INDOAMIN trade ideas

INDOAMIN CMP 185160 Level was a super strong support for this stock.After make a strong rally from Jan 2024 to Sep 2024 This stock corrected around 30% Now it Respecting its support level.After retest this area if it try to bounce back then it will be an best apportunity for a best Swing trade Setup.Add this to your wachlist and find a best Risk Reward area .Thanks.

Indo Amines - Diwali PickMarket Cap - ₹ 1,343 Cr.

Current Price - ₹ 190

High / Low - ₹ 248 / 100

Stock P/E - 26.9

ROCE - 16.6 %

ROE - 16.7 %

Sales growth -3.72 %

Profit growth -12.1 %

Debt to equity - 0.82

Industry PE - 39.2

OPM- 8.84 %

Pledged percentage - 0.00 %

Debt - ₹ 217 Cr.

Down from 52w high - 23.5 %

QoQ Profits - 112 %

QoQ Sales - 4.62 %

Sales - ₹ 965 Cr.

Promoter holding - 66.8 %

Indo amines earlier given breakout around 187 and now retested the same breakout zone and its a perfect entry point to go long in this stock.

Darvas Box Strategy - Breakout StockDisclaimer: I am Not SEBI Registered adviser, please take advise from your financial adviser before investing in any stocks. Idea here shared is for education purpose only.

Stock has given break out. Keep this stock in watch list.

Buy above the High and do not forget to keep stop loss best suitable for swing trading.

Target and Stop loss Shown on Chart. As stop loss is Big we keep Initial Target Ratio 1:2.

Be Discipline, because discipline is the key to Success in Stock Market.

Trade what you See Not what you Think.

INDOAMIN Showing Volume Strength near ALL TIME HIGH Zone NSE:INDOAMIN

Strengths:

Established market position: IAL was promoted by Mr Vijay B Palkar in 1979, as Techno Chemical Industries, and converted to IAL in 1992. Over the years, the promoters have developed strong expertise in the chemical industry. The company now manufactures oleo, specialty and performance chemicals, used across various industries, such as pharmaceuticals, agrochemicals, fertilizers, petrochemicals, pesticides and perfumeries. Benefits from the longstanding presence of the promoters in the chemical industry and their established relationships with customers and suppliers will continue over medium term.

Above average financial risk profile: The financial risk profile is above average with a robust net worth of around Rs. 213.86 crore as on March 31, 2023. This supports the financial flexibility of the group. Supported by a robust net worth the capital structure is moderate with total outside liabilities to adjusted networth (TOLANW) of 1.72 time as on March 31, 2023. This is expected to remain comfortable going forward. Capital structure is expected to improve over medium term on the back of healthy accruals, absence of large debt funded capex and scheduled repayments. Overall financial risk profile is expected to further improve over medium term.

Technical Analysis of INDOAMIN (Bullish)Technical Analysis of INDOAMIN based on Price Action - Based on the technical analysis of the chart, the current price of INDO AMINES LTD is 161.55 INR.

Technical Analysis:

RSI (14): The Relative Strength Index (RSI) is currently at 45.46, which suggests that the stock is oversold. This could indicate a potential buying opportunity.

EMA (200): The 200-day Exponential Moving Average (EMA) is at 152.88 INR. The current price is above the EMA, which suggests a bullish trend.

Support and Resistance: The chart shows potential support levels at 140-154 INR and 166 INR. The resistance level is at 175.17 INR.

Overall Trend & My Personal Opinion: - My technical analysis suggests that INDO AMINES LTD has a bullish bias. However, it is important to note that this is just a technical analysis and should not be the sole basis for investment decisions. Investors should also consider other factors such as fundamental analysis and their own risk tolerance before making any investment decisions.

Disclaimer: I am not a financial advisor. The information provided here is for informational purposes only and should not be construed as financial advice. Please consult with a financial advisor before making any investment decisions. Also I am not SEBI registered person and this is my personal opinion based on price action and my technical understandings about the stock

Thanks for your support as always

IndoaminStock name = Indoamine Limited.

Weekly chart setup

Chart is self explanatory. Levels of breakout, possible up-moves (where stock may find resistances) and support (close below which, setup will be invalidated) are clearly defined.

Disclaimer: This is for demonstration and educational purpose only. this is not buying and selling recommendations. I am not SEBI registered. please consult your financial advisor before taking any trade.

Indo Amines LtdIndo Amines Ltd Promoted in 1979, as Techno Chemical Industries, the company was incorporated in 1994 as Indo Amines Limited. The company is a world-wide manufacturer, developer and supplier of fine and specialty chemicals, performance chemicals, perfumery chemicals and active pharmaceutical ingredients.

The company has five manufacturing units in Gujarat and Maharashtra.

Indo Amines Ltd.*Indo Amines Ltd*

C&H Formation on Weekly Basis.

Strong Price BreakOut & Sustained.

Heavy Vol. BuiltUp Continued.

RB Formation Triggered @141 / 147/152

Opening Targets of 350+

Trail SL with Upside.

Book Profit as per Risk Appetite.

Do Your Own Research as well. This is an Opinion.

Happy Investing 😇

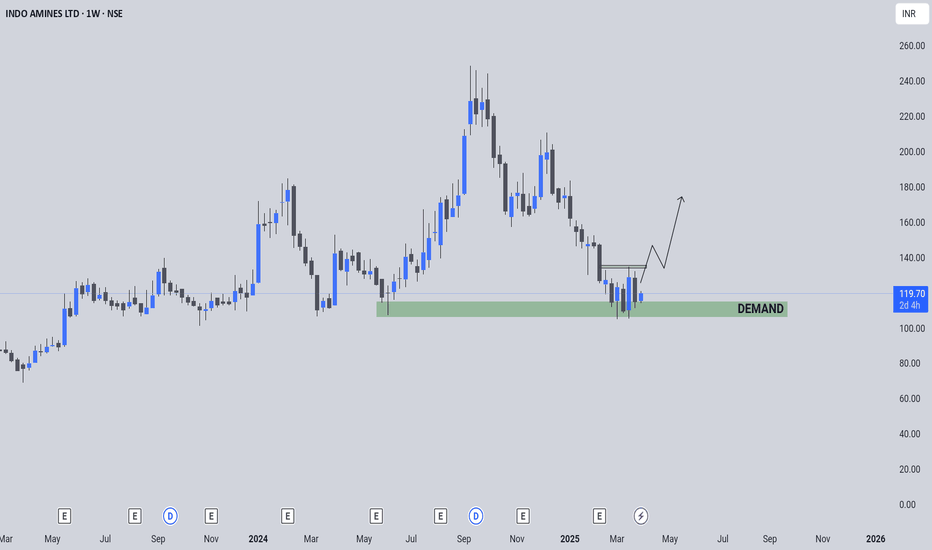

Indo Amines (Swing):Indo Amines (Swing):

A 30-50% up move is on the cards for swing.

Keep adding in chunks while script ranges at 112-120.

Appropriate support, demand zone, resistance and targets are highlighted.

Note: Do your own due diligence before taking any action.

I would be posting updates for this chart in the comments sections as time progresses.

Explosive!Very clean and simple setup.

We have a range from 70 to 145. Every time price has established base around 67-70 region it has tapped into 145 region, and good thing is the up moves from 70 region are very quick and sharp (refer highlighted region with green rectangles). Another confluence we have is a weekly TL.

This is a very good risk reward setup, just wait for the stock to show its hand first!

Watch out for action around 67-70 region!