EDELWEISS trade ideas

Review and plan for 18th December 2024Nifty future and banknifty future analysis and intraday plan.

Swing trade.

This video is for information/education purpose only. you are 100% responsible for any actions you take by reading/viewing this post.

please consult your financial advisor before taking any action.

----Vinaykumar hiremath, CMT

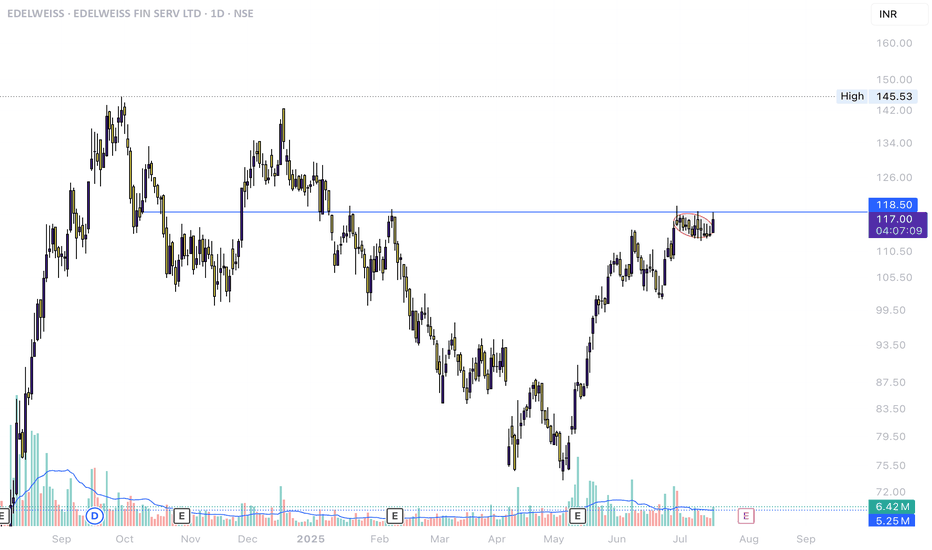

Edelweiss: Ready for a Big Run!🚀 Edelweiss: Ready for a Big Run! 🚀

Current Market Price: ₹136

Stop Loss: ₹115

Targets: ₹159 | ₹195

Key Highlights:

Major Resistance Breakout: Edelweiss broke a significant resistance at ₹122 on 9th September and touched ₹143 before retesting down to ₹102.

Sustaining Above ₹122: The stock is now holding firmly above the ₹122 level, a strong base for further upside.

Fibonacci Support: The 61.8% retracement level at ₹127 strengthens the current structure.

Trigger Point: A move above ₹143 could confirm momentum and trigger a sharp rally toward the targets.

Strategy:

Wait for Confirmation: Monitor closely for a breakout above ₹143 before adding significant positions.

Risk Management: Stick to the stop loss at ₹115 to protect capital.

Staggered Entry: Build positions gradually as the stock confirms upward movement.

📈 Outlook: With strong technical backing and a healthy retracement, Edelweiss could be poised for a substantial run toward its higher targets.

📉 Disclaimer: As a non-SEBI registered analyst, I recommend conducting thorough research or seeking advice from financial professionals before making investment decisions.

#Edelweiss #StockMarket #TradingOpportunities #TechnicalAnalysis #BreakoutStrategy #InvestmentIdeas

EDELWEISS FIN SERV LTD S/RSupport and Resistance Levels:

Support Levels: These are price points (green line/shade) where a downward trend may be halted due to a concentration of buying interest. Imagine them as a safety net where buyers step in, preventing further decline.

Resistance Levels: Conversely, resistance levels (red line/shade) are where upward trends might stall due to increased selling interest. They act like a ceiling where sellers come in to push prices down.

Breakouts:

Bullish Breakout: When the price moves above resistance, it often indicates strong buying interest and the potential for a continued uptrend. Traders may view this as a signal to buy or hold.

Bearish Breakout: When the price falls below support, it can signal strong selling interest and the potential for a continued downtrend. Traders might see this as a cue to sell or avoid buying.

MA Ribbon (EMA 20, EMA 50, EMA 100, EMA 200) :

Above EMA: If the stock price is above the EMA, it suggests a potential uptrend or bullish momentum.

Below EMA: If the stock price is below the EMA, it indicates a potential downtrend or bearish momentum.

Trendline: A trendline is a straight line drawn on a chart to represent the general direction of a data point set.

Uptrend Line: Drawn by connecting the lows in an upward trend. Indicates that the price is moving higher over time. Acts as a support level, where prices tend to bounce upward.

Downtrend Line: Drawn by connecting the highs in a downward trend. Indicates that the price is moving lower over time. It acts as a resistance level, where prices tend to drop.

