Key facts today

Hindustan Unilever's Q1 2025 revenue was Rs 15,670 Crore, down from Rs 15,818 Crore. Net profit fell to Rs 2,476 Crore. Annual revenue rose to Rs 63,121 Crore.

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

45.30 INR

106.49 B INR

628.81 B INR

886.60 M

About HINDUSTAN UNILEVER LTD.

Sector

Industry

CEO

Rohit Jawa

Website

Headquarters

Mumbai

Founded

1956

ISIN

INE030A01027

FIGI

BBG000CSMHN7

Hindustan Unilever Limited is engaged in fast-moving consumer goods business comprising home and personal care, foods and refreshments. The Company's segments are Soaps and Detergents, which includes soaps, detergent bars, detergent powders, detergent liquids and scourers; Personal Products, which includes products in categories of oral care, skin care (excluding soaps), hair care, deodorants, talcum powder, color cosmetics and salon services; Beverages, which includes tea and coffee; Packaged Foods, which includes branded staples (atta, salt and bread), culinary products (tomato-based products, fruit-based products and soups) and frozen desserts, and Others that includes exports, chemicals, water business and infant care products. The Others segment also includes export sale of marine and leather products. Its brands include Lux, Surf excel, Rin, Wheel, Fair & Lovely, Pond's, Vaseline, Lakme, Dove, Clinic Plus, Sunsilk, Axe, Brooke Bond, Bru, Knorr, Kissan, Kwality Wall's and Pureit.

Related stocks

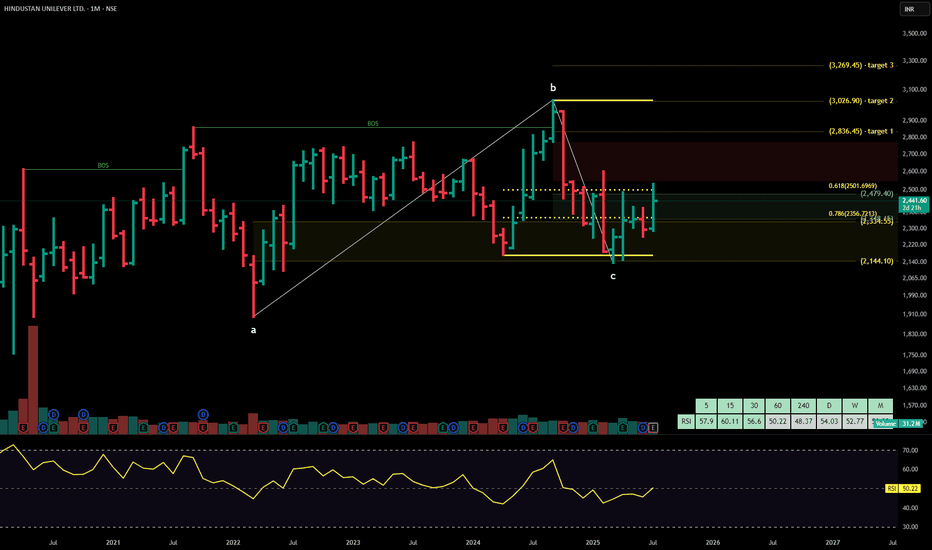

HINDUSTAN UNILEVERHindustan Unilever Ltd. is India’s leading fast-moving consumer goods (FMCG) company, with a portfolio spanning personal care, home care, foods, and beverages. Backed by strong brand equity, extensive distribution, and consistent innovation, the company maintains dominant market share across categor

Hindustan Unilever Ltd. – Bullish Breakout with Strong MomentumHindustan Unilever opened the session with a gap-up accompanied by above-average volume, signaling strong buying interest right from the start. While the stock saw some early profit-booking, it quickly regained momentum and is currently trading near the day’s high—an encouraging sign of sustained de

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

Curated watchlists where HINDUNILVR is featured.

Indian stocks: Racing ahead

46 No. of Symbols

See all sparks

Frequently Asked Questions

The current price of HINDUNILVR is 2,441.60 INR — it has increased by 1.08% in the past 24 hours. Watch HINDUSTAN UNILEVER LTD. stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on NSE exchange HINDUSTAN UNILEVER LTD. stocks are traded under the ticker HINDUNILVR.

HINDUNILVR stock has fallen by −1.98% compared to the previous week, the month change is a 7.05% rise, over the last year HINDUSTAN UNILEVER LTD. has showed a −10.37% decrease.

We've gathered analysts' opinions on HINDUSTAN UNILEVER LTD. future price: according to them, HINDUNILVR price has a max estimate of 3,055.00 INR and a min estimate of 1,943.00 INR. Watch HINDUNILVR chart and read a more detailed HINDUSTAN UNILEVER LTD. stock forecast: see what analysts think of HINDUSTAN UNILEVER LTD. and suggest that you do with its stocks.

HINDUNILVR reached its all-time high on Sep 23, 2024 with the price of 3,035.00 INR, and its all-time low was 61.50 INR and was reached on Jan 5, 1996. View more price dynamics on HINDUNILVR chart.

See other stocks reaching their highest and lowest prices.

See other stocks reaching their highest and lowest prices.

HINDUNILVR stock is 1.49% volatile and has beta coefficient of 0.56. Track HINDUSTAN UNILEVER LTD. stock price on the chart and check out the list of the most volatile stocks — is HINDUSTAN UNILEVER LTD. there?

Today HINDUSTAN UNILEVER LTD. has the market capitalization of 5.67 T, it has decreased by −0.39% over the last week.

Yes, you can track HINDUSTAN UNILEVER LTD. financials in yearly and quarterly reports right on TradingView.

HINDUSTAN UNILEVER LTD. is going to release the next earnings report on Jul 31, 2025. Keep track of upcoming events with our Earnings Calendar.

HINDUNILVR earnings for the last quarter are 10.61 INR per share, whereas the estimation was 10.20 INR resulting in a 4.00% surprise. The estimated earnings for the next quarter are 10.83 INR per share. See more details about HINDUSTAN UNILEVER LTD. earnings.

HINDUSTAN UNILEVER LTD. revenue for the last quarter amounts to 155.13 B INR, despite the estimated figure of 152.30 B INR. In the next quarter, revenue is expected to reach 159.82 B INR.

HINDUNILVR net income for the last quarter is 24.64 B INR, while the quarter before that showed 29.84 B INR of net income which accounts for −17.43% change. Track more HINDUSTAN UNILEVER LTD. financial stats to get the full picture.

HINDUSTAN UNILEVER LTD. dividend yield was 1.90% in 2024, and payout ratio reached 94.87%. The year before the numbers were 1.85% and 96.02% correspondingly. See high-dividend stocks and find more opportunities for your portfolio.

As of Jul 29, 2025, the company has 26.67 K employees. See our rating of the largest employees — is HINDUSTAN UNILEVER LTD. on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. HINDUSTAN UNILEVER LTD. EBITDA is 148.51 B INR, and current EBITDA margin is 23.65%. See more stats in HINDUSTAN UNILEVER LTD. financial statements.

Like other stocks, HINDUNILVR shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade HINDUSTAN UNILEVER LTD. stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So HINDUSTAN UNILEVER LTD. technincal analysis shows the buy rating today, and its 1 week rating is buy. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating HINDUSTAN UNILEVER LTD. stock shows the buy signal. See more of HINDUSTAN UNILEVER LTD. technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.