KPIT: From Code to Car – Is This the Next Auto-Tech Multibagger?📊 Technical Chart Insights

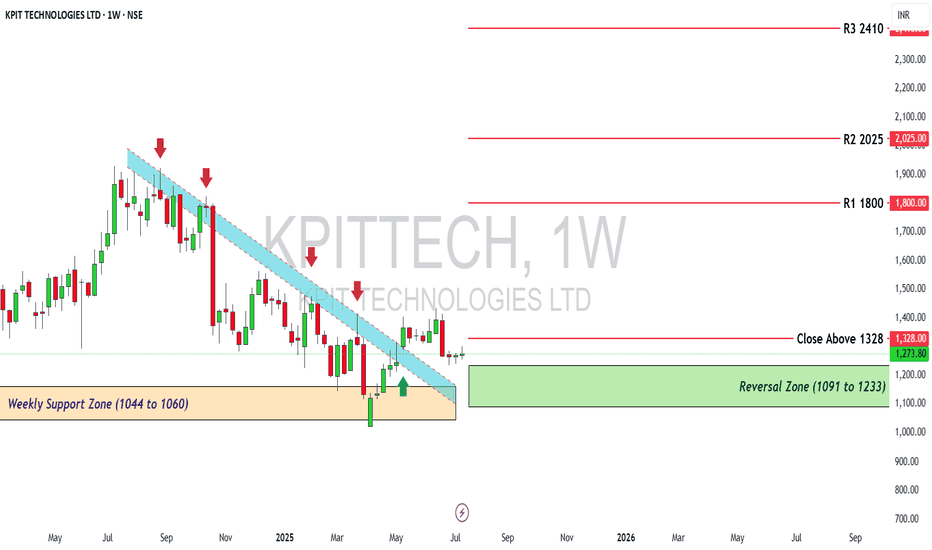

The stock was in a strong downtrend but has now broken above the descending trendline, which is a positive signal.

It has shown a strong reversal from the weekly support zone between ₹1,044 and ₹1,060.

A clear reversal zone is visible between ₹1,091 and ₹1,233 — this is a good accumulation or buy zone for long-term investors.

The stock is currently facing resistance at ₹1,328. A weekly close above this level can confirm a breakout.

If the breakout happens, potential price targets are:

₹1,800 (R1)

₹2,025 (R2)

₹2,410 (R3)

🧠 Investment Strategy Based on Both Views

For Long-Term Investors:

KPIT has strong fundamentals, is in a future-ready business, and is debt-free.

Ideal to buy in dips within ₹1,090 to ₹1,200 range (reversal zone).

Add more if the stock gives a weekly close above ₹1,328.

For Short-Term Traders:

Avoid entries until the stock closes above ₹1,328.

You can enter short-term trades near ₹1,090–₹1,200, with a stop-loss below ₹1,044.

Watch for upside moves towards ₹1,800 or higher if breakout holds.

✅ Strengths

High revenue and profit growth

Strong cash flow and zero debt

High return on equity and capital

Serves leading global auto brands

Positioned well for the EV and autonomous vehicle boom

⚠️ Risks

Valuation is high, so returns may slow in the short term

Relies heavily on global auto industry health

Any correction in global markets can affect KPIT stock

📌 Conclusion

KPIT is a strong company fundamentally and is showing technical signs of reversal.

Ideal for long-term investors looking for growth in auto-tech.

Best approach: buy on dips or breakout above ₹1,328.

Be cautious of short-term volatility but confident in long-term potential.

Disclaimer: lnkd.in

KPITTECH trade ideas

Review and plan for 17th June 2025 Nifty future and banknifty future analysis and intraday plan.

Swing trading ideas.

This video is for information/education purpose only. you are 100% responsible for any actions you take by reading/viewing this post.

please consult your financial advisor before taking any action.

----Vinaykumar hiremath, CMT

KPITECH past and short term trendKPITech is a chip designing company for EVs and electronics, They are more active in Europe than the US, so they might have a huge advantage in safeguarding them from Trump Tariffs. The short-term GTT I think would be 1150 for me as there is a big support of around 6 months at this point.

KPIT TECH LONGEntry- 1200 (OR any dip till 1188)

Support- 1150 (which is the hammer candle low)

Target- 1300

Reason- A great reversal can be seen with a hammer candle in 4hr and a bullish engulfing in `1hr with 4hr RSI being oversold.

Disclaimer- This is just for educational purpose please take advice from your own financial advisor before taking any decision.

Jai Shree Ram.

KPIT LONGKKPIT

MTF Analysis Price

KPITYearly Demand 801

KPIT 6 Month Demand 1,160

KPITQtrly Demand BUFL 1,219

KPITMonthly Demand 1,251

KPITWeekly Demand 1,110

KPITDaily Demand DMIP 1,137

ENTRY -1 Long 1,219

SL 1,090

RISK 129

REWARD 599

Target as per Entry-1 1,818

RR 5

Last High 1,921

Last Low 1,090

ENTRY -2 Long 1,110

SL 1,090

RISK 20

REWARD 708

Target as per Entry-2 1,818

RR 35

Last High 1,921

Last Low 1,090

Trade Set Up

Buy Volume -1 As per Entry-1 1,000

Buy Volume -2 As per Entry-2 1,000

Average Buy Price 1,165

Trade Value 2,329,000

SL Point 1,090

RISK 75

Exit Target 1,818

Target Value 3,636,000

Profit Target 1,307,000

RISK Value 149,000

Risk to Reward 9

KPITTECH - RSI Divergence on major support/Demand AreaStock currently showing classical RSI Divergence case where price has made a Lower Low and lower high on Major support zone but at the same time RSI is making HH and HL.

This can be a major turning point for stock to start up-moving only in case if it continues to make HH and HL.

