Dynemic Ltd: Bullish Setup UnfoldingDynemic Products Ltd (NSE: DYNPRO) is a well-established exporter and manufacturer of synthetic food-grade dyes, lake colors, and D&C colors, catering to global markets. As of July 16, 2025, the stock trades at ₹341 and has recently broken out of a prolonged consolidation zone, indicating renewed investor interest.

From a fundamental perspective, the company’s financials show notable improvements:

🔸 Revenue (FY25): ₹214 crore, up 29% YoY

🔸 Net Profit (FY25): ₹15 crore, up 269% YoY

🔸 EPS (TTM): ₹3.65

🔸 P/E Ratio: ~23× – moderately valued

🔸 P/B Ratio: ~1.56× – near fair book value

🔸 ROE: ~7%, showing improving return to shareholders

🔸 ROCE: ~12.7%, indicating decent operational efficiency

🔸 Debt-to-Equity: ~0.43× – financially stable

🔸 Current Ratio: ~0.95× – slightly below ideal liquidity levels

🔸 Operating Cash Flow: ₹28 crore – healthy cash generation

While the company has a stable balance sheet and growing profitability, investors should note that liquidity remains slightly tight, requiring careful monitoring of working capital and short-term obligations. Nonetheless, the financial turnaround and earnings consistency signal strength.

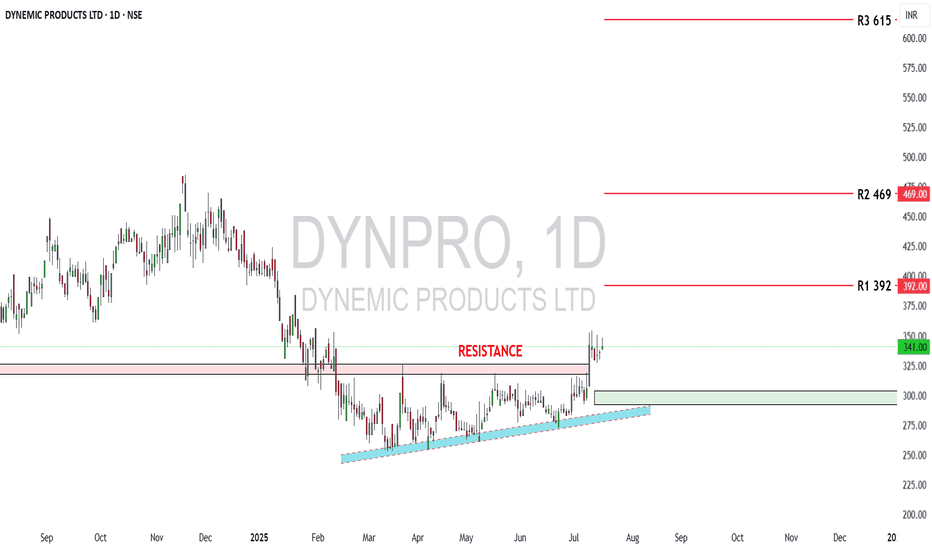

On the technical front, the stock has shown strong bullish action after breaking above a multi-month resistance:

🔹 Breakout Zone Cleared: ₹325–₹330 (previous resistance)

🔹 Current Price: ₹341

🔹 Reversal Zone (Strong Support): ₹292 to ₹304

🔹 R1: ₹392 – short-term resistance

🔹 R2: ₹469 – medium-term target

🔹 R3: ₹615 – long-term upside if momentum sustains

The breakout is confirmed with increased volume and a clear higher-high, higher-low structure, validating bullish sentiment. The price now rides above a rising trendline, suggesting trend continuation unless a breakdown occurs below ₹292.

In summary, Dynemic Products Ltd currently offers a compelling techno-fundamental setup. The financials have improved significantly, valuations remain reasonable, and the technical breakout suggests potential for further upside. Investors can consider accumulating on dips above ₹304, while swing traders may target ₹392 and ₹469 in the short-to-medium term. A close watch on liquidity and cash flows is advised, but the stock presents a strong growth case in the specialty chemicals space.

Disclaimer: lnkd.in

DYNPRO trade ideas

DYNEMIC PRODUCTS - READY FOR BREAKOUT2 Years of "W" Pattern Breakout breakout

BUY PRICE : 420

SL : 340 (only for swing traders)

TARGET : 530, 680 (62%)

Disclaimer - All information on this page is for educational purposes only,

we are not SEBI Registered, Please consult a SEBI registered financial advisor for your financial matters before investing And taking any decision. We are not responsible for any profit/loss you made.

Darvas Box Strategy - Breakout StockDisclaimer: I am Not SEBI Registered adviser, please take advise from your financial adviser before investing in any stocks. Idea here shared is for education purpose only.

Stock has given break out. Buy above high. Keep this stock in watch list.

Buy above the High and do not forget to keep stop loss best suitable for swing trading.

Target and Stop loss Shown on Chart. As stop loss is Big we keep Risk to Reward Ratio - Target Ratio 1:2

Be Discipline, because discipline is the key to Success in Stock Market.

Trade what you See Not what you Think.

DNPRO Shares: A Strong Buy with a Bright Future Ahead spot 303*Executive Summary**

Dynamic Products Limited (DP) is a leading manufacturer of food colors and dye intermediates in India. The company has been in operation for over 50 years and has a strong track record of performance. DP has been performing well in recent quarters, with revenue and earnings growing steadily. The overall market for industrial products is also strong, which bodes well for DP's future prospects.

Based on the current market price of DP shares (CMP) of 303 and a target price of 390, the recommendation is to **buy** the shares. The target price of 390 is calculated by multiplying the CMP by 1.3. This means that the target price is 390. Since the CMP is currently lower than the target price, it is recommended to buy the shares.

**Analysis**

There are a few reasons why DP shares may be undervalued. First, the company has been performing well in recent quarters. Second, the overall market for industrial products is strong. Third, there are a number of other companies in the same industry that are trading at a higher valuation.

**Appreciation**

DP is a well-managed company with a strong track record of performance. The company has a diversified product portfolio and a wide customer base. DP is also a leader in innovation, with a strong focus on research and development.

**Conclusion**

Based on the analysis, the recommendation is to buy DP shares. The shares are currently undervalued and there are a number of other companies in the same industry that are trading at a higher valuation. DP is a well-managed company with a strong track record of performance and a bright future.

**Recommendations**

If you do not currently own DP shares, you should consider buying them. You can buy them through a broker or directly from another investor. If you are considering selling DP shares, you should wait until the price rises above the target price of 390.

**Risks**

There are always risks associated with investing in stocks. The price of DP shares could fall, even below the target price of 390. Additionally, the company could experience a setback, which could further decrease the value of the shares.

**Disclaimer**

This report is not financial advice. It is simply an analysis of the current market price of DP shares and a recommendation of whether to buy or sell them. You should always do your own research before making any investment decisions.

Reversal Is on The HorizonAfter Breaking the important resistance of level of 340 to 342.

It looks Reversal is on the horizon.

Look out for the range of 470 to 480 in coming days.

Best level to enter seems 340, however seems very difficult to get there. If it dosen't go there, then I should be happy with 370.

Already in portfolio, it's not a recommendation. This is just for education.