NAVA trade ideas

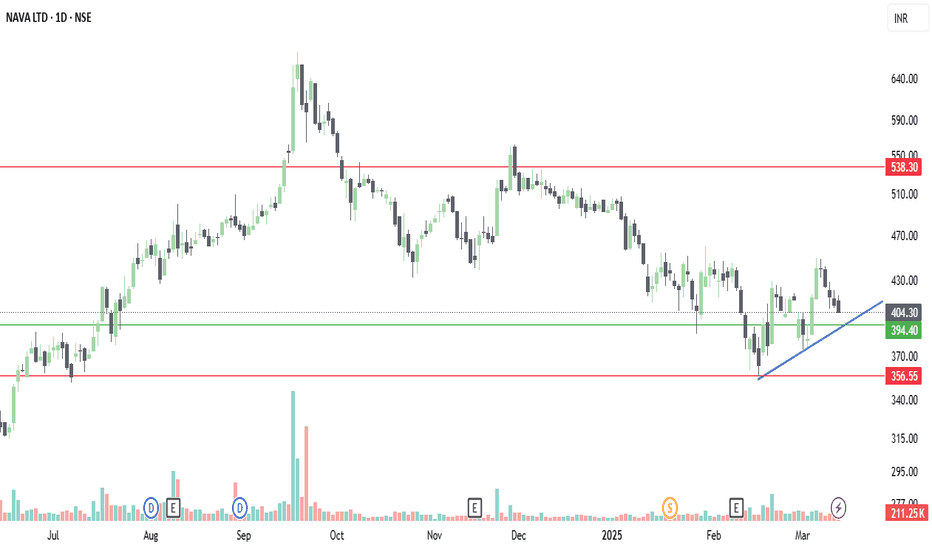

NAVA LIMITED – Bullish breakout in 1d soonNAVA Limited is currently exhibiting strong bullish momentum, supported by both technical indicators and improving fundamentals. The stock has shown a sustained uptrend with higher highs and strong volumes, indicating buyer dominance.

✅ Key Bullish Factors:

📊 Strong Fundamentals: Consistent profitability with solid EBITDA margins and minimal debt. Recent buyback reflects management's confidence in the company.

💡 Technicals in Favor: Price trading above key moving averages (20/50/100 EMA), showing strong trend continuation.

🔄 Breakout Confirmation: Stock recently broke past a key resistance zone and is now forming a new base, suggesting potential for the next leg up.

📈 Momentum Indicators: RSI above 60, MACD showing bullish crossover, and volume buildup on green candles.

🏭 Diversified Business: Exposure to energy, ferro alloys, and mining – adding stability and growth potential.

🎯 Potential Upside Levels:

Immediate Target: ₹658

🔒 Stop-Loss: ₹419 (Below key support or recent swing low)

📌 Strategy: Ideal for swing or positional traders looking for high-probability setups with risk-reward in favor.

🧠 Disclaimer: This is not investment advice. Please conduct your own analysis or consult a financial advisor before making any trading decisions.

NAVA Trading Above Fresh Demand ZoneNAVA is currently trading at ₹972.4, above its fresh demand zone between ₹954.9 and ₹923.65, established on 25th November 2024. This untested zone indicates potential buying interest. Investors may watch for price movements near this zone to assess trading opportunities.

Disclaimer: This analysis is for informational purposes only and should not be considered as financial advice. Please conduct your own research or consult a financial advisor before making any investment or trading decisions.

NAVA CMP 1085NAVA LTD is good fundamentally strong company with the PE of 15,ROCE-16,ROCE-18.It shows that company in trading at fair value price.If sustain above 1100 than we can see a good upmove for next resistance level-1300. Keep waching and add to your wachlist.Decide your Risk and Reward levels Thank You.

NAVA LTD - A Diversified Investment OpportunityCore Business:

- **Metals:** Nava Limited is involved in the production of ferro alloys, including Silico Manganese Alloys and Ferro Silicon. The company operates ferro alloy plants in Telangana and Odisha, India.

- **Energy:** The company has a significant presence in the energy sector, primarily through its subsidiaries such as Nava Bharat Energy India Limited (NBEIL) and Maamba Collieries Limited (MCL). These entities operate power plants, including a 150 MW plant in Telangana and a 300 MW plant in Zambia.

- **Mining:** Nava is engaged in coal mining, particularly through MCL in Zambia. The mining division also explores other minerals like magnetite ore.

- **Agribusiness:** The company has ventured into agribusiness, focusing on avocado plantations in Zambia. This project is managed by Nava Avocado Limited.

- **Emerging Businesses:** Nava is diversifying into healthcare services, especially in Singapore and Malaysia, and other innovative business initiatives.

Global Hue:

- **Geographical Presence:** Nava has a global footprint with operations in India, Zambia, Singapore, Malaysia, and Côte d'Ivoire. This global presence is a key aspect of its business strategy, enabling the company to leverage diverse markets and resources.

- **International Subsidiaries:** The company has several international subsidiaries, including Nava Bharat (Singapore) Pte. Limited, Maamba Collieries Limited, and Nava Resources CI, which facilitate its global operations.

Investment Perspective

Qualitative Analysis:

1. **Diversification:** Nava's diversified business portfolio across metals, energy, mining, agribusiness, and emerging sectors reduces dependence on any single market, making it a more stable investment.

2. **Financial Performance:** The company has achieved significant financial milestones, including becoming long-term debt-free and reporting record revenues and profits. This indicates strong financial management and resilience.

3. **Operational Efficiency:** Nava has demonstrated operational efficiency improvements, such as cost optimization in its metals and energy segments, which contribute to its profitability.

