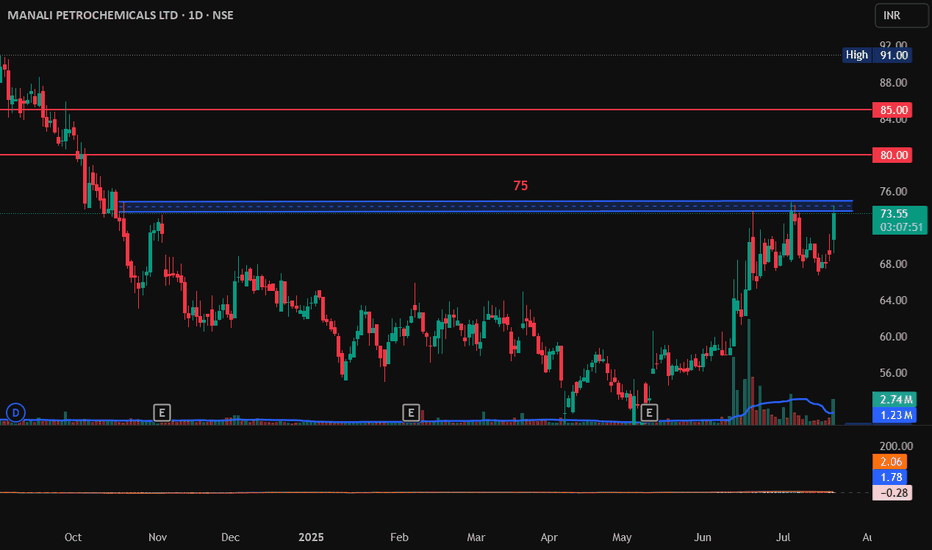

MANALI PETROCHEMICALS LTD, Breakout, LongMANALI PETROCHEMICALS LTD has raised 6% today and its near the resistance zone of 75. If it breaks this 75 and sustain it with Bullish candlestick patterns like Bullish Engulfing, Hammer & Inverted Hammer, Piercing Line, Morning Star, Three White Soldiers, Tweezer Bottoms or Bullish Harami.

Entry on Bullish pattern: 75

Target1: 80

Target2: 85.

SL: 70.

MANALIPETC trade ideas

Shorts time very long position in very low SL ! Disclaimer: We are not registered

advisors. The views expressed here ar merely personal opinions. Irrespective the language used, Nothing mentioned here should be considered as advice or recommendation. Please consult with your financial advisors before making any investment decisions. Like everybody else, we too can be wrong a times

MANALIPETCStock name = Manali Petrochemicals Limited.

Weekly chart setup

Chart is self explanatory. Levels of breakout, possible up-moves (where stock may find resistances) and support (close below which, setup will be invalidated) are clearly defined.

Disclaimer: This is for demonstration and educational purpose only. this is not buying and selling recommendations. I am not SEBI registered. please consult your financial advisor before taking any trade.

Manali's idea on rising crude prices !Manali Petrochem is involved in the business activities of Manufacture of plastic in primary forms (includes amino-resins, polyurethanes etc.). So rising crude oil doesn't impact it much, dont go for the name of the company

Fundamentals

Company has a total operating revenue of Rs. 1,620.82 Cr. on a trailing 12-month basis. An annual revenue growth of 27% is outstanding, Pre-tax margin of 26% is great, ROE of 29% is exceptional. The company is debt free and has a strong balance sheet enabling it to report stable earnings growth across business cycles.

Technical

The stock has an EPS Rank of 99 which is a GREAT score indicating consistency in earnings, a RS Rating of 43 which is POOR indicating the underperformance as compared to other stocks.

Along with it I have marked crucial Resistance and Support line for this stock on the chart.

Conclusion

Overall, the stock is lagging behind in some of the technical parameters, but great earnings make it a stock to examine in more detail.

Manalipetro - Time to fly

- Undervalued Pick : MANALIPETRO CHEMICALS.

- Reasons :

- Pros :

- Very UNDERVALUED Stock.

- Price is taking support on SIGNIFICANT TRENDLINE.

- Trend is still Upward after correction.

- GOOD BUY RIGHT NOW FOR SHORT TERM ON TRENDLINE SUPPORT OR DEMAND ZONE.

- CONS :

- It is repeatedly coming in ASM STAGE 4.

- It is now in the T2T SEGMENT.

- GOOD FOR FUTURE OR TARGETS.

- Wait for it to come OUT OF ASM STAGE once .

- Can touch 52W HIGH OR ALL TIME HIGH IN Short Term.

- TAKE TRADES BASED ON YOUR RR RATIO.

Manalipetrochem prediction and levels.Manalipetrochem is traveling in a trend channel. As manalipetrochem is a crude oil based company, the price of the crude oil may affect the company performance. The crude oil price also increasing and it may cause increase of their raw material costs and negative impact of their profit. The levels are mentioned in the chart buy or sell after breakout.