NETWORK18 trade ideas

SWING IDEA - NETWORK 18 MEDIANetwork 18 Media , a prominent player in the media and entertainment industry, is showing signs of a promising swing trade opportunity based on several key technical indicators.

Reasons are listed below :

75-80 Support Zone : The 75-80 level is a crucial support zone that has held multiple times, indicating strong buying interest at these levels.

Bullish Engulfing Candle on Weekly Timeframe : The formation of a bullish engulfing candle on the weekly chart suggests a reversal of the previous downtrend and indicates strong buying pressure.

0.618 Fibonacci Support : The stock has retraced to the 0.618 Fibonacci support level and is now bouncing back, indicating a potential reversal and continuation of the uptrend.

Breaking Consolidation Phase of 2+ Months : Network 18 Media is breaking out of a consolidation phase that lasted over two months, signaling the beginning of a new bullish trend.

Decisive Break Above 50 EMA : The price has decisively broken above the 50-day exponential moving average, confirming the bullish sentiment and providing a strong support level.

Target - 105 // 120 // 135

Stoploss - weekly close below 81

DISCLAIMER -

Decisions to buy, sell, hold or trade in securities, commodities and other investments involve risk and are best made based on the advice of qualified financial professionals. Any trading in securities or other investments involves a risk of substantial losses. The practice of "Day Trading" involves particularly high risks and can cause you to lose substantial sums of money. Before undertaking any trading program, you should consult a qualified financial professional. Please consider carefully whether such trading is suitable for you in light of your financial condition and ability to bear financial risks. Under no circumstances shall we be liable for any loss or damage you or anyone else incurs as a result of any trading or investment activity that you or anyone else engages in based on any information or material you receive through TradingView or our services.

@visionary.growth.insights

NETWORK 18 - RANGE BREAKOUT FOR SWINGRANGE BREAKOUT FOR SWING TRADING

NEW BUY PRICE : 95

SL : 85 (only for swing traders)

TARGET : 120, 135 (40%)

Disclaimer - All information on this page is for educational purposes only, we are not SEBI Registered, Please consult a SEBI registered financial advisor for your financial matters before investing And taking any decision. We are not responsible for any profit/loss you made.

Ready to jump Company Overview:

Network18 Media & Investments Limited is a media and entertainment conglomerate based in India. The company operates a diverse portfolio of media properties, including television channels, digital content platforms, films, and print publications. As a key player in the Indian media industry, Network18 has a substantial presence across news, entertainment, and digital content segments.

Market Position:

Network18 is a prominent player in the Indian media landscape, reaching millions of viewers and readers through its various channels and platforms. The company's diverse content offerings cater to a broad audience, making it a valuable entity in the media and entertainment sector.

Key Investment Themes:

Multi-Platform Presence: Network18 has a multi-platform presence encompassing television, digital media, films, and print. This diversified approach allows the company to reach a wide audience and capitalize on the evolving media consumption habits of viewers.

Digital Transformation: With a focus on digital content platforms, Network18 is actively participating in the digital transformation of the media industry. The company's digital initiatives align with the growing trend of online content consumption, providing additional revenue streams and engagement opportunities.

News and Information Dominance: Network18 has a strong presence in the news and information segment through its news channels and digital platforms. The demand for credible and real-time news content positions the company favorably, especially given the increasing digitalization of news consumption.

Entertainment Portfolio: The company's entertainment channels and film production contribute to its overall revenue. Network18's diverse entertainment portfolio caters to varied audience demographics, enhancing its market position and advertising appeal.

Strategic Partnerships: Network18 has entered into strategic partnerships and collaborations to strengthen its content offerings and market presence. Such alliances provide access to a broader audience and open up opportunities for content diversification.

Risks and Mitigation:

Ad Revenue Sensitivity: Media companies, including Network18, are sensitive to fluctuations in advertising revenue, which can be influenced by economic conditions. The company mitigates this risk by maintaining a diverse revenue mix and adapting to changing advertiser preferences.

Digital Competition: The digital media landscape is highly competitive. Network18 addresses this by investing in content quality, user experience, and innovative digital strategies to stand out in the crowded online content space.

Regulatory Environment: The media industry is subject to regulatory changes. Network18 actively monitors regulatory developments, ensuring compliance and adapting its strategies to align with evolving regulatory frameworks.