RSI divergence is just a price behavior indicator which give indication of demand at demand zone and a confirmation of is always needed to support this fact by stock behavior making HH and HL.

KPIT Technologies Ltd for Intraday 25th October #KPITTECH KPIT Technologies Ltd for Intraday 25th October #KPITTECH

Resistance 1425. Watching above 1428 for upside movement...

Support area 1400. Below 1400 ignoring upside momentum for intraday

Support 1400.Watching below 1395 for downside movement...

Resistance area 1420-1425

Above 1400 ignoring downside move for intraday

Charts for Educational purposes only.

Please follow strict stop loss and risk reward if you follow the level.

Thanks,

V Trade Point

KPIT TECH S/RSupport and Resistance Levels:

Support Levels: These are price points (green line/shade) where a downward trend may be halted due to a concentration of buying interest. Imagine them as a safety net where buyers step in, preventing further decline.

Resistance Levels: Conversely, resistance levels (red line/shade) are where upward trends might stall due to increased selling interest. They act like a ceiling where sellers come in to push prices down.

Breakouts:

Bullish Breakout: When the price moves above resistance, it often indicates strong buying interest and the potential for a continued uptrend. Traders may view this as a signal to buy or hold.

Bearish Breakout: When the price falls below support, it can signal strong selling interest and the potential for a continued downtrend. Traders might see this as a cue to sell or avoid buying.

20 EMA (Exponential Moving Average):

Above 20 EMA(50 EMA): If the stock price is above the 20 EMA, it suggests a potential uptrend or bullish momentum.

Below 20 EMA: If the stock price is below the 20 EMA, it indicates a potential downtrend or bearish momentum.

Trendline: A trendline is a straight line drawn on a chart to represent the general direction of a data point set.

Uptrend Line: Drawn by connecting the lows in an upward trend. Indicates that the price is moving higher over time. Acts as a support level, where prices tend to bounce upward.

Downtrend Line: Drawn by connecting the highs in a downward trend. Indicates that the price is moving lower over time. It acts as a resistance level, where prices tend to drop.

RSI: RSI readings greater than the 70 level are overbought territory, and RSI readings lower than the 30 level are considered oversold territory.

Combining RSI with Support and Resistance:

Support Level: This is a price level where a stock tends to find buying interest, preventing it from falling further. If RSI is showing an oversold condition (below 30) and the price is near or at a strong support level, it could be a good buy signal.

Resistance Level: This is a price level where a stock tends to find selling interest, preventing it from rising further. If RSI is showing an overbought condition (above 70) and the price is near or at a strong resistance level, it could be a signal to sell or short the asset.

Disclaimer:

I am not a SEBI registered. The information provided here is for learning purposes only and should not be interpreted as financial advice. Consider the broader market context and consult with a qualified financial advisor before making investment decisions.

KPIT Technologies Ltd view for Intraday 29th August #KPITTECH KPIT Technologies Ltd view for Intraday 29th August #KPITTECH

Buying may witness above 1885

Support area 1850.. Below ignoring buying momentum for intraday

Selling may witness below 1820

Resistance area 1850

Above ignoring selling momentum for intraday

Charts for Educational purposes only.

Please follow strict stop loss and risk reward if you follow the level.

Thanks,

V Trade Point

KPIT TECHKindly do your own study. This study is only for view discussion.

Kpit tech is in momentum in higher time frame and making higher high and higher low.

Monthly price has challenged upper bollinger band

Monthly MACD is in PCO stat

Weekly price has given ATH BO with high volume

Weekly MACD has given PCO above zero line.

Weekly RSI is above 60 level

Weekly ADX is showing strength

Daily price has given breakout with huge volume

Daily RSI is above 60

Daily ADX is strong

NSE:KPITTECH Trendline and Resistance BreakoutTechnical Analysis:

KPITTECH has recently demonstrated a bullish breakout above a significant trendline and resistance level, indicating potential for further upward momentum in the stock price. This breakout is reinforced by technical indicators and price action, suggesting additional gains are probable.

Trendline Breakout:

The stock had been consolidating below a long-term descending trendline for several weeks. Recently, KPITTECH broke above this trendline, indicating a potential trend reversal from bearish to bullish. The breakout occurred around the ₹1600 level, which had been a significant resistance point.

Resistance Breakout:

In addition to breaking the trendline, KPITTECH also surpassed a critical horizontal resistance level at ₹1620. This level had previously acted as a strong barrier, but the recent price action suggests that the bulls have taken control.

Volume Confirmation:

The breakout was accompanied by a notable increase in trading volume, providing additional confirmation of the bullish trend. This surge in volume indicates strong buying interest and enhances the reliability of the breakout.

Potential Trade Setup:

Entry Point: After a confirmed breakout above the ₹1640 level.

Stop Loss: Below the recent swing low at ₹1610.

Target 1: ₹1997

Target 2: ₹2030

RSI Analysis:

The Relative Strength Index (RSI) is currently trending upwards, indicating increased buying pressure. The RSI remains below the overbought territory, suggesting there is still room for further price appreciation.

Moving Averages:

The stock is trading above its 50-day and 200-day moving averages, further confirming the bullish sentiment. The crossover of the 50-day moving average above the 200-day moving average (Golden Cross) adds to the bullish outlook.

MACD Analysis:

The Moving Average Convergence Divergence (MACD) indicator shows a bullish crossover, with the MACD line crossing above the signal line. This crossover supports the bullish trend and the potential for higher prices.

Disclaimer:

This analysis is for informational purposes only and does not constitute investment advice. Trading stocks and other financial instruments involves risk and can result in significant financial loss. Past performance is not indicative of future results. Always conduct your own research or consult with a professional financial advisor before making any investment decisions.