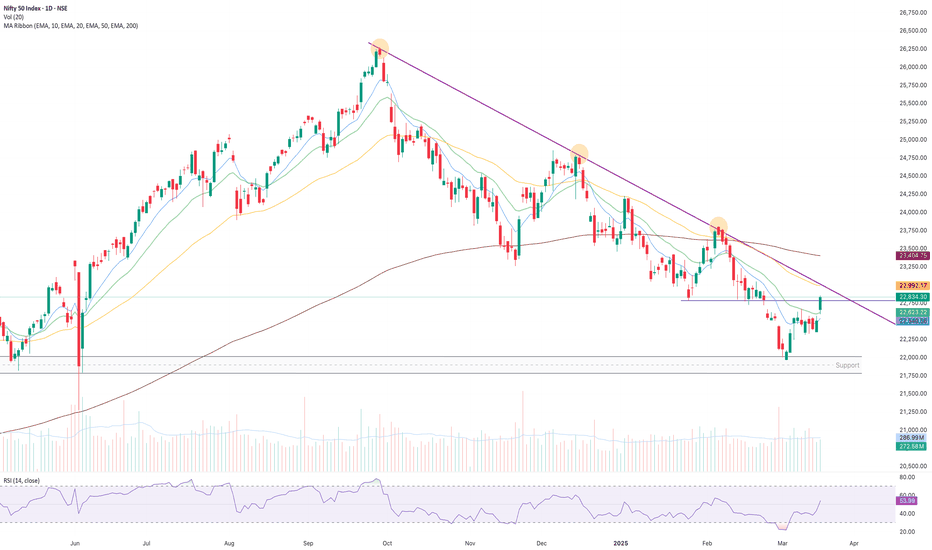

Make or Break 3 key Resistances Approaching. Nifty saw 3 good days of recovery. Now the real test begins as we are approaching the 3 big daddy resistances.

1) R1 Mother line Resistance (50 days EMA) 22988.

2) R2 Long Term Trend line Resistance 23237.

3) R3 Father Line Resistance 23399.

If these 3 are crossed the Nifty has potential to hit 23809 in the medium to short term.

If Nifty rally does not have steam it can again fall back to the support levels at 22638, 22334 or even 21974.

IT has not contributed to the current rally Infact it has remained laggard. RIL has not contributed. HDFC has remained range bond. If some IT counters or Heavy Weights like RIL or HDFC join the rally we can see Nifty flying otherwise there is a potential for this rally to fizzle out again. Things are in balance right now. Shadow of the candle neutral as I write this. Very important closing weekly closing awaits us on Friday.

Disclaimer: The above information is provided for educational purpose, analysis and paper trading only. Please don't treat this as a buy or sell recommendation for the stock or index. The Techno-Funda analysis is based on data that is more than 3 months old. Supports and Resistances are determined by historic past peaks and Valley in the chart. Many other indicators and patterns like EMA, RSI, MACD, Volumes, Fibonacci, parallel channel etc. use historic data which is 3 months or older cyclical points. There is no guarantee they will work in future as markets are highly volatile and swings in prices are also due to macro and micro factors based on actions taken by the company as well as region and global events. Equity investment is subject to risks. I or my clients or family members might have positions in the stocks that we mention in our educational posts. We will not be responsible for any Profit or loss that may occur due to any financial decision taken based on any data provided in this message. Do consult your investment advisor before taking any financial decisions. Stop losses should be an important part of any investment in equity.

NIFTY trade ideas

Nifty Analysis -Breakout soon FII inflows have turned positive, aided by a stable dollar index at 103. Nifty extended gains for the second session, closing above 22,800, driven by global cues and short covering. Surpassing the 20 DEMA after a month, it may target 23,100-23,200. Broad-based buying supported market breadth.

#Nifty

#NIFTY Intraday Support and Resistance Levels - 19/03/2025Gap up opening expected in nifty. After opening expected resistance near 22950 level. Possible reversal from this level. Downside 22750 level will act as a support for nifty. Strong upside rally expected if nifty starts trading above 23000 level. This upside rally can goes upto 23250+ level in today's session.

NIFTY S/R for 19/2/25Support and Resistance Levels:

Support Levels: These are price points (green line/shade) where a downward trend may be halted due to a concentration of buying interest. Imagine them as a safety net where buyers step in, preventing further decline.

Resistance Levels: Conversely, resistance levels (red line/shade) are where upward trends might stall due to increased selling interest. They act like a ceiling where sellers come in to push prices down.

Breakouts:

Bullish Breakout: When the price moves above resistance, it often indicates strong buying interest and the potential for a continued uptrend. Traders may view this as a signal to buy or hold.

