NETWEB trade ideas

Netweb technology I'm not a SEBI REGISTERED ANYLISIS

just for learning purpose

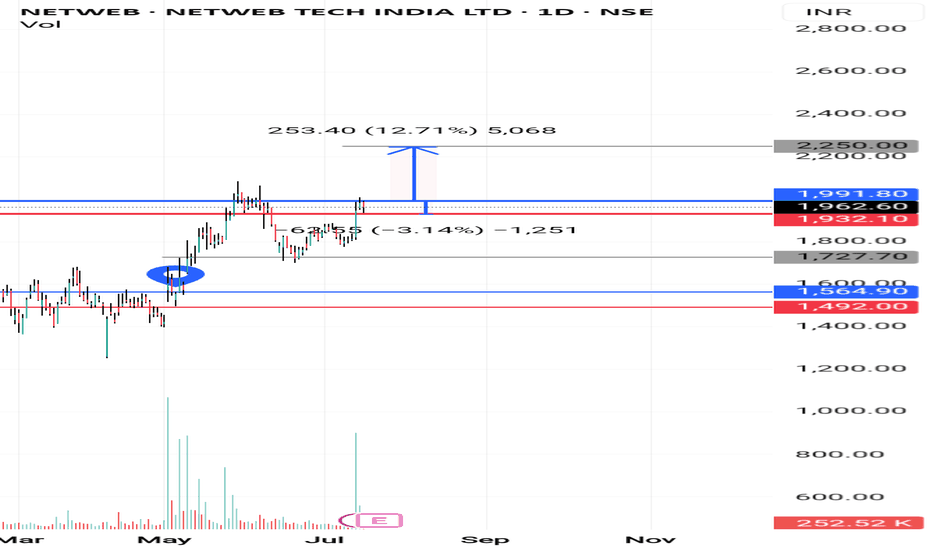

above the blue line close in D chart candle i will buy and put strictly SL to below red line...once candle close below Red line in D chart...i will close the Trade...

Note: 1

Breakout candle should close time 6 or below 6 points I will buy same day or I will wait for the blue line price to re-trace)

Note:2

If previous volume is buyers(for ex- 10k) Breakout candle volume should be low in present day with buyers volume(below 10k for ex- 9k like this)

target check the chart

WAIT FOR ENTRY......then after

WAIT FOR TARGET...... or

WAIT FOR STOPLOSS

educational purpose only

oits simple ORB WITH VOLUME BREAKOUT STRATEGY...with small condition apply for selecting the stocks

owt not response for your profit and loss

Netweb Technologies India Ltd. (NETWEB)I'm not a SEBI REGISTERED ANYLISIS

just for learning purpose

above the blue line close in D chart candle i will buy and put strictly SL to below red line...once candle close below Red line in D chart...i will close the Trade...

target check the chart

educational purpose only

oits simple ORB WITH VOLUME BREAKOUT STRATEGY...with small condition apply for selecting the stocks

owt not response for your profit and loss

Netweb-a breakout stock to watchNetweb has recorded stellar quarterly results- double digit earnings and revenue growth YoY. But stock has not performed since market was unfavorable and it has stored pent up energy of strong earnings backing. Now stock has reached a resistance zone on daily chart that too with a humungous volume. Today its quarterly earnings were announced and yet again stock has delivered very good results. It's a good breakout stock to watch.

NETWEB TECH INDIA LTD S/RSupport and Resistance Levels:

Support Levels: These are price points (green line/shade) where a downward trend may be halted due to a concentration of buying interest. Imagine them as a safety net where buyers step in, preventing further decline.

Resistance Levels: Conversely, resistance levels (red line/shade) are where upward trends might stall due to increased selling interest. They act like a ceiling where sellers come in to push prices down.

Breakouts:

Bullish Breakout: When the price moves above resistance, it often indicates strong buying interest and the potential for a continued uptrend. Traders may view this as a signal to buy or hold.

Bearish Breakout: When the price falls below support, it can signal strong selling interest and the potential for a continued downtrend. Traders might see this as a cue to sell or avoid buying.

20 EMA (Exponential Moving Average):

Above 20 EMA(50 EMA): If the stock price is above the 20 EMA, it suggests a potential uptrend or bullish momentum.

Below 20 EMA: If the stock price is below the 20 EMA, it indicates a potential downtrend or bearish momentum.

Trendline: A trendline is a straight line drawn on a chart to represent the general direction of a data point set.

