Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

92.35 INR

707.92 B INR

4.75 T INR

7.66 B

About HDFC BANK LTD

Sector

Industry

CEO

Kapila Deshapriya

Website

Headquarters

Mumbai

Founded

1994

ISIN

INE040A01034

FIGI

BBG000F8XD00

HDFC Bank Ltd. engages in the provision of banking and financial services, including commercial banking and treasury operations. The firm also provides financial services to upper and middle income individuals and corporations in India. It operates through the following segments: Treasury, Retail Banking, Wholesale Banking and Other Banking Operations. The Treasury segment consists of bank's investment portfolio, money market borrowing and lending, investment operations and trading in foreign exchange and derivative contracts. The Retail Banking segment provides loans and other services to customers through a branch network and other delivery channels. The Wholesale Banking segment provides loans, non-fund facilities and transaction services to large corporates, emerging corporates, public sector units, government bodies, financial institutions, and medium scale enterprises. The Other Banking Business segment includes income from para banking activities such as credit cards, debit cards, third party product distribution, primary dealership business, and the associated costs. The company was founded by Aditya Tapishwar Puri in August 1994 and is headquartered in Mumbai, India.

Related stocks

Risk Management in Options TradingTrading options can be exciting and rewarding—but it's also full of risks. Without proper risk management, even the best strategies can lead to heavy losses. In this comprehensive guide, we'll dive deep into how to manage risk in options trading, covering everything from the basics to advanced techn