Bearish Breakout: When the price falls below support, it can signal strong selling interest and the potential for a continued downtrend. Traders might see this as a cue to sell or avoid buying.

MA Ribbon (EMA 20, EMA 50, EMA 100, EMA 200) :

Above EMA: If the stock price is above the EMA, it suggests a potential uptrend or bullish momentum.

Below EMA: If the stock price is below the EMA, it indicates a potential downtrend or bearish momentum.

Trendline: A trendline is a straight line drawn on a chart to represent the general direction of a data point set.

Uptrend Line: Drawn by connecting the lows in an upward trend. Indicates that the price is moving higher over time. Acts as a support level, where prices tend to bounce upward.

Downtrend Line: Drawn by connecting the highs in a downward trend. Indicates that the price is moving lower over time. It acts as a resistance level, where prices tend to drop.

Disclaimer:

I am not a SEBI registered. The information provided here is for learning purposes only and should not be interpreted as financial advice. Consider the broader market context and consult with a qualified financial advisor before making investment decisions.

STRONG UPMOVE as expected! What’s next? As we can see NIFTY finally showed its strength after testing our patience as discussed in our previous analysis that it formed bullish flag-pole pattern. Now following the structure we can see more room for upmove in NIFTY reaching its trendline resistance but based on global cues we can expect a weaker opening can be followed by strong closing so plan your trades accordingly and keep watching.

*Is Nifty turning Bullish..?***Market Overview**

The Nifty 50 index has experienced a significant downtrend since late 2024, with persistent selling pressure driving prices lower. However, recent price action suggests that buyers are attempting to stage a recovery. The question remains: **Is this a real reversal or just a temporary bounce?

In this analysis, we’ll break down the technical structure, key levels, indicator readings, and potential trade setups to help traders make informed decisions.

1. Market Structure & Trend Analysis

**Trend Direction:**

- The index recently found support at **22,307 – 22,738**, leading to a bounce.

- Multiple "Buy" signals indicate a possible reversal, but confirmation is needed.

**Key Support & Resistance Levels:

- **Resistance:**

- 23,043 (**38.2% Fibonacci Retracement**)

- 23,612 (**50% Fibonacci Retracement**)

- 24,108 (**61.8% Fibonacci Retracement**)

- **Support:**

- 22,738 (**Immediate support**)

- 22,307 (**Critical level**)

- 22,008 (**Major long-term support**)

**Price Pattern:**

- Nifty is trading within a **descending channel**.

- A **breakout above 23,043** could confirm a bullish reversal.

- A breakdown **below 22,307** could accelerate selling momentum.

2. Indicator Analysis**

Trend Meter (Momentum Indicator)**

- Mixed **green and red bars** suggest **market indecision**.

- More green bars are needed to confirm a trend shift.

Moving Averages & EMA Trend

- Price is still **below key EMAs**, meaning the overall trend is bearish.

- A breakout **above 23,043** is necessary for trend confirmation.

3. Trade Scenarios & Strategy

#*Bullish Scenario: If Price Holds Above 22,738**

- If Nifty **breaks & closes above 23,043**, expect an upside move toward **23,612 – 24,108**.

#* Bearish Scenario: If Price Breaks Below 22,307**

- If Nifty **fails to hold 22,738**, it could test **22,307**.

- If **22,307 breaks**, expect a further decline toward **22,008**.

**Conclusion**

🔹 **Nifty is at a crucial decision point.**

🔹 **Buyers must push above 23,043 for a confirmed reversal.**

🔹 **Sellers regain control if 22,738 breaks.**

NIFTY : Intraday Trading Levels and Plan for 19-March-2025🔥 NIFTY – Intraday Trading Plan for 19-Mar-2025

Current Market Price (CMP): 22,848.75

Chart Time Frame: 15-min

📘 Opening Scenario 1: GAP-UP Opening (100+ points)

If NIFTY opens with a strong gap-up above 22,950, it would directly open into the Profit Booking Zone: 22,995 – 23,067 .

Avoid aggressive long entries near the opening if prices directly hit the profit booking zone, as early buying could trap latecomers. Wait and observe price action in the 22,995 – 23,067 range. If the index forms bullish consolidation with strength, breakout above 23,067 can push it towards the final resistance at 23,185. If rejection occurs near this zone, look for reversal signals like a 15-min bearish candle with follow-up selling to consider short scalps targeting back to 22,850 – 22,775.

🧠 Tip: Avoid call option entries if IVs are inflated and premiums are already factored in after a big gap-up. Time decay can eat your premiums fast.

