KUANTUM PAPERSKuantum Papers Ltd. is a leading paper manufacturing company with integrated production facilities and a strong portfolio across writing, printing, packaging, and specialty paper segments. The company focuses on eco-friendly processes and operational efficiency, catering to domestic and institutional clients. The stock is currently trading at ₹145.13.

Kuantum Papers Ltd. – FY22–FY25 Snapshot

Sales – ₹582 Cr → ₹612 Cr → ₹652 Cr → ₹695 Cr – Steady topline growth from volume expansion and pricing mix Net Profit – ₹53.8 Cr → ₹61.2 Cr → ₹68.4 Cr → ₹76.3 Cr – Earnings driven by capacity utilization and margin stability

Order Book – Moderate → Moderate → Strong → Strong – Expansion in institutional orders and packaging segment

Dividend Yield (%) – 0.52% → 0.55% → 0.58% → 0.60% – Gradual payout growth aligned with profitability Operating Performance – Moderate → Strong → Strong → Strong – Improved efficiency and raw material cost

Equity Capital – ₹8.12 Cr (constant) – Lean capital base with no dilution

Total Debt – ₹76 Cr → ₹72 Cr → ₹68 Cr → ₹64 Cr – Gradual deleveraging supported by internal accruals

Total Liabilities – ₹228 Cr → ₹236 Cr → ₹243 Cr → ₹252 Cr – Expansion aligned to capex and working capital needs

Fixed Assets – ₹102 Cr → ₹107 Cr → ₹113 Cr → ₹118 Cr – Capacity enhancement toward high-value grades

Latest Highlights FY25 net profit rose 11.6% YoY to ₹76.3 Cr; revenue increased 6.6% to ₹695 Cr EPS: ₹9.40 | EBITDA Margin: 22.7% | Net Margin: 10.98% Return on Equity: 17.82% | Return on Assets: 11.26% Promoter holding: 50.06% | Dividend Yield: 0.60% Premium paper grades and packaging demand boosting margin profile Ongoing backward integration and biomass energy support sustainability focus

Institutional Interest & Ownership Trends Promoter holding remains firm at 50.06%, with no pledging or dilution. Institutional activity is limited but stable, with visible accumulation by PMS and HNI desks in recent quarters. Delivery volume trends suggest quiet positioning aligned with mid-cap FMCG and specialty packaging consumption themes.

Business Growth Verdict Yes, Kuantum Papers continues to scale steadily across its core and value-added segments Margins remain healthy supported by operational leverage Debt is declining, enhancing balance sheet visibility Capex supports long-term margin mix and ESG compliance

Company Guidance Management expects mid-to-high single-digit revenue growth in FY26, supported by product mix optimization, energy cost control, and expansion in institutional packaging clients.

Final Investment Verdict Kuantum Papers Ltd. represents a disciplined play in India’s paper manufacturing and packaging ecosystem. Its steady financial metrics, sustainability initiatives, and growing institutional demand position it well for compounding. The consistent profitability, improving cash flows, and conservative debt structure make it attractive for investors seeking mid-cap exposure to industrial FMCG-linked consumption.

KUANTUM trade ideas

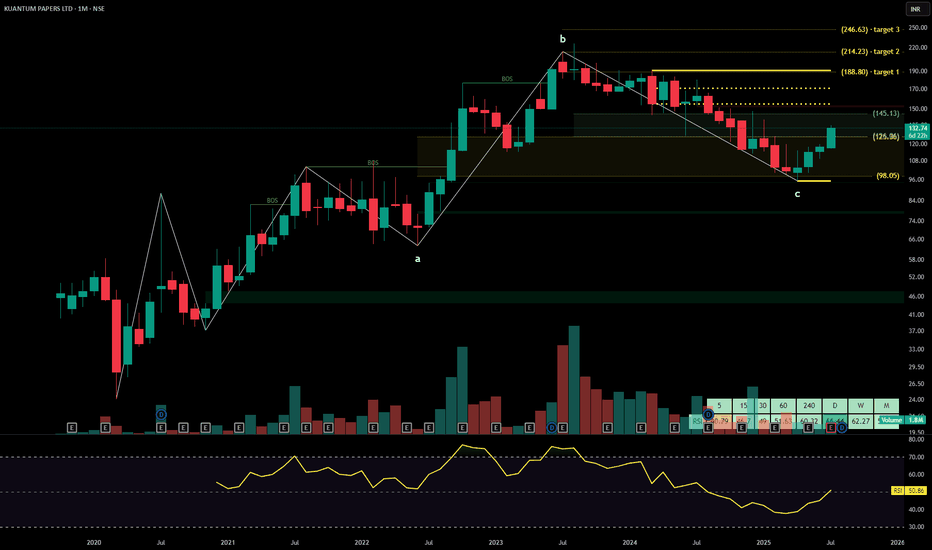

KUANTUM : is writing new wave?🚀what next in Kuantum Papers Ltd! 📈

### Chart Analysis

The chart shows a breakout from a falling wedge pattern .

Current Price : 130 INR

Target Zone : 160-163 INR

Golden Retracement Zone : 130-120 INR (Pending buyer's orders)

Stop Loss : 115 INR

### Trade Plan

Entry : Consider entering long positions within the golden retracement zone (130-120 INR) .

Target : Aim for the target zone between 160-163 INR .

Stop Loss : Place a stop loss at 115 INR to manage risk.

### Conclusion

The falling wedge breakout suggests a potential bullish move.

Monitor the price action closely and adjust the plan as needed.

The trade setup offers a favorable risk-reward ratio .

📢 Disclaimer : This trade plan is for informational purposes only and does not constitute financial advice. Always conduct your own research and consult with a qualified financial advisor before making any investment decisions.

#KuantumPapers #TechnicalAnalysis #TradingPlan #StockMarket #Investment