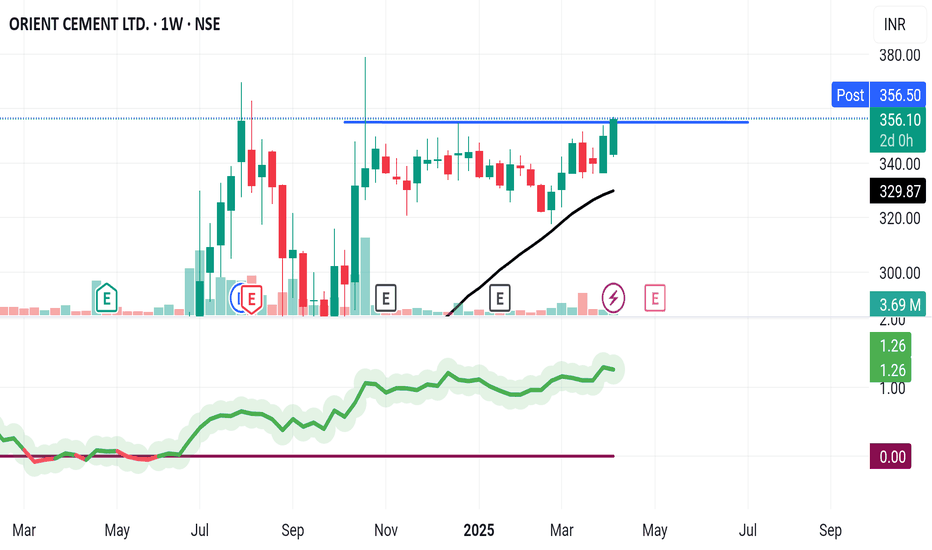

Orient Cement (Long):Orient Cement (Long):

Despite the volatility in the broader and small cap indices this script has setup well for a significant up move by breaking the crucial supply area.

OC present position also offers a trade with RR of more than 1:4.

Note: Do your own due diligence before taking any action.

ORIENTCEM trade ideas

50 SMA Rising- Positional TradeDisclaimer: I am not a Sebi registered adviser.

This Idea is publish purely for educational purpose only before investing in any stocks please take advise from your financial adviser.

Its 50 SMA Rising Strategy. Suitable for Positional Trading Initial Stop loss lowest of last 2 candles and keep trailing with 50 days SMA if price close below 50 SMA then Exit or be in the trade some time trade can go for several months.

Be Discipline because discipline is the Key to Success in the STOCK Market.

Trade What you see not what you Think

Orient Cements : Mysterious 186 Points Orient Cements:

Monthly Chart Observation

Each up-move clocks186 points.

Considering (204) as a monthly open and a pocket friendly Stop Loss longs can be initiated

A FVG exists on the Daily Chart (288-291). This also can be a good Long Entry point.

Use your reasoning (Wave Theory included) and trade decisions around these levels.

Targets are depicted on the chart based on (186) points.

Orient Cement might fill the mentioned target box very soonOrient Cement Ltd. has shown significant price movement.

Recent Performance: The stock increased by 2.76%.

Support and Resistance Levels:

- Support: ₹292.90

- Resistance: ₹368.60

Moving Averages:

- 10 EMA: ₹319.06

Key Financial Metrics:

- PE Ratio: 22.56

- EPS: ₹14.81

- Market Cap: ₹6,250 Crores

- Recent Earnings: FY 2023-2024 revenue ₹2,745 Crores, with PAT of ₹125 Crores

Entry, Exit, and Stop Loss:

- Entry Point: Above ₹340 if signs of recovery are shown

- Exit Point: Near ₹390 (resistance level)

- Stop Loss: At ₹310

Disclaimer - Not a Buy/Sell Recommendation.

Just A View - ORIENTCEM📊 Script: ORIENTCEM

📊 Sector: Cement

📊 Industry: Cement - South India

Key highlights: 💡⚡

📈 Script has taken support at 195 level and started moving upward we may see 229 level.

📈 MACD is giving Crossover

⏱️ C.M.P 📑💰- 213

🟢 Target 🎯🏆 - 229

⚠️ Stoploss ☠️🚫 - 205

⚠️ Important: Always maintain your Risk & Reward Ratio.

✅Like and follow to never miss a new idea!✅

Disclaimer: I am not SEBI Registered Advisor. My posts are purely for training and educational purposes.

Eat🍜 Sleep😴 TradingView📈 Repeat 🔁

Happy learning with trading. Cheers!🥂

Orient Cement Ltd Ready to Rock?Hello Everyone, Orient Cem has given breakout from its all time high with a Monthly candle with Good Volumes and it is near the entry point, one can look for short to long term investment opportunity in this scrip.

Stock has significantly reduced their Debts from previous years this could be another reason for breakout and going forward there can be huge rally upwards, this stock pay good dividends also another reason to hold for long term.

orient cementEstablished in 1979, Orient Cement was formerly, a part of Orient Paper & Industries. It was demerged in the year 2012 and since then, it has emerged as one of the fastest growing and leading cement manufacturers in India. Orient Cement began cement production in the year 1982 at Devapur in Adilabad District, Telangana. In 1997, a split-grinding unit was added at Nashirabad in Jalgaon, Maharashtra. In 2015, Orient Cement started commercial production at its integrated cement plant located at Chittapur, Gulbarga, Karnataka. The product mix includes Pozzolana Portland Cement (PPC) & Ordinary Portland Cement (OPC) marketed under the brand name of Birla.A1 – Birla.A1 Premium Cement and Birla.A1 StrongCrete.

Business area of the company

The Company is primarily engaged in the manufacture and sale of Cement and its manufacturing facilities at present are located at Devapur in Telangana, Chittapur in Karnataka and Jalgaon in Maharashtra.

Products

Birla.A1 StrongCrete: Birla.A1 StrongCrete is a specially engineered cement for concrete applications such as foundation, beams, columns and slabs.

Birla .A1 Premium Cement: Birla .A1 Premium Cement is manufactured by the inter-grinding of clinker, gypsum and very fine-grained highly reactive fly ash. Its biggest advantage is uniform particle size distribution which gives greater strength, and helps achieve higher density with lower porosity in concrete made from it, leading to increased durability.

Birla .A1 Premium Cement: OPC 53 Grade: One of the pioneers of 53-Grade Cement in India, Orient Cement opened up a whole new dimension in building construction with the launch of Orient Gold 53-Grade Cement in 1992.

Birla .A1 Premium Cement: OPC 43 Grade: Originally named Orient 43 Grade Cement, it was amongst the earliest successes of Orient Cement paving the way for the others to follow.