and DIIs, with public decreasing

4. A fundamental score of 6 on 9, which is good on fundamentals.

5. Stock P/E is 16, and its median PE is 18. So, there is an opportunity.

6. Analyst rating is BUY for a TARGET of Rs 900/-

If you go through the investments of FIIs, they started investing in September 2021 quarter.

Since September, the price of Dhanuka has been in a downward consolidation and FIIs are still sitting in it without any returns.

But they might have seen some good opportunity in Dhanuka and are still invested.

Now, there is a breakout in Weekly timeframe, and the stock is consolidating above above its horizontal resistance zone.

We can see a good upmove in coming weeks in DHANUKA

My Next Bet On For my followers i have a good news will be sharing some ideas for the coming year .. please like and share if you like .. i will appreciate each n every effort of yours

My pick -1

Cmp - 1020

Buy above 1050

TGT - 1250-1500-2000+

SL - Below 900

Pattern observed : cup n handle

Pro's:

Increasing profit margin

Increasing EPS

ROCE 27

ROE 21

Low P/E 19

Debt free

Increasing DI stakes

CONS:

DECREASING FII STAKE IN LAST QUARTER

Note : Do your own analysis.. Its my own views mentioned not any personal recommendations to buy or sell the mentioned stock .. let's learn n then earn together 💎

Dhanuka Agritech - bullish tradeMonsoon season is coming soon, and it is expected to be a good monsoon season this time that will be beneficial for agri stocks like Dhanuka.

Current pattern of Dhanuka presents a good trading opportunity.

Stock is creating a base near 700. There is a positive divergence on leading indicators as well. One can go long at CMP and add more positions when a weekly close comes above 800.

Expected targets from CMP are 800, 850 and 915.

You can keep a SL of 688 on weekly closing basis.