Ye Chart Kuch Kehta Hai - IXIGO (Le Travenues Technology)IXIGO (Le Travenues Technology) Stock Analysis

Technical Chart Analysis

Key Observations

Strong Weekly Breakout: The stock has surged past previous resistance levels with a sharp upward move. The current price is ₹219.88, near its recent high of ₹229.96.

Fibonacci Retracement Levels:

The price has decisively cleared major Fibonacci retracement levels (0.236, 0.382, 0.5, 0.618), indicating strong momentum.

Price is trading above the important 0.786 level (₹216.70), often seen as a bullish continuation signal.

Volume Spike: There's a significant surge in volume (circled in blue). Such big volume confirms strong accumulation and buying interest from institutional and retail investors.

Moving Averages:

The price is well above the EMA clusters (50, 100, 200), reflecting sustained uptrend and strong relative strength.

The 21 EMA and other short/long-term averages are below the current price, confirming bullish trend continuation.

Future Growth Signals From Chart

Breakout With Volume: A high-volume breakout above resistance and Fibonacci levels suggests potential for further upside as buyers dominate the market.

No Immediate Overhead Resistance: With price at all-time or recent highs, there's less supply overhead, which often allows for unimpeded further growth.

Positive Trend Structure: Higher highs and higher lows are observed on the weekly timeframe, signifying a well-established bullish trend.

Fundamental Analysis Aspects

Business Model

Core Business: IXIGO (Le Travenues Technology) operates as a leading travel booking platform in India, leveraging technology to aggregate travel options (flights, trains, buses, hotels) for price comparison and booking.

Asset-light Model: The company primarily acts as an aggregator, minimizing capital expenditure and allowing for scalable growth.

Financial & Growth Metrics

Revenue Growth: IXIGO has reported strong revenue growth in recent years, driven by the recovery in travel demand, increased market penetration, and digital adoption.

Profitability: The company has moved towards profitability, capitalizing on operating leverage as volumes grow.

Expanding Market: The Indian travel and tourism sector is expected to see sustained double-digit growth aided by rising disposable incomes, digital transformation, and increasing urbanization.

Cost Efficiency: Operating margin improvements are visible, strengthened by digital efficiencies and low fixed costs.

Competitive Strengths

Brand Recognition: IXIGO is regarded as a trusted platform with a large user base, especially for train and budget travel.

Technology-driven: Advanced use of AI and data analytics to personalize recommendations and reduce customer acquisition costs.

Government Initiatives: Broader policy push towards digital public infrastructure (e.g., UPI, IRCTC integrations) continues to support volumes.

Future Growth Catalysts

Expansion into Tier 2/3 cities with increasing internet penetration.

Continued recovery in the travel sector post-pandemic.

Diversification into new travel segments and value-added services.

Strategic partnerships and potential international expansion.

Risks to Watch

Intense competition from established OTAs.

Vulnerability to economic downturns or travel disruptions.

Fluctuations in user acquisition costs and evolving technology.

Conclusion:

The technical setup for IXIGO shows strong bullish signals with robust volume support and price action above key resistance levels. Fundamentally, the company stands to benefit from sectoral recovery, digital adoption, and its asset-light, technology-driven business model—making it well-positioned for potential future growth.

IXIGO trade ideas

Amazing breakout on WEEKLY Timeframe - IXIGOCheckout an amazing breakout happened in the stock in Weekly timeframe, macroscopically seen in Daily timeframe. Having a great favor that the stock might be bullish expecting a staggering returns of minimum 25% TGT. IMPORTANT BREAKOUT LEVELS ARE ALWAYS RESPECTED!

NOTE for learners: Place the breakout levels as per the chart shared and track it yourself to get amazed!!

#No complicated chart patterns

#No big big indicators

#No Excel sheet or number magics

TRADE IDEA: WAIT FOR THE STOCK TO BREAKOUT IN WEEKLY TIMEFRAME ABOVE THIS LEVEL.

Checkout an amazing breakout happened in the stock in Weekly timeframe.

