NAZARA trade ideas

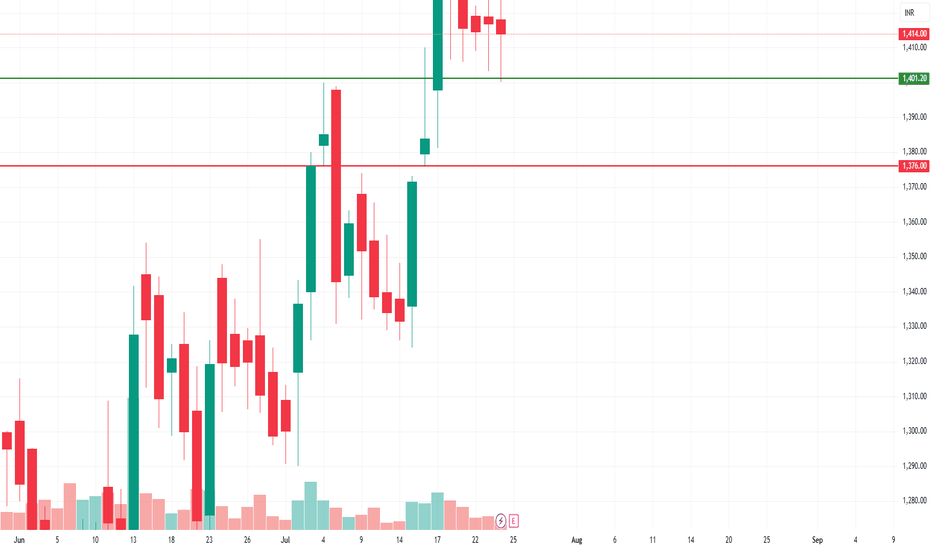

NAZARA TECHNOLOGIES LTD S/RSupport and Resistance Levels:

Support Levels: These are price points (green line/shade) where a downward trend may be halted due to a concentration of buying interest. Imagine them as a safety net where buyers step in, preventing further decline.

Resistance Levels: Conversely, resistance levels (red line/shade) are where upward trends might stall due to increased selling interest. They act like a ceiling where sellers come in to push prices down.

Breakouts:

Bullish Breakout: When the price moves above resistance, it often indicates strong buying interest and the potential for a continued uptrend. Traders may view this as a signal to buy or hold.

Bearish Breakout: When the price falls below support, it can signal strong selling interest and the potential for a continued downtrend. Traders might see this as a cue to sell or avoid buying.

MA Ribbon (EMA 20, EMA 50, EMA 100, EMA 200) :

Above EMA: If the stock price is above the EMA, it suggests a potential uptrend or bullish momentum.

Below EMA: If the stock price is below the EMA, it indicates a potential downtrend or bearish momentum.

Trendline: A trendline is a straight line drawn on a chart to represent the general direction of a data point set.

Uptrend Line: Drawn by connecting the lows in an upward trend. Indicates that the price is moving higher over time. Acts as a support level, where prices tend to bounce upward.

Downtrend Line: Drawn by connecting the highs in a downward trend. Indicates that the price is moving lower over time. It acts as a resistance level, where prices tend to drop.

Disclaimer:

I am not a SEBI registered. The information provided here is for learning purposes only and should not be interpreted as financial advice. Consider the broader market context and consult with a qualified financial advisor before making investment decisions.

Nazara Technologies Ltd view for Intraday 26th May #NAZARA Nazara Technologies Ltd view for Intraday 26th May #NAZARA

Resistance 1320 Watching above 1324 for upside momentum.

Support area 1290 Below 1300 ignoring upside momentum for intraday

Watching below 1285 for downside movement...

Above 1300 ignoring downside move for intraday

Charts for Educational purposes only.

Please follow strict stop loss and risk reward if you follow the level.

Thanks,

V Trade Point

Nazara Tech: Weekly Rounding Bottom Breakout with Volume!🚀 Nazara Tech: Weekly Rounding Bottom Breakout with Volume! 🚀

Current Market Price: 1049

Stop Loss: 890

Targets: 1218, 1390

Nazara Tech is showing signs of a bullish breakout from a weekly rounding bottom pattern, supported by strong volume. The stock has begun a Fibonacci reversal with a solid close above the 38% level, and base consolidation has occurred around the 900 support mark. If Nazara Tech closes above 1218 (62% Fibonacci level), it will confirm the continuation of an uptrend.

📉 Risk Management: Ensure to manage your risk with a stop loss at 890.

📊 Disclaimer: As a non-SEBI registered analyst, I recommend conducting thorough research or seeking advice from financial professionals before making investment decisions.

#MarketAnalysis #NazaraTech #TechnicalAnalysis #RoundingBottom #Breakout #InvestmentOpportunities #FibonacciLevels

breakout the ipo

🎮 **Nazara Technologies Ltd (NSE)** – 🚀 *On the Verge of a Big Move?* 🚀

### 🏛️ **Chart Breakdown:**

1. **The IPO High Resistance 📊:**

Nazara Technologies’ **IPO high** was marked around **₹1,049**, a level it initially struggled to break past. After a rollercoaster ride, the stock is now retesting this crucial resistance.

2. **Cup & Handle Pattern 🏆:**

As discussed before, the **Cup** formed from **2022 to 2023**, creating a solid base for the stock.

After that, we saw the **Handle** shape up around **₹880** to **₹950** in mid-2024. This bullish structure signaled potential strength.

