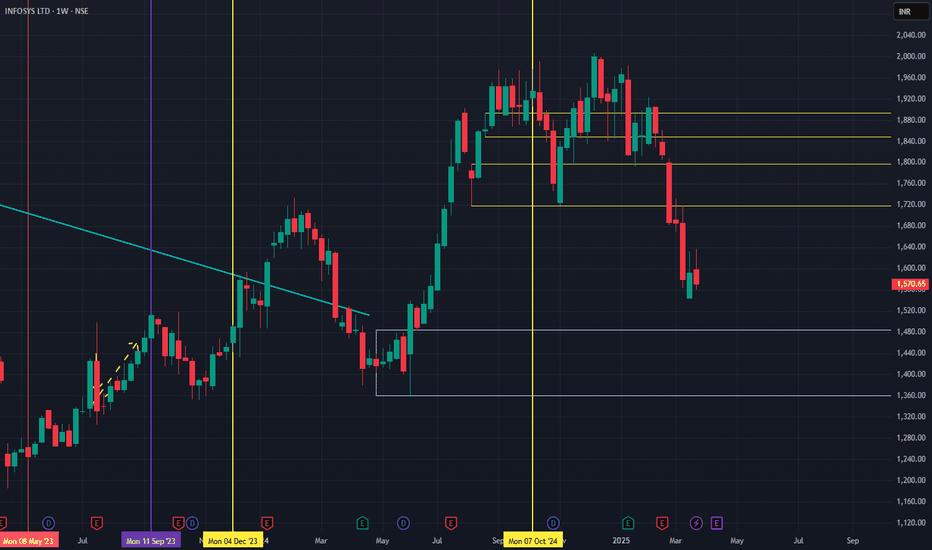

INFOSYS 📊 Chart Analysis – Infosys Ltd (INFY)

Currently, the stock is testing a key resistance zone between ₹1620–₹1630.

If the price breaks and closes above this resistance, it can signal a strong bullish breakout.

---

💼 Trade Setup (Based on Cup and Handle Pattern):

Entry (Buy): On a closing above ₹1640

Stop Loss: ₹1570

Target 1: ₹1700

Target 2: ₹1780

---

This is a classic Cup and Handle breakout setup, which often indicates the start of an upward trend.

If you find this helpful and want more FREE forecasts in TradingView, Hit the 'BOOST' button

Drop some feedback in the comments below! (e.g., What did you find most useful?

How can we improve?)

Your support is appreciated!

Now, it's your turn!

Be sure to leave a comment; let us know how you see this opportunity and forecast.

Have a successful week

DISCLAIMER: I am NOT a SEBI registered advisor or a financial adviser. All the views are for educational purpose only

INFY trade ideas

INFY 1H Chart Analysis (Bullish Bat + Falling Wedge)NSE:INFY

INFY 1H Chart Analysis (Bullish Bat + Falling Wedge)

In this 1-hour chart of Infosys Ltd (NSE: INFY), a Bullish Bat Harmonic Pattern has completed at point D, suggesting a potential reversal zone. Additionally, a falling wedge formation adds to the bullish confluence.

1. Pattern Structure:

The chart displays a complete Bullish Bat Pattern (X-A-B-C-D).

Point D aligns with the PRZ (Potential Reversal Zone), with a CD leg extending \~1.618 of BC, supporting a bullish reversal.

2. Falling Wedge Pattern;

A falling wedge, generally a bullish pattern, has formed from point C to D.

A breakout above the wedge trendline may confirm a bullish move.

3. Price Action:

The price is testing the upper boundary of the wedge.

Buying interest is visible at the P,R,Z near ₹1,540–₹1,545.

Trade Plan:

Buy Entry: Above ₹1,555 (confirmation breakout above wedge)

Stop Loss: Below ₹1,538 (beneath point D and wedge support)

Target 1: ₹1,568 (previous resistance)

Target 2: ₹1,611 (mid-term resistance)

Target 3: ₹1,631 (major swing high)

A strong bullish confluence exists with the harmonic pattern and falling wedge. Wait for confirmation above ₹1,555 before entering. Maintain proper risk-reward with a stop below ₹1,538.