4. **Sustainability and CSR:** The company's commitment to sustainability and corporate social responsibility (CSR) aligns with global ESG standards, which can attract socially responsible investors.

5. **Innovation and Adaptability:** Nava's ability to adapt to market challenges and innovate across its business segments is a positive indicator for long-term growth.

Quantitative Information:

1. **Revenue and Profit:**

- **Consolidated Revenue:** `3,818 crores for FY 2023-24, a YoY growth of 8.2%.

- **Consolidated Profit:** `1,256 crores, the highest in the company's history.

2. **Financial Metrics:**

- **EBITDA Margin:** 46.9% for FY 2024, indicating resilience in consolidated operations.

- **Debt Repayment:** MCL repaid long-term debt of US$ 314.4 million, making it debt-free.

3. **Segment Performance:**

- **Metals:** Despite challenges, the segment demonstrated resilience with strategic shifts to Ferro Silicon production.

- **Energy:** NBEIL's 150 MW plant operated throughout the year, supported by bilateral contracts and remunerative tariffs.

- **Mining:** MCL's coal sales increased by 35.3% YoY, contributing to free cash flows.

4. **Dividend Payout:**

- **Dividend:** Recommended dividend of 200% (`4.00 per share of `2/- each) for FY 2023-24.

Risk Analysis

1. **Market Risks:**

- **Export Market Fluctuations:** The metals segment faced reduced demand in the export market, affecting realizations.

- **Competition:** The mining division faced competition from newly opened coal mines nearby.

2. **Operational Risks:**

- **Raw Material Handling System Breakdown:** The Odisha operations experienced a breakdown in the raw material handling system, affecting production.

- **High Coal Costs:** The 114 MW power plant in Telangana faced high coal costs from Singareni Collieries, impacting generation and sales.

3. **Regulatory Risks:**

- **Compliance:** The company must comply with various regulations, including those related to environmental and social governance.

4. **Financial Risks:**

- **Loan Repayments:** Delays in loan repayments from subsidiaries, such as NBEIL, though managed within the group, could impact credit profiles if not managed carefully.

Value and Growth Investment

**Value Investment:**

- **Debt-Free Status:** Achieving long-term debt-free status at both standalone and group levels enhances the company's financial stability and reduces risk.

- **Consistent Dividend Payout:** The company's policy of consistent dividend payout provides a stable return for investors.

- **Operational Efficiency:** Cost optimization and efficiency improvements across segments contribute to sustained profitability.

**Growth Investment:**

- **Diversification and Expansion:** Nava's expansion into new sectors like agribusiness and healthcare, along with its global footprint, offers potential for future growth.

- **Innovation and Adaptability:** The company's ability to innovate and adapt to market challenges positions it for long-term growth.

- **Strategic Initiatives:** Initiatives such as backward integration in mining and the development of new products in the metals segment are expected to drive future growth.

Overall, Nava Limited presents a balanced profile for both value and growth investors, with its strong financial performance, diversified business portfolio, and commitment to sustainability and innovation. However, investors should be aware of the operational and market risks associated with the company's diverse business segments.

NAVA*NAVA* Good for Holding around 9 Months ..... Current Price at *480* ......... Keep SL at *459.40* .... (On Closing Basis ... Means ... Daily Candle closed Below *459.40* )….. After Close Crossing *573.80* …. Trail SL to *545.85* Targets are Shown on Chart in Greens ..

Company has reduced debt.

Stock is trading at 1.09 times its book value.

Company has delivered good profit growth of 31.0% CAGR over last 5 years.

Arbitration :

Under the Arbitration initiated by MCL and its lenders against ZESCO, both the Parties have agreed to and got a Consent Award from the Arbitration Tribunal, London for US$ 518 Mn in Dec 2022 after giving a discount of US$ 60 Mn to ZESCO. ZESCO has submitted its revised payment plan of clearing US$ 338 Mn by Dec 2023 and the balance of US$ 180 Million by Dec 2024.

Debt Reduction :

MCL repaid US$ 98.4 Million to its lenders during the year bringing down the loan to US$ 315 Mn as of March 2023 from US$ 413 Mn as of March 2022.

Nava Ltd on the verge of Inv Head & Shoulders pattern Break Out.Keep Nava Ltd on radar as stock is ready for breakout from Inverted Head & Shoulders pattern in daily TF. Volumes are improving gradually. Momentum gaining strength. if breakout of Neckline @ 468/- sustains, then price may touch 562/- Level.

Nava Ltd.*Nava Ltd*

C&H Formation on Yearly Basis.

Strong Price BreakOut/ Sustained.

Strong Vol. Consolidation/ Continued BuiltUp.

1972 Co. Ferro Alloys Mfg.

Owns Power Generation: 434 MW in India.

300 MW in Zambia.

Growing Sales/Profitability: Yrly/Qtrly.

Moderate leverage. Growing TNW.

+Ve CF from Ops. Stable Promoter Holding

Stretched WC Cycle

Trail SL with Upside.

Book Profit as per Risk Appetite.

Do Your Own Research as well. This is an Opinion.

Happy Investing 😇

Nava LTD LONG1. Fundamentally great company.

Stock is trading at 0.53 times its book value

Company has delivered good profit growth of 63.2% CAGR over last 5 years.

p/e is 3.39

2. Technically well placed too.

3. Short to medium term trade.

4. Buy above the white line keeping sl below the white line on closing basis.Very small sl.

navaThe company is engaged in the business of manufacture of ferro alloys, generation of power and rendering of operation and maintenance services from its principle place of business located in Paloncha, Hyderabad, Kharagprasad and Samalkot in the states of Telangana, Odisha and Andhra Pradesh, respectively.

Business verticals

Ferro Alloys

Energy

Operation & Maintenance

Mining

Agribusiness

Healthcare