3. **Zoom in on the Final Consolidation Zone 🔍:**

The **highlighted consolidation zone** (the box on the chart) represents the final resting phase before a **breakout**.

This area spans from **₹997 to ₹1,049**, right at the previous **IPO high**.

**Why is this consolidation important?**

It shows that **buyers and sellers are in a tight battle** after the stock approached its previous high.

**Lower volatility in this range** indicates that the stock is **preparing for a decisive move** — either a breakout above ₹1,049 or a pullback.

The stock is **coiling up** for its next move, much like a spring that’s waiting to release energy. ⚡

4. **Volume Surge Confirmation 💥:**

The volume in the last few weeks is rising, particularly the **week of September 2024** where we see a **significant spike** in buying activity. This is a strong bullish signal, as it suggests the market is ready to push the stock higher with significant force. 📊💪

### 🎯 **What to Watch Next:**

Breakout Watch 📈:**

If the stock can close **decisively above ₹1,049**, this consolidation would serve as the launchpad for the next rally. 📊

Short-term **target** could be around **₹1,250-₹1,350** if the breakout is successful. 🚀

**Support Levels (In Case of Pullback) 🔑:**

If the breakout fails, look for the stock to retest **₹997**, the **bottom of the consolidation box**, which will act as immediate support.

**Price Range**: ₹997 - ₹1,049

**Action**: A **break above ₹1,049** on strong volume could trigger a new rally!

**Risk Management**: Keep an eye on ₹997 as the **key support**.

⚠️ *Disclaimer*: This is **NOT a buy or sell recommendation**. Educational purposes only. Always do your own research! 📚💡

NAZARA TECHNOLOGIES EYEING A 30% MOVE??🚀 Nazara Technologies Breakout Alert! 🚀

Exciting times ahead for Nazara Technologies as the stock has officially broken out and is gearing up for a powerful rally! 🎯 With target levels set at ₹1060, ₹1215, and a potential high of ₹1315, investors are eyeing big gains. This gaming and sports media powerhouse has been making waves in the industry, and now, the charts are showing signs of a major move.

But what makes this even more interesting? Zerodha's very own co-founder and CEO, Nikhil Kamath, is one of the investors in Nazara Technologies. Kamath’s track record in identifying winning investments speaks for itself, adding a layer of confidence to the stock’s future performance. When seasoned investors like Kamath see potential in a company, it’s a signal that the future could be very bright.

Nazara’s growth in the gaming sector, combined with its smart partnerships and diversified business model, makes it a standout in the tech space. As the gaming industry continues to boom, Nazara is positioning itself as a leader both in India and globally.

Keep your eyes on this one—it could be a game-changer! 🔥 #NazaraTechnologies #StockBreakout #NikhilKamath #InvestSmart #BullishRally #StockMarket #GamingIndustry #TechStocks #FutureBright

Golden Crossover - NAZARA📊 Script: NAZARA

📊 Sector: Telecomm-Service

📊 Industry: Telecommunications - Service Provider

Key highlights: 💡⚡

📈 Golden Crossovers are seen into this Script.

📈 Golden Crossover is where slow moving average line crosses fast moving average above.

📈 Although Script is trading at All Time High we may see some bullish rally.

⏱️ C.M.P 📑💰- 873

🟢 Target 🎯🏆 - 932

⚠️ Important: Always maintain your Risk & Reward Ratio.

✅Like and follow to never miss a new idea!✅

Disclaimer: I am not SEBI Registered Advisor. My posts are purely for training and educational purposes.

Eat🍜 Sleep😴 TradingView📈 Repeat 🔁

Happy learning with trading. Cheers!🥂

SWING IDEA - NAZARA TECHNOLOGIESWe can see a very good buying opportunity in NAZARA TECHNOLOGIES .

The reasons are stated below :

750-770 zone was tested multiple times and finally it broke and is now retesting it

0.382 Fibonacci support

Price action formation - higher highs

Double bottom pattern on higher timeframe (500 zone)

Targets - 926 // 1066 // 1345 // 1681

StopLoss - 730 on closing basis

SWING IDEA - NAZARA TECHNOLOGIESNazara Technologies has captured our attention as a prospective candidate for a swing trade, showcasing compelling technicals that hint at the potential for an upward rally.

Reasons are stated below :

Nazara Technologies has undergone multiple tests around the 900 levels and successfully broken through, signaling a notable shift in market dynamics.

A noteworthy bullish marubozu candle observed on the weekly timeframe adds a robust bullish sentiment, laying the foundation for a potential upward rally.

The surge in volume activity is a noteworthy signal, suggesting heightened market interest and potential momentum behind Nazara Technologies.

Trading above the 50 exponential moving average (EMA) signifies a continued upward trend, providing confidence in the stock's potential for a swing trade.

Nazara Technologies consistently forms higher highs, indicating a sustained uptrend and reflecting positive sentiment among market participants.

Target - 1244 // 1676

StopLoss - weekly close below 837

Disclaimer :

Decisions to buy, sell, hold or trade in securities, commodities and other investments involve risk and are best made based on the advice of qualified financial professionals. Any trading in securities or other investments involves a risk of substantial losses. The practice of "Day Trading" involves particularly high risks and can cause you to lose substantial sums of money. Before undertaking any trading program, you should consult a qualified financial professional. Please consider carefully whether such trading is suitable for you in light of your financial condition and ability to bear financial risks. Under no circumstances shall we be liable for any loss or damage you or anyone else incurs as a result of any trading or investment activity that you or anyone else engages in based on any information or material you receive through TradingView or our services.

@visionary.growth.insights