NSE:INFY NSE:NIFTY NSE:CNXIT

Infy India is in making of big move ... Disclaimer : This is just a chart analysis based on my understanding. Do your own research before investing.

Looking at daily chart of Infosys, first a chart pattern of M was made in the past which means stock moved up and come down. Now its trying to form a inverted head and shoulder chart pattern. Infosys stock may move up from the current levels.

Infosys Ltd view for Intraday 21st May #INFY Infosys Ltd view for Intraday 21st May #INFY

Resistance 1570 Watching above 1573 for upside momentum.

Support area 1550 Below 1550 ignoring upside momentum for intraday

Watching below 1545 for downside movement...

Above 1570 ignoring downside move for intraday

Charts for Educational purposes only.

Please follow strict stop loss and risk reward if you follow the level.

Thanks,

V Trade Point

INFOSYS📈 Final Trade Plan – INFOSYS

Component Value

Trade Direction BUY

Entry Price 1578

Stop Loss (SL) 1465

Risk ₹113

Target Price 2177

Reward ₹599

Risk-Reward Ratio 5.3 ✅

Last Swing High 2004

Last Swing Low 1405

✅ Why This Trade is Strong

Strengths:

✔️ HTF, MTF, ITF all aligned UP—multi-timeframe confirmation.

✔️ Entry is backed by ITF BUFL, giving a low-risk setup for a momentum move.

✔️ MTF demand at 1523–1465 acts as a cushion if entry sees minor pullbacks.

✔️ R:R of 5.3 is strong and meets the threshold for a positional swing trade.

⚠️ Key Considerations

🔄 Entry at 1578 is at the very top of the ITF zone, so it must be a momentum-driven breakout entry. Use volume confirmation.

💸 If price falls below 1564–1465 range, it signals weakness—avoid averaging without clear reversal confirmation.

🧱 Resistance levels to monitor: 1680 (minor), 2004 (major previous high), 2177 (target zone).

🧭 Tactical Suggestions

🟨 Partial Entry: Consider 50% entry at 1578, and the rest if it retests 1525 with support.

🟩 Full Add-on: If price breaks 1600 on strong volume, consider an add-on trade with a trail SL.

🔔 Set alerts for:

Breakout above 1600

Retest zone 1525–1480

Profit booking zone around 2000–2177

📊 INFOSYS – Multi-Timeframe Demand Zone Analysis

🔷 Higher Timeframe (HTF)

Timeframe Trend Demand Logic Type Proximal Distal Avg Zone

Yearly UP Yearly Demand Rally–Rally 1259 1231 1245

Half-Yearly UP 6M Demand Rally–Rally 1259 1231 1245

Quarterly UP Qtrly Demand BUFL 1406 1311 1359

HTF Avg 1308 1258 1283

🧠 Insight: Strong long-term trend support from historical demand zones, especially Quarterly zone (1406–1311), shows consistent upward movement.

🔷 Medium Timeframe (MTF)

Timeframe Trend Demand Logic Type Proximal Distal Avg Zone

Monthly UP Monthly Demand BUFL 1480 1400 1440

Weekly UP Weekly Demand DMIP 1523 1465 1494

Daily UP Daily Demand BUFL 1523 1465 1494

MTF Avg 1509 1443 1476

🧠 Insight: Your entry of 1578 is above the MTF zone – implying a breakout buy. The demand band between 1523–1465 provides solid buffer support.

🔷 Intraday Timeframe (ITF)

Timeframe Trend Demand Logic Type Proximal Distal Avg Zone

240M UP 240M Demand BUFL 1578 1564 1571

180M UP 180M Demand BUFL 1578 1564 1571

60M UP 60M Demand BUFL 1578 1564 1571

ITF Avg 1578 1564 1571

🧠 Insight: Entry sits precisely on ITF proximal—a high conviction buy with short-term support and momentum expected from lower timeframes.

Infosys Ltd view for Intraday 15th May #INFY Infosys Ltd view for Intraday 15th May #INFY

Resistance 1600-1610 Watching above 1583 for upside momentum.

Support area 1550 Below 1580 ignoring upside momentum for intraday

Watching below 1545 for downside movement...

Above 1580 ignoring downside move for intraday

Charts for Educational purposes only.

