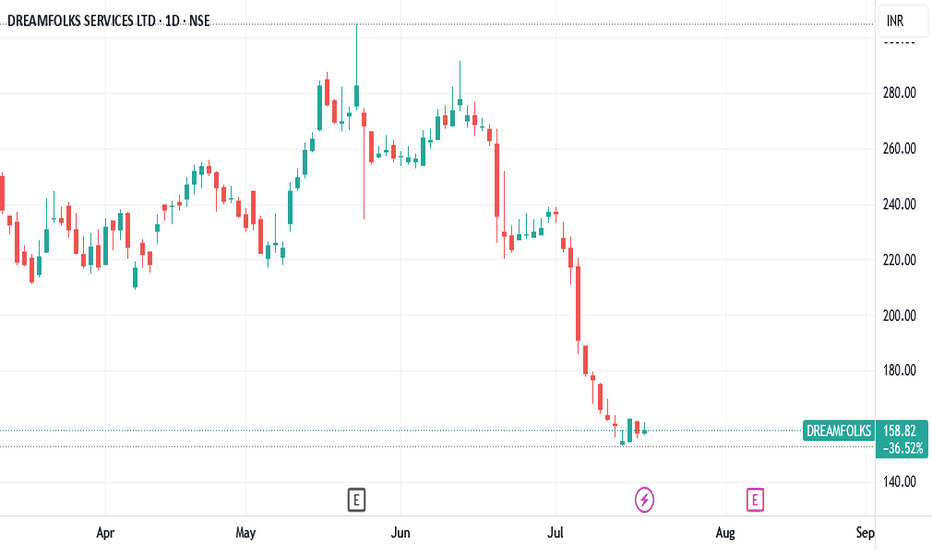

DREAMFOLKS trade ideas

Review and plan for 4th July 2025 Nifty future and banknifty future analysis and intraday plan.

Swing ideas.

This video is for information/education purpose only. you are 100% responsible for any actions you take by reading/viewing this post.

please consult your financial advisor before taking any action.

----Vinaykumar hiremath, CMT

DreamFolks Nice Breakout on NEWSDreamFolks Services launched a nationwide highway dining service, expanding beyond its traditional airport and railway lounge services. This new service is available at over 600 outlets along key highways across India, offering specially designed meals at popular routes from major cities such as Delhi, Mumbai, Bangalore, Hyderabad, Chennai, and Kolkata. This strategic move aims to enhance convenience for highway travelers and diversify DreamFolks' service offerings, contributing positively to the company’s market performance and share price

Dream for next year?Market leader in the airport lounge aggregation industry in India.

Just stabilising the business because of recent shift from the CrediCard model change by many CC providers.

Budget being focused on Travel Industry, Airports can bring attractive share of tourists and revenue and the DreamFolks Services Ltd is India's largest airport service aggregator.

But it haven't seen volume growth in price chart. Price is lacking support from financials. Looking for the fantastic qtr results in upcoming qtrs.

So this could be any soon (2024) or near future (2025)...

#Margin_Expansion

#Travel #Tourism

DreamfolksRising air traffic movements

Increasing footprints at airport

This stock is almost zerodebt IPO stock and with rising card users in India will be significantly benefited

Revenue seems to increase many fold in coming days

Stock at present at very attractive price and showing good support at present level

Long term portfolio stock

Company profile:-The current revenue profile of Dreamfolks is 95% lounge service fee and 5% fee related to other airport services like food & beverages, meet and assist, airport transfers etc. The company has 60% market share of all lounge traffic and 99% market share of all lounge traffic paid for by cards.

Dreamfloks - A dream run to start The company delivered a strong revenue performance registering 65.0% growth YoY in Q2FY24 while on a QoQ basis revenue grew marginally by 6.1%. On a sequential basis, the company has seen a gross margin improvement of 174 bps to 12.4% in Q2FY24.

The domestic passenger traffic, as reported by the DGCA, has witnessed a growth of 20% on a YoY basis in H1FY24, while the Dreamfolks pax has increased by 47% in the same period, indicating the growing demand for lounge services in India as well as changing attitude of people towards having new experiences.

Moving averages crossover is confirming trend reversal. Lot of accumulation is observed and now with big volume spikes, this is ready for dream run.

🚫 not to be taken as buy sell recommendation, I can sell without informing 😉 Do your own research.

**Dreamfolks Services Ltd: Technical Analysis

🚀 **Technical Highlights: Strong Bullish Momentum**

Dreamfolks Services Ltd is currently exhibiting a robust bullish trend, supported by substantial trading volumes. The stock's price has seen a significant rise, indicating strong positive sentiment in the market.

📈 **BOLLINGER Bands: Positive Breakout**

The BOLLINGER Bands analysis reinforces the bullish outlook, showcasing a positive breakout. This suggests that the stock has the potential for further upward movement, adding confidence to the overall bullish sentiment.

🕯️ **Latest Candlestick / Heikin Ashi Patterns**

Both Daily and Weekly charts reveal strong bullish signals, with Bullish Heikin Ashi Patterns formed accompanied by high trading volumes. This combination of candlestick patterns and volume supports the likelihood of continued upward momentum.

📊 **Strength Analysis: Daily and Weekly Signals**

- **Daily candlestick:** The daily chart indicates a Strong Bullish trend, with the formation of a Bullish Heikin Ashi Pattern supported by high volume. This suggests a favorable environment for short-term traders.

- **Weekly candlestick:** The weekly chart mirrors the daily sentiment, showcasing a Strong Bullish trend with a Bullish Heikin Ashi Pattern formed alongside high volume. This indicates a sustained bullish momentum over the longer term.

📈 **Trading Strategy: Buy above 555, Stop @ 472**

Based on the technical analysis, a potential entry point for traders is identified at 555. This level suggests a continuation of the bullish trend. A stop-loss order is recommended at 472 to manage risk in case of an unexpected downturn.

⚖️ **Short-Term Support Levels: 501 - 503**

For risk management and identifying potential bounce-back levels, short-term support is identified between 501 and 503. This can serve as a reference point for traders to reassess their positions in case of price retracement.

🔍 **Conclusion:**

Dreamfolks Services Ltd currently presents a compelling technical setup for traders. The combination of strong bullish momentum, positive BOLLINGER Bands breakout, and bullish candlestick patterns indicates a favorable environment for potential gains. Traders are advised to monitor the stock closely, adhering to the suggested entry and stop-loss levels to optimize risk-reward ratios. As with any investment, it is crucial to conduct further research and stay informed about market conditions.

📈🚀 Happy Trading! 🚀📈