Review and plan for 17th July 2025 Nifty future and banknifty future analysis and intraday plan.

This video is for information/education purpose only. you are 100% responsible for any actions you take by reading/viewing this post.

please consult your financial advisor before taking any action.

----Vinaykumar hiremath, CMT

LTTS trade ideas

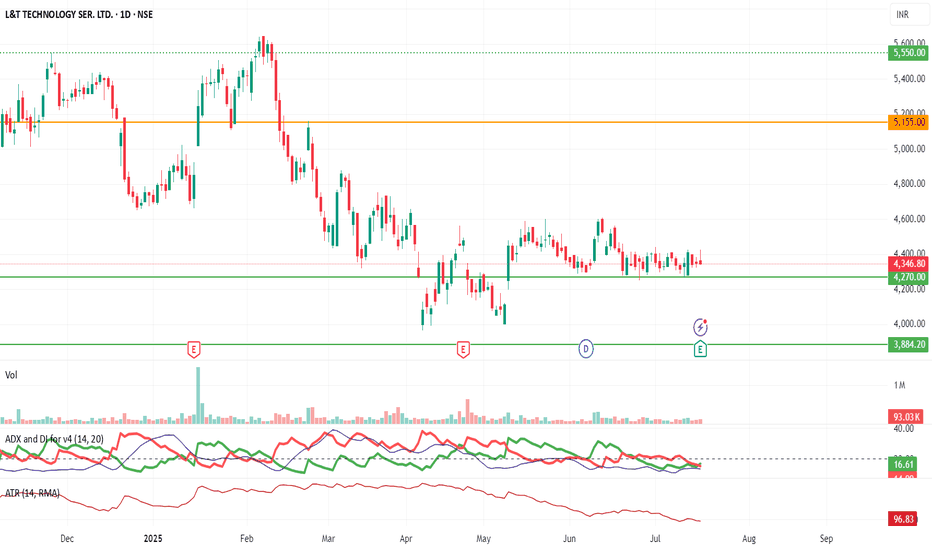

LTTS Weekly Trade Setup(14th-18th July 2025) – Parallel ChannelThis week, L&T Technology Services (LTTS) is showing a potential breakout opportunity that requires patience and precision. As the stock approaches a key resistance zone near ₹4445, traders should resist the urge to jump in early and instead wait for a breakout and confirmed re-test before entering any long positions.

Let’s break this down.

1. Why the Breakout is Important

- LTTS has been consolidating within a parallel channel between ₹4280 (support) and ₹4445 (resistance). Breakouts from such structures often trigger significant moves — but only when confirmed.

- A false breakout can trap early traders. Hence, waiting for the price to break above ₹4445 and then re-test this level is critical.

2. The Strategy – Wait and React

📌 Step 1: Watch for Breakout

Monitor price action as it approaches and breaches the ₹4445 resistance.

Look for strong bullish candles with volume to validate the breakout.

📌 Step 2: Wait for Re-test

After breakout, price may pull back to test the previous resistance.

This re-test acts as a confirmation that bulls are defending the breakout.

📌 Step 3: Look for Confirmation

Enter only when you see a bullish candlestick pattern (like a bullish engulfing or hammer) near the re-test level on 15-min or 1-hour charts.

🛡️ Stop Loss:

Place your stop below the swing low of the re-test.

This protects you if the breakout fails.

🎯 Target:

Profit booking zone is near ₹4580–₹4600.

Risk/reward ratio: 1:2, 1:3, 1:4+

3. Why Re-test Entries are Powerful

They allow low-risk entries with a tight stop loss.

You avoid chasing price and reduce emotional trading.

Confirmation helps you filter out false breakouts.

4. Final Words

In trading, discipline often beats speed. This LTTS setup is all about timing and structure.

🔔 Watch for the breakout.

🧘♂️ Wait for the re-test.

🎯 Enter only with confirmation.

If executed properly, this trade offers a clean, high R:R opportunity with a clearly defined setup.