📗 Opening Scenario 2: FLAT Opening (within 50-80 pts)

In case of a flat or minor gap opening near 22,800 – 22,850, the price will open just above the key consolidation zone: 22,727 – 22,801 .

Look for first 15-30 minutes consolidation. If NIFTY sustains above 22,801, fresh buying can push it to test 22,995. A failure to sustain above 22,801 and breakdown below 22,775 will drag prices back into the range. The downside targets then would be 22,656 and 22,532. No trade zone for flat opening: avoid trades inside 22,727 – 22,775, unless a directional breakout occurs.

🧠 Tip: For flat openings, best setups come after the first 15-30 minutes. Let the market decide the direction first—then align your trade.

📙 Opening Scenario 3: GAP-DOWN Opening (100+ points)

A gap-down below 22,700 will place the index back into or below the consolidation zone. Major supports are at 22,656**, 22,532, and Buyers’ Support: 22,270 – 22,320.

Aggressive buying should be avoided unless NIFTY shows strong reversal signals from support zones like 22,532 or 22,270. If prices bounce from the Buyers’ Support Zone, a quick upside retracement towards 22,656 or even 22,727 is possible. However, if NIFTY breaks below 22,270, it could enter a deeper correction territory—so keep strict stop losses.

🧠 Tip: When buying the dip in a gap-down scenario, use options spreads (e.g., bull call spreads) to reduce premium decay risk while maintaining upside exposure.

💡 Risk Management Tips for Options Traders:

✅ Use defined-risk strategies like spreads (Bull Call / Bear Put)

✅ Avoid chasing momentum in the first 15 minutes of market opening

✅ Stick to 1–2 high probability trades per day

✅ Always place stop loss based on structure or candle close

✅ Never average into losing options trades—respect time decay

✅ Focus on ATM or slightly OTM contracts with 1–2 day expiry for best gamma moves

📊 Summary & Conclusion:

Key Zones to Watch:

🔸 Resistance Zone: 22,995 – 23,067

🔸 Support Zone: 22,656 – 22,532

🔸 Buyers’ Zone: 22,270 – 22,320

🔸 No Trade Zone: 22,727 – 22,775

Be reactive, not predictive. Let price action guide your trades based on these levels. Respect volatility and avoid emotional trades.

⚠️ Disclaimer: I am not a SEBI registered analyst. The above levels and insights are for educational purposes only. Please consult your financial advisor before taking any positions. Trade responsibly! 💼📉

Nifty Review & Analysis - DailyNifty opened Gap up 150 points following Global Cues and saw surge throughout the day making a high of 22857 and closing at 22834 +1.45%

Price Action : - Bullish

Nifty closed 1.5% in positive.

Candle Pattern:

Formed a Big Green candle with a small wick on upside.

Daily EMA Positioning:

10dEMA 22540

20dEMA 22623

50dEMA 22992

200dEMA 23404

EMA Trend:

Closed above 10dEma and 20dEma,

Daily MA suggests Buy

Hourly suggests Buy

15mins Suggests Strong Buy

The momentum indicator, RSI - Relative Strength Index at 54

Momentum gaining towards Upside

Support/Resistance Levels:

Major Support 22750

Immediate Support 22500

Immediate Resistance 22900

Major Resistance 23000

Trend:

Short Term Trend is Slight Bullish

Daily Options Activity:

Highest CE OI was at 23000 with highest addition at 23000 - Resistanc

Highest CE unwinding see at 22700 - Support

Highest PE OI was at 22500, highest Put addition seen at 22600, 22700 - support

PCR is 1.4 indicating Bullishness

Daily Futures Activity FII + Pro F&O Data:

FII Long/Short ratio at 24%/76% indicating slowly addition of Longs by FIIs - Bullish

Change in Futures OI:

FII Future positions saw little addition in longs +7K with -2K change in shorts -Bullish

Nifty Futures price was higher with 0.7% OI addition - Bullish

Observation:

Overall looks a positive breakout above 22600, with good PE addition at 22600 & 22700 levels can see

higher levels if 22850 taken out for targets 23000 in shortterm

Overall Trend:

Sideways consolidating turning positive

Outlook for Next Session:

Nifty looks strong above 22700, untill breakout above 23000 it might consolidate

Approach & Strategy:

Wait and watch as last 2 day’s strategy worked perfectly and Nifty has given around 500 points in 2 days, i would wait till 22900-23000 taken out for further Longs

My Trades & Positions:

Closed Long positions at 22800+ held from 22340.