Disclaimer:

I am not a SEBI registered. The information provided here is for learning purposes only and should not be interpreted as financial advice. Consider the broader market context and consult with a qualified financial advisor before making investment decisions.

Edelweiss Financial Services - Positional Trade Idea💹 Breakout Alert!

Edelweiss Fin Services has broken out above key resistance at ₹123 with strong volume support.

Entry: Above ₹124

Target 1: ₹140

Target 2: ₹145

Stop-loss: ₹113

RSI indicates bullish momentum, and the breakout shows potential for a continued uptrend. Keep an eye on volume for confirmation.

#Edelweiss #TradingIdeas #StockMarket #Breakout

EDELWEISSHi guys,

In this chart i Found a Demand Zone in EDELWEISS CHART for Positional entry,

Observed these Levels based on price action and Demand & Supply.

*Don't Take any trades based on this Picture.

... because this chart is for educational purpose only not for Buy or Sell Recommendation..

Thank you

TECHNICAL ANALYSIS of Edelweiss financial services Please note that this analysis is only for educational purposes. I am not giving you any kind of recommendation. Its my analysis for myself. You can use this post as educational purposes. Thank you!

### **Technical Analysis:**

1. **Ascending Triangle Pattern:**

- The chart shows an *ascending triangle pattern,* which is a bullish continuation pattern. The price is making higher lows, indicating increasing buying pressure, while the resistance zone around **115-116 INR** is acting as a strong barrier.

2. **Volume Analysis:**

- The volume has been decreasing during the consolidation phase, which is typical before a breakout. A significant increase in volume during the breakout would confirm the pattern and signal a potential strong upward move.

3. **Support and Resistance:**

- **Support:** The rising trendline acts as dynamic support, with immediate support around **112 INR** and stronger support near **108 INR.**

- **Resistance:** The resistance zone is between **115-116 INR.** A breakout above this level with strong volume would indicate bullish momentum.

### **Trade Setup:**

#### **Entry:**

1. **Bullish Scenario (Breakout):**

- **Entry Point:** Enter a long position when the price closes above **116 INR** on strong volume. This confirms a breakout from the ascending triangle.

2. **Bearish Scenario (Breakdown):**

- **Entry Point:** Consider a short position if the price breaks and closes below the trendline support around **112 INR** with increased volume. This would indicate a possible bearish reversal.

#### **Stop-Loss (SL):**

1. **Bullish Scenario:**

- **Stop-Loss:** Place the SL below the recent swing low or the trendline, around **112 INR.** This level acts as strong support, and a breakdown below it would invalidate the bullish setup.

2. **Bearish Scenario:**

- **Stop-Loss:** Set the SL just above the breakdown point, around **114 INR,** to protect against a false breakdown.

#### **Exit:**

1. **Bullish Scenario:**

- **Target 1:** The first target could be set around **120-122 INR,** based on the height of the triangle pattern added to the breakout point.

- **Target 2:** If the bullish momentum continues, the next target could be around **128-130 INR,** which is near the next significant resistance zone.

2. **Bearish Scenario:**

- **Target 1:** The first target for the short position could be around **108 INR,** where there is a strong support level.

- **Target 2:** If the price continues to decline, the next target could be around **100-102 INR,** where there is a psychological and technical support level.

### **Conclusion:**

- **Bullish Breakout:** Watch for a breakout above **116 INR** with increased volume for a long position.

- **Bearish Breakdown:** Monitor the **112 INR** level for a breakdown to consider a short position.

- **Volume Confirmation:** In both scenarios, confirm the move with volume to avoid false breakouts or breakdowns.

This setup offers a balanced risk-reward ratio, allowing you to capitalize on the directional move following the breakout or breakdown.

Technical Analysis of EDELWEISS Fin Serv LtdTechnical Analysis of EDELWEISS Fin Serv Ltd

Overview of the Stock - The chart presents a 1-hour timeframe of EDELWEISS Fin Serv Ltd (NSE:EDELWEISS) stock. Key indicators and patterns suggest a slightly bullish sentiment.

Key Observations

Price Action: The price has been consolidating above a support level around 113.50. A breakout above the recent high of 114.19 could signal a stronger uptrend.

Moving Averages: The 200-hour Exponential Moving Average (EMA) is providing support, indicating a potential bullish trend.

Fibonacci Retracements: The price is currently near the 0.618 Fibonacci retracement level of a previous decline, suggesting a potential reversal.

Relative Strength Index (RSI): - The RSI is hovering near the 50 level, indicating a neutral-to-slightly bullish sentiment. A break above 60 could signal stronger bullish momentum.

Support and Resistance: -The 113.50 level acts as a key support, while the 115.90 level is a potential resistance.