L&T TECHNOLOGY SER LTD S/RSupport and Resistance Levels:

Support Levels: These are price points (green line/shade) where a downward trend may be halted due to a concentration of buying interest. Imagine them as a safety net where buyers step in, preventing further decline.

Resistance Levels: Conversely, resistance levels (red line/shade) are where upward trends might stall due to increased selling interest. They act like a ceiling where sellers come in to push prices down.

Breakouts:

Bullish Breakout: When the price moves above resistance, it often indicates strong buying interest and the potential for a continued uptrend. Traders may view this as a signal to buy or hold.

Bearish Breakout: When the price falls below support, it can signal strong selling interest and the potential for a continued downtrend. Traders might see this as a cue to sell or avoid buying.

MA Ribbon (EMA 20, EMA 50, EMA 100, EMA 200) :

Above EMA: If the stock price is above the EMA, it suggests a potential uptrend or bullish momentum.

Below EMA: If the stock price is below the EMA, it indicates a potential downtrend or bearish momentum.

Trendline: A trendline is a straight line drawn on a chart to represent the general direction of a data point set.

Uptrend Line: Drawn by connecting the lows in an upward trend. Indicates that the price is moving higher over time. Acts as a support level, where prices tend to bounce upward.

Downtrend Line: Drawn by connecting the highs in a downward trend. Indicates that the price is moving lower over time. It acts as a resistance level, where prices tend to drop.

Disclaimer:

I am not a SEBI registered. The information provided here is for learning purposes only and should not be interpreted as financial advice. Consider the broader market context and consult with a qualified financial advisor before making investment decisions.

LTT Preempting Horizontal Line & Rounding Bottom Breakout!🚀 LTTS: Near All-Time High and Preempting Horizontal Line & Rounding Bottom Breakout! 🚀

Current Market Price: 5431

Stop Loss: 4927

Target: 8980

LTTS is gearing up for a major long-term rounding bottom breakout above the critical level of 5955. The stock is contracting near this level, indicating potential preparation for a significant breakout. With the IT sector showing strong momentum, this could be an exciting opportunity for investors!

📈 Strategy:

Create positions in a staggered manner to manage risk effectively.

Watch for a confirmed breakout above 5955, as this could lead to substantial upside.

📉 Disclaimer: As a non-SEBI registered analyst, I recommend conducting thorough research or seeking advice from financial professionals before making investment decisions.

#LTTS #TechnicalAnalysis #ITSector #BreakoutStrategy #RoundingBottom #InvestmentOpportunities

LTTS BREAKOUT RESISTANCE ZONE AND CUP AND HANDLE PATTERN**Explanation:**

This trading system helps you avoid blind trades by providing confirmation for better entries and exits. It considers volume, past prices, and price range.

**Entry/Exit Points:**

- **Entry/Exit Lines:** Use the GREEN line for long trades and the RED line for short trades, based on confirmation from your trading plan.

- **Stop Loss:** For long trades, set the stop loss at the RED line below. For short trades, set it at the GREEN line above.

- **Take Profit:** For long trades, target the next RED line above. For short trades, target the next GREEN line below.

**Timeframe:**

Use a M timeframe for trading.

**Risk Disclaimer:**

This setup is for educational purposes. I'm not responsible for your gains or losses. Check the chart for more details.

L&T Technology Services Ltd

Target mentioned in chart - Longterm play

FUNDAMENTALS

Market Cap

₹ 60,020 Cr.

Current Price

₹ 5,671

High / Low

₹ 6,000 / 4,107

Stock P/E

47.2

Book Value

₹ 478

Dividend Yield

0.88 %

ROCE

33.4 %

ROE

25.8 %

Face Value

₹ 2.00

Price to book value

11.9

Intrinsic Value

₹ 1,912

PEG Ratio

4.19

Price to Sales

6.76

Debt

₹ 627 Cr.

Debt to equity

0.12

Int Coverage

36.4

Reserves

₹ 5,030 Cr.

