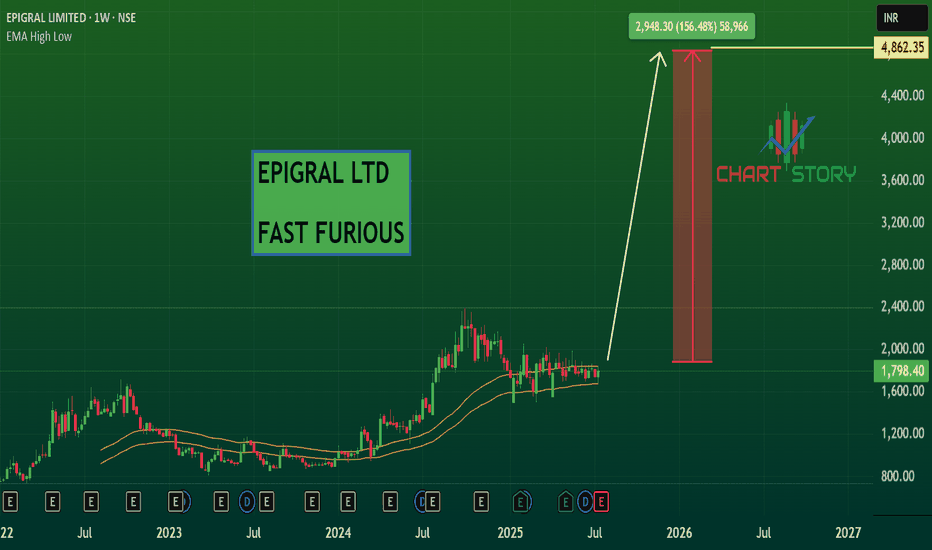

EPIGRAL trade ideas

EPIGRAL LTD S/RSupport and Resistance Levels:

Support Levels: These are price points (green line/shade) where a downward trend may be halted due to a concentration of buying interest. Imagine them as a safety net where buyers step in, preventing further decline.

Resistance Levels: Conversely, resistance levels (red line/shade) are where upward trends might stall due to increased selling interest. They act like a ceiling where sellers come in to push prices down.

Breakouts:

Bullish Breakout: When the price moves above resistance, it often indicates strong buying interest and the potential for a continued uptrend. Traders may view this as a signal to buy or hold.

Bearish Breakout: When the price falls below support, it can signal strong selling interest and the potential for a continued downtrend. Traders might see this as a cue to sell or avoid buying.

20 EMA (Exponential Moving Average):

Above 20 EMA(50 EMA): If the stock price is above the 20 EMA, it suggests a potential uptrend or bullish momentum.

Below 20 EMA: If the stock price is below the 20 EMA, it indicates a potential downtrend or bearish momentum.

Trendline: A trendline is a straight line drawn on a chart to represent the general direction of a data point set.

Uptrend Line: Drawn by connecting the lows in an upward trend. Indicates that the price is moving higher over time. Acts as a support level, where prices tend to bounce upward.

Downtrend Line: Drawn by connecting the highs in a downward trend. Indicates that the price is moving lower over time. It acts as a resistance level, where prices tend to drop.

Disclaimer:

I am not a SEBI registered. The information provided here is for learning purposes only and should not be interpreted as financial advice. Consider the broader market context and consult with a qualified financial advisor before making investment decisions.

Epigral LtdEpigral Ltd

Epigral Limited, formerly known as Meghmani Finechem Ltd, incorporated in 2007, is a leading integrated manufacturer of chemicals in India. Epigral’s Dahej facility is a backward and forward integrated and automated complex with a well-planned infrastructure.

In India, Epigral is the first to set up an Epichlorohydrin plant and largest capacity plant of CPVC Resin. Epigral is also a leading manufacturer of Caustic Soda, Caustic Potash, Chloromethanes, Hydrogen Peroxide, Chlorine and Hydrogen.

EPIGRAL trendline breakresistance 1160

support 872

Meghmani Finechem Limited (MFL) is part of the Ahmedabad-based Meghmani Group. It was incorporated in September 2007 as a subsidiary of Meghmani Organics Ltd (MOL) but was demerged in April 2021. The company is primarily engaged in manufacturing and selling of Chlor Alkali & its Derivatives with backward and forward integration facilities and also engaged in trading of Agrochemical products.

EPIGRALThis stock is in consolidation phase. taking support near 880 level. this week candle looking candle like elephant candle also it seems that selling is over because volume is very low on selling day. so at this price it seems it may be gud buy. sl will be green weekly candle low.

SL 880

target will be weekly candle trailing basis..

Epigral - Good Reversal betLooks like a good reversal candidate for ATH + New High.

Unlike its previous reversals, The confirmation candle has good volume. Respecting the trend line support and following the Fib levels.

Can add any dips or at 1040. My first target is 1400.

Traders SL at 970 and Investors nothing to worry

Meghmani Finechem Ltd - 13.04.2023Meghmani Finechem Ltd - 13.04.2023

The Price is above EMA

The Stock can be considered for the long upside movement with support @ 951/-

Watch out for the price action

DISCLAIMER: This is not a stock recommendation. The post is only for learning purposes, understanding candlestick patterns.

Meghmani Finechem Limited - Multiple Indicators📊 Script: MFL (MEGHMANI FINECHEM LIMITED)

📊 Nifty50 Stock: NO

📊 Sectoral Index: N/A

📊 Sector: Chemicals

📊 Industry: Specialty Chemicals

Key highlights: 💡⚡

This stock pick is according to my study. I have use few indicator that is

BOLLINGER BAND

MACD

RSI

DOUBLE MOVING AVERAGE

VOLUME

📈 Script is trading at upper band of Bollinger Bands (BB) and giving breakout of it.

📈 Crossover in MACD .

📈 Already Crossover in Double Moving Averages.

📈 Volume is increasing along with price which is volume breakout.

📈 Current RSI is around 76.

📈 One can go for Swing Trade.

⏱️ C.M.P 📑💰- 1701

🟢 Target 🎯🏆 - 1829

⚠️ Stoploss ☠️🚫 - 1638

⚠️ Important: Always maintain your Risk & Reward Ratio.

✅Like and follow to never miss a new idea!✅

Disclaimer: I am not SEBI Registered Advisor. My posts are purely for training and educational purposes.

Eat🍜 Sleep😴 TradingView📈 Repeat 🔁

Happy learning with trading. Cheers!🥂