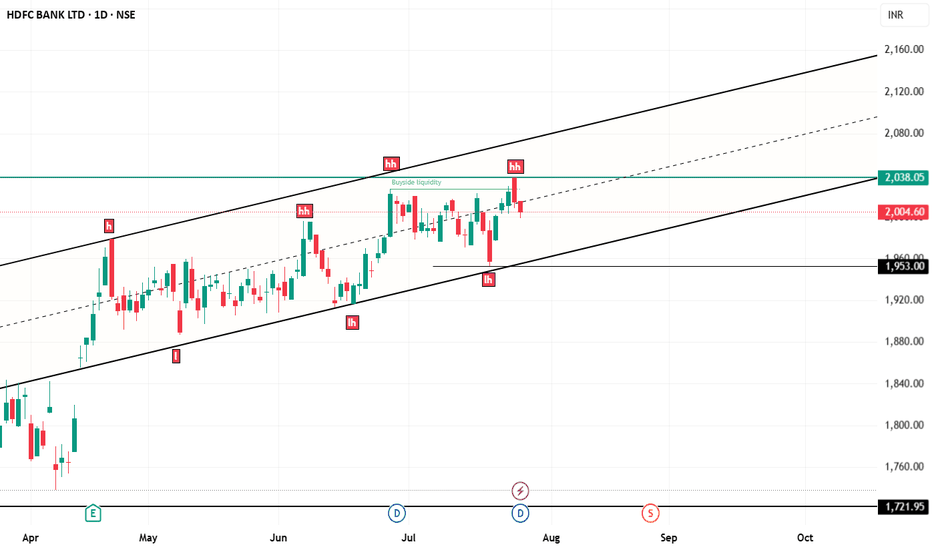

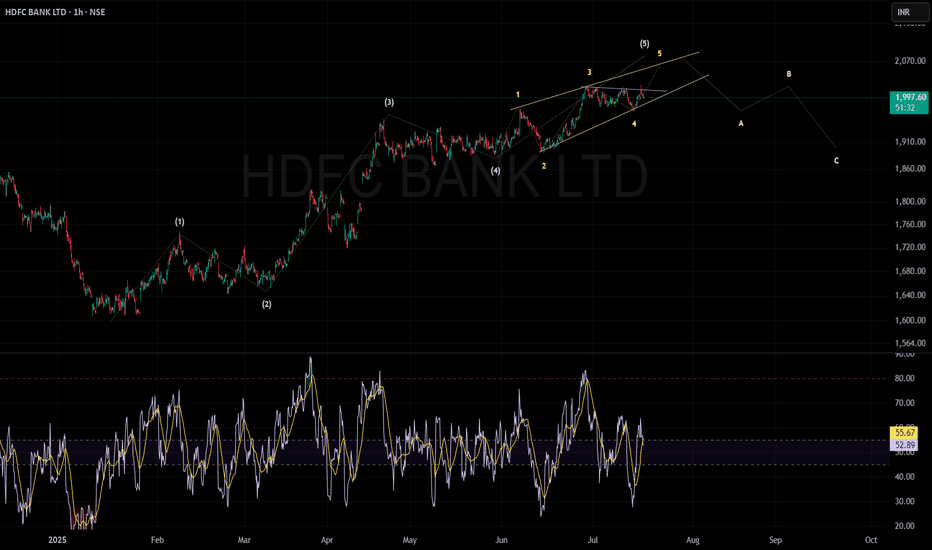

HDFC BANK can move 5th wave upHDFC Bank is currently in the last (5th) wave of an uptrend. This wave is moving inside a narrow, rising wedge pattern called an ending diagonal.

The price can move higher towards ₹2,050–₹2,100 before the trend finishes.

If the price breaks below the bottom of the wedge pattern (ending diagonal),

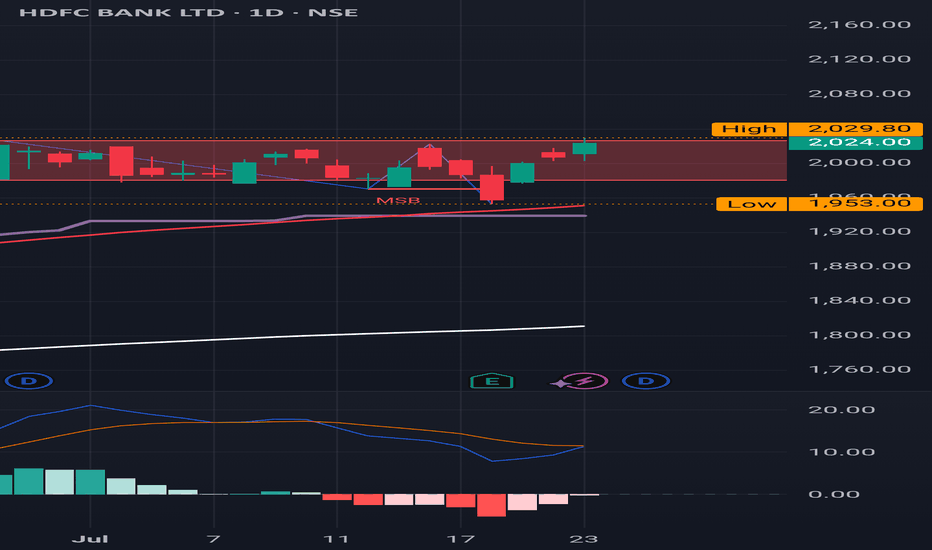

HDFC Accumulation Breakdown Setup?HDFC seems to be building an accumulation range with:

Range High: ₹1955

Range Low: ₹1908

Currently, price is consolidating within this zone. I'm biased to the sell side for now, expecting a potential breakdown below the ₹1908 level.

