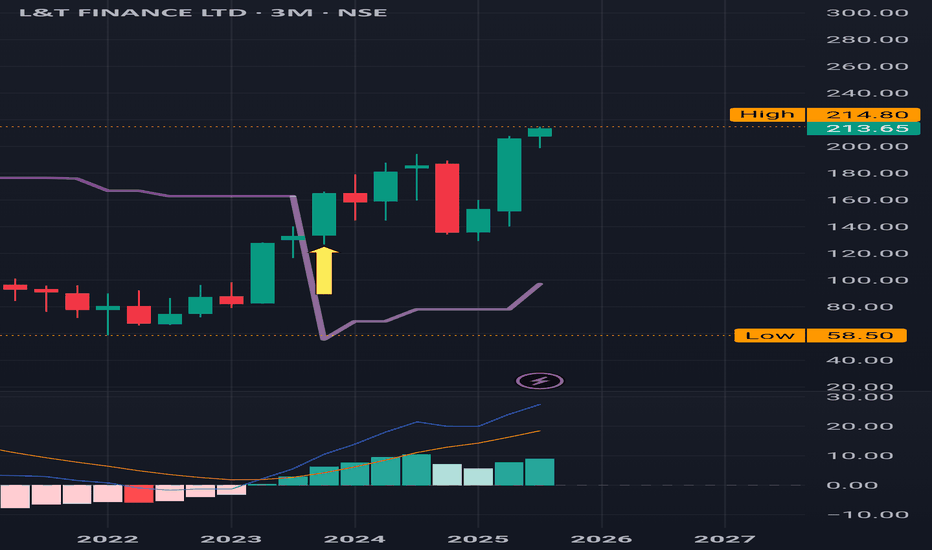

L&T Finance : Made a new High after a buy signal ,3 Months Time L&T Finance : Made a new High after a buy signal . Cleared the previous resistance of 198.90.

3 months Time Frame .

( Not a Buy / Sell Recommendation

Do your own due diligence ,Market is subject to risks, This is my own view and for learning only .)

LTF trade ideas

L&T Finance – Cup & Handle Breakout After 8 Years!L&T Finance has finally broken out of a classic Cup and Handle pattern, reclaiming its 2017 all-time high after nearly 8 years of consolidation. Strong volume confirmation adds weight to this long-term bullish breakout. A must-watch for positional traders and investors looking for momentum in the NBFC space!

L&T Finance : Monthly Time Frame , cleared the Red Band L&T Finance : Monthly Time Frame , cleared the Red Band Resistance at around 175 .

It's in a Buy trajectory on a daily time frame.

( Not a Buy / Sell Recommendation

Do your own due diligence ,Market is subject to risks, This is my own view and for learning only .)

LTF Price actionSO there is many change in character in the zone

firstly it moved upward and from the high of 196 the stock fell

it came near 180 to get some liquidity and then it it consolidated for a while

Then it gave a breakout, touched the level of 193 and later on again came to retest the level of 187.

After the breakout, it again came down to the level of 188. Then it gave us a trade rally of 5%.'

HISTORIC BREAKOUT IN L&T FINANCE! The stock is trading at high levels at all times. Why is this a strong buy?

1. The Stock has given a breakout on a monthly as well as weekly chart.

2. When the stock breached the important levels, the volume was significantly high.

3. It has given a good close after the breakout and sustained the selling pressure.

4. The Nifty Financial Index is also in favour.

Note: This stock can give 20-30% returns in the coming 1-2 months. This is the right moment to invest in this sector for potential returns.

Stop Loss: Though the stock has given a breakout, for confirmation, we have to see whether it will sustain throughout the week or not. If the weekly close is above our levels, we will add some more quantities.

L&T Finance : Daily Time Frame , Buy L&T Finance : In a Buy trajectory on a daily time frame. Very clean buy signal and a flawless run after a Buy Signal

200 will be an important level to test as mentioned in my other post.

( Not a Buy / Sell Recommendation

Do your own due diligence ,Market is subject to risks, This is my own view and for learning only .)

L&T Finance : In a Buy trajectory on a Monthly time frame L&T Finance : In a Buy trajectory on a Monthly time frame .

Trying hard to stay above and clear major the Red Band resistance.

Rs. 200+ would be an important milestone.

( Not a Buy / Sell Recommendation

Do your own due diligence ,Market is subject to risks, This is my own view and for learning only .)

L&T Finance Gearing Up — Breakout or Rejection Ahead?"L&T Finance is showing strength as it approaches a key resistance zone on the chart. With increasing volume and bullish momentum, a breakout above this level could trigger a fresh upward move. However, if the resistance holds, a pullback may follow. Traders should watch closely for confirmation before taking positions.

l&t- this will finance my expenses !!! 2X!!Key Observations:

Chart Patterns:

A cup-and-handle formation is visible, indicating a bullish continuation pattern.

A wave structure (likely Elliott Wave) is drawn, showing a Wave 5 target at 259.50 INR.

Support & Resistance:

Support Zone: 125-135 INR (marked as a buying opportunity).

Stop Loss (SL): 111 INR.

Resistance Levels:

164.05 INR (1.618 Fibonacci level).

188.77 - 198.90 INR (previous highs).

259.50 INR (projected Wave 5 target).

Fibonacci Levels:

0.5 Retracement: 125.12 INR (aligns with the buy zone).

0.382 Retracement: 141.11 INR (potential resistance).

1.618 Extension: 164.05 INR (breakout level).

Indicators:

RSI (Relative Strength Index): 49.39, indicating neutral momentum.

RSI-Based Moving Average: 62.65, showing a previous uptrend losing strength.

Conclusion:

The chart suggests a bullish long-term outlook, with a buying opportunity in the 125-135 INR range.

A break above 164 INR could confirm the next bullish wave.

The RSI is neutral, meaning the stock could consolidate before making the next move.

L&T Finance - Strong Support Zone Swing Trade SetupL&T Finance has reached a key support zone around the 140-145 range , which has been tested several times in the past (indicated by the blue arrows). This zone has consistently held up, with strong rebounds, signaling significant buying interest.

Support Zone: 140-145 range

Current Price: 150.40

Entry Strategy: I’ll be watching for a bullish or green daily candle forming near the support zone. Once that candle is established, I’ll look for a 15-minute candle to break above the high of the daily candle. Once that happens, the entry will be confirmed.

If the support holds and we get a bullish daily candle, followed by a 15-minute breakout, this could be a strong setup for a reversal. The volume spike seen here also adds confidence that buyers may be stepping back in at these levels.

Disclaimer: This post is for educational purposes only and not financial advice. Always do your own research and manage your risk responsibly.

LTF LONGLTF

MTF Analysis

LTF Corp Yearly Breakout 166

LTF Corp 6 Month Demand Breakout 166

LTF Corp Qtrly Demand BUFL 179

LTF Corp Monthly Demand 175

LTF Corp Weekly bufl 157

LTF Corp Weekly bufl 169

LTF Corp dAILY bufl 175

LTF Corp dAILY DMIP 167

ENTRY 175

SL 170

RISK 5

Target 213

REWARD POINT 38

Last High 194

RR 7.60

RR 22%