Long-Term Outlook:

Network18 Media & Investments Limited presents a compelling investment opportunity in the Indian media and entertainment sector. The company's multi-platform presence, digital initiatives, and diverse content portfolio position it to capitalize on the evolving media landscape in India.

Investors seeking exposure to the Indian media industry may consider including Network18 in their portfolio. However, it's crucial to stay informed about industry trends, digital advancements, and regulatory changes while maintaining a long-term investment horizon. Conducting thorough research and periodic reassessment of the investment thesis is advisable to adapt to changing market conditions.

Network18 looks bullishNetwork18 is looking bullish on monthly, weekly and daily time frames. It has crossed 60 RSI levels monthly, weekly and daily. You can see volume has been increasing recently. It has been forming a rounding bottom. It has broken resistance at 77 with significant volume. If it retraces 78-77 levels, it would be an excellent entry-level and can trade for 1:4 risk-to-reward ratio.

Network 18The media sector is displaying optimism in the short run, with a positive outlook for most media stocks.

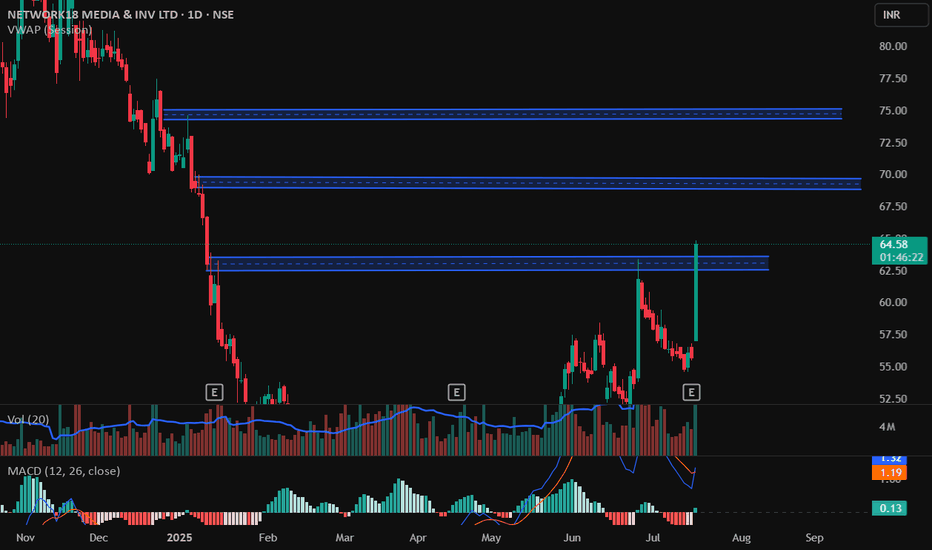

Among them, Network 18 stands out as a promising option. The weekly candle is finding support at 63, and a prudent entry point could be around 67 at the close of the week. Targets and supports have been identified with blue horizontal lines.

For those unfamiliar with Gann tools, let's engage in constructive conversations to learn and develop together.

NETWORK18 - Bullish ConsolidationNSE: NETWORK18 is closing with a bullish consolidation candle supported with volumes.

Today's volumes and candlestick formation indicates strong demand and stock should move to previous swing highs in the coming days.

The stock has been moving along the horizontal support for the past few days which is indicating demand.

One can look for a 8% to 12% gain on deployed capital in this swing trade.

The view is to be discarded in the event of the stock breaking previous swing low.

#NSEindia #Trading #StockMarketindia #Tradingview #SwingTrade

Network 18Hello and welcome to this analysis

After 13 years of downtrend its now trying to consolidate and form a higher low (March 2023) with the all time low made in March 2020.

Stock is currently on a pullback of its trend line breakout with support at 40-36 and immediate resistance between 62-72.

Sustaining above 72 it could rally till 125-170-270. While failure to hold 31-30 could lead further selling pressure.

Breakout!!!breakout after low volatility and consolidation.

substantial volume.

BUY on the open and carry the trade using macd histogram.

as soon as the macd histogram crosses below 0 line put a stoploss at the low of the latest candle.

if this breakout gives a good rally it can trigger a bullish trend out of the consolidation on the weekly.