Please follow strict stop loss and risk reward if you follow the level.

Thanks,

V Trade Point

INFYThe IT sector has been under pressure for a long time and has had significant correction, but I believe that it will now undergo a positive retracement.

I saw that the INFY had a strong chance of providing a good payoff. I believe it will attempt to reach 1480, 1550, and 1650 if it crosses the 1431 level with a slight SL of 1380.

Please speak with your advisor before placing an investment; this is only for educational purposes.

Infosys Ltd view for Intraday 14th May #INFY Infosys Ltd view for Intraday 14th May #INFY

Resistance 1580 Watching above 1583 for upside movement...

Support area 1550 Below 1550 ignoring upside momentum for intraday

Watching below 1545 for downside movement...

Above 1580 ignoring downside move for intraday

Charts for Educational purposes only.

Please follow strict stop loss and risk reward if you follow the level.

Thanks,

V Trade Point

INFY - Infosys Ltd (2 hours chart, NSE) - Long PositionINFY - Infosys Ltd (2 hours chart, NSE) - Long Position; short-term research idea.

Risk assessment: Medium {volume & support structure integrity risk}

Risk/Reward ratio ~ 2.83

Current Market Price (CMP) ~ 1480

Entry limit ~ 1455 to 1435 (Avg. - 1445) on April 28, 2025

1. Target limit ~ 1485 (+2.77%; +40 points)

2. Target limit ~ 1530 (+5.88%; +85 points)

Stop order limit ~ 1415 (-2.08%; -30 points)

Disclaimer: Investments in securities markets are subject to market risks. All information presented in this group is strictly for reference and personal study purposes only and is not a recommendation and/or a solicitation to act upon under any interpretation of the letter.

LEGEND:

{curly brackets} = observation notes

= important updates

(parentheses) = information details

~ tilde/approximation = variable value

-hyphen = fixed value

Infosys Ltd view for Intraday 24th April #INFY Infosys Ltd view for Intraday 24th April #INFY

Resistance 1480 Watching above 1483 for upside movement...

Support area 1460 Below 1460 ignoring upside momentum for intraday

Watching below 1458 for downside movement...

Above 1480 ignoring downside move for intraday

Charts for Educational purposes only.

Please follow strict stop loss and risk reward if you follow the level.

Thanks,

V Trade Point

Infosys Ltd view for Intraday 22nd April #INFY Infosys Ltd view for Intraday 22nd April #INFY

Resistance 1460-1465 Watching above 1466 for upside movement...

Support area 1445-1450 Below 1430 ignoring upside momentum for intraday

Watching below 1427 for downside movement...

Above 1445 ignoring downside move for intraday

Charts for Educational purposes only.

Please follow strict stop loss and risk reward if you follow the level.

Thanks,

V Trade Point

Infosys Ltd view for Intraday 22nd April #INFY Infosys Ltd view for Intraday 22nd April #INFY

Resistance 1460-1465 Watching above 1466 for upside movement...

Support area 1445-1450 Below 1430 ignoring upside momentum for intraday

Watching below 1427 for downside movement...

Above 1445 ignoring downside move for intraday

Charts for Educational purposes only.

Please follow strict stop loss and risk reward if you follow the level.

Thanks,

V Trade Point

INFY Daily looking like its bear flaggingInfosys on the daily looking like its bear flagging. The Stock has fallen from 1900+ to 1600 now within past 2 months. However, the daily does not look promising as it's forming a bear flag.

Below is my plan

Wait to see if INFY can get above 1650 to initiate any longs or

Wait to see if INFY cracks below 1575 to initiate any shorts

Will not be touching in between these levels

INFOSYSINFOSYS

MTF Analysis

INFOSYSYearly Demand 1,260

INFOSYS 6 Month Demand 1,730

INFOSYSQtrly Demand BUFL 1,730

INFOSYSMonthly Demand 1,481

INFOSYSWeekly Demand 1,481

INFOSYSDaily Demand DMIP 1,415

ENTRY -1 Long 1,481.0

SL 1,400.0

RISK 81.0

Target as per Entry 2,502.0

RR 12.6

Last High 1,951.0

Last Low 1,400.0