PROSTARM trade ideas

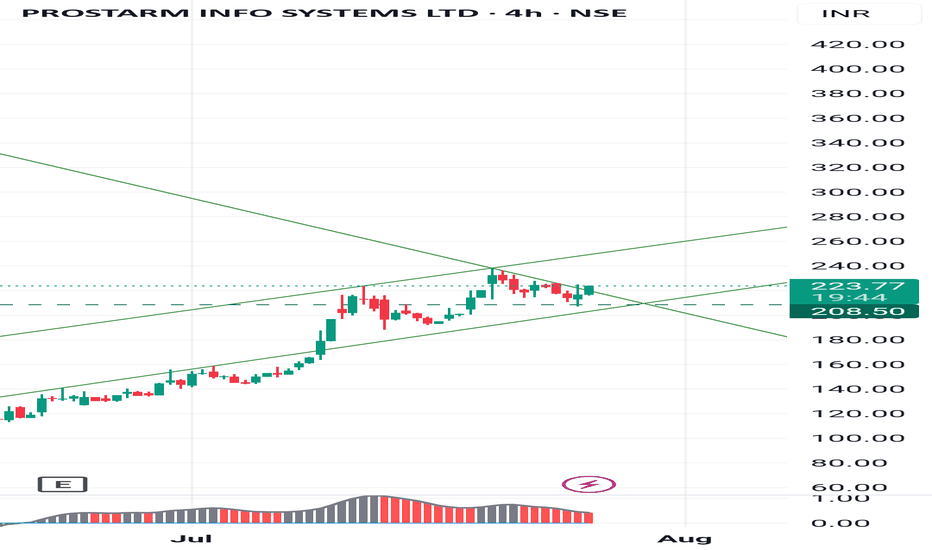

PROSTARM INFO SYSTEMES LTD S/RSupport and Resistance Levels:

Support Levels: These are price points (green line/shade) where a downward trend may be halted due to a concentration of buying interest. Imagine them as a safety net where buyers step in, preventing further decline.

Resistance Levels: Conversely, resistance levels (red line/shade) are where upward trends might stall due to increased selling interest. They act like a ceiling where sellers come in to push prices down.

Breakouts:

Bullish Breakout: When the price moves above resistance, it often indicates strong buying interest and the potential for a continued uptrend. Traders may view this as a signal to buy or hold.

Bearish Breakout: When the price falls below support, it can signal strong selling interest and the potential for a continued downtrend. Traders might see this as a cue to sell or avoid buying.

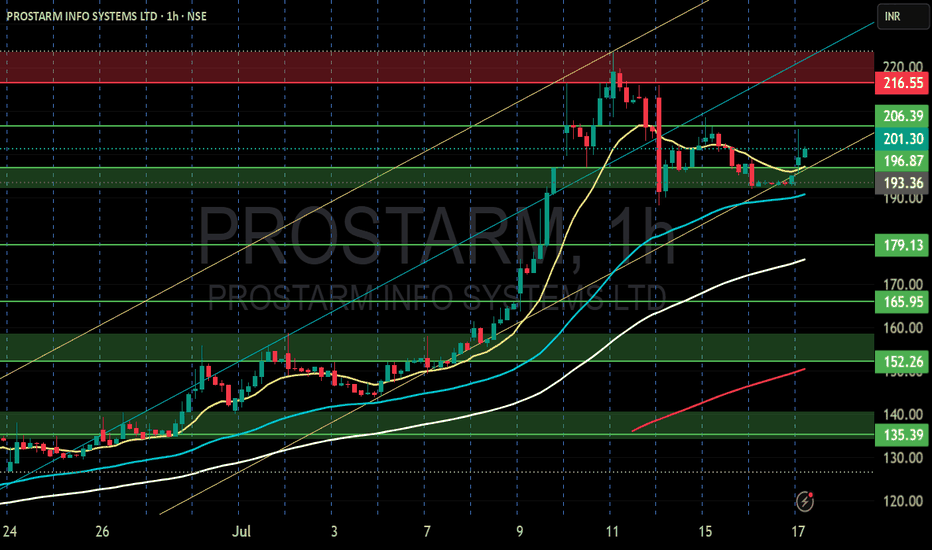

MA Ribbon (EMA 20, EMA 50, EMA 100, EMA 200) :

Above EMA: If the stock price is above the EMA, it suggests a potential uptrend or bullish momentum.

Below EMA: If the stock price is below the EMA, it indicates a potential downtrend or bearish momentum.

Trendline: A trendline is a straight line drawn on a chart to represent the general direction of a data point set.

Uptrend Line: Drawn by connecting the lows in an upward trend. Indicates that the price is moving higher over time. Acts as a support level, where prices tend to bounce upward.

Downtrend Line: Drawn by connecting the highs in a downward trend. Indicates that the price is moving lower over time. It acts as a resistance level, where prices tend to drop.

Disclaimer:

I am not a SEBI registered. The information provided here is for learning purposes only and should not be interpreted as financial advice. Consider the broader market context and consult with a qualified financial advisor before making investment decisions.

What’s Next for PROSTARM Investors...?Prostarm has decisively broken its all-time high. Since its IPO on June 3rd, it has successfully surpassed the major resistance level of 126 and is holding strong above it. We should take advantage of this opportunity and establish a long position on the retest of the 126 level.

Prostarm Microfinance Ltd: Investment Update Buy, Sell, OR Hold Technical Outlook: Prostar Microfinance Ltd.

Current Market Structure:

Prostar Microfinance Ltd. is presently consolidating within a narrow trading range between ₹112 and ₹118. This range-bound movement indicates indecision in the market, with neither bulls nor bears taking full control at this stage.

Scenario-Based Strategic Guidance

1. Existing Shareholders (Including IPO Allottees):

Investors already holding shares—especially those allotted during the IPO—are advised to continue holding their positions while the stock remains above the key support level of ₹112. However, if the stock breaches this level on a daily close basis and sustains below ₹112 on the following trading session, it would signal a breakdown of the current support zone. In such a case, we recommend exiting the position and waiting for technical stabilization or a new bullish setup.

2. Prospective Buyers (No Current Holdings):

Investors looking to enter fresh positions should adopt a wait-and-watch approach until a clear breakout above ₹118 is observed. A breakout accompanied by significant volume and a confirmed close above ₹118 could offer a potential buying opportunity, with a near-term price target of ₹126.

3. Risk Monitoring:

A sustained move below ₹112 could open the downside toward the ₹105–₹100 levels. Hence, strict stop-loss discipline is crucial, especially for short-term traders and technical participants.

Summary :

| Scenario Action Plan

-------------------------- --------------------------------------------------

| Holding from IPO Hold above ₹112; exit if closes below and sustains

| No Holdings Buy only after a breakout and close above ₹118

| Post-Breakout First Target ₹126

Disclaimer: This is a technical outlook and should not be construed as investment advice. Investors are advised to consider their risk appetite, broader market conditions, and consult financial advisors before making investment decisions.