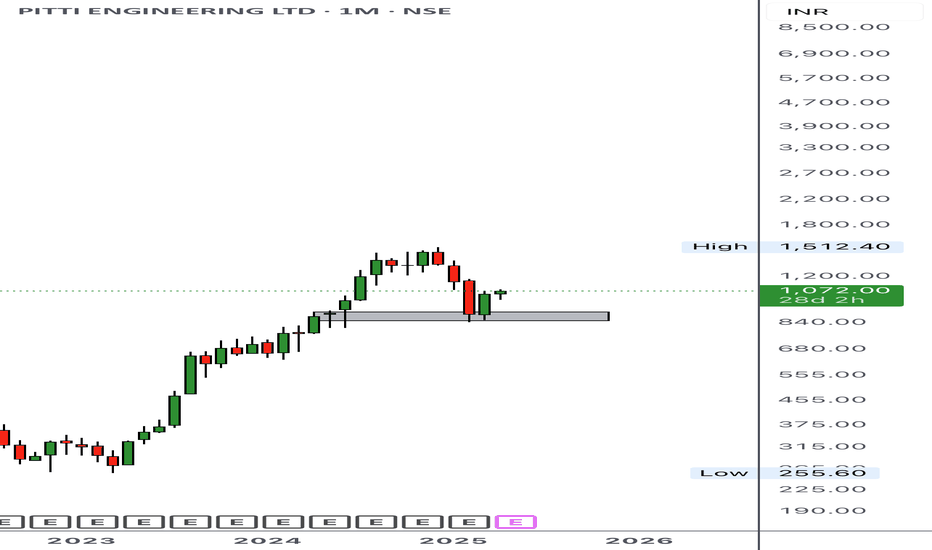

PITTIENG trade ideas

Darvas Box Strategy - Break out Stock - Swing TradeDisclaimer: I am Not SEBI Registered adviser, please take advise from your financial adviser before investing in any stocks. Idea here shared is for education purpose only.

Stock has given break out. Buy above high. Keep this stock in watch list.

Buy above the High and do not forget to keep stop loss, best suitable for swing trading.

Target and Stop loss Shown on Chart. Risk to Reward Ratio/ Target Ratio 1:1 & 2

Stop loss can be Trail when it make new box / Swing.

Be Discipline, because discipline is the key to Success in Stock Market.

Trade what you See Not what you Think.

PITTIENG - BULLISHStock name = Pitti Engineering Limited.

Weekly chart setup

Chart is self explanatory. Levels of breakout, possible up-moves (where stock may find resistances) and support (close below which, setup will be invalidated) are clearly defined.

Master Score - B

Disclaimer: This is for demonstration and educational purpose only. this is not buying and selling recommendations. I am not SEBI registered. please consult your financial advisor before taking any trade.

Pitti Engineering LtdPitti Engg. is engaged in the manufacturing of Electrical Steel Laminations, Motor Cores, Sub-Assemblies, Die-Cast Rotors, Press Tools and machining of metal components.

The product portfolio of the co. includes Sheet Metal used in 20+ end user industries , Precision Machining used for complex machining parts, & Assemblies. And the products under developments are Fabricated Assembles and Machining for Mining applications

Pitti Engineering LtdENTRY - 320 -330 levels

SL - 290

Hold for Longterm

Market Cap

₹ 1,214 Cr.

Current Price

₹ 379

Stock P/E

20.6

Book Value

₹ 104

Dividend Yield

0.40 %

ROCE

18.2 %

ROE

19.0 %

Face Value

₹ 5.00

Promoter holding

59.3 %

EPS last year

₹ 18.4

EPS latest quarter

₹ 7.75

Debt

₹ 356 Cr.

Pledged percentage

20.5 %

Net CF

₹ 32.1 Cr.

Price to Cash Flow

5.48

Free Cash Flow

₹ 117 Cr.

Debt to equity

1.07

OPM last year

13.8 %

OPM 5Year

14.3 %

Reserves

₹ 318 Cr.

Price to book value

3.64

Int Coverage

2.79

PEG Ratio

0.55