Uptrend Line: Drawn by connecting the lows in an upward trend. Indicates that the price is moving higher over time. Acts as a support level, where prices tend to bounce upward.

Downtrend Line: Drawn by connecting the highs in a downward trend. Indicates that the price is moving lower over time. It acts as a resistance level, where prices tend to drop.

RSI: RSI readings greater than the 70 level are overbought territory, and RSI readings lower than the 30 level are considered oversold territory.

Combining RSI with Support and Resistance:

Support Level: This is a price level where a stock tends to find buying interest, preventing it from falling further. If RSI is showing an oversold condition (below 30) and the price is near or at a strong support level, it could be a good buy signal.

Resistance Level: This is a price level where a stock tends to find selling interest, preventing it from rising further. If RSI is showing an overbought condition (above 70) and the price is near or at a strong resistance level, it could be a signal to sell or short the asset.

Disclaimer:

I am not a SEBI registered. The information provided here is for learning purposes only and should not be interpreted as financial advice. Consider the broader market context and consult with a qualified financial advisor before making investment decisions.

Trend Trading of Netweb TechnologiesIntroduction

Netweb Technologies India Limited is a leading Indian-origin, owned and controlled OEM in the space of High-end Computing Solutions (HCS). The company has been at the forefront of cutting-edge innovation for two and a half decades, with a focus on high-end computing solutions and comprehensive manufacturing capabilities. In this report, we will analyze the company's financial performance, growth drivers, and technical analysis to identify potential trends and opportunities for trend trading.

Financial Performance

Netweb's financial performance has been impressive, with a significant increase in revenue, EBITDA, and PAT. The company's revenue grew from ₹ 2,624 Mn in FY2021 to ₹ 7,359.62 Mn in FY2024, with a CAGR of 166.3%. The EBITDA margin also increased from 15.8% in FY2021 to 29.4% in FY2024. The PAT also grew from ₹ 759.03 Mn in FY2021 to ₹ 759.03 Mn in FY2024.

Growth Drivers

Netweb's growth drivers include:

Enhanced Capabilities: The company has commissioned a cutting-edge manufacturing facility equipped with the latest Surface Mount Technology (SMT) in May 2024.

Enhanced Opportunities: The growing investment in Generative AI infrastructure by government bodies and large enterprises is driving demand for large language model (LLM) oriented solutions.

Expanding Product Portfolio: Netweb's diversification by offering Enterprise-grade network Switches opens up new opportunities and markets for the company.

Strong Topline Visibility: Netweb boasts a robust pipeline valued at ₹ 34,466 Mn, alongside an L1 value of ₹ 3,142 Mn and an order book of ₹ 4,112 Mn as of March 31, 2024.

Technical Analysis

Based on the company's financial performance and growth drivers, we can identify the following technical trends:

Trend Line: The company's revenue trend line has been consistently increasing, with a CAGR of 166.3% over the period of FY2021-FY2024.

Moving Averages: The 50-day moving average has been consistently above the 200-day moving average, indicating a strong uptrend.

Conclusion

Based on the company's financial performance, growth drivers, and technical analysis, we can conclude that Netweb Technologies India Limited is a strong trend trading opportunity. The company's revenue trend line has been consistently increasing, with a CAGR of 166.3% over the period of FY2021-FY2024.

Disclaimer

This report is for informational purposes only and should not be considered as investment advice. The reader should do their own research and consult with a financial advisor before making any investment decisions.

Symmetrical Triangle Breakout - NETWEB📊 Script: NETWEB

📊 Sector: IT - Software

📊 Industry: Computers - Software - Medium / Small

Key highlights: 💡⚡

📈 Script is giving Symmetrical Triangle Breakout on 18th April but there was no rally todays candle is giving breakout of that little consolidation so we may see some good rally.

📈 Script is trading at upper band of BB.

📈 MACD & Double Moving Averages are giving crossover .

📈 Right now RSI is around 61.

📈 One can go for Swing Trade.

⏱️ C.M.P 📑💰- 1730

🟢 Target 🎯🏆 - 1890

⚠️ Stoploss ☠️🚫 - 1664

⚠️ Important: Always maintain your Risk & Reward Ratio.

✅Like and follow to never miss a new idea!✅

Disclaimer: I am not SEBI Registered Advisor. My posts are purely for training and educational purposes.

Eat🍜 Sleep😴 TradingView📈 Repeat 🔁

Happy learning with trading. Cheers!🥂