⚠️ No confirmation yet — it's a “wait and watch” scenario. A st

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

78HDFCB33

HDFCB-7.8%-03-05-33-CPYield to maturity

7.80%

Maturity date

May 3, 2033

705HDFCB31

HDFCB-7.05%-2-12-31-PVTYield to maturity

6.86%

Maturity date

Dec 1, 2031

797HDFCB33

HDFCB-7.97%-17-2-33-PVTYield to maturity

6.77%

Maturity date

Feb 17, 2033

HDB5548686

HDFC Bank Limited 5.686% 02-MAR-2026Yield to maturity

4.77%

Maturity date

Mar 2, 2026

835HDFCB25

HDFCBL-8.35%-15-12-25-PVTYield to maturity

—

Maturity date

Dec 15, 2025

775HDFCB33

HDFCB-7.75%-13-6-33-PVTYield to maturity

—

Maturity date

Jun 13, 2033

756HBL27

HBL-7.56%-29-6-27-PVTYield to maturity

—

Maturity date

Jun 29, 2027

765HDFCB33

HDFCB-7.65%-25-5-33-PVTYield to maturity

—

Maturity date

May 25, 2033

786HDFC32

HDFCBL-7.86%-02-12-32-PVTYield to maturity

—

Maturity date

Dec 2, 2032

784HDFCB27

HDFCBL-7.84%-8-9-27-PVTYield to maturity

—

Maturity date

—

765HDFC34

HDFC-7.65%-20-3-34-PVTYield to maturity

—

Maturity date

Mar 20, 2034

See all HDFCBANK bonds

Curated watchlists where HDFCBANK is featured.

Indian stocks: Racing ahead

46 No. of Symbols

See all sparks

Frequently Asked Questions

The current price of HDFCBANK is 2,012.20 INR — it has decreased by −0.30% in the past 24 hours. Watch HDFC BANK LTD stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on NSE exchange HDFC BANK LTD stocks are traded under the ticker HDFCBANK.

HDFCBANK stock has fallen by −0.14% compared to the previous week, the month change is a −0.38% fall, over the last year HDFC BANK LTD has showed a 23.99% increase.

We've gathered analysts' opinions on HDFC BANK LTD future price: according to them, HDFCBANK price has a max estimate of 2,770.00 INR and a min estimate of 1,950.00 INR. Watch HDFCBANK chart and read a more detailed HDFC BANK LTD stock forecast: see what analysts think of HDFC BANK LTD and suggest that you do with its stocks.

HDFCBANK reached its all-time high on Jul 24, 2025 with the price of 2,037.70 INR, and its all-time low was 2.40 INR and was reached on Jan 29, 1996. View more price dynamics on HDFCBANK chart.

See other stocks reaching their highest and lowest prices.

See other stocks reaching their highest and lowest prices.

HDFCBANK stock is 0.95% volatile and has beta coefficient of 0.87. Track HDFC BANK LTD stock price on the chart and check out the list of the most volatile stocks — is HDFC BANK LTD there?

Today HDFC BANK LTD has the market capitalization of 15.44 T, it has decreased by −0.51% over the last week.

Yes, you can track HDFC BANK LTD financials in yearly and quarterly reports right on TradingView.

HDFC BANK LTD is going to release the next earnings report on Oct 20, 2025. Keep track of upcoming events with our Earnings Calendar.

HDFCBANK earnings for the last quarter are 23.70 INR per share, whereas the estimation was 22.74 INR resulting in a 4.23% surprise. The estimated earnings for the next quarter are 22.57 INR per share. See more details about HDFC BANK LTD earnings.

HDFC BANK LTD revenue for the last quarter amounts to 531.68 B INR, despite the estimated figure of 432.61 B INR. In the next quarter, revenue is expected to reach 438.79 B INR.

HDFCBANK net income for the last quarter is 162.58 B INR, while the quarter before that showed 188.35 B INR of net income which accounts for −13.68% change. Track more HDFC BANK LTD financial stats to get the full picture.

HDFC BANK LTD dividend yield was 1.20% in 2024, and payout ratio reached 23.70%. The year before the numbers were 1.35% and 21.57% correspondingly. See high-dividend stocks and find more opportunities for your portfolio.

As of Aug 2, 2025, the company has 214.55 K employees. See our rating of the largest employees — is HDFC BANK LTD on this list?

Like other stocks, HDFCBANK shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade HDFC BANK LTD stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So HDFC BANK LTD technincal analysis shows the buy rating today, and its 1 week rating is strong buy. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating HDFC BANK LTD stock shows the buy signal. See more of HDFC BANK LTD technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.