Breakouts happening in longer timeframe is way more powerful than the breakouts seen in Daily timeframe. You can blindly invest once the weekly candle closes above the breakout line and stay invested forever. Also these stocks breakouts are lifelong predictions, it means technically these breakouts happen giving more returns in the longer runs. Hence, even when the scrip makes a loss of 10% / 20% / 30% / 50%, the stock will regain and turn around. Once they again enter the same breakout level, they will flyyyyyyyyyyyy like a ROCKET if held in the portfolio in the longer run.

Time makes money, GREEDY & EGO will not make money.

Also, magically these breakouts tend to prove that the companies turn around and fundamentally becoming strong. Also the magic happens when more diversification is done in various sectors under various scripts with equal money invested in each N500 scripts.

The real deal is when to purchase and where to purchase the stock. That is where Breakout study comes into play.

Check this stock which has made an all time low and high chances that it makes a "V" shaped recovery.

> Taking support at last years support or breakout level

> High chances that it reverses from this point.

> Volume dried up badly in last few months / days.

> Very high suspicion based analysis and not based on chart patterns / candle patterns deeply.

> VALUABLE STOCK AVAILABLE AT A DISCOUNTED PRICE

> OPPURTUNITY TO ACCUMULATE ADEQUATE QUANTITY

> MARKET AFTER A CORRECTION / PANIC FALL TO MAKE GOOD INVESTMENT

DISCLAIMER : This is just for educational purpose. This type of analysis is equivalent to catching a falling knife. If you are a warrior, you throw all the knives back else you will be sorrow if it hits SL. Make sure to do your analysis well. This type of analysis only suits high risks investor and whose is willing to throw all the knives above irrespective of any sectoral rotation. BE VERY CAUTIOUS AS IT IS EXTREME BOTTOM FISHING.

HOWEVER, THIS IS HOW MULTIBAGGERS ARE CAUGHT !

STOCK IS AT RIGHT PE / RIGHT EVALUATION / MORE ROAD TO GROW / CORRECTED IV / EXCELLENT BOOKS / USING MARKET CRASH AS AN OPPURTUNITY / EPS AT SKY.

LET'S PUMP IN SOME MONEY AND REVOLUTIONIZE THE NATION'S ECONOMY!

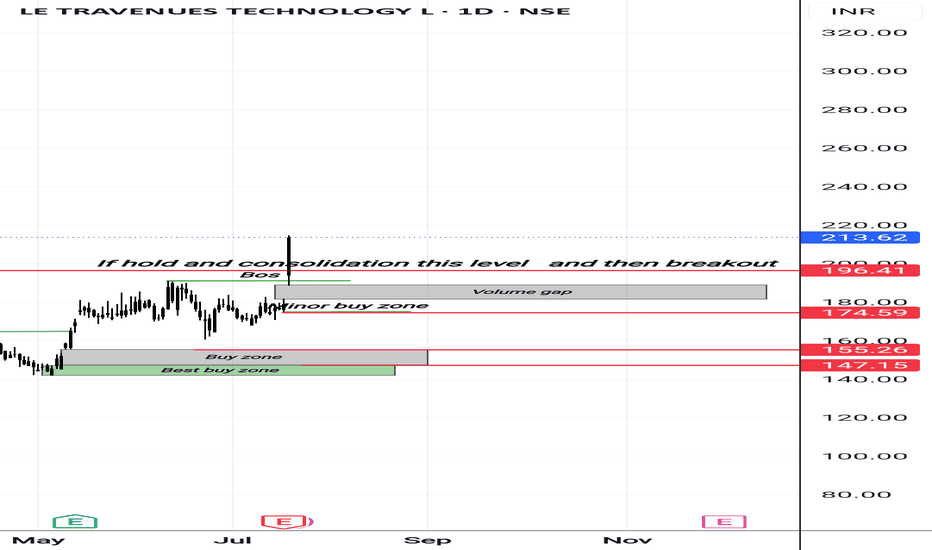

LE TRAVENUES TECHNOLOGY L S/RSupport and Resistance Levels:

Support Levels: These are price points (green line/shade) where a downward trend may be halted due to a concentration of buying interest. Imagine them as a safety net where buyers step in, preventing further decline.