Promoter holding

73.7 %

Pledged percentage

0.00 %

EPS last year

₹ 119

Net CF

₹ 463 Cr.

Price to Cash Flow

44.7

Free Cash Flow

₹ 1,101 Cr.

OPM last year

21.1 %

Return on assets

15.1 %

Industry PE

36.1

Sales growth

8.69 %

SWING IDEA - L&T TECHNOLOGY SERVICESL&T Technology Services (LTTS) is showing technical signals that suggest a promising swing trading opportunity.

Reasons are listed below :

4700 Resistance Zone Breakout and Retest : The 4700 level has been a significant resistance zone. The price broke above this level, retested it, and is now continuing its upward move, indicating strong bullish momentum.

Bullish Engulfing Candle on Daily Timeframe : The formation of a bullish engulfing candle on the daily chart signifies strong buying pressure and suggests potential for further upward movement.

200 EMA Support on Daily Timeframe : The stock is finding support at the 200-day exponential moving average (EMA), reinforcing the overall bullish sentiment and providing a strong support level.

0.382 Fibonacci Support : The price is also supported by the 0.382 Fibonacci retracement level, further strengthening the case for an upward move.

Target - 5420 // 5870

Stoploss - daily close below 4390

DISCLAIMER -

Decisions to buy, sell, hold or trade in securities, commodities and other investments involve risk and are best made based on the advice of qualified financial professionals. Any trading in securities or other investments involves a risk of substantial losses. The practice of "Day Trading" involves particularly high risks and can cause you to lose substantial sums of money. Before undertaking any trading program, you should consult a qualified financial professional. Please consider carefully whether such trading is suitable for you in light of your financial condition and ability to bear financial risks. Under no circumstances shall we be liable for any loss or damage you or anyone else incurs as a result of any trading or investment activity that you or anyone else engages in based on any information or material you receive through TradingView or our services.

@visionary.growth.insights

L&T TECHNOLOGY GOODLTTS is an engineering services provider incorporated in 2012, offers engineering,, research and development (ER&D) and digitalization solutions to companies in the areas such as Transportation, Industrial Products, Telecom and Hi-Tech, Medical Devices and Plant

Engineering. LTTS’ customer base includes 69 Fortune 500 companies and 53 of the world’s top ER&D companies

LTTS: Beautiful Breakout But ...The chart should give you everything you need to know. But here are some pointers for those who like to read:

- A beautiful Symmetric Triangle breakout. The support and resistance trendlines were religiously followed. Thus, making the pattern stronger.

- The consolidation period was a good 15 months. Every IT company has gone through the pain.

- We have defined support and resistance zones. The triangle breakout is good but is exactly near the Crucial resistance zone.

- A break and sustenance of it will be crucial for the future upmove.

- We have a 5000 psychological level sitting on the top as our first target

- Nifty IT is also gearing up for some long-due momentum. This should give a push.

What should we analyze next??

Have Requests, Questions, or Suggestions? Let us know in the comments below.👇

While you do that, how about a boost for some motivation🚀

⚠️Disclaimer: We are not registered advisors. The views expressed here are merely personal opinions. Irrespective of the language used, Nothing mentioned here should be considered as advice or recommendation. Please consult with your financial advisors before making any investment decisions. Like everybody else, we too can be wrong at times ✌🏻

LTTS is facing ResistanceLTTS can be a good buy or sell for tomorrow as it is an all-time high.

If it breaks the level of 5560 then take buy-side trade but be careful as the market is bearish and you are on an all-time high.

And if it gives any rejection candle in 5 min. timeframe and confirm its reversal move by another bearish candle then take the sell side trade and targets can be 5546,5526. Further, it can also fill the gap and the target would be 5388 i.e. 200 EMA.

LTTS Yesterday on resistance a big marubozu candle generate a signal & today confirm candle stick pattern. Market sentiments very Bearish.

Macd also indicate some downside move possible

RSI indicate bearish

Make a fresh short when today low break.

Disclaimer This is my personal view for education purpose only

No Buy sell recommendations