MARUTI trade ideas

Divergence on Maruti Suzuki In Falling MarketExtremely High Risk Trade

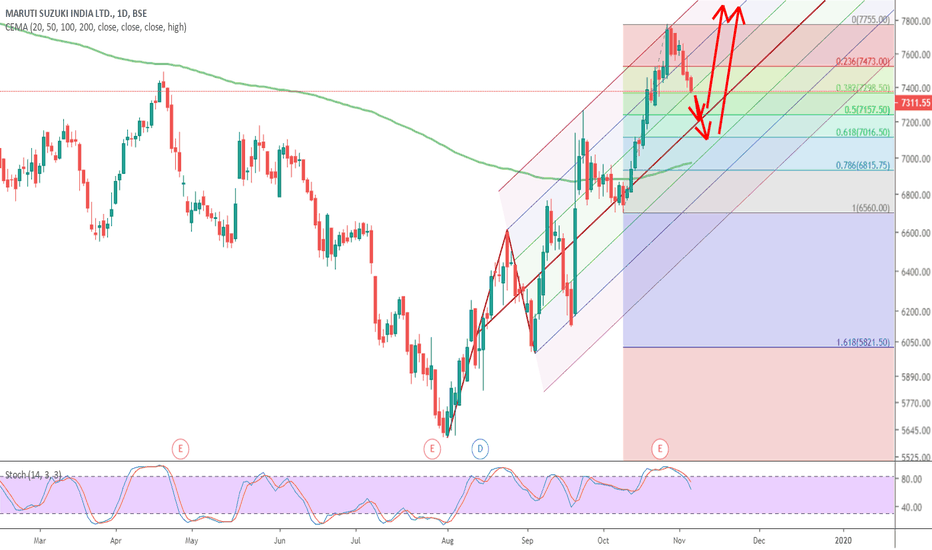

Maruti Suzuki Auto Heavy Weigh In Nifty 50 And Sensex 30 Index Showing Divergence on stochastic Indicator

Inverse Head And Shoulder Formation On weekly Chart.

If Gaps up to traps the bear, Shortcovering can be seen in this counter.

Do u your own analysis before trading

Maruti Multi time frame analysis - Downtrend swing tradeHello,

Maruti stock is trading in monthly time zone and clearly is in downtrend with making higher high and higher low and recently its decisively break the monthly support and took the rest at daily support range. now it will retrace till the monthly support zone and monthly support zone will react as a resistance for the retrenchment . after that it will continues his downtrend.

Will make the position after the rejection at monthly support. Will see how it works.. This can be our swing trade ..

Regards,

Satish

Buy long term and sell covered callCorrect time to buy auto sector stock when things are not going so well. Things will be choppy for couple of months. Maruti is fundamentally strong support and captures around 50% market in passenger vehicles. It will bounce back soon.

The idea is to buy equity on each dip, pledge shares and sell CE (won't cross the channel given in graph this month).