Resistance Levels: Conversely, resistance levels (red line/shade) are where upward trends might stall due to increased selling interest. They act like a ceiling where sellers come in to push prices down.

Breakouts:

Bullish Breakout: When the price moves above resistance, it often indicates strong buying interest and the potential for a continued uptrend. Traders may view this as a signal to buy or hold.

Bearish Breakout: When the price falls below support, it can signal strong selling interest and the potential for a continued downtrend. Traders might see this as a cue to sell or avoid buying.

MA Ribbon (EMA 20, EMA 50, EMA 100, EMA 200) :

Above EMA: If the stock price is above the EMA, it suggests a potential uptrend or bullish momentum.

Below EMA: If the stock price is below the EMA, it indicates a potential downtrend or bearish momentum.

Trendline: A trendline is a straight line drawn on a chart to represent the general direction of a data point set.

Uptrend Line: Drawn by connecting the lows in an upward trend. Indicates that the price is moving higher over time. Acts as a support level, where prices tend to bounce upward.

Downtrend Line: Drawn by connecting the highs in a downward trend. Indicates that the price is moving lower over time. It acts as a resistance level, where prices tend to drop.

Disclaimer:

I am not a SEBI registered. The information provided here is for learning purposes only and should not be interpreted as financial advice. Consider the broader market context and consult with a qualified financial advisor before making investment decisions.

Ixigo Stock Momentum AnalysisIxigo Stock Momentum Analysis

Current Price Action:

Ixigo is currently trading at ₹165.6, showing strong momentum with potential for further upward movement. Recent price action and technical indicators suggest an attractive risk-to-reward setup.

volume is also supporting the move

Trading Levels:

Entry: ₹166

Stop-Loss (SL): ₹153 (below key support, limiting downside risk).

Target: ₹183 (near the next resistance zone, offering a solid reward potential).

Technical Outlook:

Trend: The stock was in consolidation phase now it is coming out from consolidation with very gud volume also supported by 20MA on daily time frame ,

Indicators:

RSI: Currently at 68 indicating bullish strength without overbought conditions

Volume: Increased trading volume suggests strong investor interest, supporting the upward momentum.

Trading Plan:

Enter at ₹166 for an optimal risk-reward setup.

Place a strict SL at ₹153 to protect against unexpected downside.

Book profits at ₹183 as the price approaches the next resistance level.

Risk-Reward Ratio: Approximately 1:1.31, making this a well-balanced trade for momentum-focused investors.

Disclaimer: This analysis is for informational purposes only. Please conduct your own research before making any trading decisions.

Breakout Alert: High-Potential Long Trade Setup in IXIGOIt highlights a descending channel pattern in IXIGO, a common technical analysis formation where price moves between two parallel trendlines sloping downwards.

Key Points:

Resistance (Red Line):

The upper trendline acts as a resistance level where the price faces selling pressure.

It has been tested multiple times, confirming its validity.

Support (Green Line):

The lower trendline serves as a support level where the price typically finds buying interest.

This line also has multiple touchpoints, validating its significance.

Breakout Attempt:

The latest candle shows a strong upward move (+8.87%), attempting to break out of the resistance zone.

Such a breakout might signal a potential trend reversal if it sustains above the channel.

Trading Strategy:

Bullish Case:

If the price sustains above the resistance trendline with good volume, it could indicate the start of an uptrend. Targets can be set using Fibonacci retracement or previous swing highs.

Risk Management:

Place stop-loss below the breakout candle for long positions.

Adjust the stop loss upward as the price progresses to secure profits

IXIGONSE:IXIGO (1D)

CMP : 173.36

• Recently Listed IPO Stock

• Strong Buying seen on Listing Day

• stock has never tested low of Listing Day

• stock opened gap up and sustain that area

• seems in accumulation zone

• can see Breakout of small Range in near future

Sector : Hospitality

Industry : Travel services

Market Cap : 6,714.04 cr.

