GUJGASLTD trade ideas

Review and plan for 20th May 2025 Nifty future and banknifty future analysis and intraday plan.

Quarterly results.

This video is for information/education purpose only. you are 100% responsible for any actions you take by reading/viewing this post.

please consult your financial advisor before taking any action.

----Vinaykumar hiremath, CMT

GUJRAT GAS: INVERSE H&SThe Inverse Head and Shoulders pattern is a bullish reversal chart pattern that signals a potential trend reversal from bearish to bullish. It consists of three key components:

Structure of the Pattern:

Left Shoulder: A price decline followed by a temporary rally.

Head: A deeper decline forming the lowest point, followed by another rally.

Right Shoulder: A decline similar in size to the left shoulder but not as deep as the head, followed by a move higher.

Neckline: A resistance level that connects the highs of the two rallies after the left shoulder and head.

The Inverse Head and Shoulders pattern in Gujrat Gas, with a neckline at ₹396, indicates a potential bullish reversal. The stock has formed a well-defined left shoulder, head, and right shoulder, suggesting that selling pressure is weakening. A breakout above ₹406, supported by strong volume, could confirm the pattern and trigger an upward move. The target price for this breakout is ₹440, calculated by measuring the distance from the head’s low to the neckline and projecting it upwards. If the stock sustains above the neckline, it could gain further momentum. However, traders should consider placing a stop-loss below the right shoulder i.e. 376 to manage risk in case of a failed breakout.

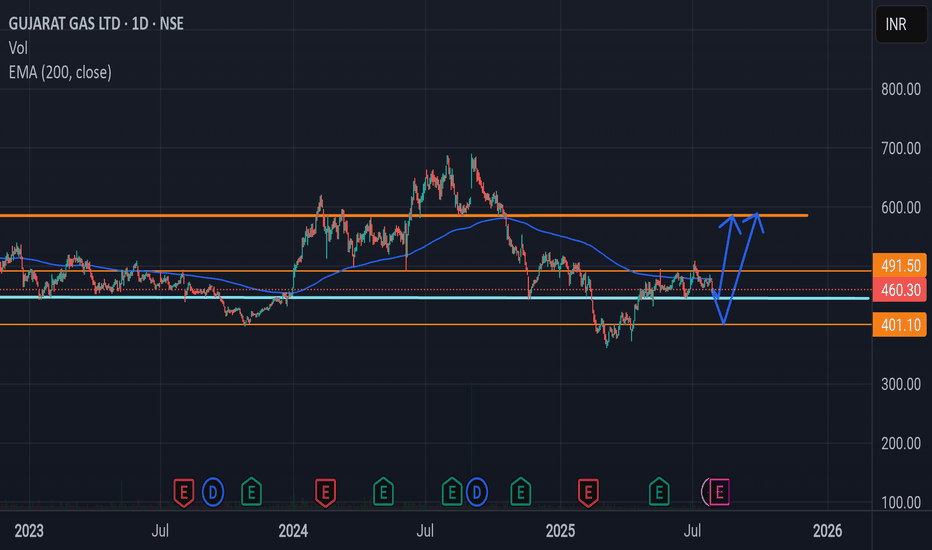

GUJGASLTD : at retracementGujarat Gas Ltd. (NSE: GUJGASLTD) - Technical Analysis and Trade Plan

🚀 Ready to catch the next big move in GUJGASLTD? 📈

### Chart Analysis

The chart indicates a potential bounce from the golden retracement zone (460-483) .

The current price is showing signs of a reversal within this zone.

### Trade Plan

Entry : Consider entering long positions within the golden retracement zone (460-483) .

Target :

First target at 566 INR .

Second target at 636 INR .

Stop Loss : Place a stop loss just below the retracement zone at 450 INR to manage risk.

### Conclusion

The golden retracement zone presents a strategic entry point with favorable risk-reward ratios.

Monitor the price action closely and adjust the plan as needed.

📢 Disclaimer : This trade plan is for informational purposes only and does not constitute financial advice. Always conduct your own research and consult with a qualified financial advisor before making any investment decisions.

#GUJGASLTD #TechnicalAnalysis #TradingPlan #StockMarket #Investment

I HAVE MISSED THE ENTRY AT - FIRST ENTRY INITIATED - GUJRAT GASEverything is pretty much explained in the picture itself.

I am Abhishek Srivastava | SEBI-Certified Research and Equity Derivative Analyst from Delhi with 4+ years of experience.