Potential Scenarios of Stock

Bullish Scenario: If the price breaks above the 114.19 resistance, it could trigger a stronger uptrend. The next target might be around 115.90, followed by higher levels.

Neutral Scenario: The price could continue to consolidate in the current range. A break below the 113.50 support could indicate a potential pullback.

Bearish Scenario: A significant break below the 113.50 support could trigger a more bearish outlook. The next support levels to watch would be around 108.50 and 103.70.

Conclusion

Based on the technical analysis, EDELWEISS Fin Serv Ltd appears to be in a slightly bullish trend. However, the market remains volatile, and it's essential to monitor price action and indicators closely for potential changes in sentiment.

Remember: This analysis is for informational purposes only and should not be considered investment advice. Always conduct your own research or consult with a financial advisor before making investment decisions.

Disclaimer: This analysis is based solely on the technical analysis of the stock and does not consider fundamental factors. Always consult with a financial advisor before making investment decisions. Do your own research before enter in the market because I am not SEBI registered person to suggest any stock.

Thanks for your support as always

Edelweiss Financial Services Stock: Outlook for FY 2024-25Current Performance Overview (2024): Edelweiss Financial Services (EDEL) has shown a marked increase in stock price, driven by substantial trading volumes and investor interest. As of August 2024, the stock price has surged to a range of INR 104.61 to INR 115.90, indicating strong bullish momentum. This rise is supported by robust market activity, with the stock price more than doubling over the last three months, reflecting significant market confidence.

EBITA Margin Analysis: Despite the positive price movement, Edelweiss's EBITA margin has seen some fluctuations. The EBITDA margin has declined by 40.33% compared to the previous year, although it had reached a five-year high of 59.10% in FY 2023. The current operating profit margins suggest that while the company has managed to keep operating expenses in check relative to revenues, there is room for improvement as the margin fell slightly in the first quarter of FY 2024.

Technical Analysis: Edelweiss’s stock is experiencing strong buy signals across various technical indicators. The stock is trading above its 50-day and 200-day moving averages, which is a clear bullish indicator. The Relative Strength Index (RSI) also suggests a buying opportunity, while other indicators like the MACD and ADX confirm the upward trend. The stock’s pivot points and support levels are well defined, with strong support around INR 90 and resistance potentially stretching up to INR 120.

Projection for FY 2024-25: Considering the current technical setup and financial performance, Edelweiss Financial Services is projected to continue its bullish trend into FY 2024-25. Analysts predict that if the market conditions remain stable, the stock could potentially reach INR 140 by the end of the fiscal year. However, investors should remain cautious as the company’s EBITA margins have shown some volatility, which might affect overall profitability.

Investment Outlook: For bullish investors, Edelweiss Financial Services offers a promising opportunity, particularly if the broader market continues its positive trend. On the downside, if market conditions deteriorate or if the company's EBITA margins do not improve, the stock might face resistance and consolidate in the INR 90-100 range.

Edelweiss Financial Services LtdEdelweiss Financial Services Ltd

Technically looking good in all time frames

Price action and volume too

So long time it's in low price now it making breakout.

Technically it's in bullish zone, we can witness quick move.

90 level is very important for this script as per GANN calculations

Target 120 and SL at 84.

EDELWEISSThe stock is trying to move out of the price rejection zone after nearly four months of sideways move. The relative strength and the money flow are also positive. The volume has been increasing in the recent past and the volume adjusted momentum is also turning positive. All the conditions are favoring the stock to take out the price rejection zone. Once we have a good close above 88, we can see the stock moving up much higher.

Edelweiss Financial Services:Bullish Breakout on Weekly Chart?Fundamentals

Edelweiss Financial Services boasts a healthy Return on Equity (ROE) and Return on Assets (ROA) track record, indicating efficient use of shareholder capital.

The company has delivered strong profit growth in recent years, with a healthy operating margin.

It trades at a reasonable valuation compared to its book value.

Technical Analysis

Edelweiss appears to have broken out of a consolidation phase on the weekly chart, with a surge in volume.

The stock is currently trading near its 20-week EMA, which could act as support.

Overall

The fundamentals of Edelweiss seem promising, and the recent breakout on the weekly chart suggests potential bullish momentum. However, it's important to note that the company reported negative earnings in the last quarter.

Important Note

This is a brief overview and should not be considered financial advice. Conduct your own research before making any investment decisions.

EDELWEISS BUYIn this script we have to be more caustions as there are two certain paths that the script might likle to take. It is important we be patient and wait for conitnious bullish one hour closes within the two area to indentifity which FVG is likley to give us a higher probability trade and a better entry to manage the risk. No buy sell reco NSE:EDELWEISS