Category : Small Cap

PE : 88.58

Industry PE : 65.82

About Company

The company is an online travel agency (OTA) that enables travellers to book train, flight, and bus tickets as well as hotels via its OTA platforms under the brand name 'ixigo'.

Le Travenues Technology Ltd .

The company was incorporated on June 3, 2006 as a private limited company under the Companies Act 1956, with the name 'Le Travenues Technology Private Limited', pursuant to a certificate of incorporation granted by the Registrar of Companies, National Capital Territory of Delhi and Haryana situated at New Delhi. Further to the conversion of the Company to a public limited company and as approved by the company's Shareholders pursuant to a special resolution dated July 29, 2021, the name of the company was changed to "Le Travenues Technology Limited' and the Registrar of Companies, Delhi and Haryana (RoC) issued a fresh certificate of incorporation on August 3, 2021.

The company is a technology company focused on empowering Indian travellers to plan, book and manage their trips across rail, air, buses and hotels. Its vision is to become the most customer-centric travel company, by offering the best customer experience to its users. Its focus on travel utility and customer experience for travellers in the 'next billion user market segment is driven by technology, cost-efficiency and its culture of innovation. Its OTA platforms allow travellers to book train tickets, flight tickets, bus tickets and hotels, while providing travel utility tools and services developed using in-house proprietary algorithms and crowd- sourced information, including train PNR status and confirmation predictions, train seat availability alerts, train running status updates and delay predictions, alternate route or mode planning, flight status updates, automated web check-in, bus running status, pricing and availability alerts, deal discovery, destination content, personalized recommendations, instant fare alerts for flights, Al-based travel itinerary planner and automated customer support services.

The company is the leading OTA for the 'next billion users', with its focus on localized content and app features that aim at solving problems of Tier II/ Tier III travellers. It has significant penetration in the next billion user market. "Next billion users' refers to an existing as well as anticipated market of 'new to Internet users that includes all non-Tier I market demand i.e., all travel demand originating from and/or concluding in Tier II, III and rural areas in India as well as 'new to Internet users emerging from middle and lower income groups of Tier I cities.

Business area of the company

The company is an online travel agency (OTA) that enables travellers to book train, flight, and bus tickets as well as hotels via its OTA platforms under the brand. name 'ixigo'. The company's list of services includes PNR status and confirmation predictions, train seat availability alerts, train running status updates and delay predictions, alternative route or transportation planning, flight status updates, automated web check-in, bus running status, price and availability alerts, deal discovery, destination content, personalized recommendations, instant fare alerts for flights, Al- based travel planning service and automated customer support.

Major events and milestones

• 2007: Launched meta-search website for flights.

• 2008: Launched meta-search website for hotels.

• 2011: Launched ixigo flights app.

• 2012: Launched a trip planner.

• 2013: Launched the ixigo-trains mobile application for android.

• 2014: Launched first train utility features on the ixigo-trains mobile application.

• 2017: Launched train bookings.

• 2017: Unveiled TARA, an artificial intelligence driven personal travel assistant.

• 2017: Launched 'ixigo money'.

• 2017: Launched bus bookings.

• 2019: Transition from meta-search model to OTA model.

• 2020: Launched 'ixigo assured".

• 2020: Started a help center and launched an updated version of TARA.

• 2021: Acquired 83.68% of the issued, subscribed and paid-up equity share capital of erstwhile subsidiary, Confirm Ticket.

• 2021: Acquired the business of AbhiBus on a slump sale basis.

• 2022: Acquired additional 6.40% of the issued, subscribed and paid-up equity share capital of erstwhile subsidiary, Confirm Ticket.

• 2022: Acquired 53.22% of the issued, subscribed and paid-up equity share capital of FreshBus.

• 2023: Launched co-branded travel credit card in association with AU Small Finance Bank.

• 2023: Launched 'ixigo assured' for international travel.

• 2023: Launched 'ixigo plan' generative Al trip planner.

• 2023: Launched hotel bookings on website.

• 2023: Launched 'ixigo assured flex' for flights and train.

• 2024: Amalgamation between the company and erstwhile subsidiary, Confirm Ticket pursuant to the Scheme of Amalgamation.