I focus on simplifying equity markets through technical analysis. On Trading View, I share easy-to-understand insights to help traders and investors make better decisions.

Kindly check my older shared stock results on my profile to make a firm decision to invest in this.

For any query kindly dm.

Thank you and invest wisely.

GUJARAT GAS LTD S/RSupport and Resistance Levels:

Support Levels: These are price points (green line/shade) where a downward trend may be halted due to a concentration of buying interest. Imagine them as a safety net where buyers step in, preventing further decline.

Resistance Levels: Conversely, resistance levels (red line/shade) are where upward trends might stall due to increased selling interest. They act like a ceiling where sellers come in to push prices down.

Breakouts:

Bullish Breakout: When the price moves above resistance, it often indicates strong buying interest and the potential for a continued uptrend. Traders may view this as a signal to buy or hold.

Bearish Breakout: When the price falls below support, it can signal strong selling interest and the potential for a continued downtrend. Traders might see this as a cue to sell or avoid buying.

20 EMA (Exponential Moving Average):

Above 20 EMA(50 EMA): If the stock price is above the 20 EMA, it suggests a potential uptrend or bullish momentum.

Below 20 EMA: If the stock price is below the 20 EMA, it indicates a potential downtrend or bearish momentum.

Trendline: A trendline is a straight line drawn on a chart to represent the general direction of a data point set.

Uptrend Line: Drawn by connecting the lows in an upward trend. Indicates that the price is moving higher over time. Acts as a support level, where prices tend to bounce upward.

Downtrend Line: Drawn by connecting the highs in a downward trend. Indicates that the price is moving lower over time. It acts as a resistance level, where prices tend to drop.

RSI: RSI readings greater than the 70 level are overbought territory, and RSI readings lower than the 30 level are considered oversold territory.

Combining RSI with Support and Resistance:

Support Level: This is a price level where a stock tends to find buying interest, preventing it from falling further. If RSI is showing an oversold condition (below 30) and the price is near or at a strong support level, it could be a good buy signal.

Resistance Level: This is a price level where a stock tends to find selling interest, preventing it from rising further. If RSI is showing an overbought condition (above 70) and the price is near or at a strong resistance level, it could be a signal to sell or short the asset.

Swing Long Trade good for GUJGAS

Source Demand formed which has the potential to move the Price until the next Fresh opposite Supply which can become the Destination of this Uptrend which is about to emerge.

Here's the Demand and Supply Equilibrium for this Script, here we clearly understand where is low and where is High and as Traders we know when we buy low we have higher reward to risk ratios and same when we short when the prices are high so now we have the curve divided into 5 parts and when we trade we see the position of the Price in the curve.

This is a Demand formed after Price has reacted to the Source Demand now this has maximum probability in the Upward direction as its the 1st 4H Demand formed since Price reacted the Source Demand. Now let's check the Reward it has to offer and against what risk?

Here's the answer we need

TradeType : Swing Trade

Entry : Rs. 607.30

Stoploss. : Rs. 597.00

TakeProfit : Rs. 659.15

Reward. : Rs. 52.15

Risk : Rs. 10.00

Ratio : 5 / 1

For FUTURES

A QUICK SWING TRADE IN GUJGAS

1. Pattern Identified : The chart displays a promising Cup and Handle pattern 📊.

2. Indicators: All major indicators are showing positive trends ✅.

3. Current Accumulation: We’re seeing a small accumulation around the 600 level 📈.

4. Breakout Potential: Once the trendline is broken, we can anticipate the following targets:

- 640 💵

- 650 💵

- 730 💵

- 740 💵

- Final target of 780 🚀

5. Profit-Taking Strategy

: Continue to book partial profits at each target level for optimal gains 💰.

Stay positive and confident as we move forward! 🌟📈

Gujarat Gas Ltd intraday level for 20th Aug #GUJGASLTD Gujarat Gas Ltd intraday level for 20th Aug #GUJGASLTD

Buying may witness above 595

Support area 590. Below ignoring buying momentum for intraday

Selling may witness below 586

Resistance area 590. Above ignoring selling momentum for intraday

Charts for Educational purposes only.

Please follow strict stop loss and risk reward if you follow the level.

Thanks,

V Trade Point

GUJGASLTD - Analysis Entry Levels - above 540 Use Small Stop loss as per your risk management

Safe entry Above 585

Targets to watch 637 Final Target around 734 to 748

Please do your due diligence before trading or investment.

*Comment or message me if you wish to see my analysis for any stocks.

