Nifty 50 Index forum

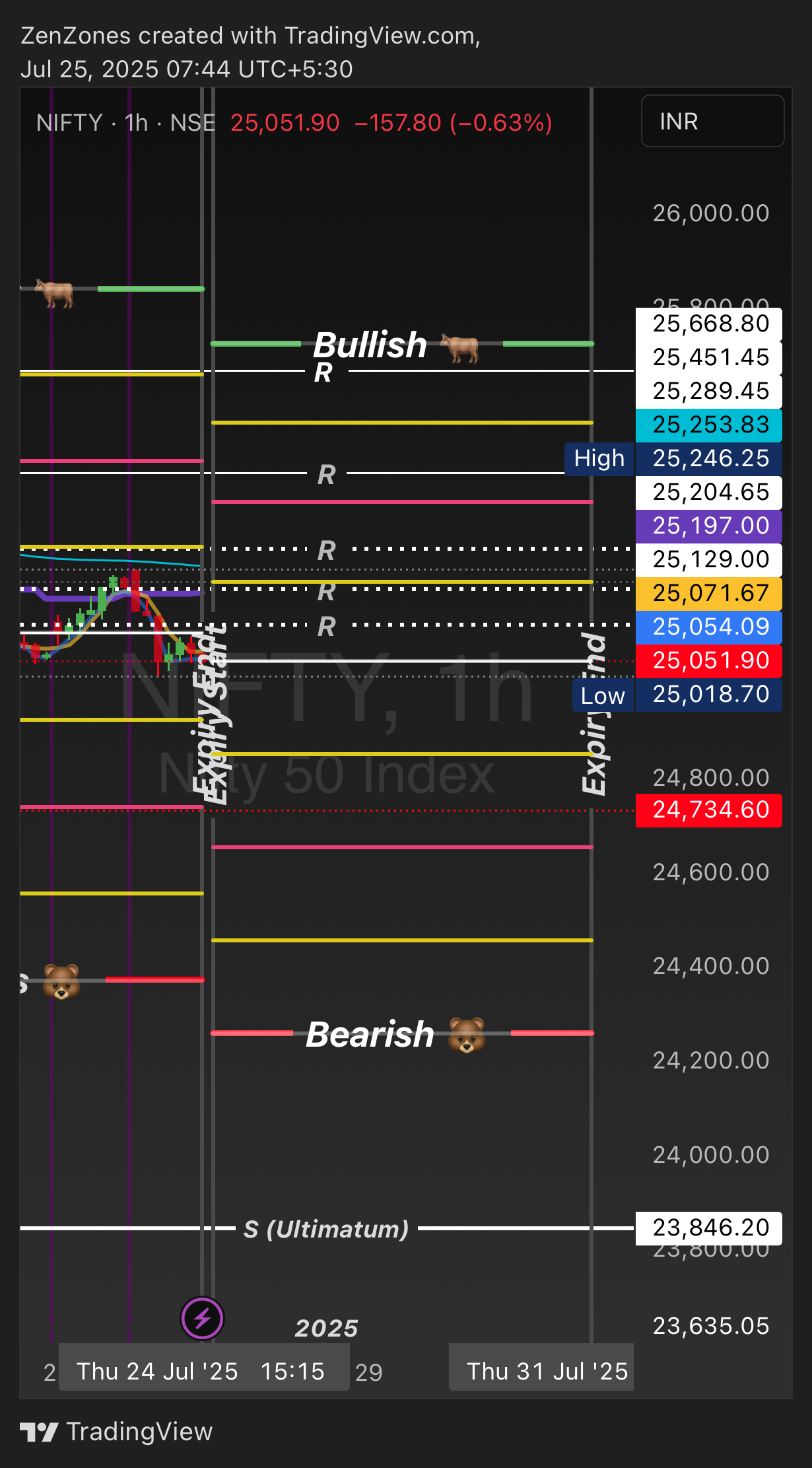

31st Expiry !

tradingview.com/x/enuL4TlV

NIFTY

NIFTY

tradingview.com/x/enuL4TlV

Same as Monday Level so Tomorrow we get last Friday 18 July Levels. Let’s Pray 🙏🏼 Oh Lord, just give us one booming July (Last) expiry 🚀.

NIFTY

NIFTY

1. Foreign investors are quitting due to over inflated markets, trump tariffs impact and other better market opportunities.

2. Inflation. False inflation report by the government, This may push the market in very short term but ultimately it'll crash.

3. Irregularities and over taxation.

current price 25090

Target 24925

230 Touched Finally That’s my Gamma 💥🤣

Exited Done For The day!!

NIFTY

NIFTY

Exited Done For The day!!