Excellent Break Out by Nifty. Will the momentum continue?Today the Nifty had a good leap after a lot of consolidation. The key question is will the momentum continue or FIIs will again take this opportunity to book profit. Today FII is on the net buying side after a long time. If the buying continues or even if FII remains neutral there is a good chance that we can see upside from here.

Key resistances for Nifty remain at 22857, 22921 and 22985. Above 22985 Nifty can gain more strength and may try to regain the levels of 23044, 23147 and 23249. 23404 as of now remains a mega resistance which is also the 200 days EMA of 200 days Father line. This zone as of now is little difficult to cross. Closing above 23404 can give might boost to the Bulls and a new Bull run can begin post closing above this point. Supports for Nifty at this juncture remain at 22726 (200 hours EMA or Father line of Hourly chart), 22594 and 22543. A closing below 22543 which is the Mother line support of the hourly chart or the (50 Hours EMA).

As there are small signs of reversal on the cards. It is a good time to read my book the Happy Candles Way to Wealth Creation. This is one of the highest rated books on Amazon. This book will teach you Behavioural Finance, Fundamental Analysis and Technical analysis. Every Bull Rally has a top and every Bear run has a bottom. If you can identify them. If you can understand the risk reward ratio. If you can understand the profit booking points, entry points the Mother, Father and the Small Child theory. The magic of Mother and Father lines. There is a lot of money to be made in the stock market. You need to learn, study and form your own strategy. If you want a ready made strategy then this book offers Happy Candles Number Strategy. All these things will help you in creating generational wealth. Do read my book and evolve into a Magnificent Investor and a Wealth creator. The Book is only priced at Rs.349 go ahead grab your copy.

Disclaimer: The above information is provided for educational purpose, analysis and paper trading only. Please don't treat this as a buy or sell recommendation for the stock or index. The Techno-Funda analysis is based on data that is more than 3 months old. Supports and Resistances are determined by historic past peaks and Valley in the chart. Many other indicators and patterns like EMA, RSI, MACD, Volumes, Fibonacci, parallel channel etc. use historic data which is 3 months or older cyclical points. There is no guarantee they will work in future as markets are highly volatile and swings in prices are also due to macro and micro factors based on actions taken by the company as well as region and global events. Equity investment is subject to risks. I or my clients or family members might have positions in the stocks that we mention in our educational posts. We will not be responsible for any Profit or loss that may occur due to any financial decision taken based on any data provided in this message. Do consult your investment advisor before taking any financial decisions. Stop losses should be an important part of any investment in equity.

How to decide Nifty decisive bull move for long term from here ?1. First nifty price has to exit parallel channel to be able to anticipate a bullish move

2. Break of Previous swing high confirms the buyers interest at higher prices.

3. Break above the equal highs lies a Long standing liquidity. sweep of all these sell stops, potentially removes weak bears

4, 5. A short term low is a possibility above which price might move with double the strength of both bulls buyers and sellers covering.

Bulletin.....2025-03-18.....It runs into my cited target area!Hello Traders,

this time I'd like to show you a lower timeframe to analyze the chart.

Let's dive in the 15 minutes time area.

The possible wave b-low @ 22329.55 was all of waves ((b))! The move to the upside probably was a wave ((c)) up, and it is developing within an impulsive structure. One target for this idea is around 22900 area. This would end a wave ((iii)) of (iii) of ((c))!

Keep in mind, that wave iv always can morph into a triangle or a variation thereof!

But this is the chance, with the lowest probability!

That's it for today......

Have a great week.....

Ruebennase

Please ask or comment as appropriate.

Trade on this analysis at your own risk.

NIFTY-Breakout Above 23,100 Signals Bullish MomentumNIFTY 23,000 as Key Resistance; Breakout Above 23,100 Signals Bullish Momentum

The NIFTY 50 index is currently facing resistance at the 23,000 level. A decisive close above 23,100, accompanied by strong trading volume, would confirm a breakout and signal further upside potential. This move would reinforce bullish sentiment and could lead to continued upward momentum.

Traders should closely monitor volume confirmation to validate the breakout. If sustained, the next potential resistance levels could be 23,500–23,800, while failure to hold above 23,100 may trigger a pullback toward 22,800–22,900.

Disclaimer: This is for demonstration and educational purpose only. this is not buying and selling recommendations. I am not SEBI registered. please consult your financial advisor before taking any trade.

NIFTY Flag BreakoutNIFTY...Finally after a long time has given a good AD ratio...Flat was forming now broke out...see chart...tgt calculated and marked on the chart....Good momentum also exists...Also note if the tgt is achieved ..then on a larger time frame a larger pattern will be broken..But we will come to that once that is achieved..Now we wait for this tgt to be achieved.