**Disclaimer -

I am not a SEBI registered analyst or advisor. I does not represent or endorse the accuracy or reliability of any information, conversation, or content. Stock trading is inherently risky and the users agree to assume complete and full responsibility for the outcomes of all trading decisions that they make, including but not limited to loss of capital. None of these communications should be construed as an offer to buy or sell securities, nor advice to do so. The users understands and acknowledges that there is a very high risk involved in trading securities. By using this information, the user agrees that use of this information is entirely at their own risk.

Thank you.

GUJARAT GAS LTD FOR LONG Gujarat Gas Ltd. is a prominent player in India's natural gas distribution sector. Here are some positive aspects about the company:

Market Leadership: Gujarat Gas Ltd. is one of the largest city gas distribution companies in India, providing natural gas to domestic, industrial, and commercial sectors.

Extensive Network: The company has a vast pipeline network, enabling it to reach a large customer base across multiple states.

Strong Financial Performance: Gujarat Gas Ltd. has demonstrated consistent revenue growth and profitability, reflecting its robust business model.

Environmental Benefits: The company promotes the use of natural gas, a cleaner and more environmentally friendly fuel compared to traditional fossil fuels.

Innovation and Technology: Gujarat Gas Ltd. continuously invests in advanced technology to enhance operational efficiency and customer service.

Government Support: The Indian government's focus on increasing the use of natural gas in the energy mix provides a favorable environment for the company's growth.

Customer-Centric Approach: The company is known for its customer-centric approach, providing reliable and efficient services to its clients.

Sustainability Initiatives: Gujarat Gas Ltd. is committed to sustainable practices and reducing its carbon footprint, aligning with global environmental goals.

Strategic Partnerships: The company forms strategic alliances and partnerships to expand its reach and improve service offerings.

Skilled Workforce: Gujarat Gas Ltd. boasts a skilled and dedicated workforce, contributing to its overall success and reputation in the industry.

Disclaimer - All information on this page is for educational purposes only,

we are not SEBI Registered, Please consult a SEBI registered financial advisor for your financial matters before investing And taking any decision. We are not responsible for any profit/loss you made.

GUJGASLTDNSE:GUJGASLTD

One Can Enter Now !

Or Wait for Retest of the Trendline (BO) !

Or wait For better R:R ratio !

Note :

1.One Can Go long with a Strict SL below the Trendline or Swing Low.

2. R:R ratio should be 1 :2 minimum

3. Plan as per your RISK appetite and Money Management.

Disclaimer : You are responsible for your Profits and loss, Shared for Educational purpose

GUJARAT GAS: Gap filling due??The chart is pretty self-explanatory as always. But as usual, Below are some good-to-know pointers.

- The price has been stuck in a range for about a year now

- The support zone is holding up. But for how long, we do not know.

- The best case scenario will be the break of the support inviting sellers followed by filling of the long due gap and a recovery. Again, this is a scenario, not a prediction.

- If the support holds, We will see a good up move only when the crucial resistance zone is broken and the price sustains above it.

- Weekly Moving averages have negativity written all over them. The 50EMA has crossed 100EMA. The price is trading close to 200EMA after taking support from it.

What do you make of this price action?

Have Requests, Questions, or Suggestions? DM us or comment below.👇

⚠️Disclaimer: We are not registered advisors. The views expressed here are merely personal opinions. Irrespective of the language used, Nothing mentioned here should be considered as advice or recommendation. Please consult with your financial advisors before making any investment decisions. Like everybody else, we too can be wrong at times ✌🏻

sell at zone ~ intradayexpecting small fall from the zone .

- good for intraday trade

expecting small fall from the zone . look for confirmation inside zone in smaller time frame

ENTRY

- entry is strictly inside the zone

- look for confirmation in smaller time frame ( 15 mins preferred )

TARGET

- use fibonacci retracement on C to latest swing high

- mark 0.236 fib value as target

STOPLOSS

- if daily tf candle close is above the zone .

GUJGAS - WeeklyGujgas has retraced 50% of the earlier swing and is getting ready for breakout. Keep it on the watchlist...

Break above 585 on Weekly closing basis will provide the required momentum.

One can add it in small qnty at the current lvl 550-560 for

Tgt 1 - 700

Tgt 2 - 760 (safer although it points to 780)

Review and plan for 7th May 2024 Nifty future and banknifty future analysis and intraday plan in kannada.

This video is for information/education purpose only. you are 100% responsible for any actions you take by reading/viewing this post.

please consult your financial advisor before taking any action.

----Vinaykumar hiremath, CMT